Advisors often like to guide clients to

That's far less true for funds that adopt risky strategies like leveraged investing or that rise and fall with the fortunes of a specific industry like digital assets. So it may come as somewhat of a surprise that many of the best performers among the top 20 index funds for 2023 were of this specialized type, according to data from Morningstar Direct.

In some ways, though, the results shouldn't be unexpected. A maxim in the investing business is that the tradeoff for taking on greater risk is the prospect of seeing greater returns.

Investors who did the cost-benefit analysis before putting money into the MicroSectors FANG+ Index 3X Leveraged ETN had reason to celebrate by the end of the year.

In 2023, the fund cleared a whopping 439% return. That put it in the No. 1 spot for funds that stayed open the entire year.

(Morningstar's initial top 20 ranking listed two funds that tracked the Russian stock market and were excluded by us after being shut down because of trade sanctions arising from the war in Ukraine.)

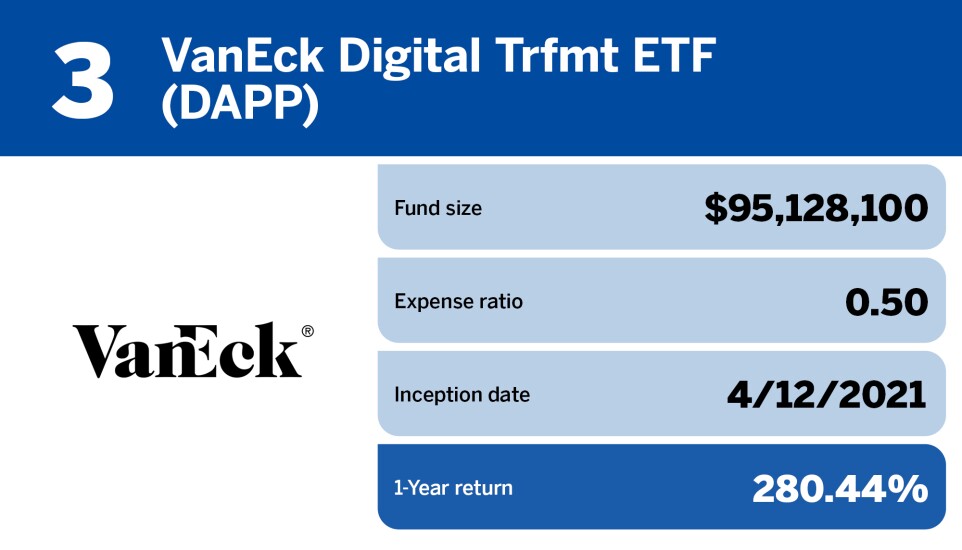

Also high on the list of top performers were funds tracking digital asset companies. Although the Securities and Exchange Commission approved exchange-traded funds tracking bitcoin for the first time only earlier this month, investors have long been able to use other types of funds to gain a piece of related businesses.

This exchange-traded fund produced a 280% return in 2023. That put it at No. 3 in Morningstar's ranking.

Good returns or not, funds of this sort aren't close to being embraced by many advisors. Noah Damsky, the principal at

The trouble, Damsky said, is that it's almost impossible to predict which parts of the economy will outshine others in any given year.

"If you look at the annual performance review heat maps, you'll see that the best-performing sectors will often vary drastically from year to year," he said. "As a result, it's best to maintain exposure to the broad market since it's almost impossible to guess which area of the market will continue to perform well."

READ MORE:

Ethan Lang, the owner of

"Leveraged funds aren't like traditional broad-market ETFs because they use derivatives and other complex financial products to achieve the 2X or 3X return," he said. "These products are expensive to hold and manage, so these costs are pushed along to the individual investor, which eats away at your returns."

Sean Beznicki, the director of investments at

"Portfolios win big by losing less," he said. "This requires risk mitigation to provide greater downside protection, which is not a characteristic of leveraged ETFs or cryptocurrency."

READ MORE: