Virtually no sector in the financial markets were left unscathed at the end of 2018.

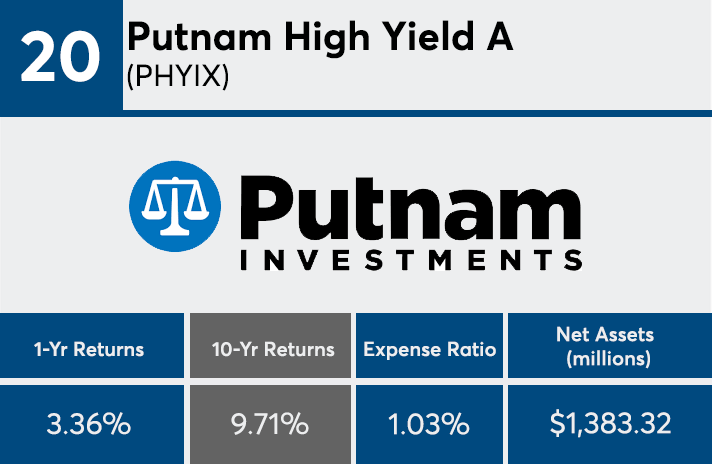

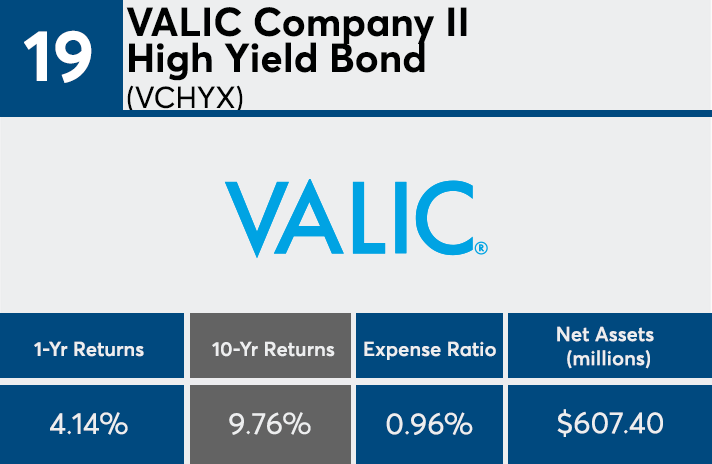

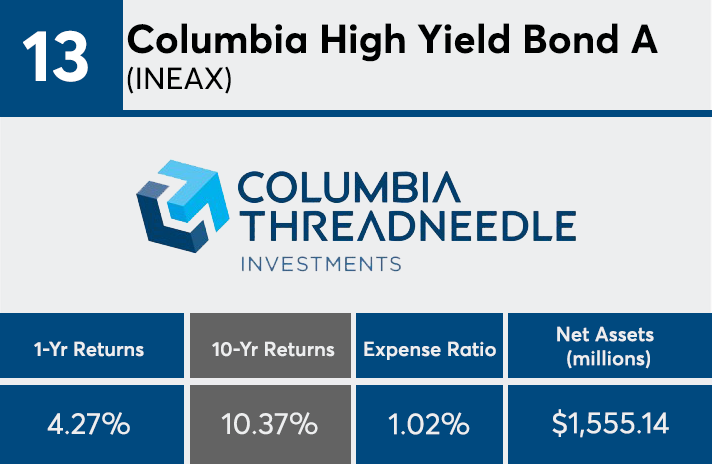

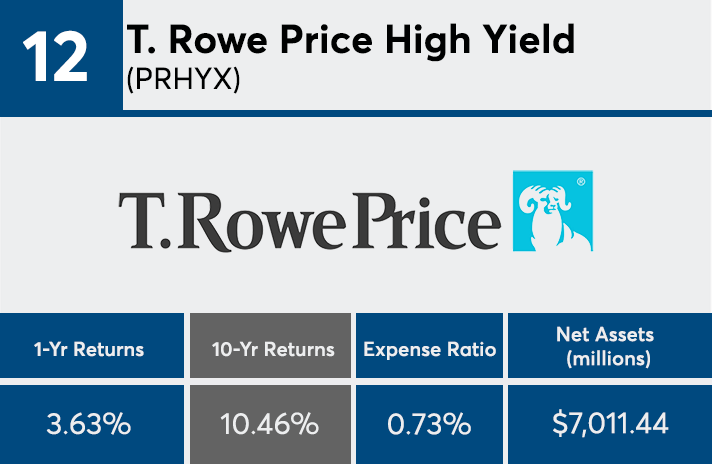

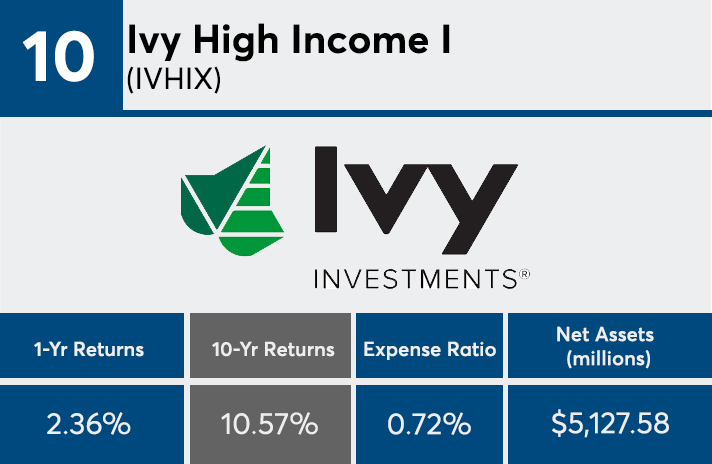

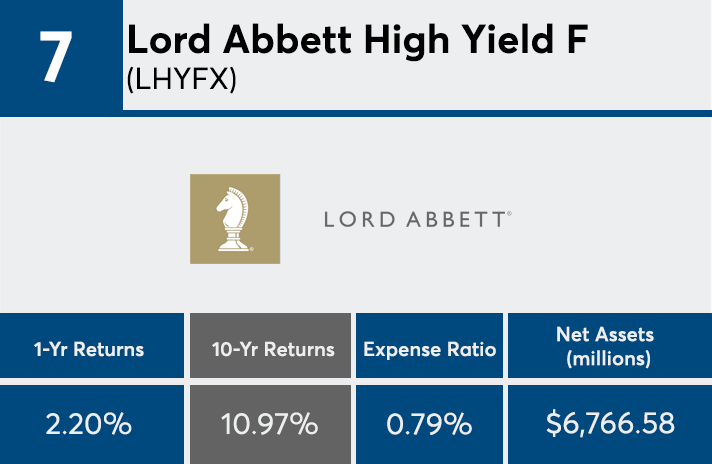

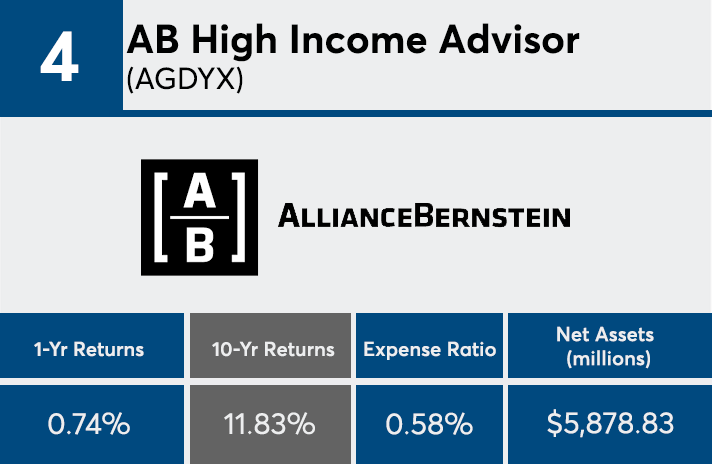

Among high-yield bond funds, the segment's 20 best-performing high-yield bond funds posted impressive returns over the past 10 years. Home to a combined $107.2 billion in assets under management, the average 10-year return among the top-performers was 10.93%, Morningstar Direct data show. These same funds posted a return roughly 7.25 percentage points lower over the last year.

“Just like equities, last year was a volatile year and the fourth quarter of 2018 did a number on the returns of risk assets,” said Greg McBride, senior financial analyst at Bankrate.

Fees among the top-performers, while higher than the average paid across equity products, were right on par with the rest of the high-yield bond fund universe. At an average of 0.76%, the average expense ratio among the 20 top-performers is one basis point higher than the category average of 75 basis points.

“These expense ratios are not excessive given the actively managed nature of many of the funds and that research costs are higher for smaller debt issuers and/or those that are privately held,” McBride said.

A similar screen of the largest high-yield bond products, while carrying lower expense ratios, produced similar results. With a combined $132.6 billion in AUM, the 20 largest funds of the category had an average 10-year return of 10.48%, but with lower fees at an average of 0.65%, data show. The biggest of the category, the Vanguard High-Yield Corporate Adm (VWEAX), which has $23.4 billion in AUM and an expense ratio of 0.13%, had a 10-year return of 9.56%, 3.71 percentage points higher than the fund’s 5.85% one-year return.

Investors paid an average of 0.52% for fund investing in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs.

While high-yield bond funds can often produce “equitylike returns when the economy is doing well, and loan defaults are low,” McBride says, advisors must remember that “when the economy takes a downturn, investors find out why these bonds are high-yield as defaults can spike quickly.”

Scroll through to see the 20 high-yield bond mutual funds and ETFs with the highest 10-year returns, as of March 18. Institutional, leveraged and funds with investment minimums over $100,000 are excluded. One-year returns, total assets and expense ratios for each fund are also listed. The data shows the individual funds’ primary share class. All data from Morningstar Direct.