In both a philosophical and financial sense, health is wealth.

In the United States, health care isn't just a necessity; it's also an enormously profitable industry. In 2022, health spending made up 17.3% of the country's gross domestic product, according to the

All this spending makes health a major segment of the U.S. stock market. In 2023, health care equities had the 10th-highest total returns of any sector, according to Morningstar Direct.

"I think investing in health care is common sense," said Kashif Ahmed, president of

And in an important way, time is on this sector's side: Americans are growing older, and they'll need more health care as they age. From 2010 to 2020, the U.S. population aged 65 and older grew by 38.6% — the fastest rate since the 19th century, the

This

"Health care is a growing segment of the American economy as the reach of technology into medicine expands," said Robin Hovis, a financial advisor at

How can investors ride this wave? Choosing particular health care stocks can be tricky, but ETFs offer something almost every financial advisor recommends: diversification.

"With one stroke, you're able to capture the entire slice of that particular market," Ahmed said. "I think that is an easy way to do it, versus trying to bet on one company. … Why bet on one store when you can buy the whole mall?"

On the other hand, one of the sector's big advantages is also a liability. The U.S. spends more on health care than any other country, according to the

"The federal government is the 800-pound gorilla in the health care sector," Hovis said. "Sudden policy changes by Medicare and Medicaid, and legislation that affects what health insurers can and cannot do, will have far-reaching and often unexpected consequences on companies that provide health care products and services."

Such policy changes are rare, however. The last major national reform was the Affordable Care Act, which was passed in 2010. And for another overhaul to arrive, Congress would need to rise above its usual gridlock — which is fierce on this issue.

READ MORE:

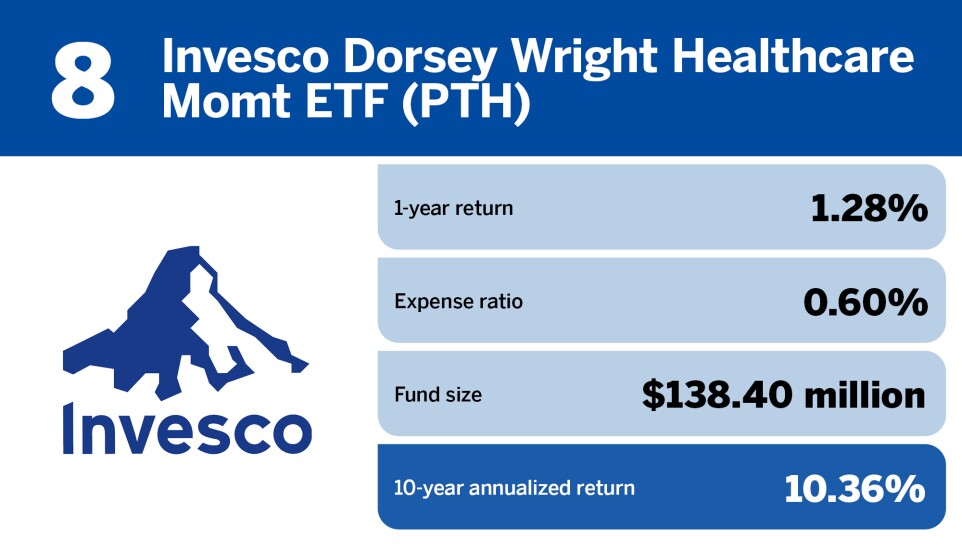

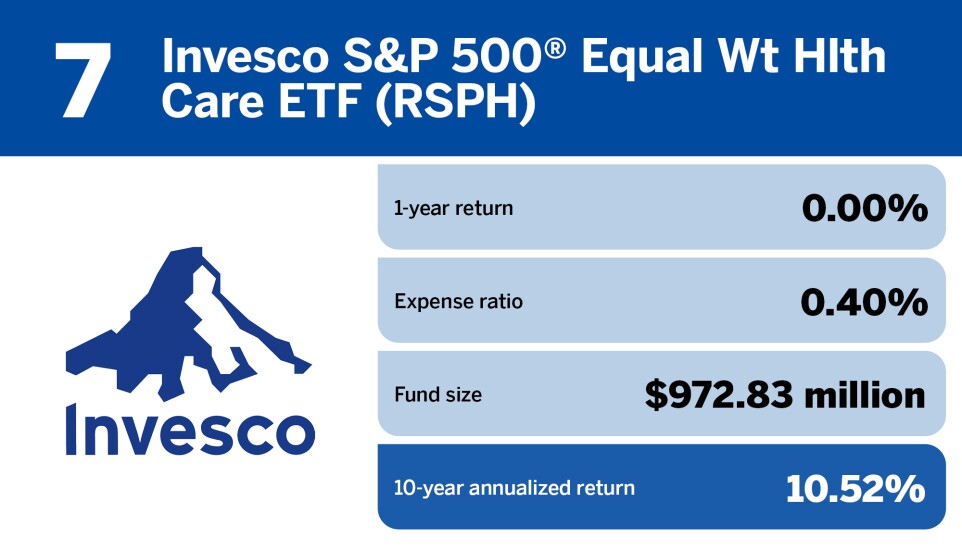

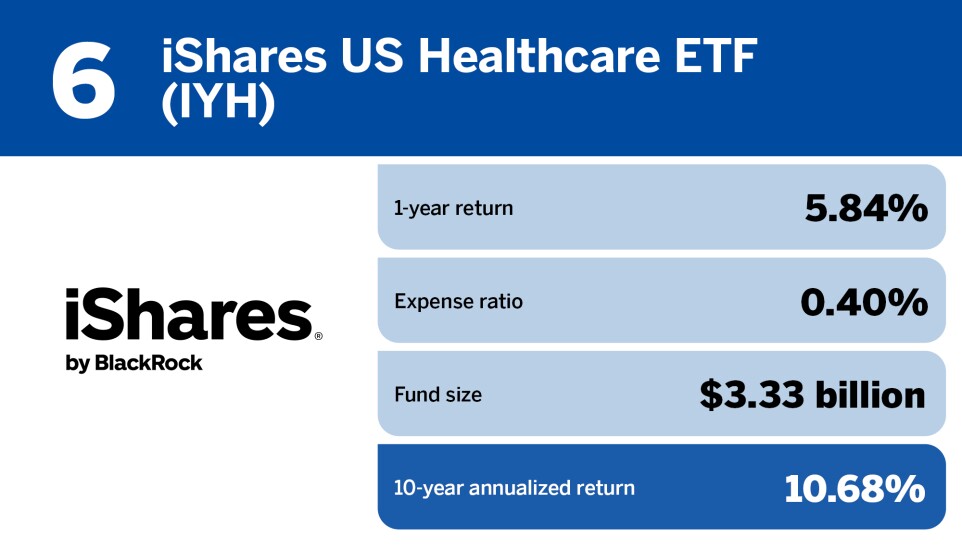

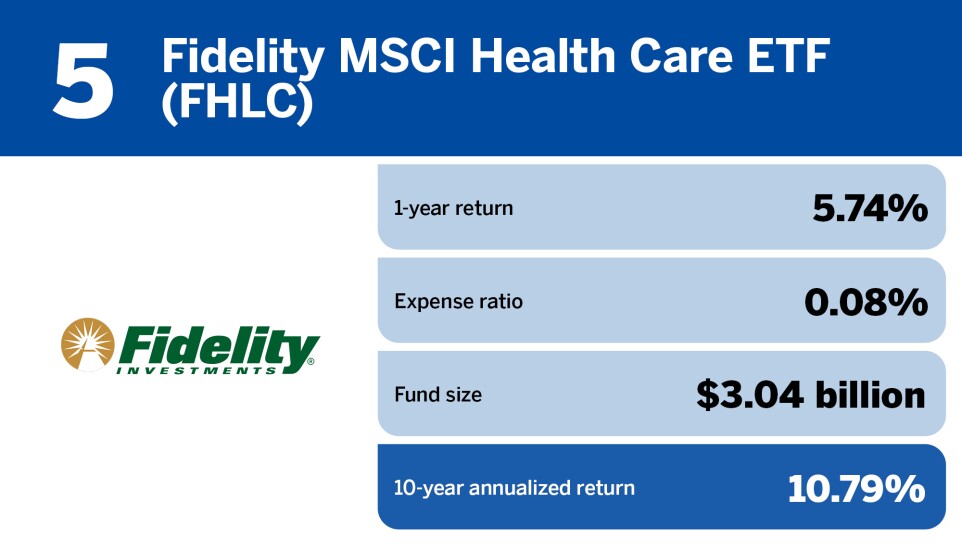

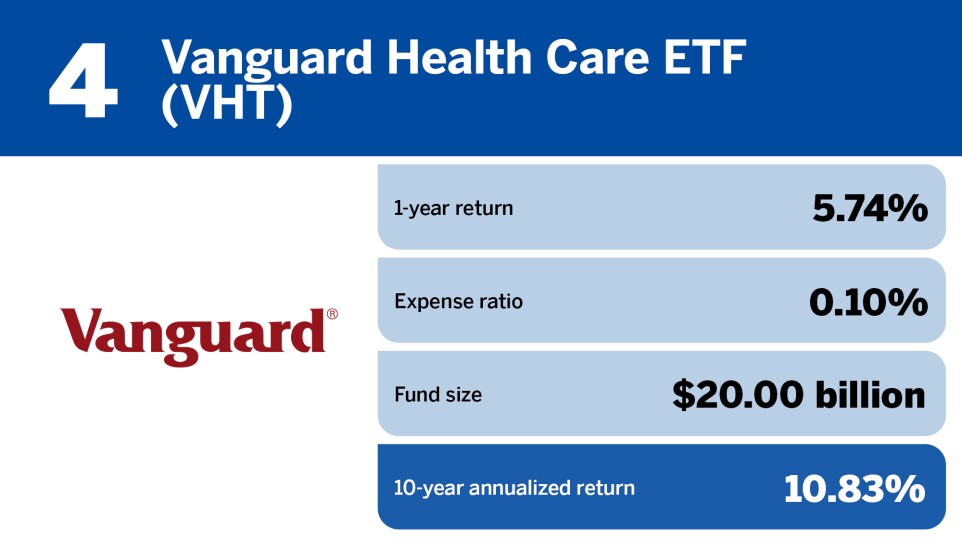

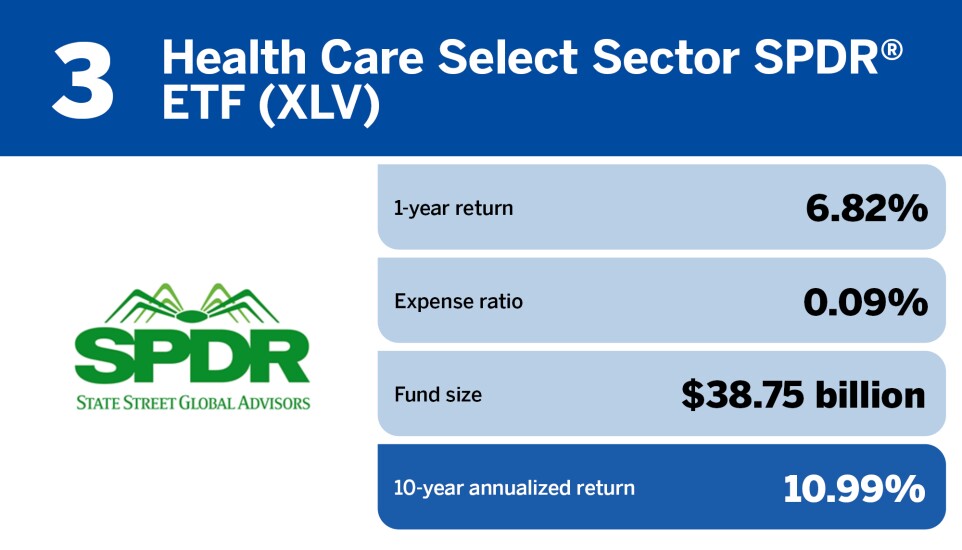

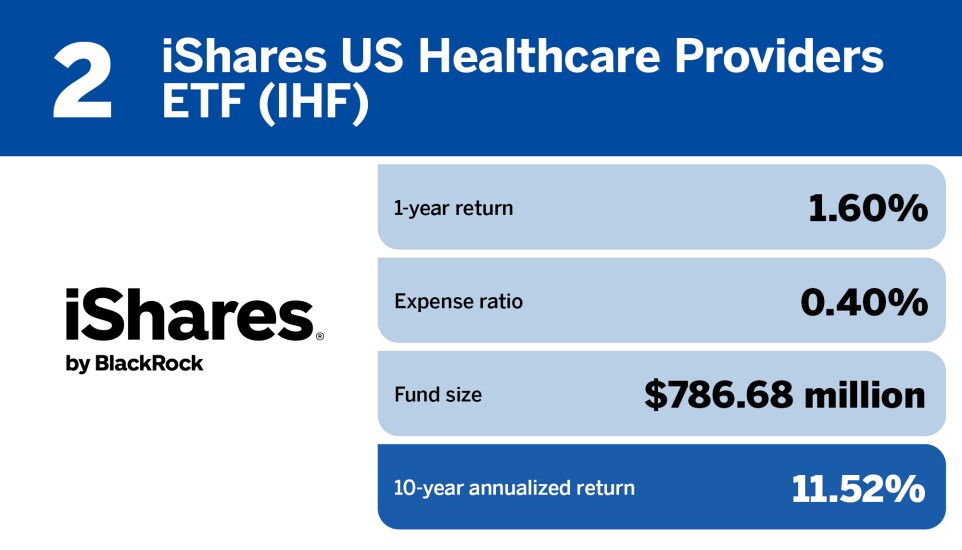

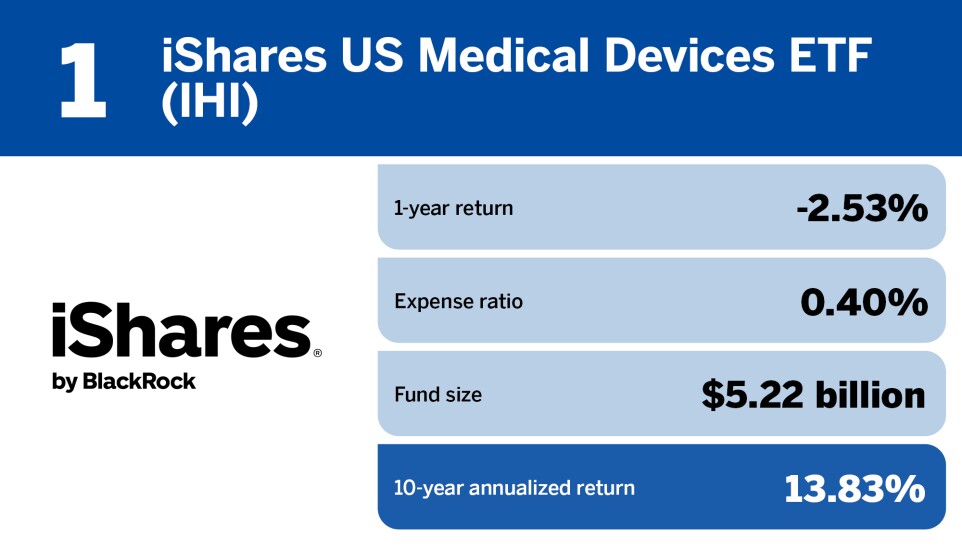

In the meantime, health-related funds have remained highly profitable. Over the past decade, the top eight health care ETFs have yielded annualized returns of more than 10%.

"It's no surprise that all of these ETFs have done well," Ahmed said. "Why would you not invest in something that every single person needs on a daily basis throughout the world?"

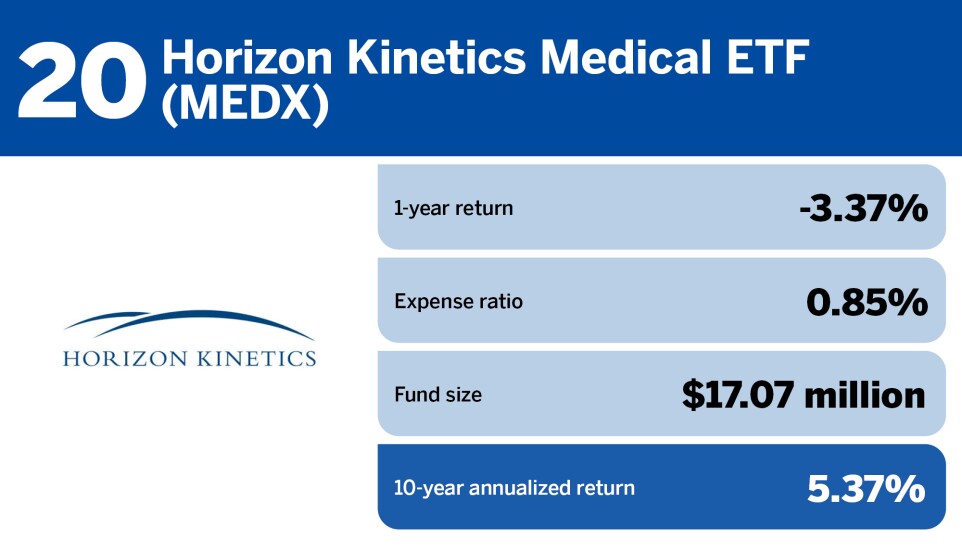

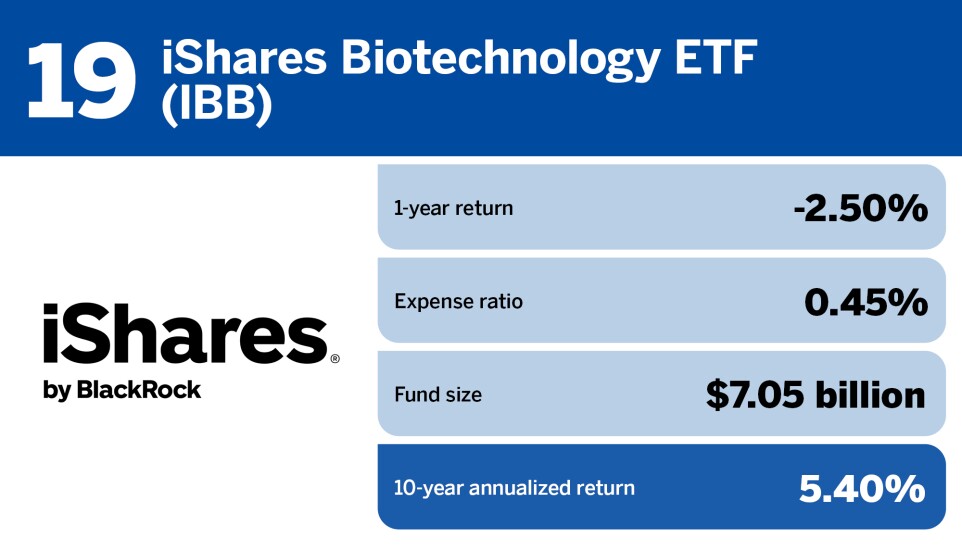

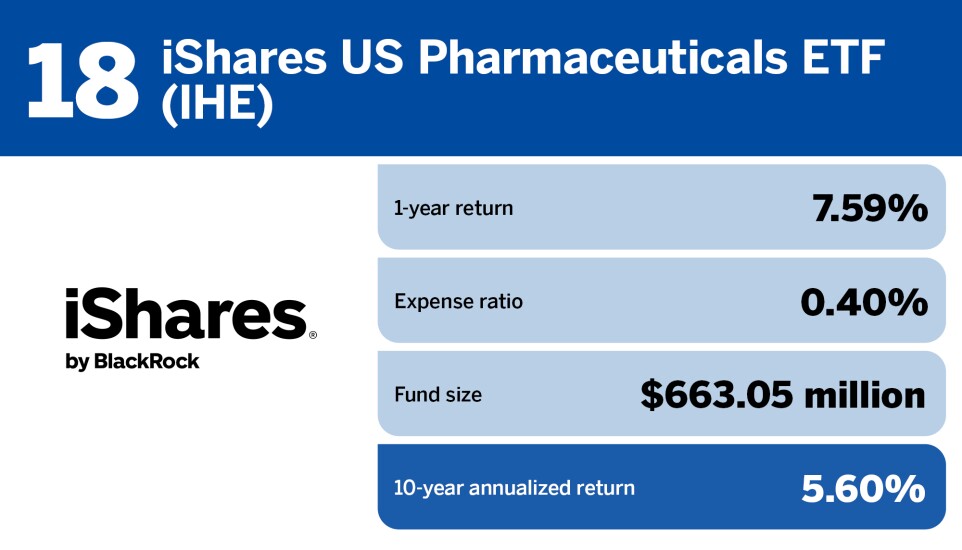

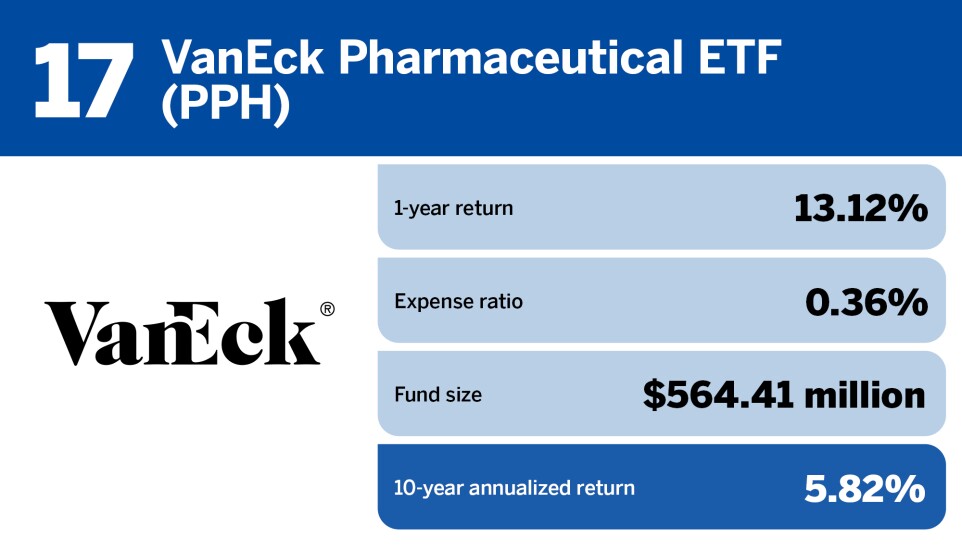

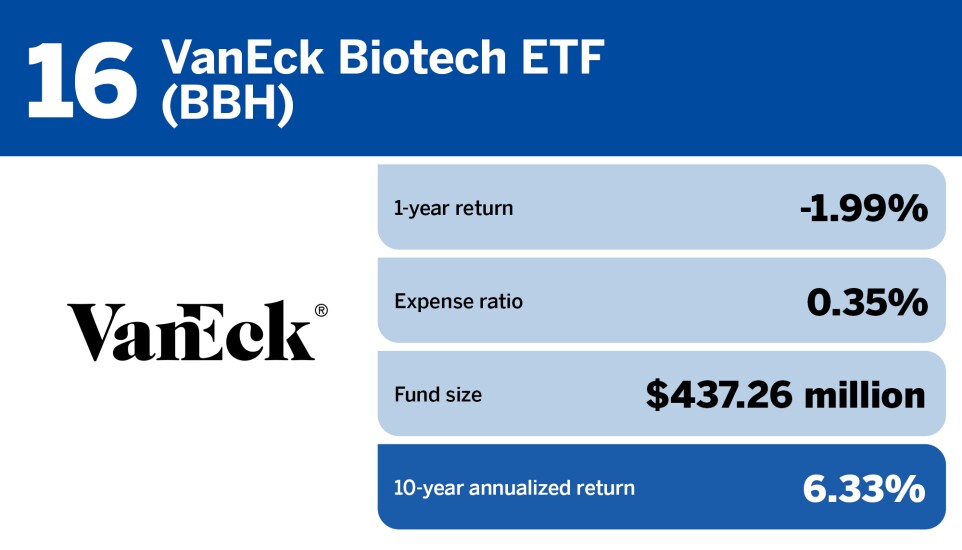

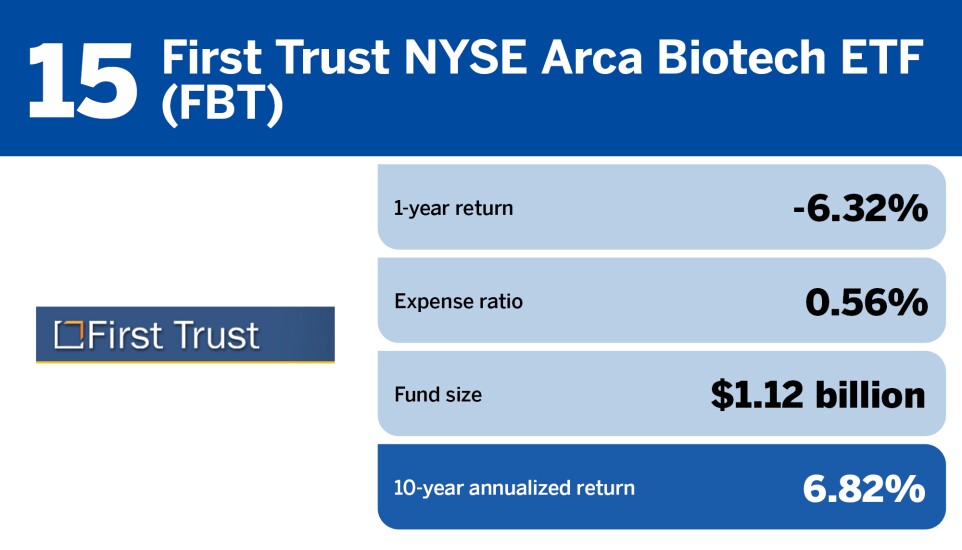

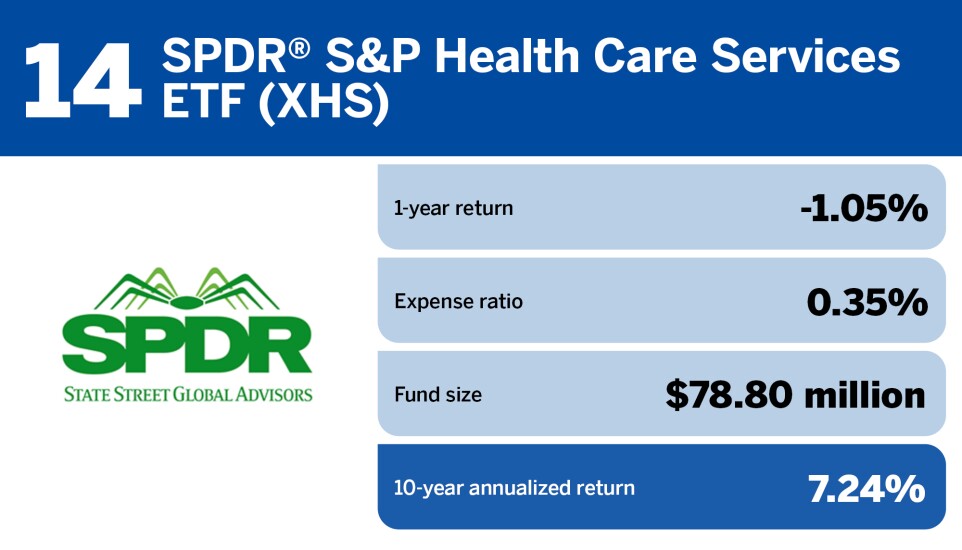

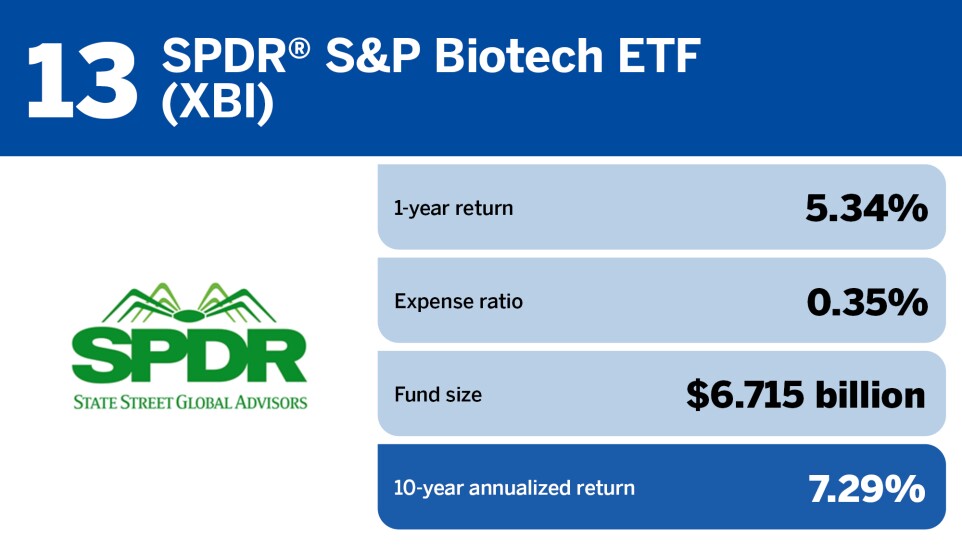

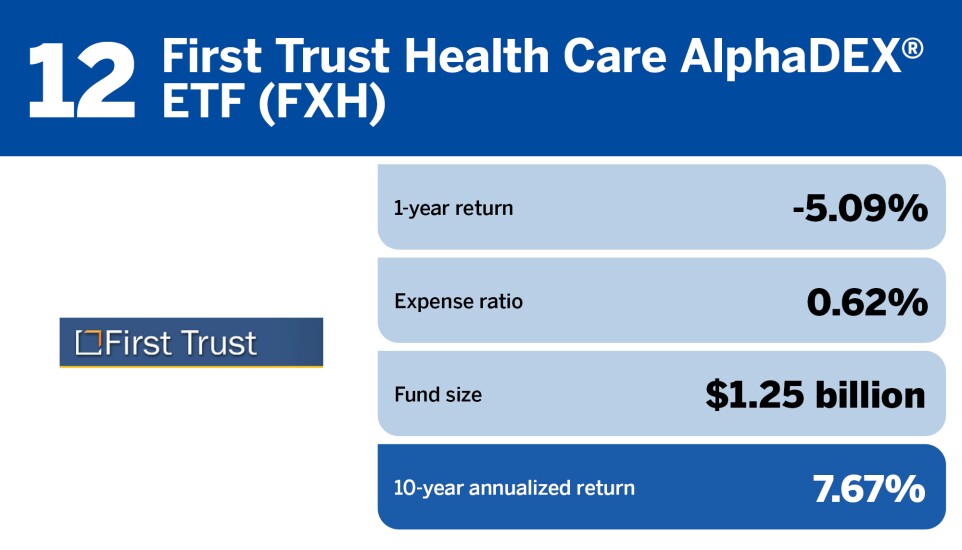

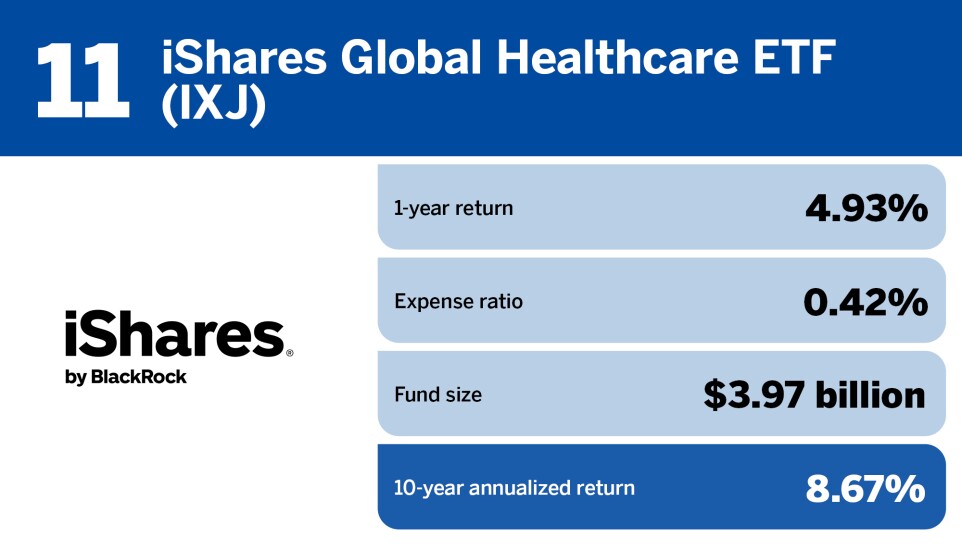

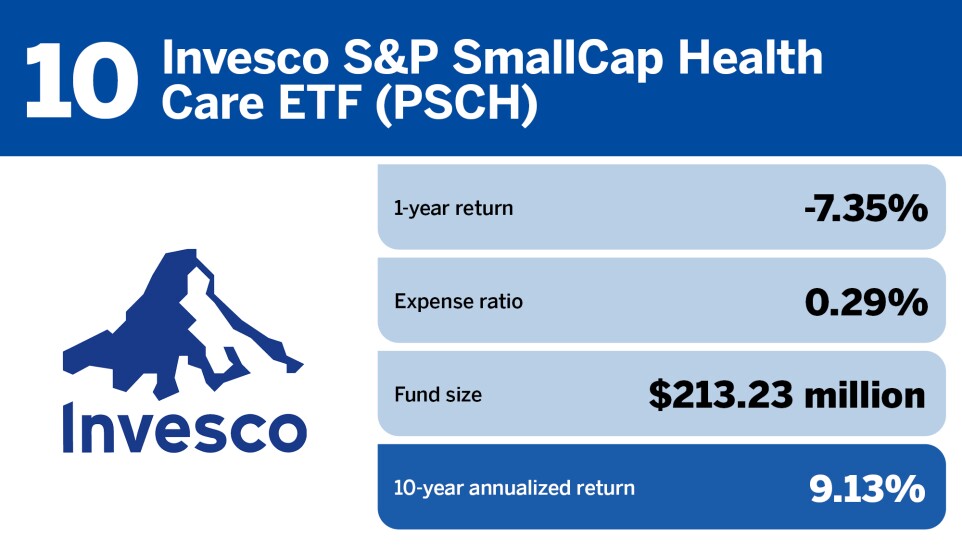

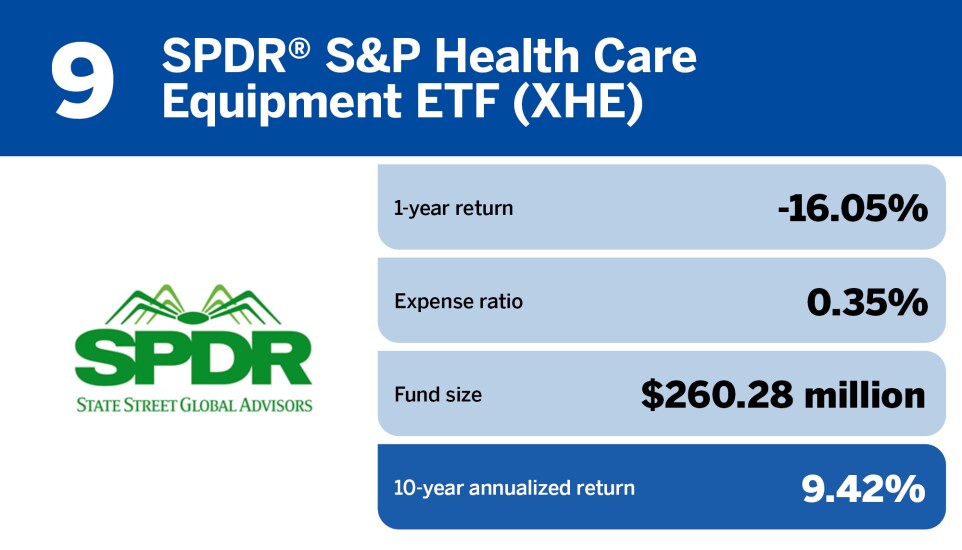

For the top 20 health care funds of the past 10 years, scroll through the cardshow below. All data is from Morningstar Direct, and is current as of May 14, 2024.