With the Standard & Poor's 500 index of leading companies down roughly 20% this year, 2022 has been unpleasant for retirement savers and financial advisors alike. But as much as your portfolio may be hurting, things could be worse if you owned certain funds.

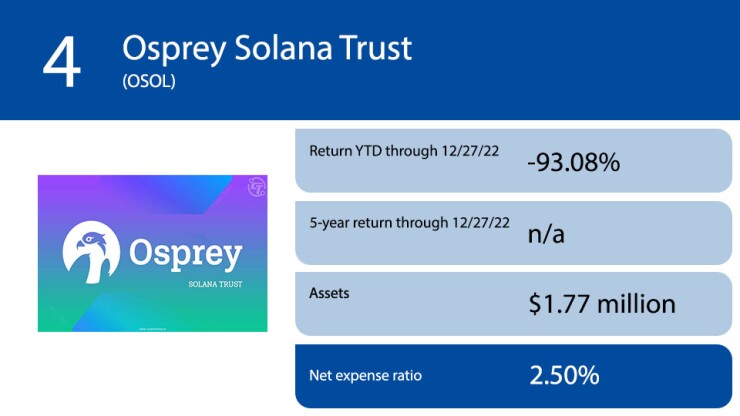

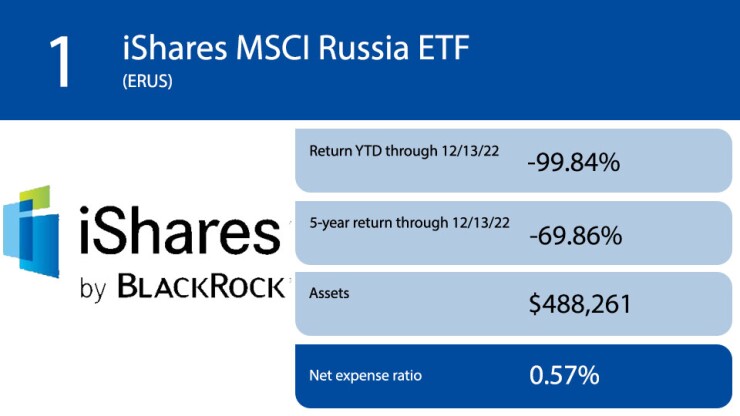

Some of the biggest market losers are exchange-traded funds invested in niche categories, like Russian stocks, and in volatile assets, such as cryptocurrencies. The funds trade on exchanges like regular shares. With an actively managed ETF, a manager, or team of people, makes continual decisions about which holdings to trade. By contrast, a passive ETF sits back and mirrors a benchmark or gauge. Passive funds have garnered the most favor for their low costs and transparency about their holdings. But active ETFs following bespoke indexes and strategies are growing.

Still, the lines between active and passive can get blurry. Throw in leverage, inverse bets and volatile assets rocked by economic and geopolitical shifts, and things can turn south quickly.

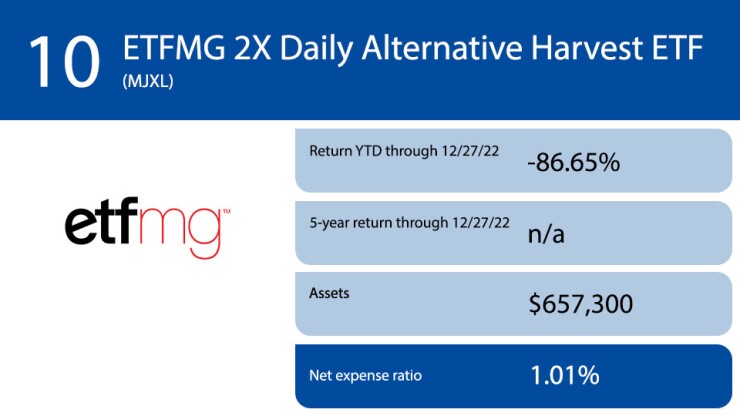

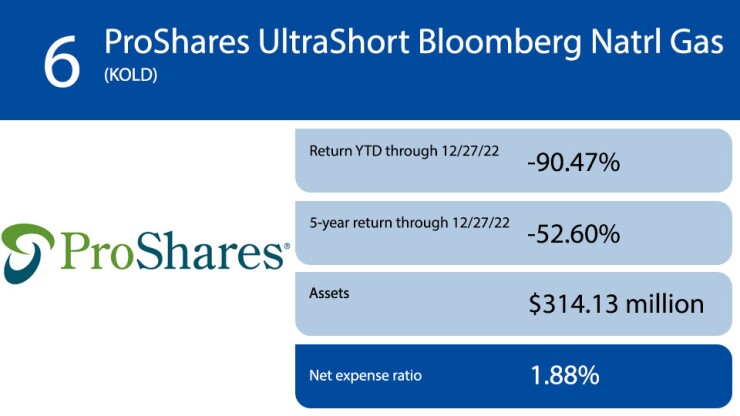

Scroll through the top 10 worst-performing U.S. equity ETFs of 2022, all actively managed. Year-to-date returns are as of Dec. 27, 2022. Funds that launched after Jan. 1, 2018, do not have 5-year annualized data. All data is from Morningstar Direct.

Read more:

Read more:

Read more: