Small-cap funds may be an attractive element of a diversified portfolio, but you wouldn't necessarily know that looking at the data from this year.

The Russell 2000, the commonly used index to track small-cap stocks, has been up only 2.3% so far this year,

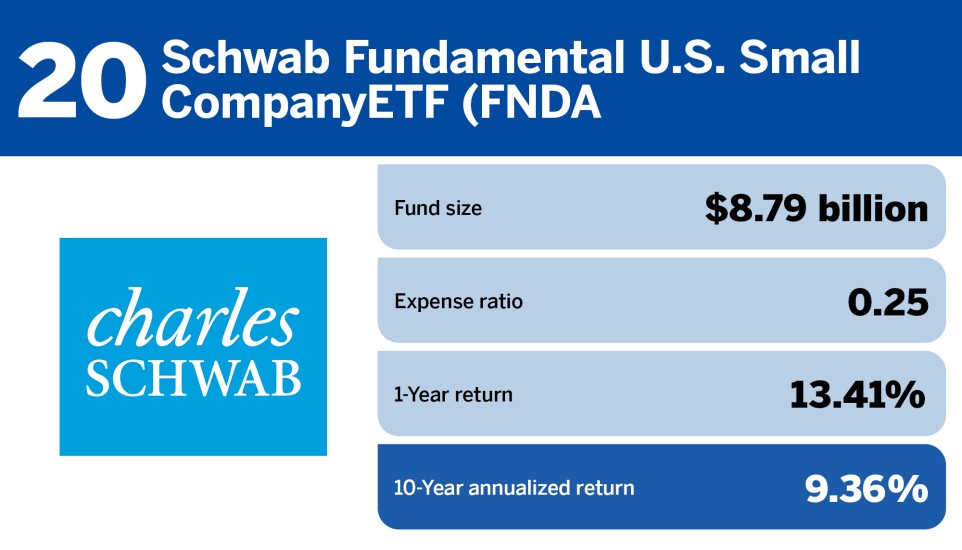

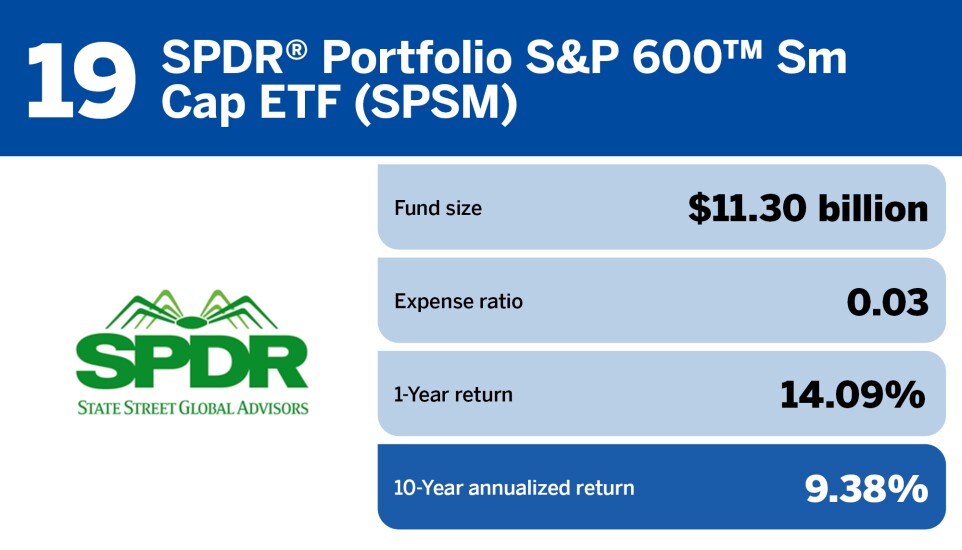

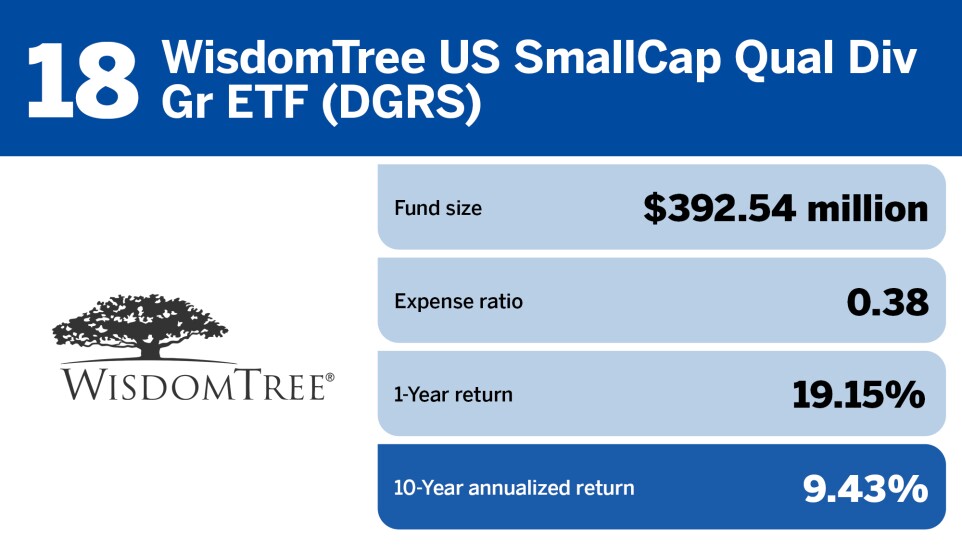

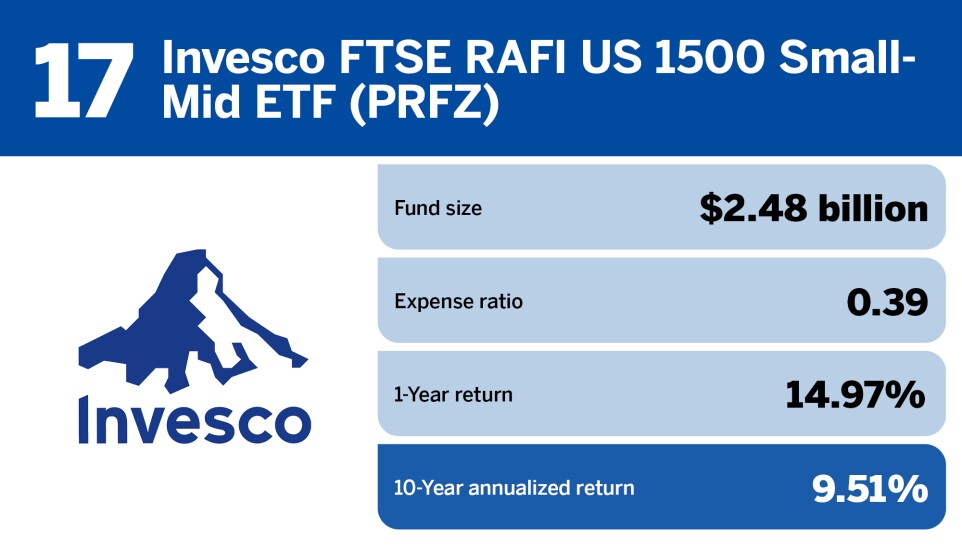

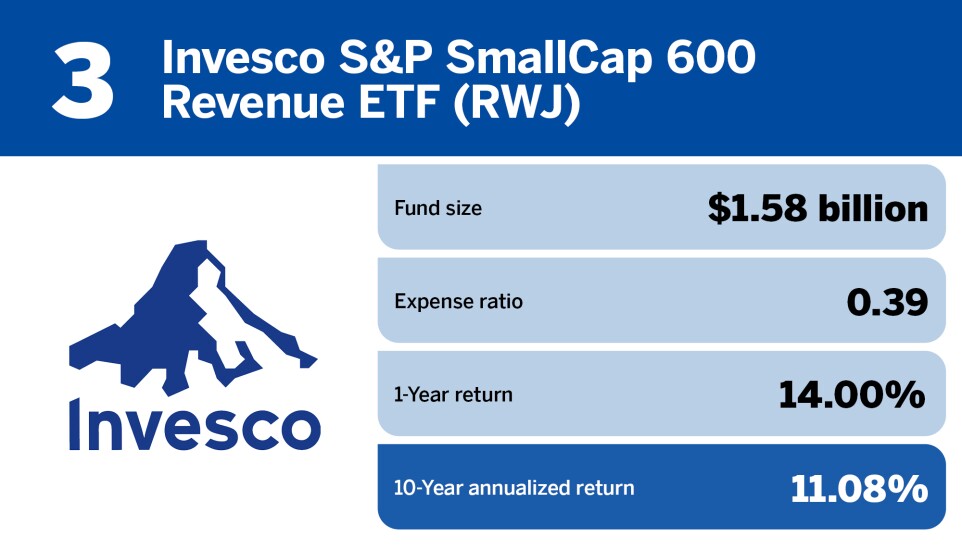

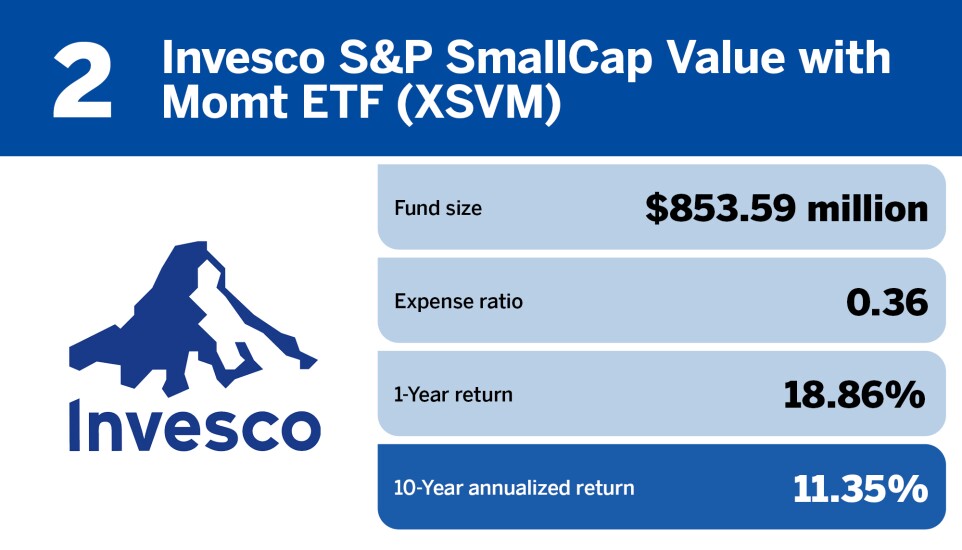

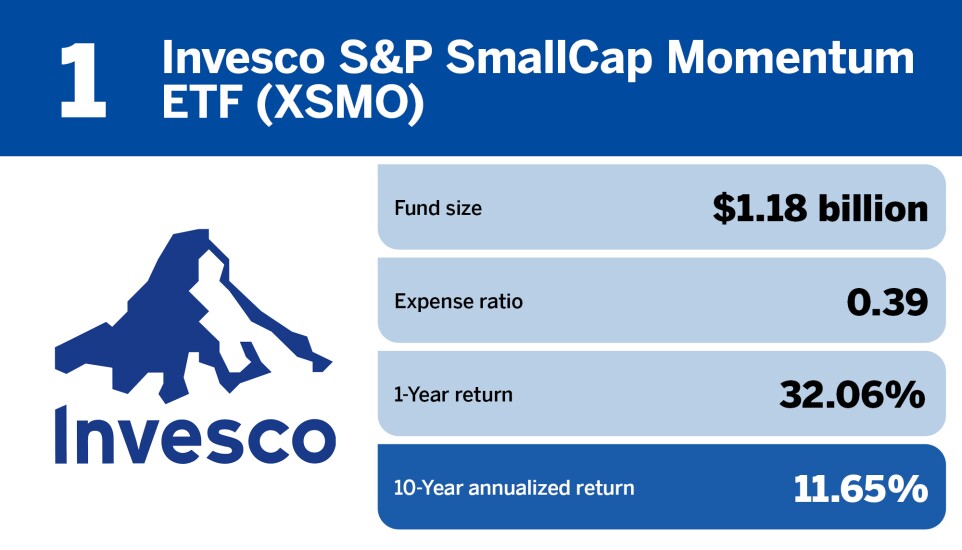

Taking a longer view, several small-cap exchange-traded funds — which track companies between $250 million and $2 billion — have had an outstanding run over the past 10 years.

For example, top performer Invesco S&P SmallCap Momentum ETF (XSMO), with a fund size of $1.18 billion, boasted a one-year return of 32.06% and a 10-year annualized return of 11.65%.

Small-caps can continue to rally as the Fed readies to

"Our models are currently market-weight to small caps, but we'll explore adding as rate cuts gain steam and the prospects for small-caps improve," he said. "Given our focus on principal protection, we'd rather miss out on the rally from the bottom if it means we are more confident in its outperformance going forward."

Andrew Herzog, a wealth advisor at

"These lower valuations can be a sign of great entry points for long-term investors, depending on your risk tolerance and goals," he said.

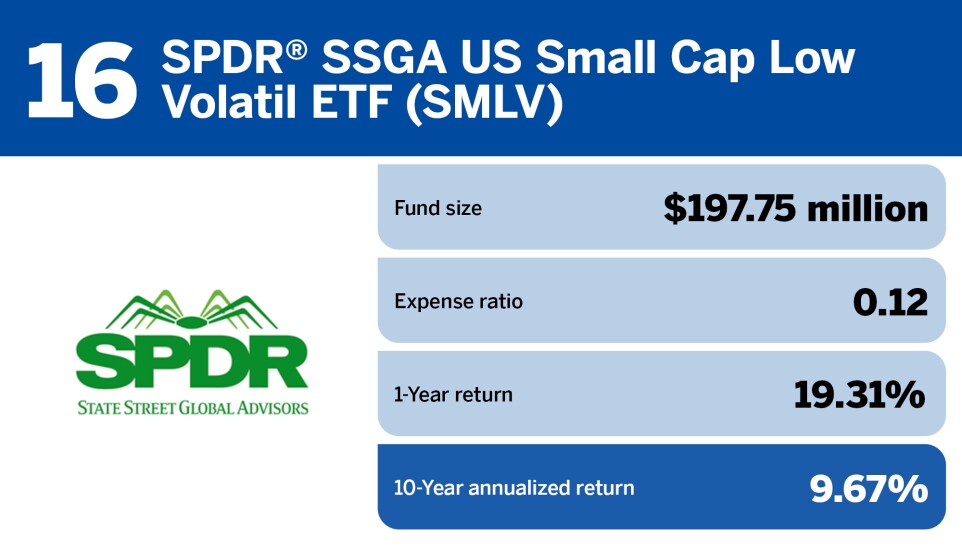

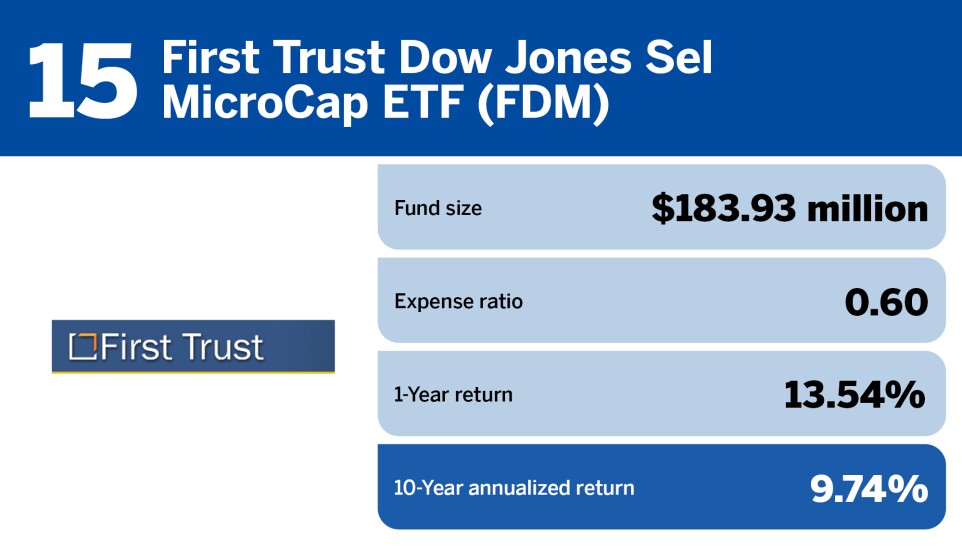

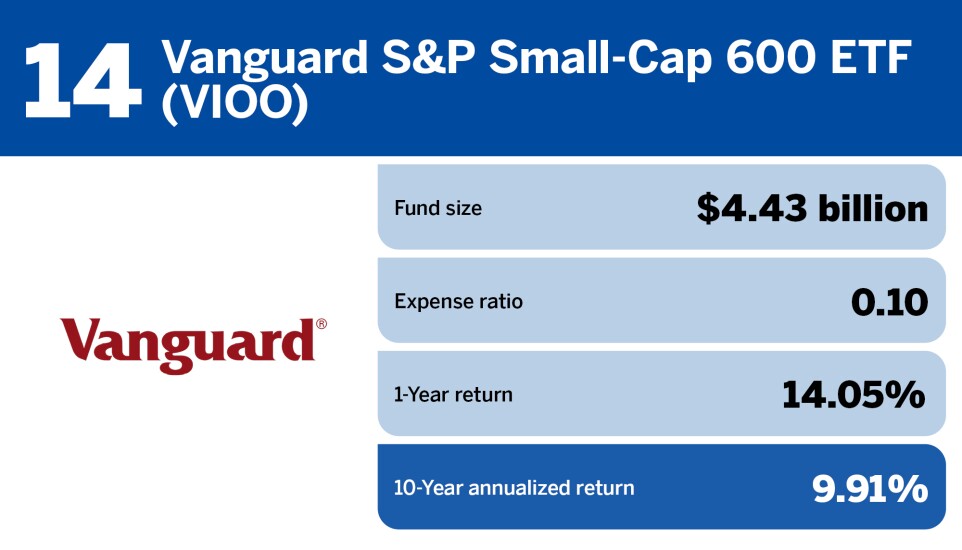

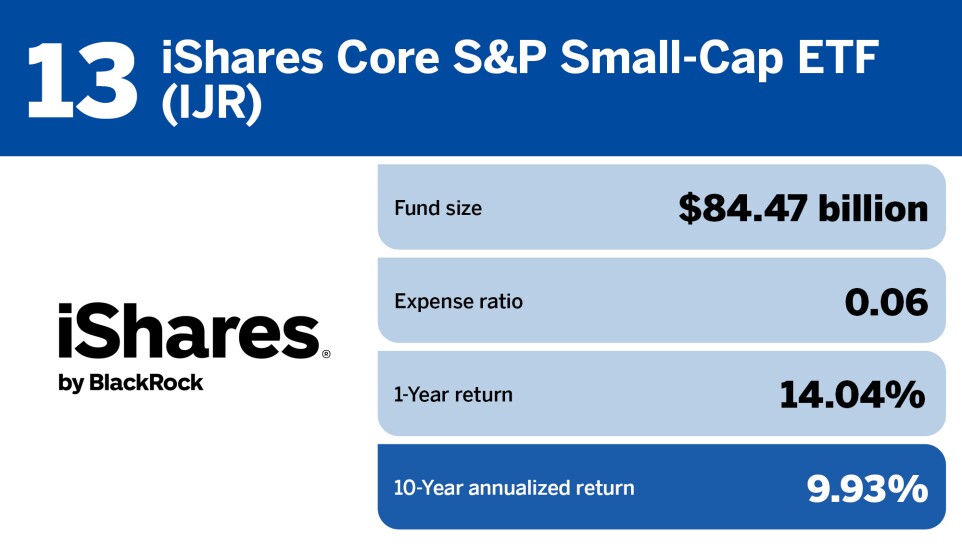

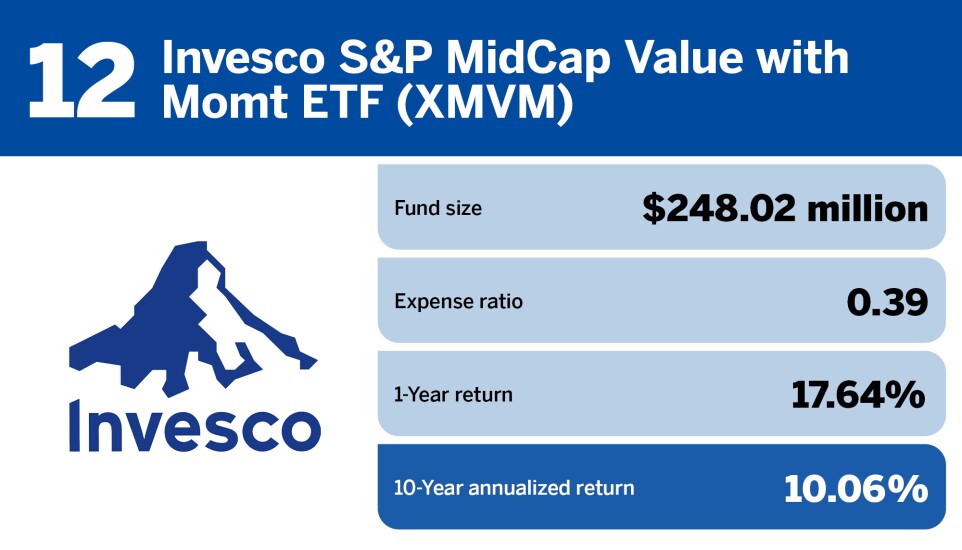

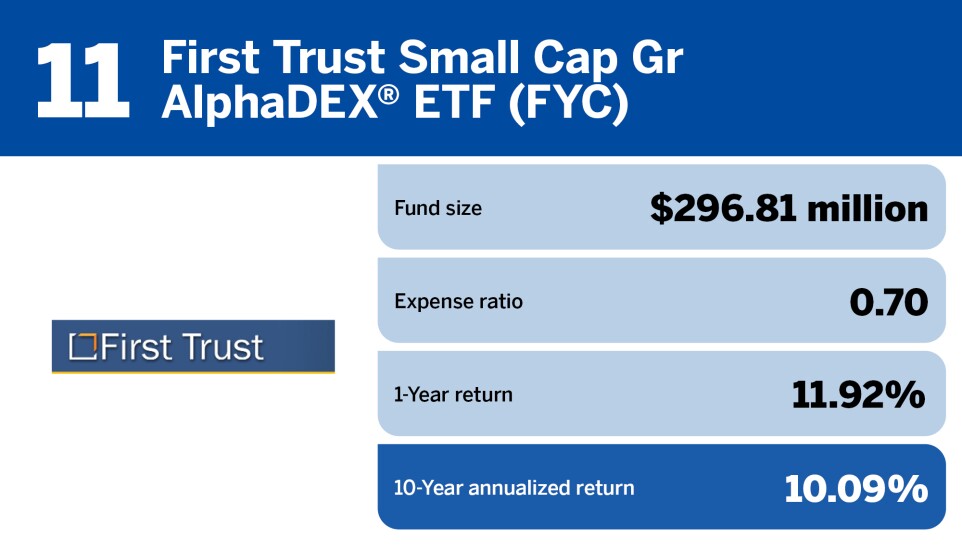

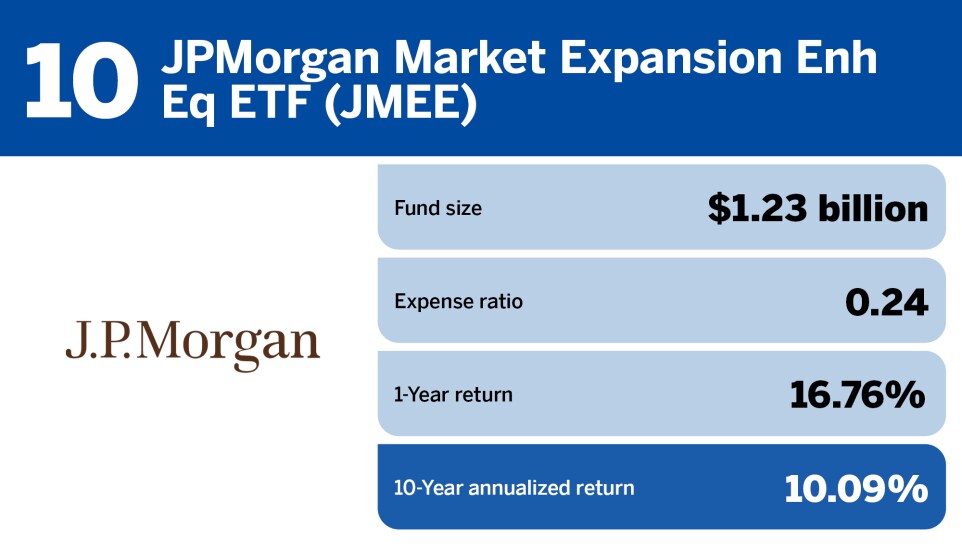

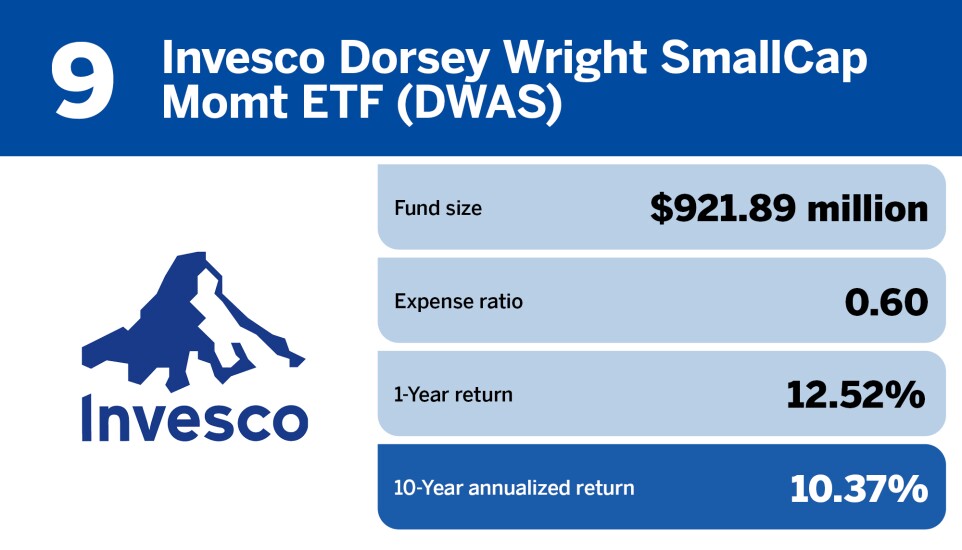

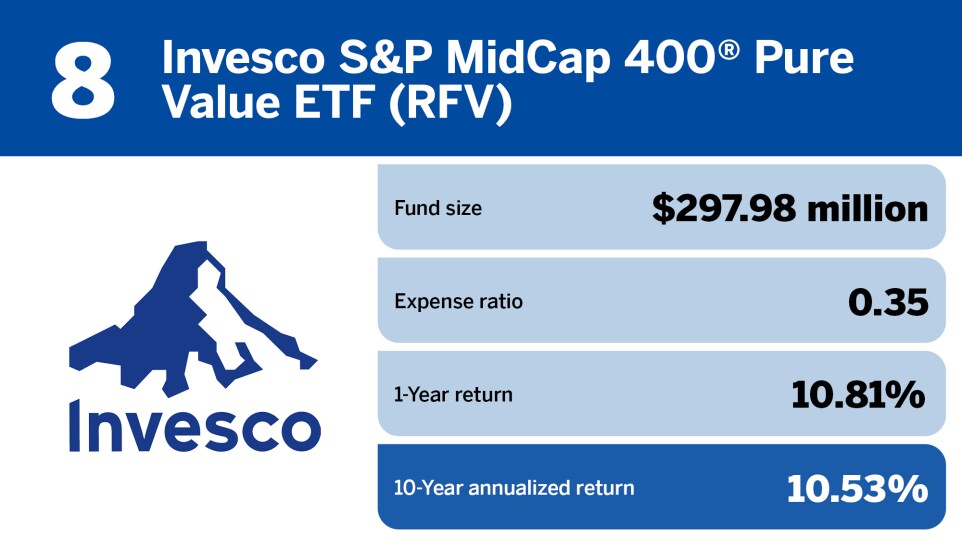

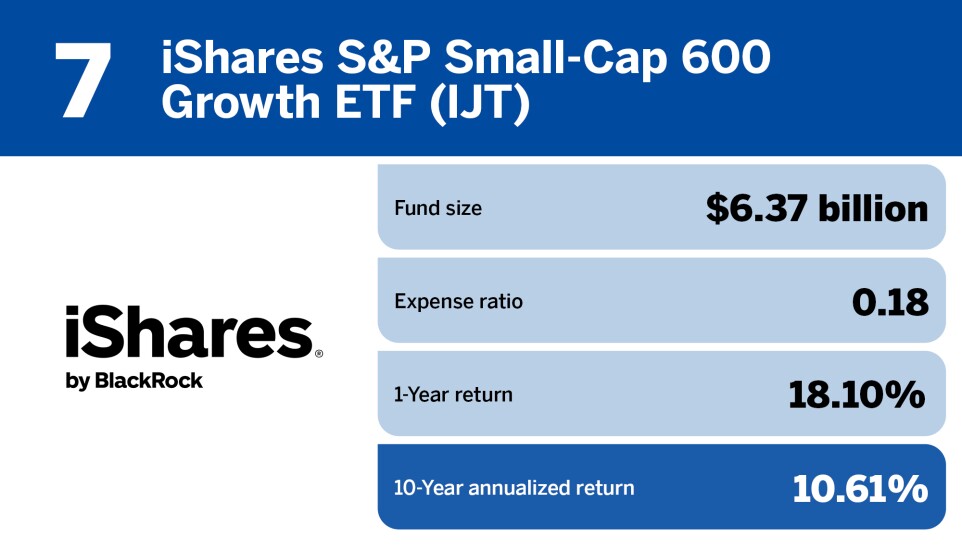

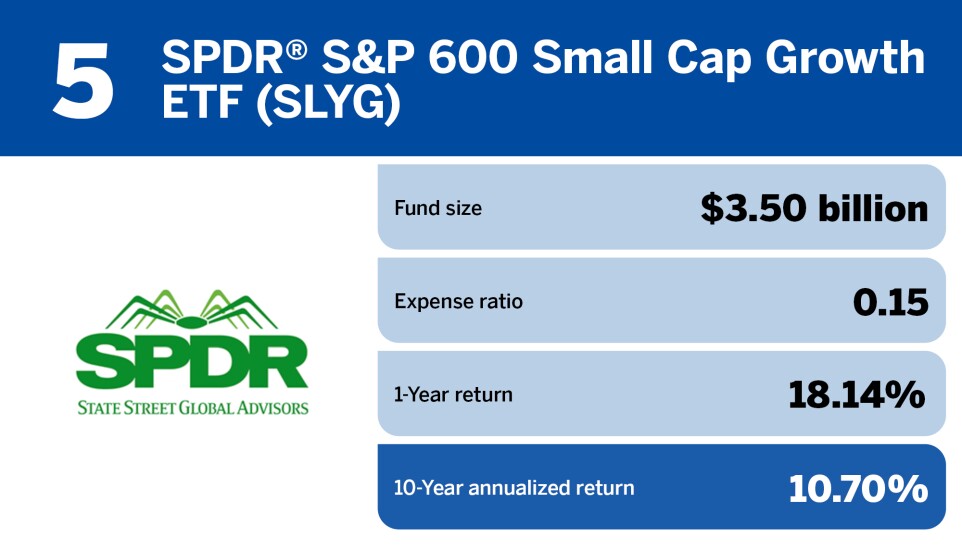

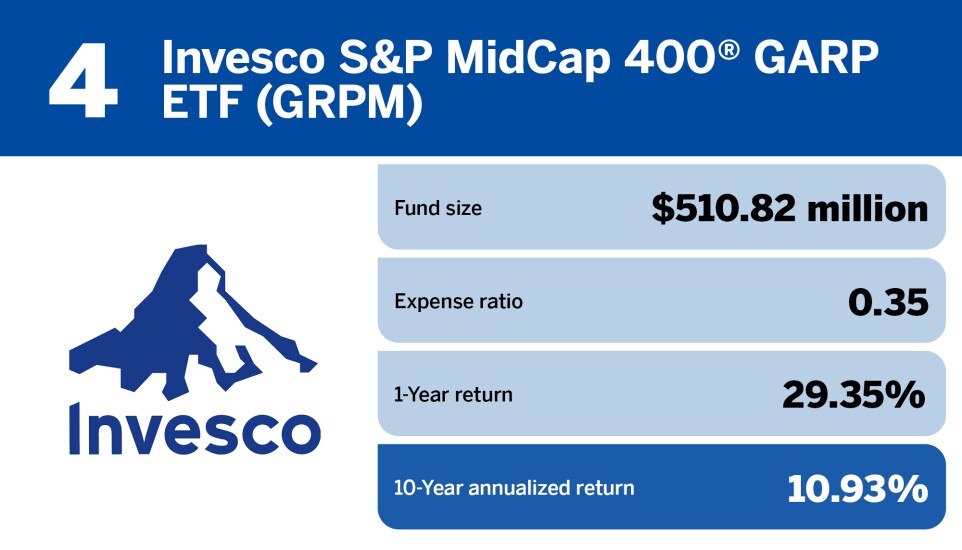

Scroll through the cardshow below for the top 20 small-cap funds of the past decade, as ranked by their 10-year returns. All data is from Morningstar Direct and is current as of Aug. 2, 2024.

READ MORE: