In the stock market, bigger is usually better. Seven giant tech companies — nicknamed the "Magnificent Seven" — made up

But sometimes it pays to think small. Small-cap companies may not be as assured of their success — or even survival — as larger corporations, but they're often nimbler and more willing to take risks on new ideas. And if those ideas pay off, they have much more room to grow.

"Investing in small companies allows one to take a wager on companies that may be at the forefront of inventing new things, processes and discoveries," said Kashif Ahmed, president of

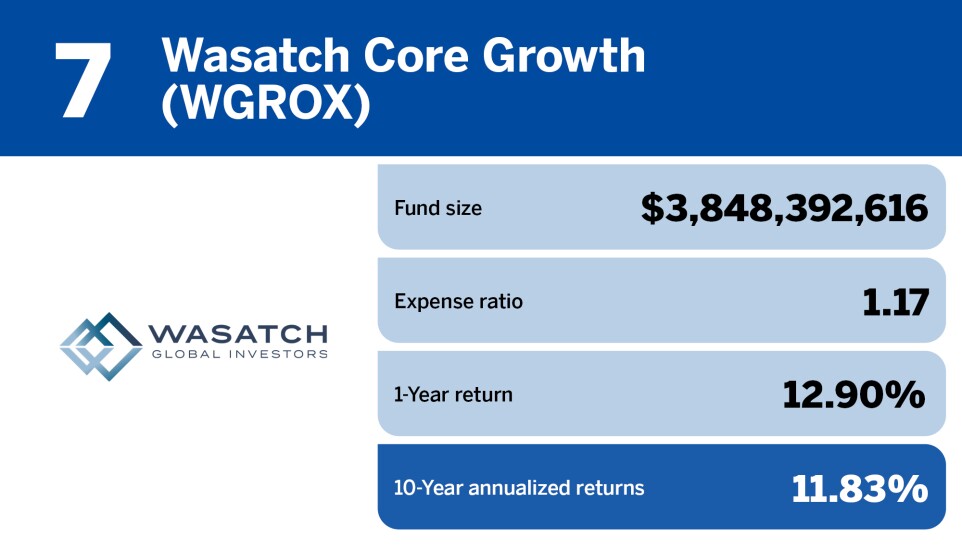

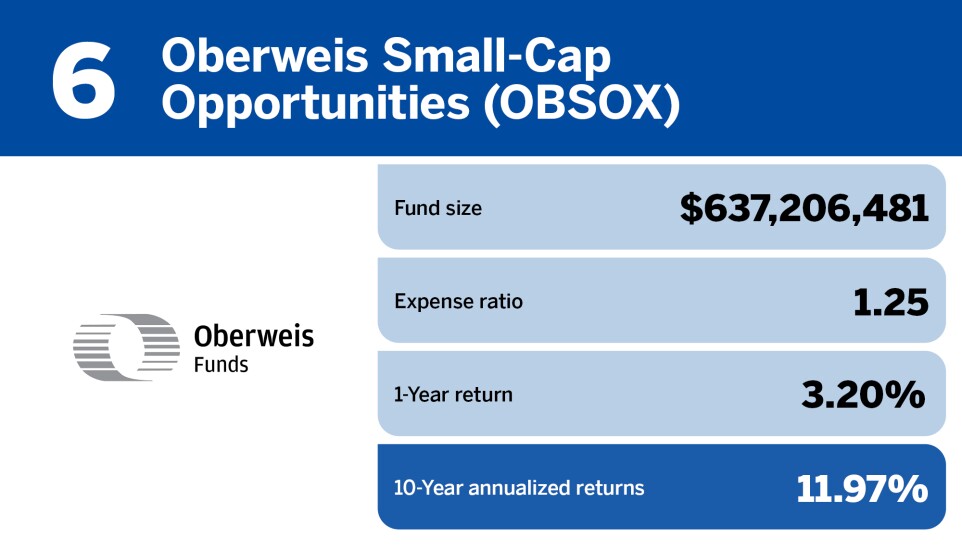

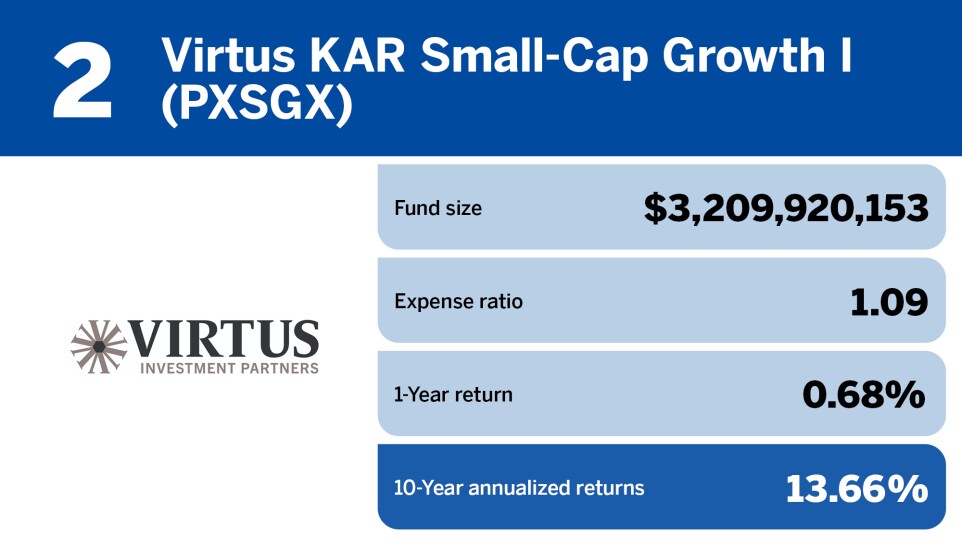

That's why many financial advisors, including Ahmed, recommend investing in small-cap funds. And new data shows how much it can pay off: According to Morningstar Direct, the top-performing small-cap funds of the past 10 years had annualized returns of almost 14% — not far behind some of the decade's

"It's akin to saying someone who is thinner and lighter has the potential to run faster," Ahmed said. "Of course when you do that, you have the potential to stumble and even fall flat on your face … but in the long run they can reward patient investors very handsomely."

READ MORE:

In fact, some prominent analysts have predicted that in 2024, small- and mid-cap companies will make up a bigger share of the tech sector's gains, prompting a shift from the "Magnificent Seven" to the "Magnificent Many."

"Tech should continue to be in a very vibrant bull market in 2024, but it is one that will broaden out across the sector, and not just be confined to the top names," James Demmert, founder of

Some have also pointed out that in today's economic climate, with interest rate cuts on the horizon, small-cap companies are particularly well positioned to prosper this year.

"The small-cap space is made up very differently than the large-cap space," said Angela Palacios, director of investments at the

And if nothing else, advisors recommend small-cap funds for the same reason they recommend

"Smaller companies deserve a seat at the asset allocation table, because at any given time, money flows between not just different asset classes, but also between stocks of different company sizes," Ahmed said.

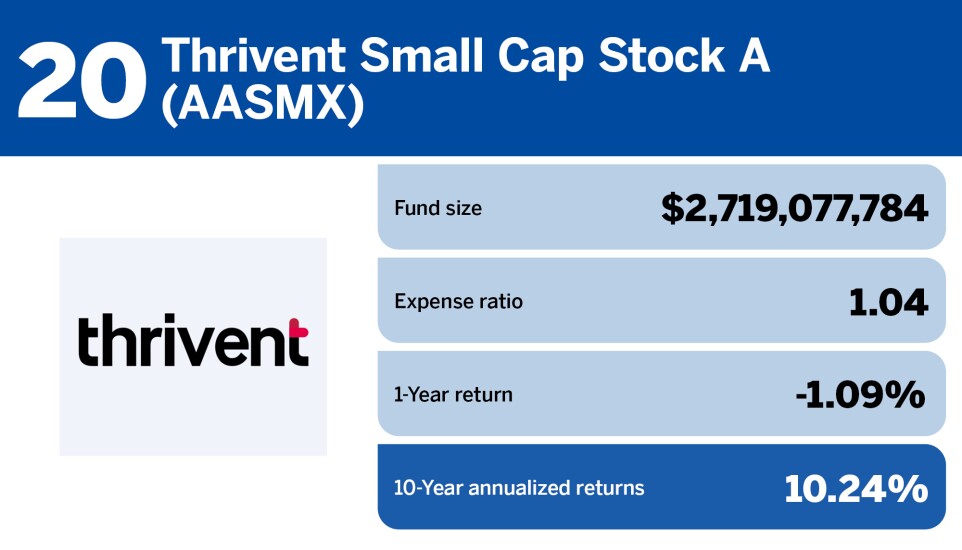

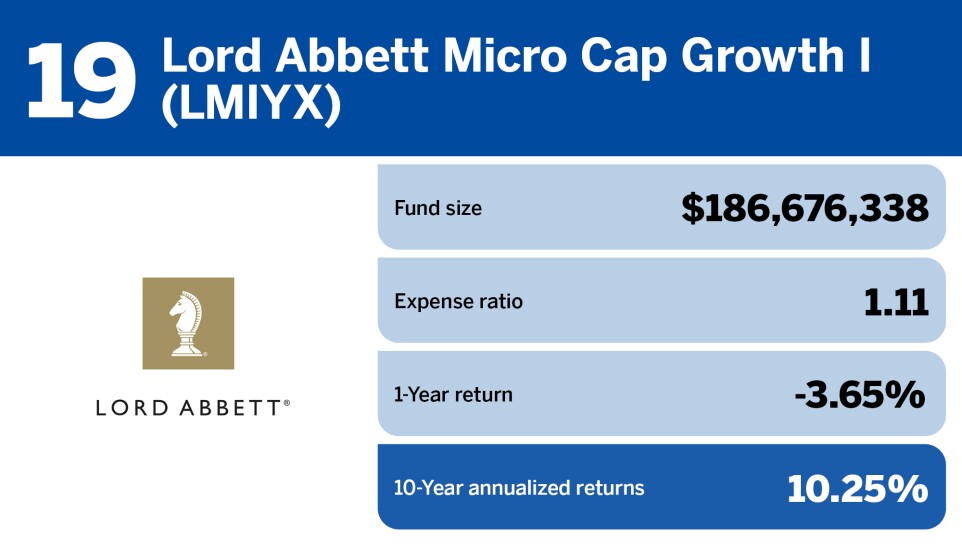

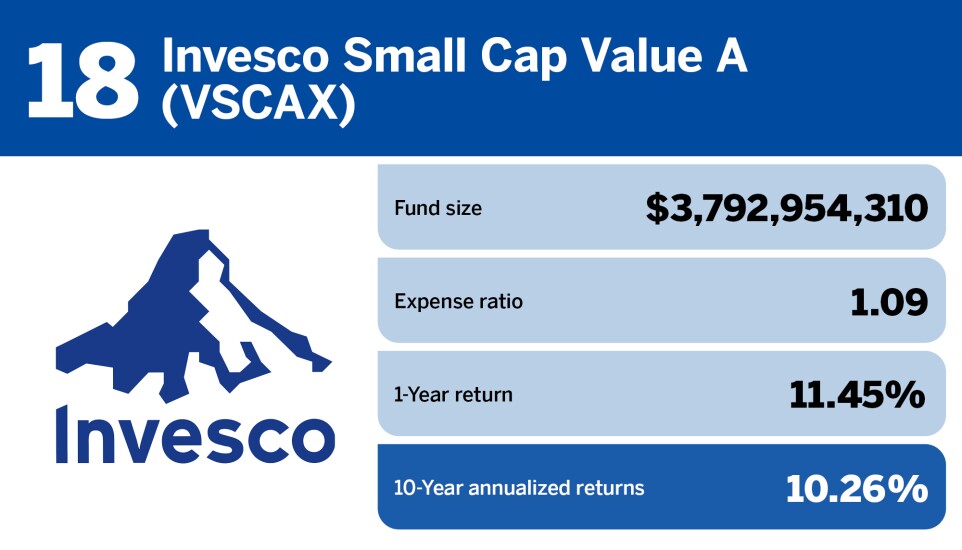

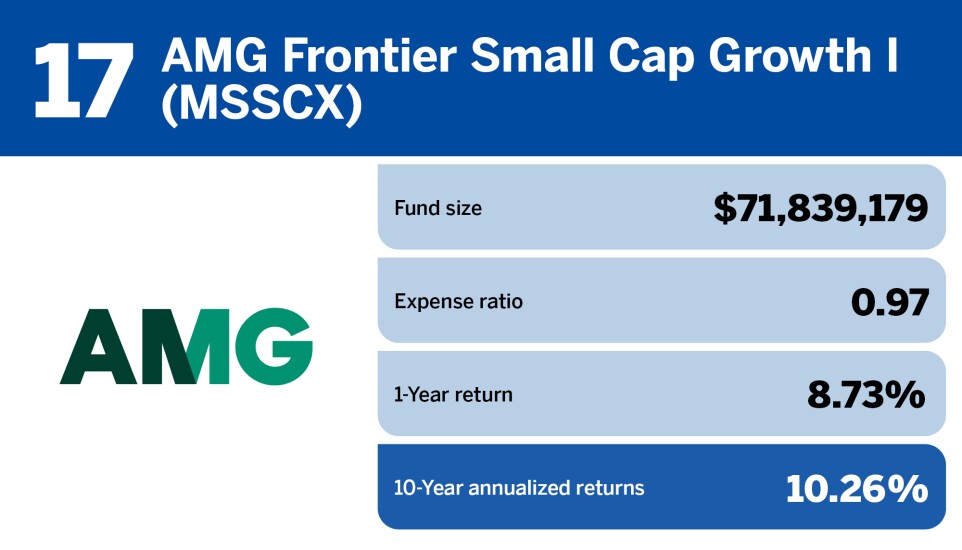

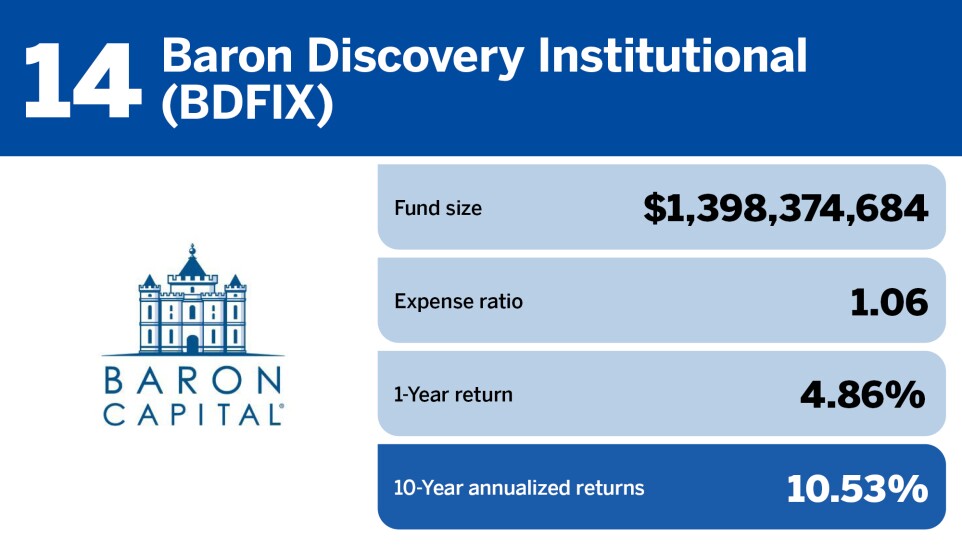

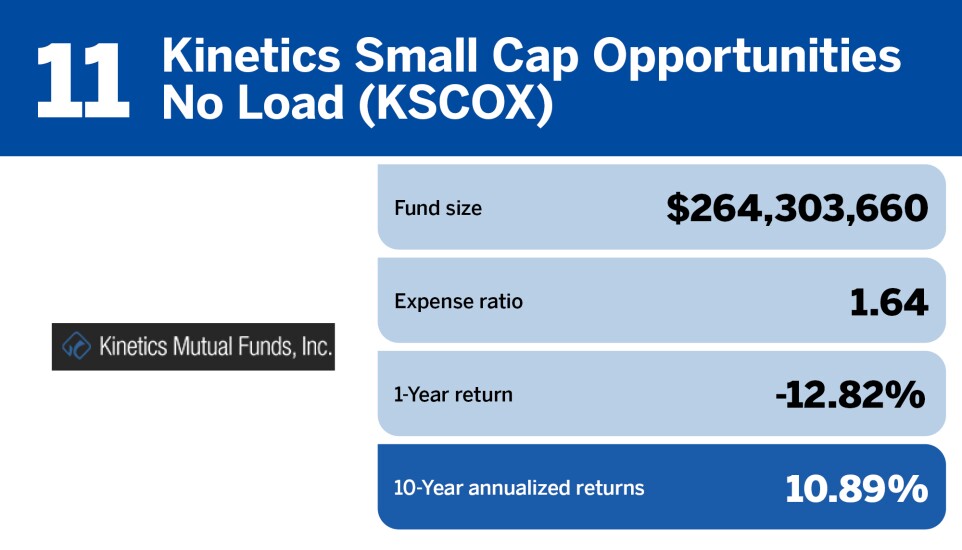

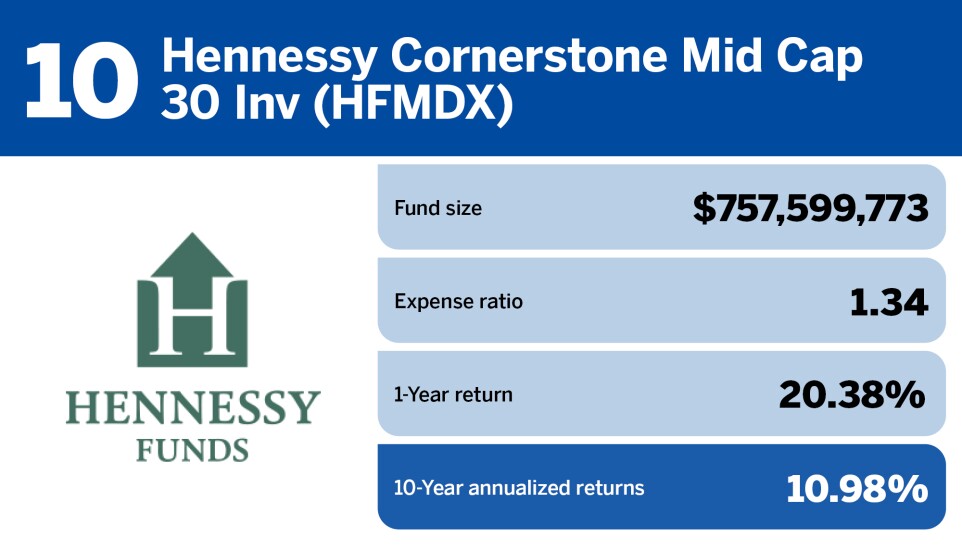

To see the top 20 small-cap funds of the past decade, scroll through the cardshow below. All data is from Morningstar Direct and is current as of Feb. 12, 2024. (All funds meet Morningstar's definition of "small cap," even if described as "mid cap" by their suppliers.)

READ MORE: