The past few years have been a whirlwind for ESG. After a political backlash and an exodus of investors, those three initials — standing for "

Following the story induces a sense of whiplash. Just six years ago, BlackRock CEO Larry Fink wrote what became ESG's manifesto, extolling the importance of socially conscious investing.

"Society is demanding that companies, both public and private, serve a social purpose," Fink wrote in his 2018

Investment flooded into ESG funds, which promised to funnel the cash only into corporations that benefited — or at least didn't harm — the planet and humanity. In 2021, investors around the world poured

Then the tides turned. Prominent Republican politicians began

READ MORE:

"Corporations across America continue to inject an ideological agenda through our economy rather than through the ballot box," DeSantis said in January 2023. "Today's actions reinforce that ESG considerations will not be tolerated here in Florida."

These political events took a heavy financial toll. In 2023, investors pulled $13 billion out of U.S. sustainable funds, according to

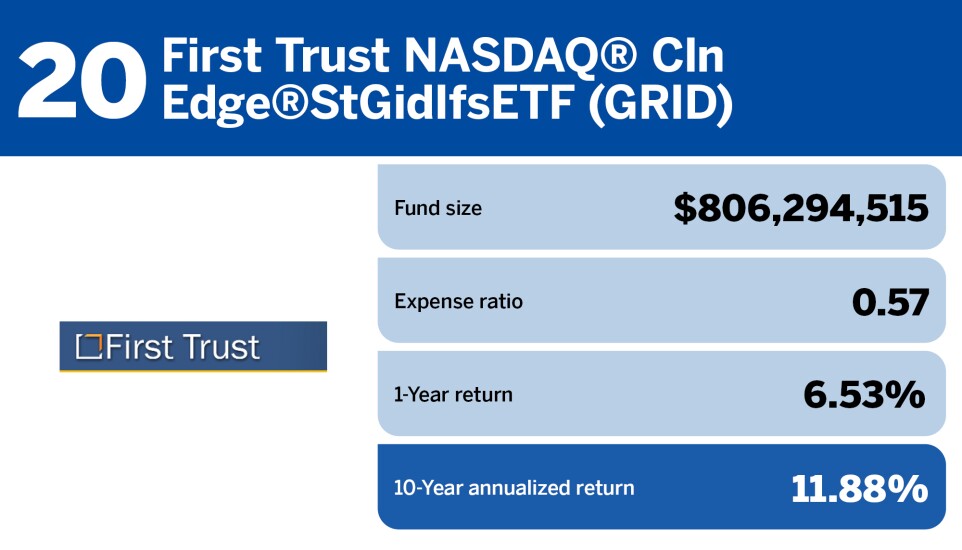

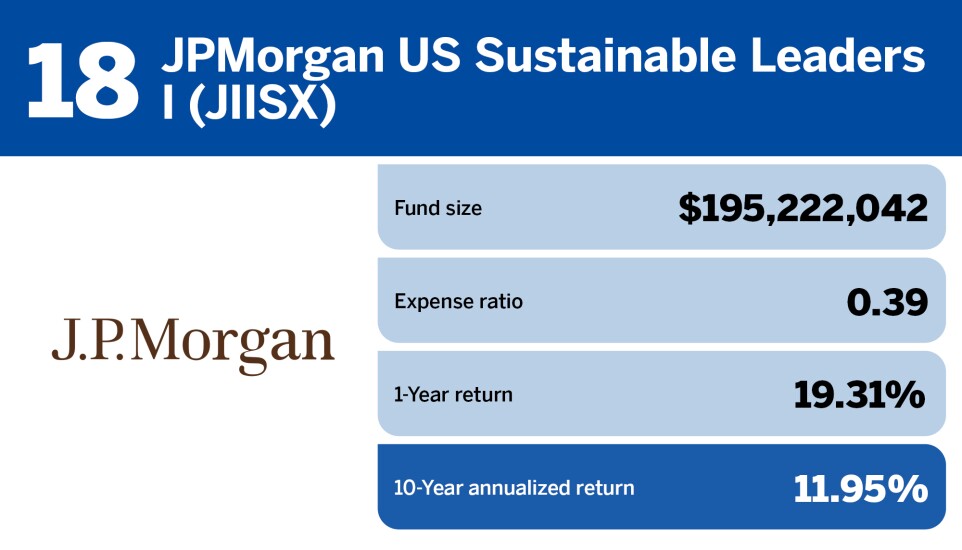

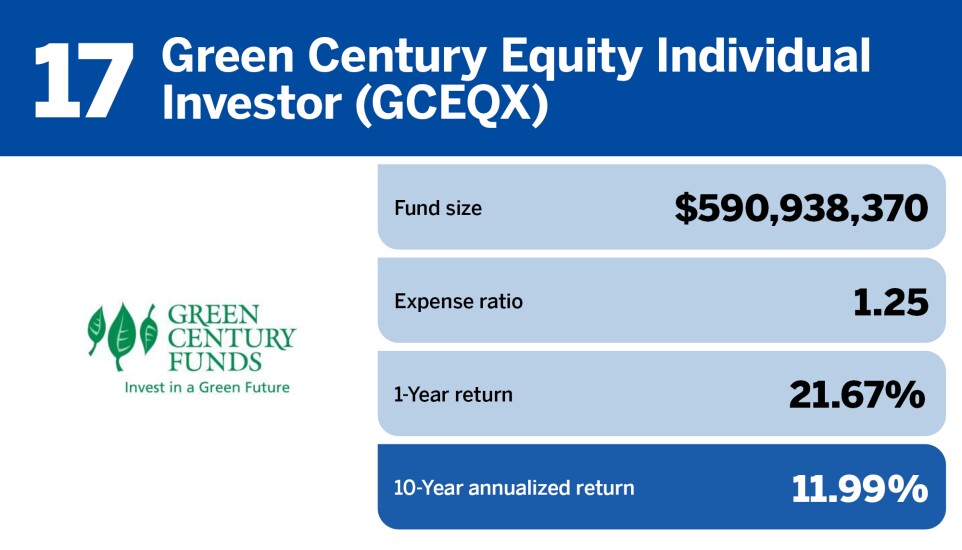

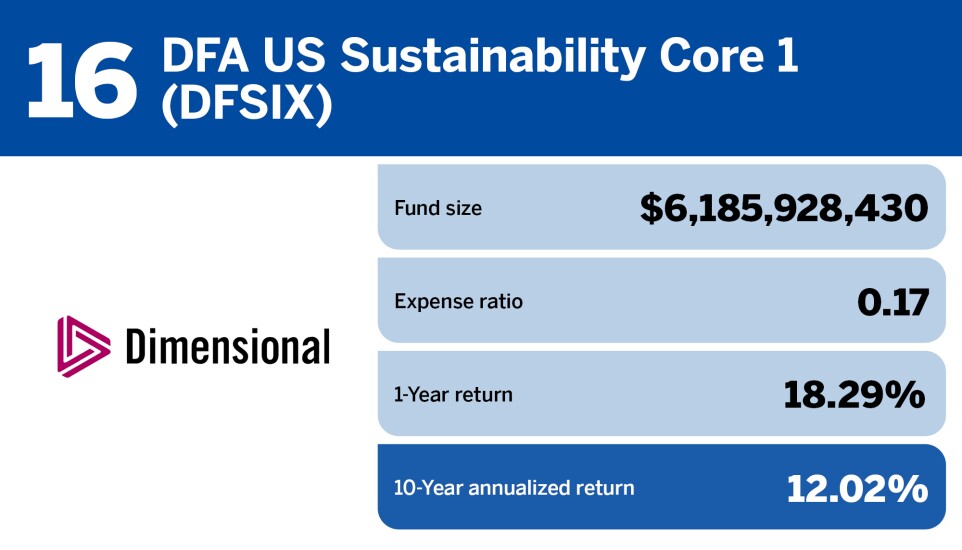

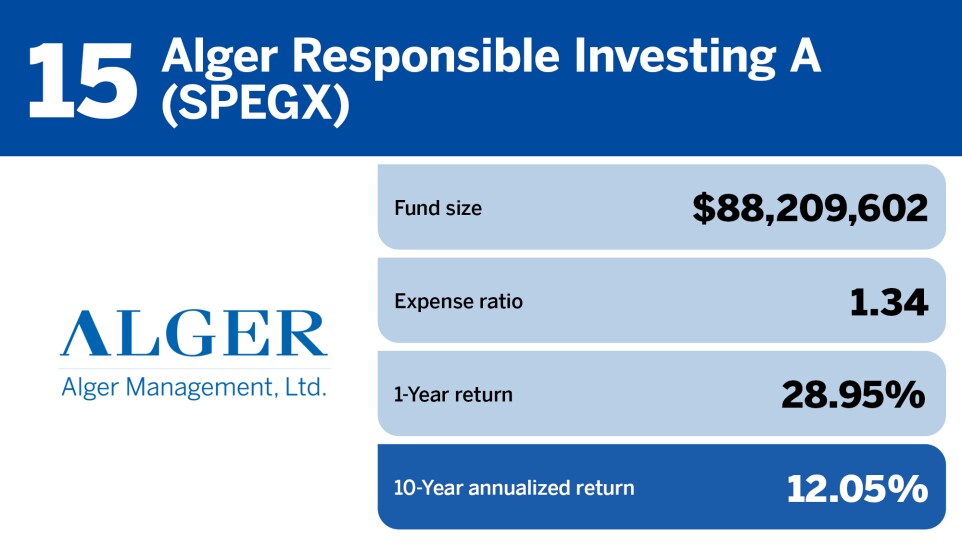

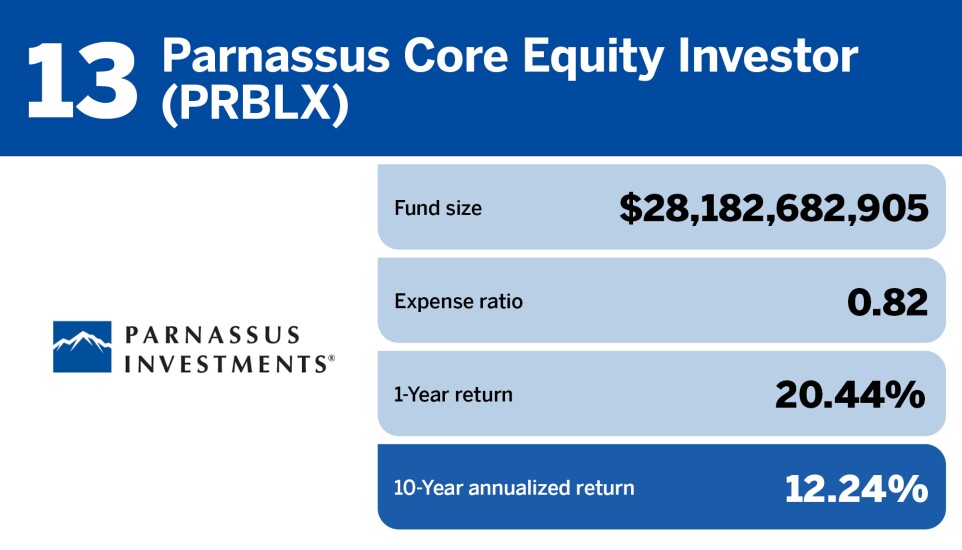

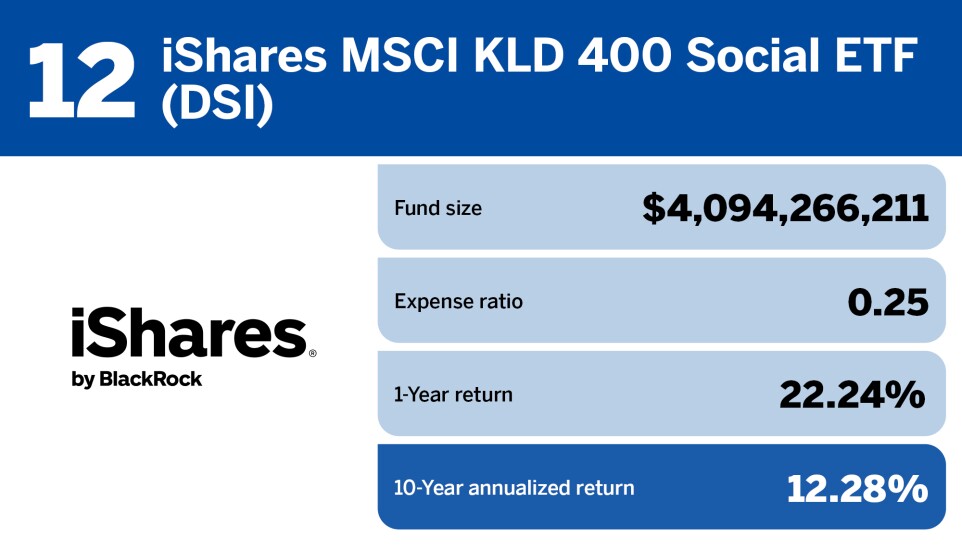

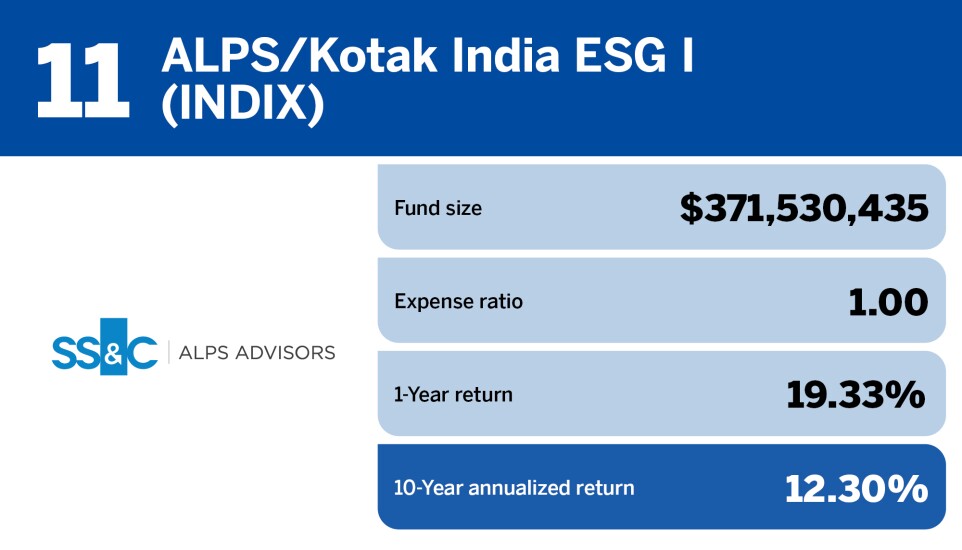

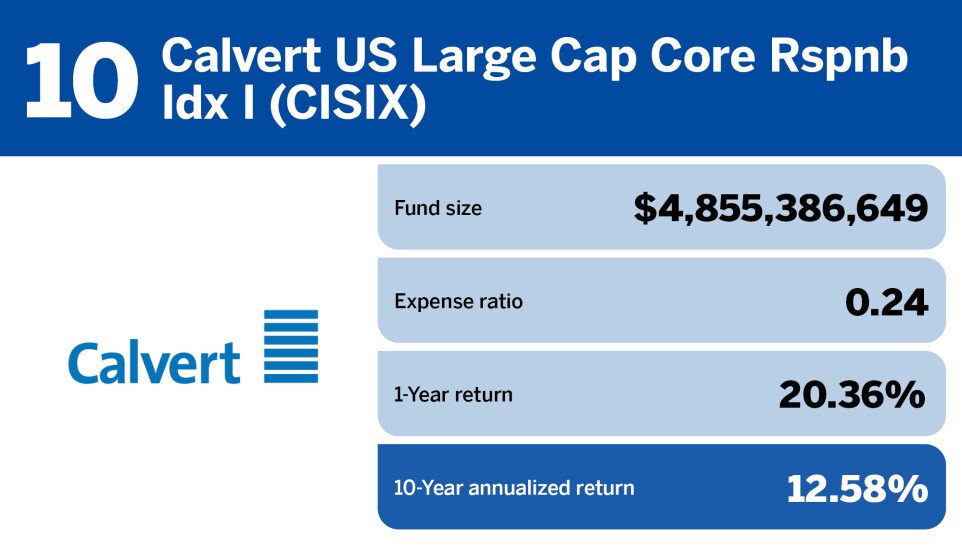

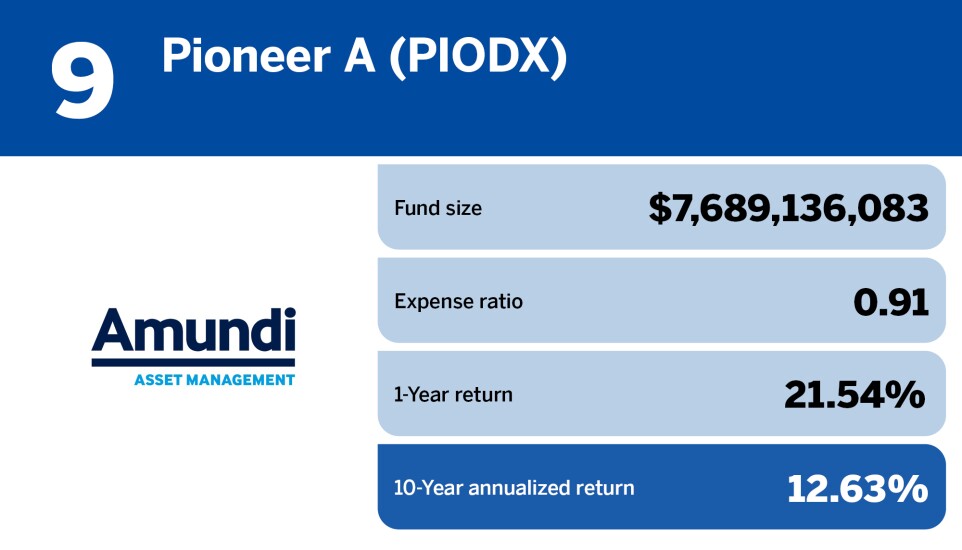

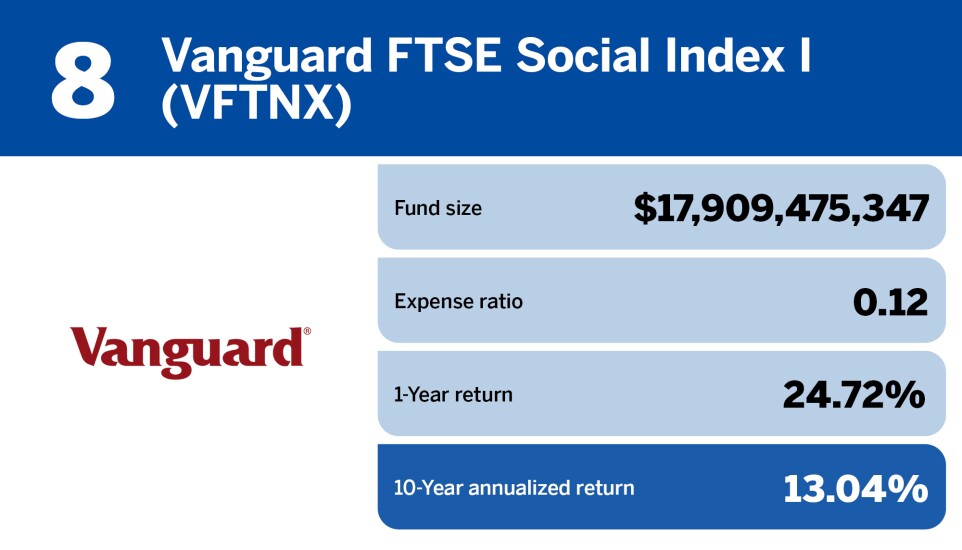

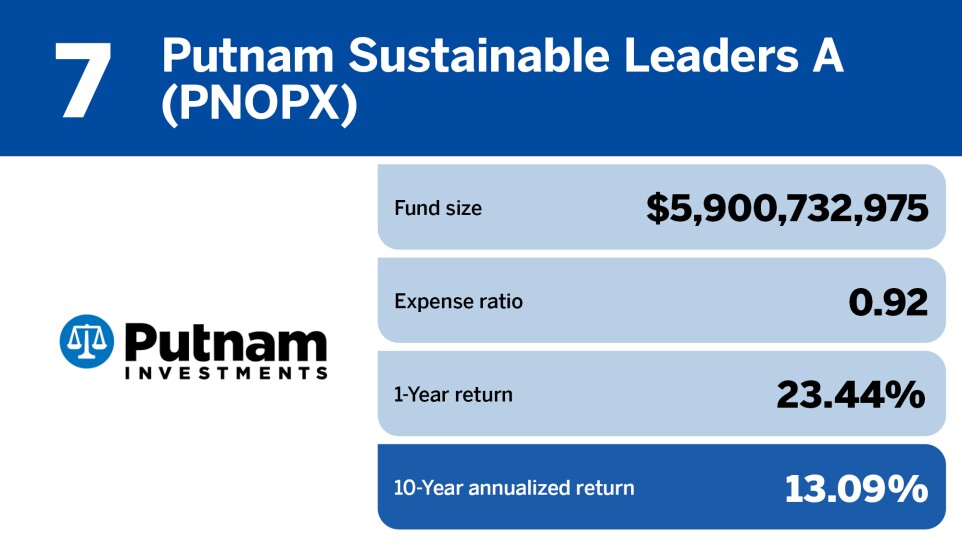

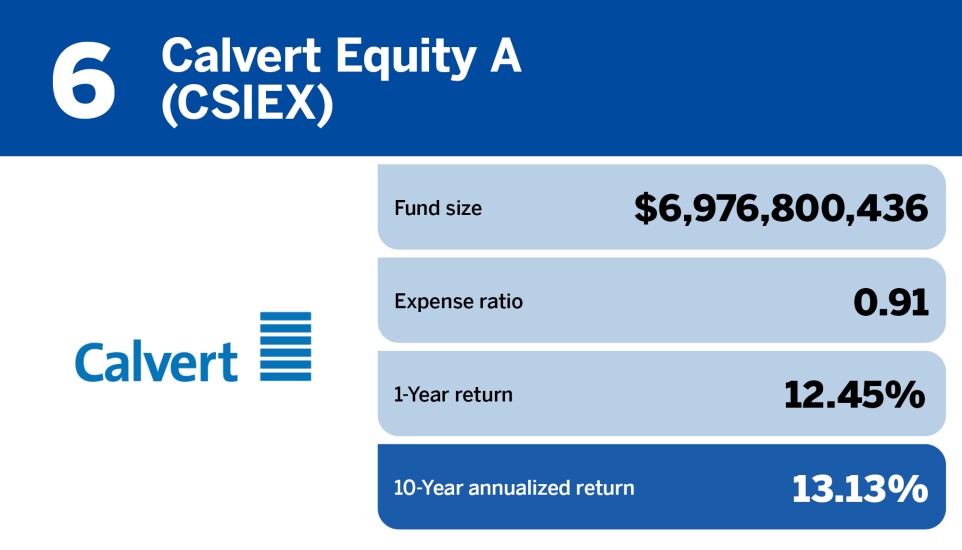

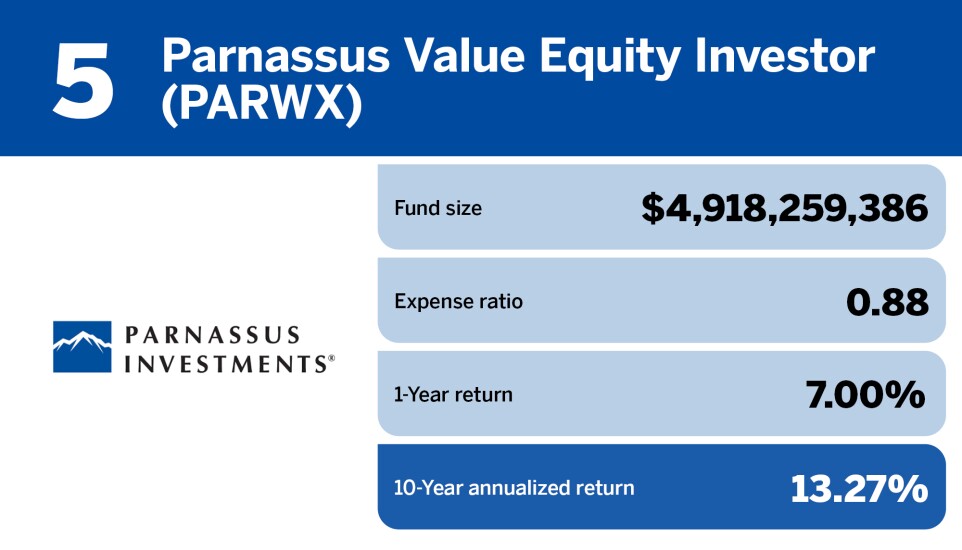

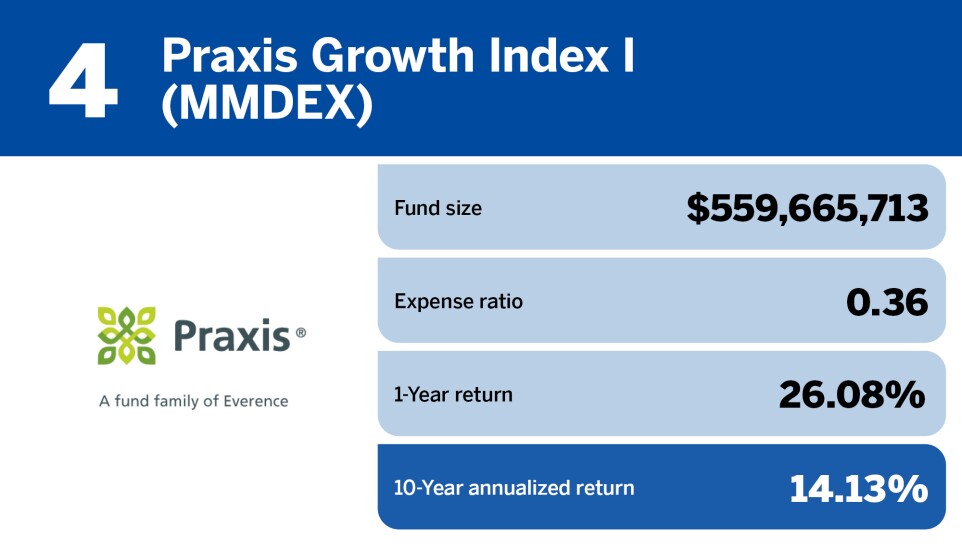

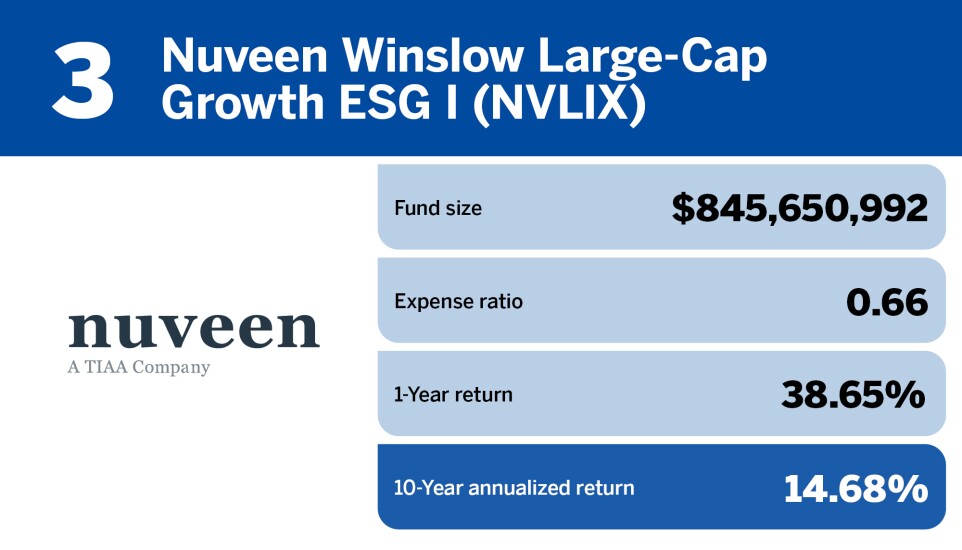

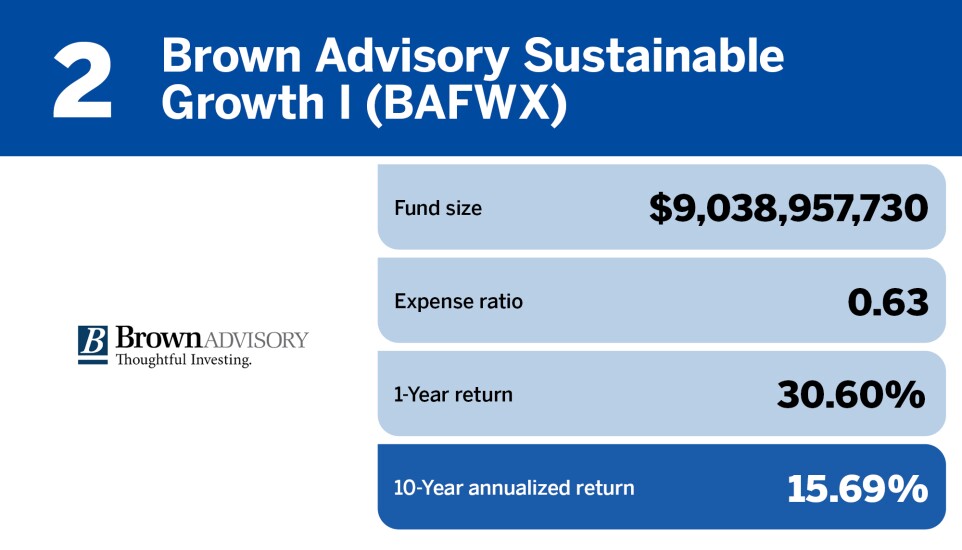

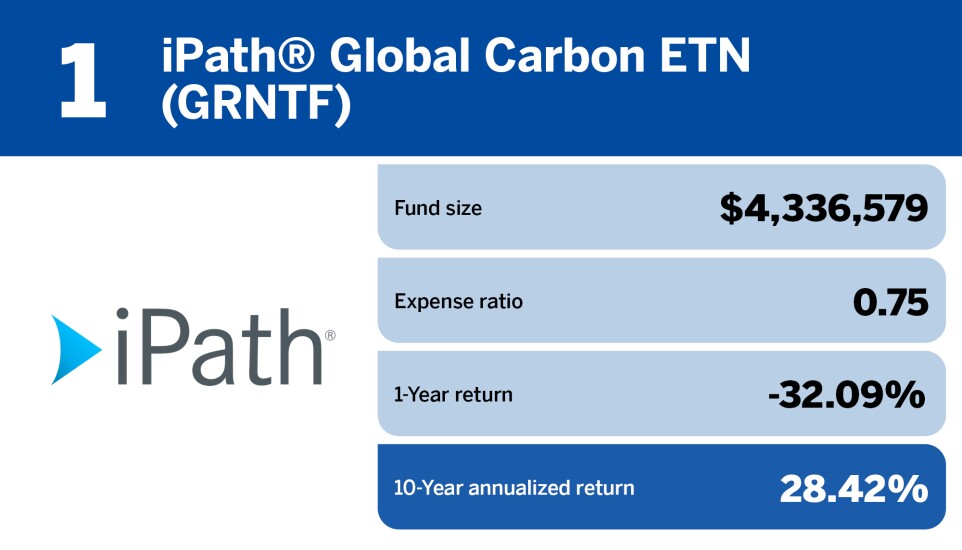

And yet in spite of all this, many ESG investments have remained highly profitable. Over the past decade, the top 20 sustainable funds have garnered an average yearly return of 13.57%, according to Morningstar Direct. In the past 12 months, their average gain was 18.29%.

READ MORE:

Granted, those numbers are down from where they were in ESG's heyday.

But given the year ESG has had, the ability of these funds to stay in the black is notable — and raises doubts about the argument that investing according to one's values inevitably means sacrificing profits.

"It's a fallacy that sustainable investing underperforms," said Peter Krull, director of sustainable investments at

To learn about the top 20 ESG funds of the past 10 years, scroll through the cardshow below. All data is from Morningstar Direct, and is current as of Feb. 23, 2024.

READ MORE: