The past three years have been tough for bonds. The past 10 years, on the other hand, have seen a number of bond ETFs pay off for investors.

To be sure, this is a difficult moment for the bond market. As interest rates have risen, so have the yields from bonds. And bond prices — which move inversely to yields — have plummeted. Since the summer of 2020, losses on 30-year Treasury bonds have

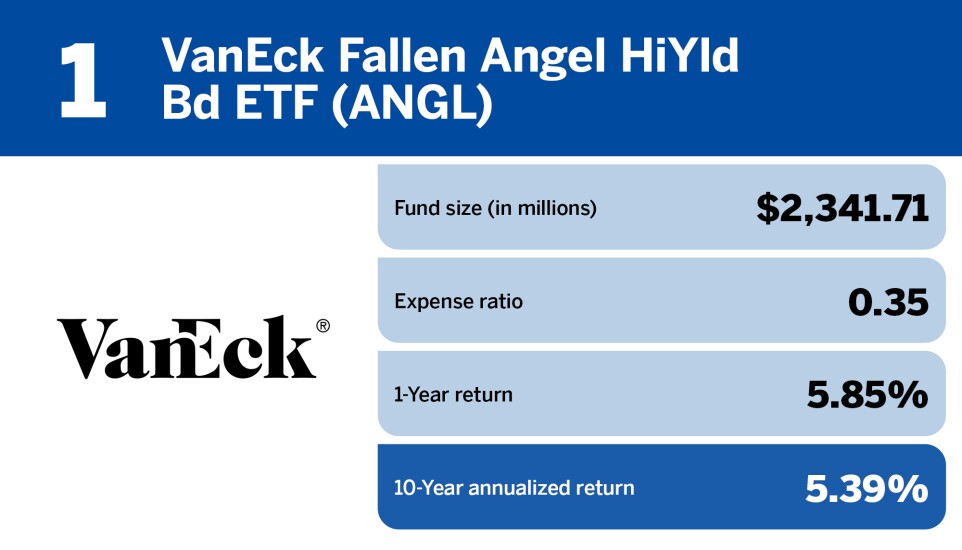

And yet, over a longer period of time, some bond funds have stayed in the black. Morningstar's 20 top-performing bond ETFs of the past decade, and their solid returns, are a reminder of why it's important to invest in fixed income, even in times like these.

"Bonds keep investors in their seats when the rollercoaster of the market gets a little scary," said Rob Schultz, a certified financial planner at

At the top of Morningstar's list is the VanEck Fallen Angel High Yield Bond ETF (ANGL). The fund tracks an index of "fallen angel" bonds — corporate bonds that have been downgraded to junk, but may experience a price rebound.

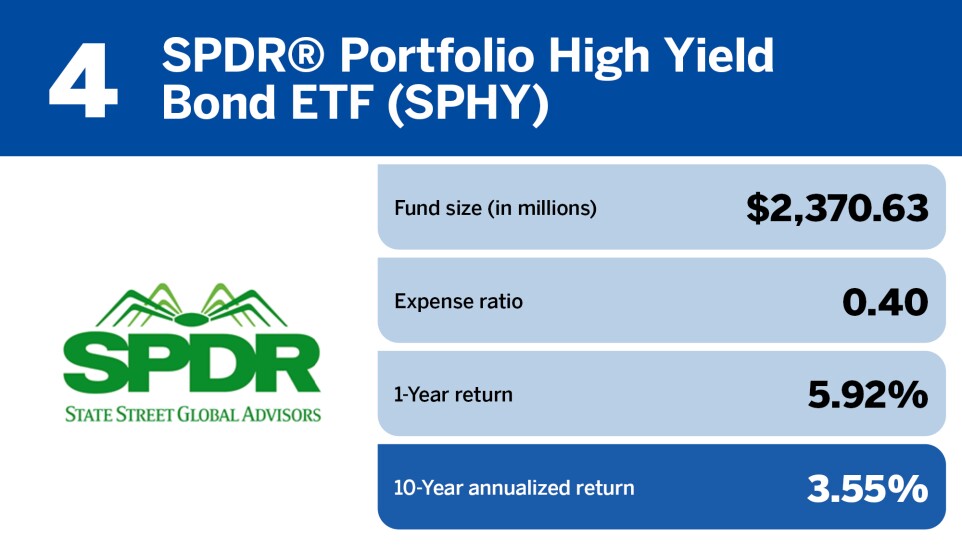

It's a risky strategy, but over the past 10 years it's been doing more soaring than falling. As of Nov. 28, the ETF's 10-year annualized return was 5.39%.

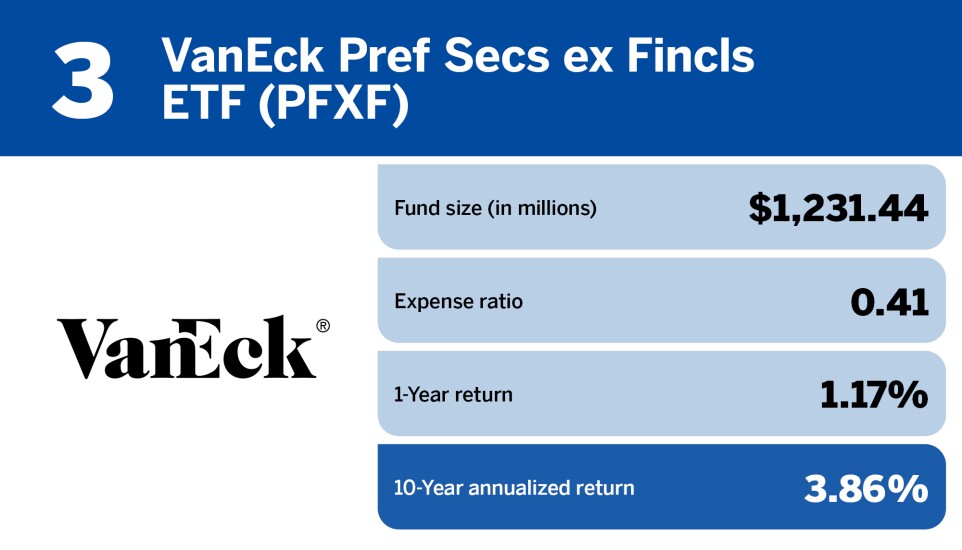

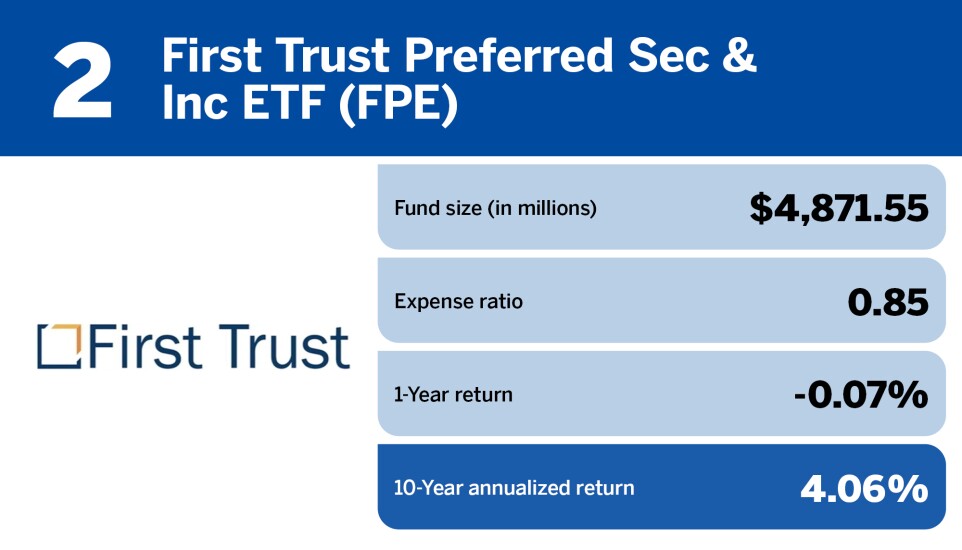

In second place is the First Trust Preferred Securities and Income ETF (FPE), with a 10-year return of 4.06%. And rounding out the top three is the VanEck Preferred Securities ex Financials ETF, whose return was 3.86%. Both these funds, according to Morningstar, are high on yield but low on diversification — something not all advisors recommend.

READ MORE:

"What these funds have in common is they invest in the riskier end of the bond market," said Kashif Ahmed, president of

However, Ahmed does recommend investing in bond ETFs in general — he just prefers ones that are more diversified.

"Investing in bond ETFs or mutual funds provides diversification and professional management," he said. "With very little money, you can gain exposure to sometimes thousands of different bonds in one fund."

READ MORE:

As for the bond market's current doldrums, some advisors see the cratering prices as an opportunity.

"The 'greatest bond bear market of all time' sounds like a great time to buy bonds," said Dennis Hunt, a senior financial advisor at

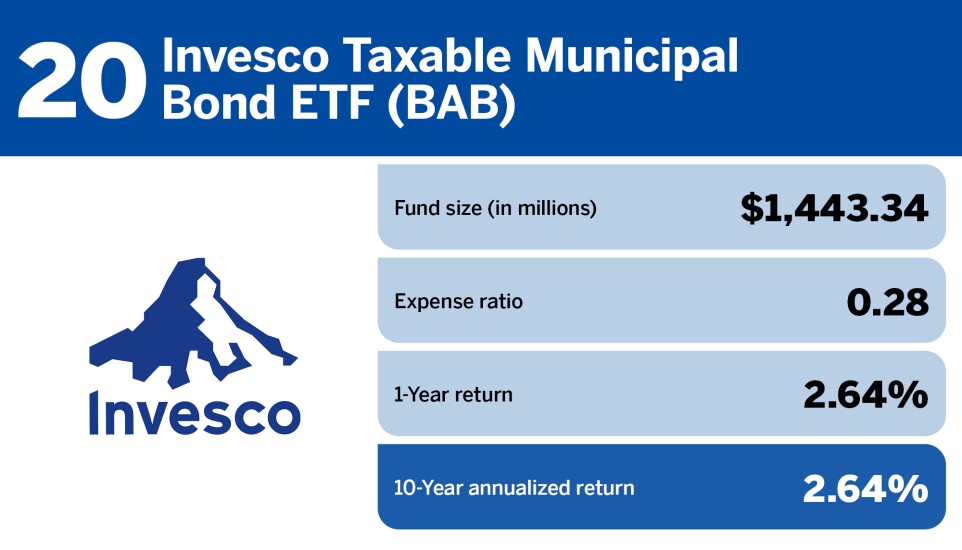

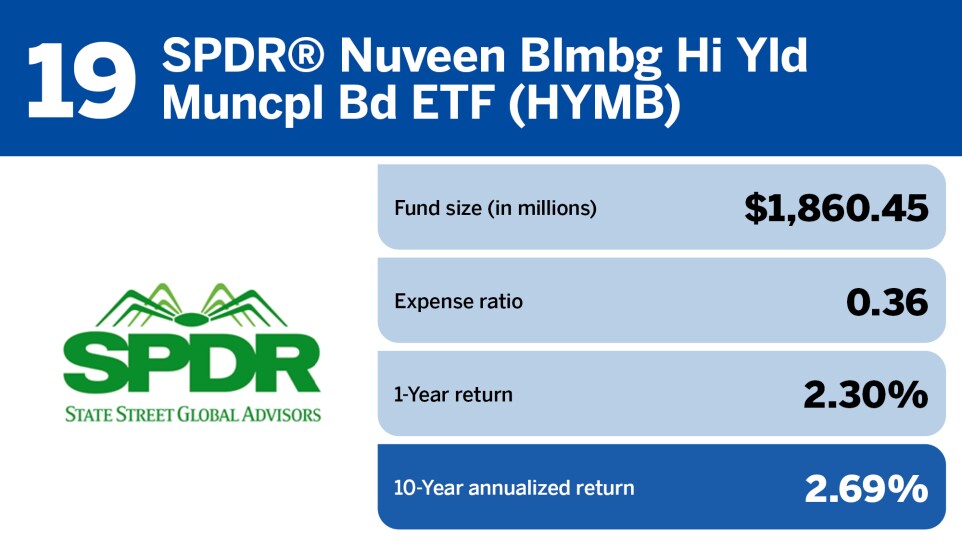

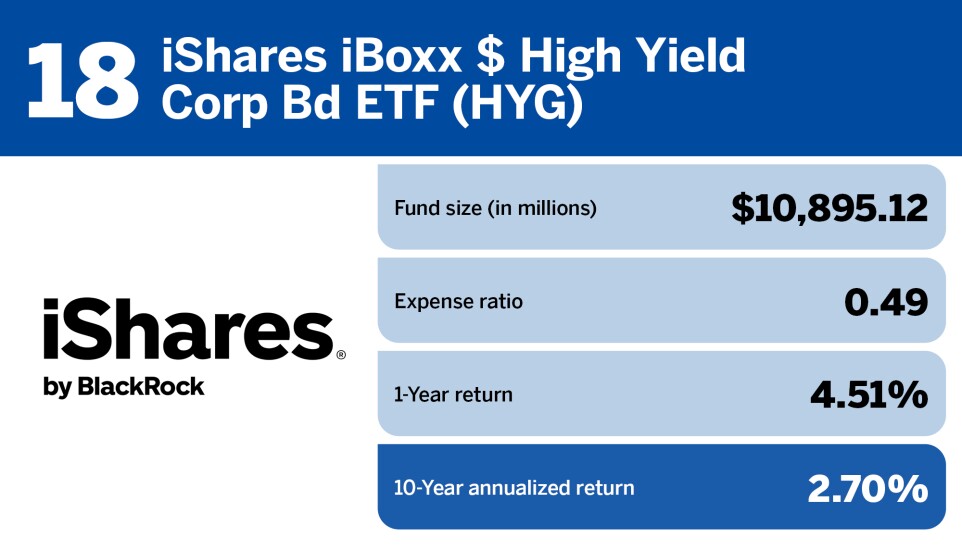

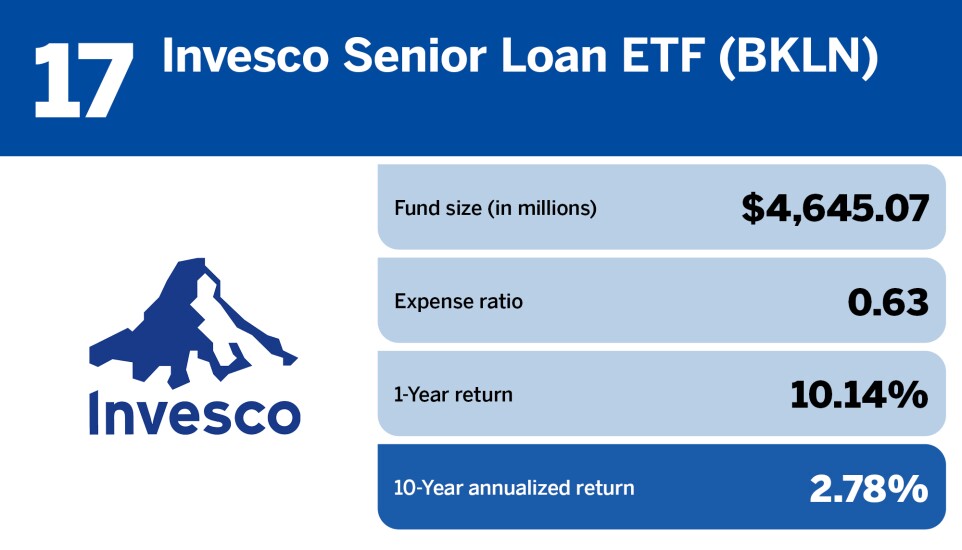

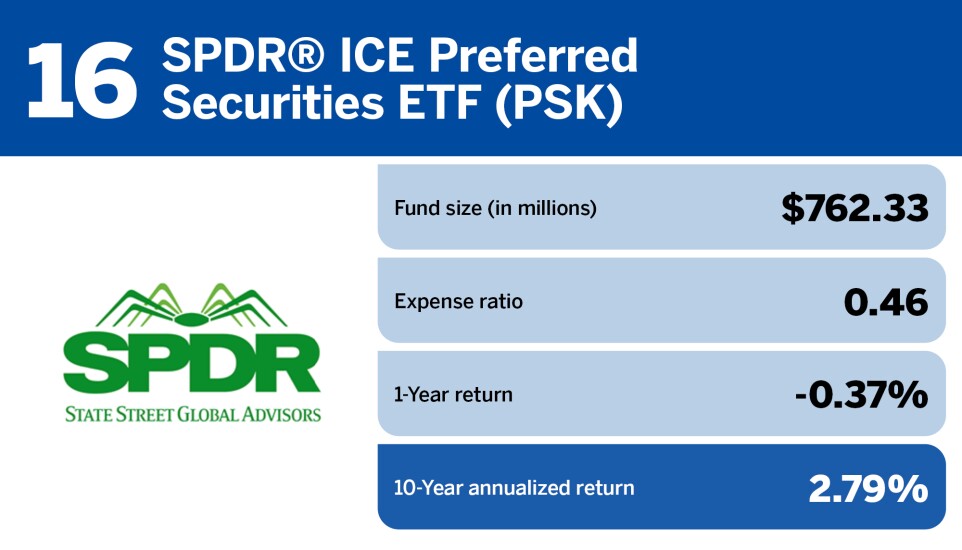

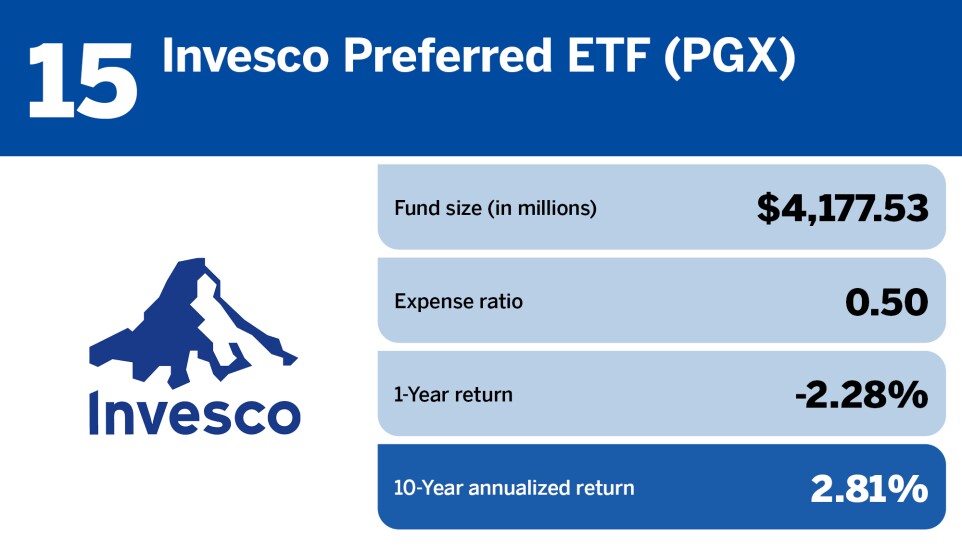

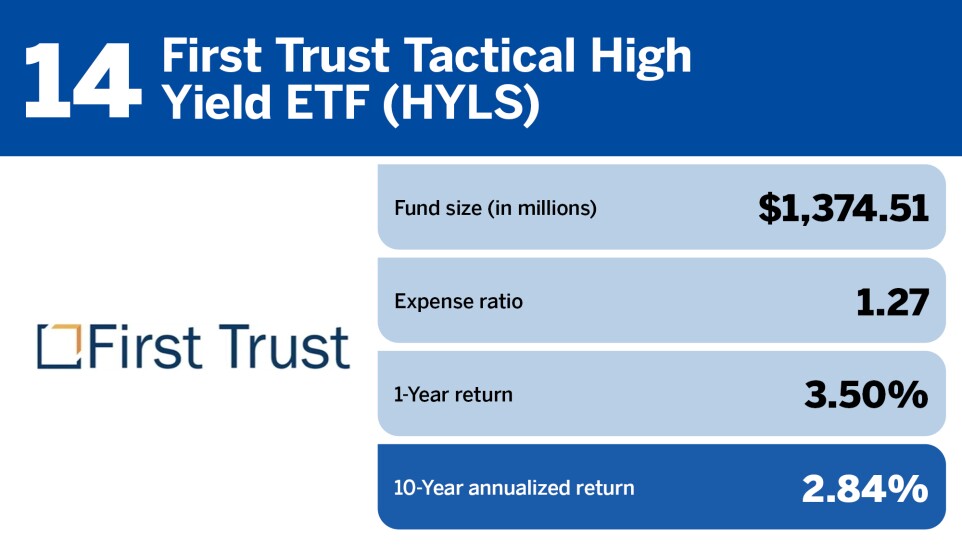

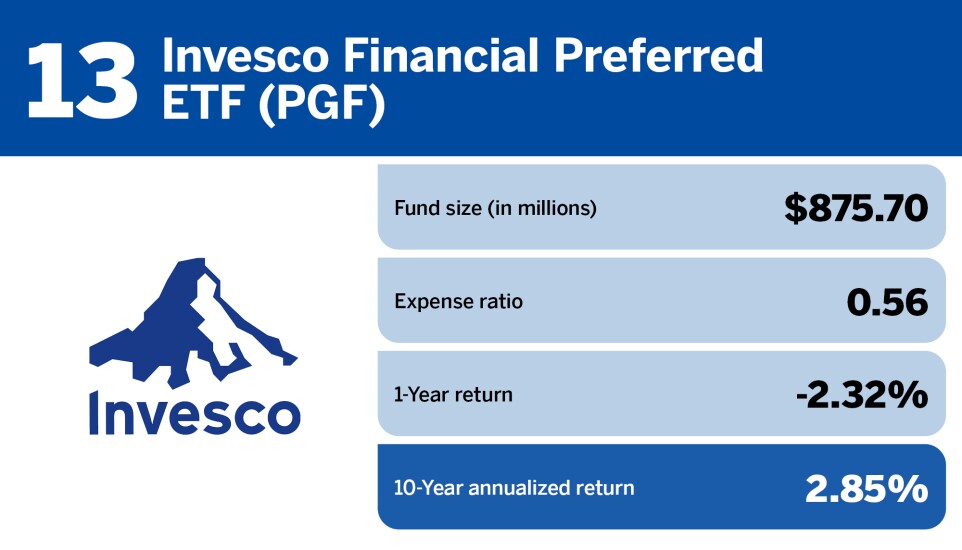

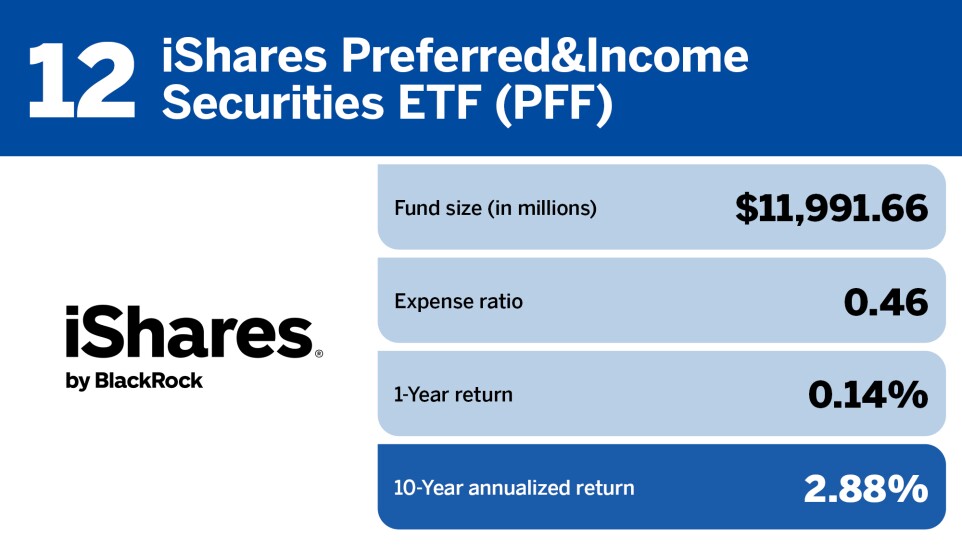

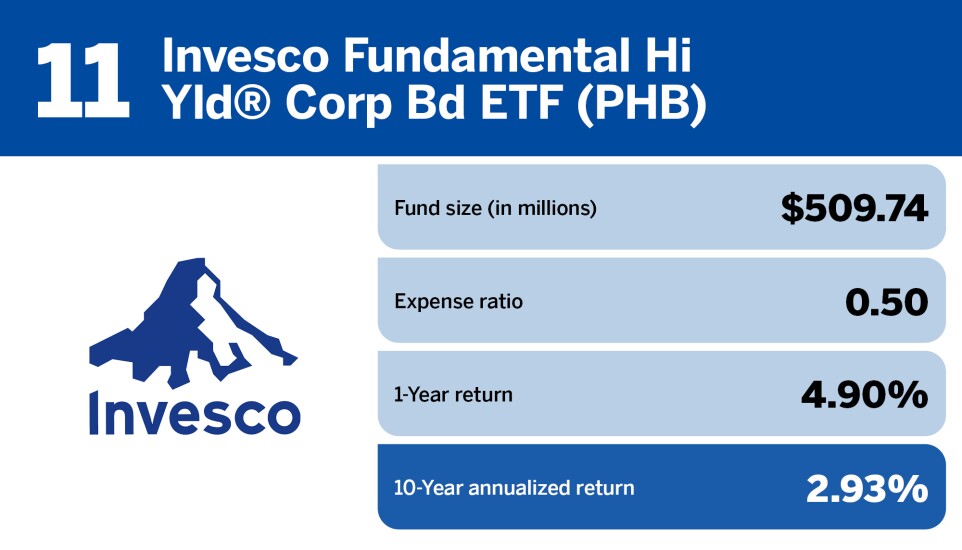

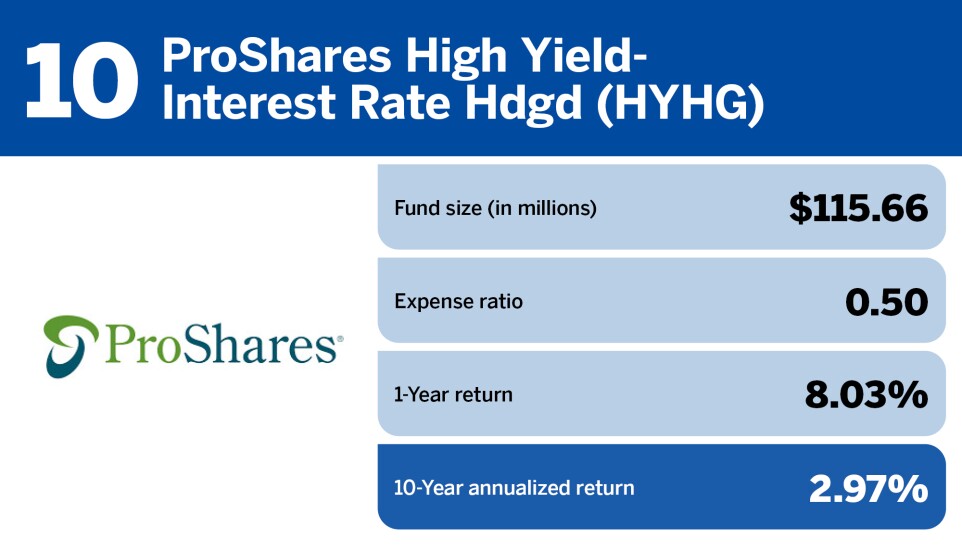

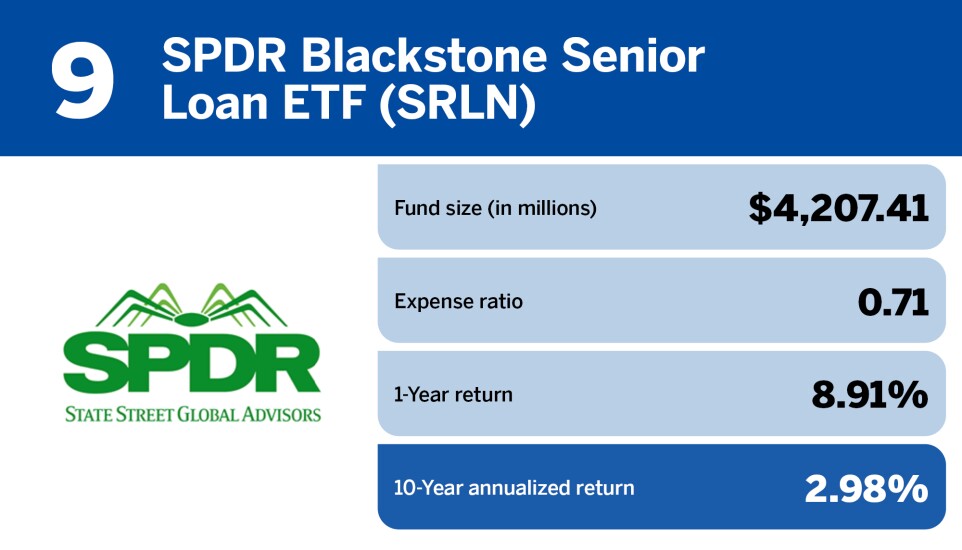

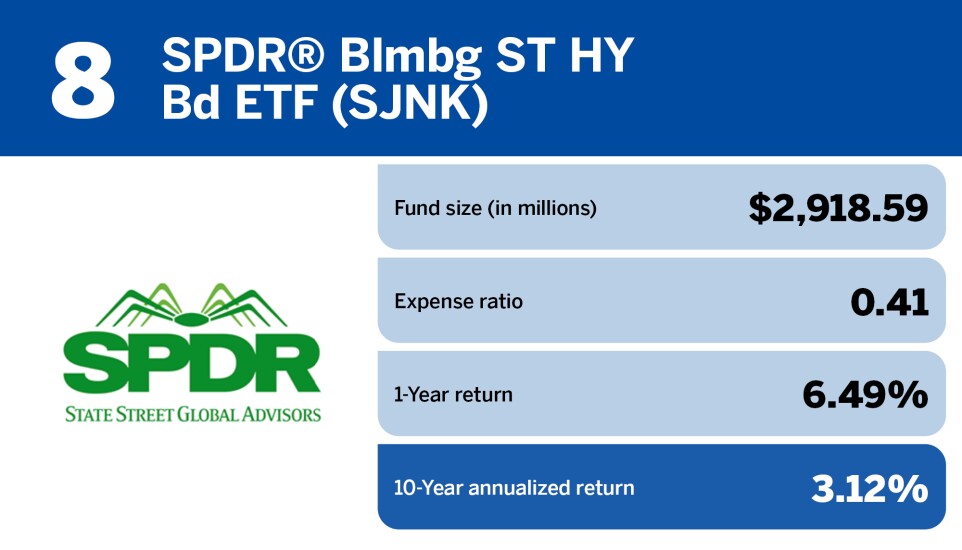

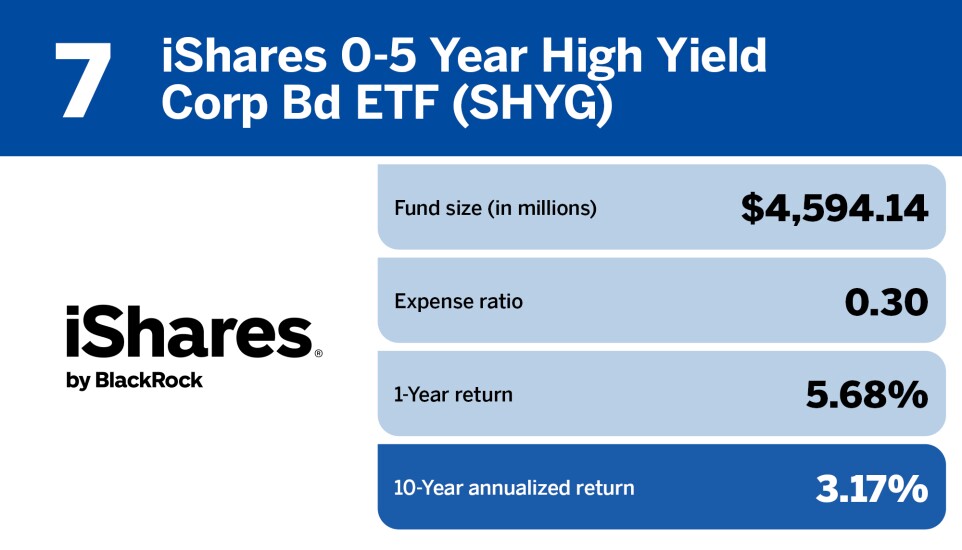

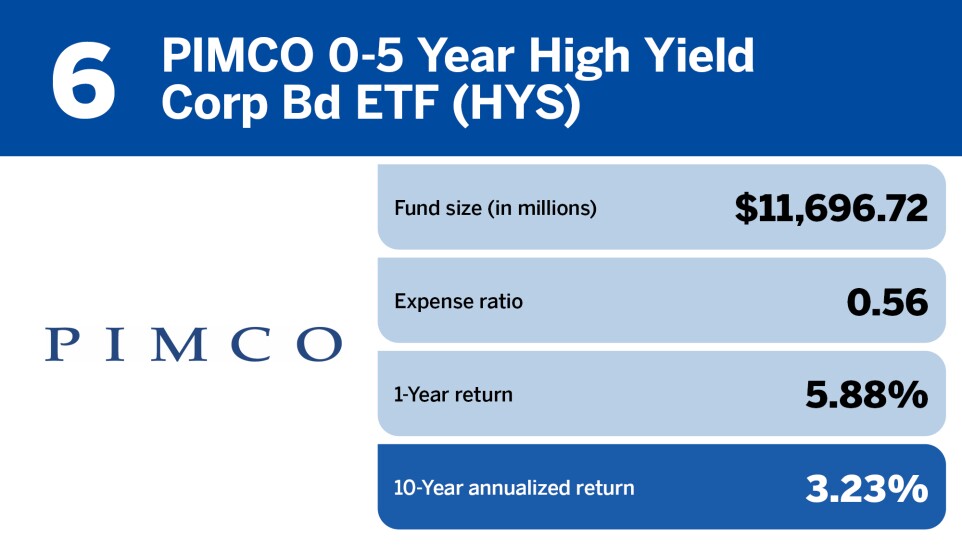

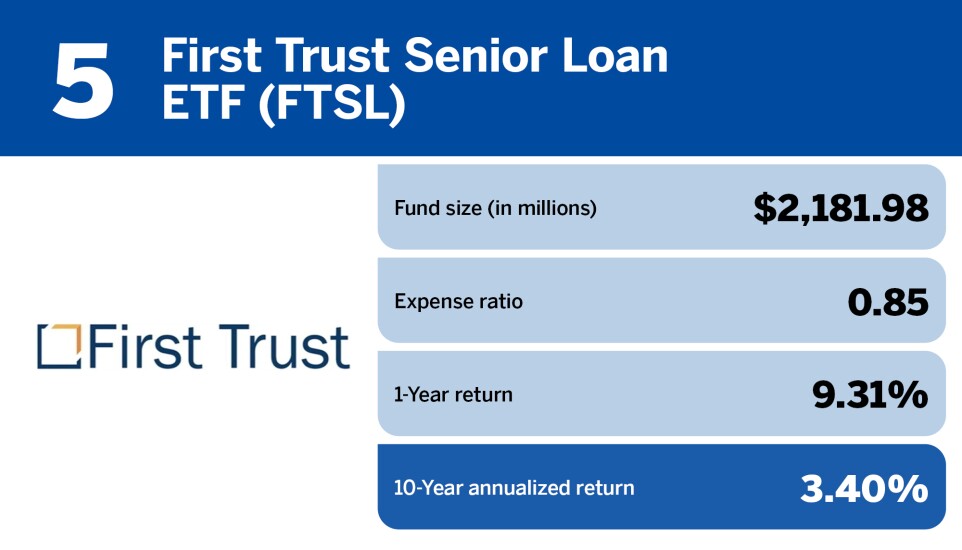

To see the rest of the top 20 bond ETFs of the past 10 years, scroll through the cardshow below. (All data is from Morningstar Direct, and is current as of Nov. 28, 2023.)

READ MORE: