All long-term investments require faith in the future, but nothing demands that long-term mindset quite like emerging markets.

In other words, these are not yet fully developed economies. Many of them lack modern financial institutions or strong regulatory systems. So why would investors put their money in them?

There are two answers to this question. First, there's that faith in the future: Ideally, these countries — and their corporations — will blossom into modernity, and as they catch up, they can grow far faster than developed economies. Forward-thinking investors can benefit from getting in on the ground floor.

But there's also a second answer: diversification. People invest in emerging markets for the same reason they invest in any foreign assets: They provide a hedge against domestic investments. And since emerging markets are typically less intertwined with the global economy, they provide even more protection than investments in other economies.

"Adding emerging markets to a portfolio is akin to eating your broccoli," said Tom Balcom, founder of

Examples of emerging markets include China, India, Russia, Brazil, Turkey and many other nations. In fact, according to

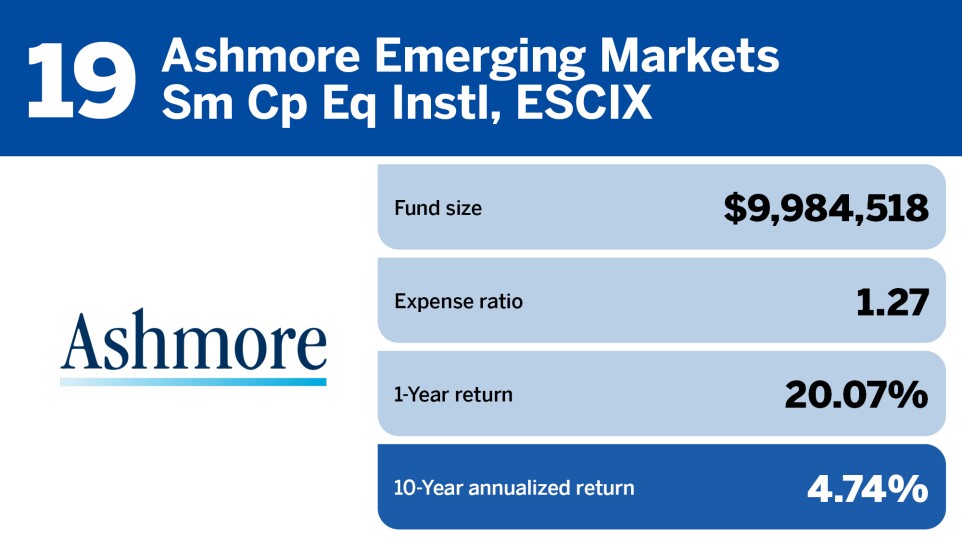

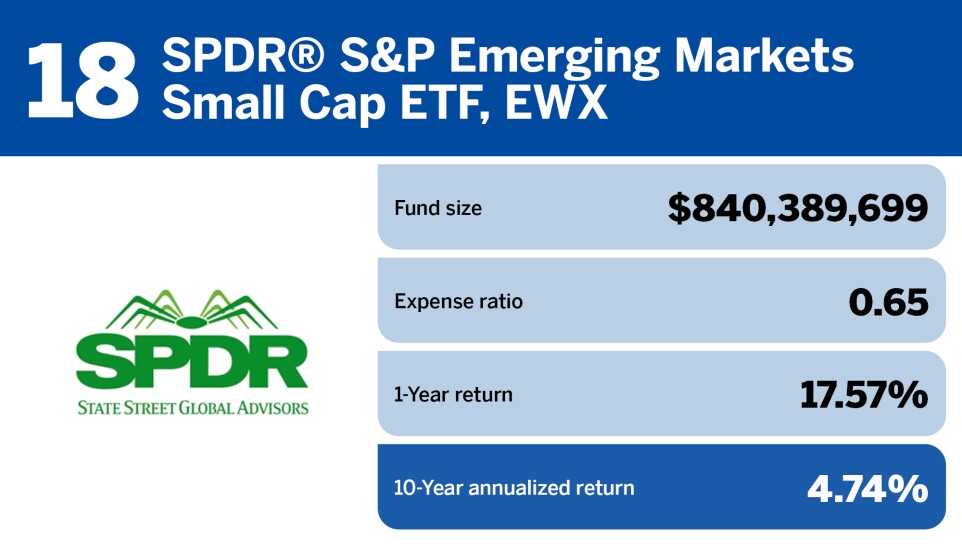

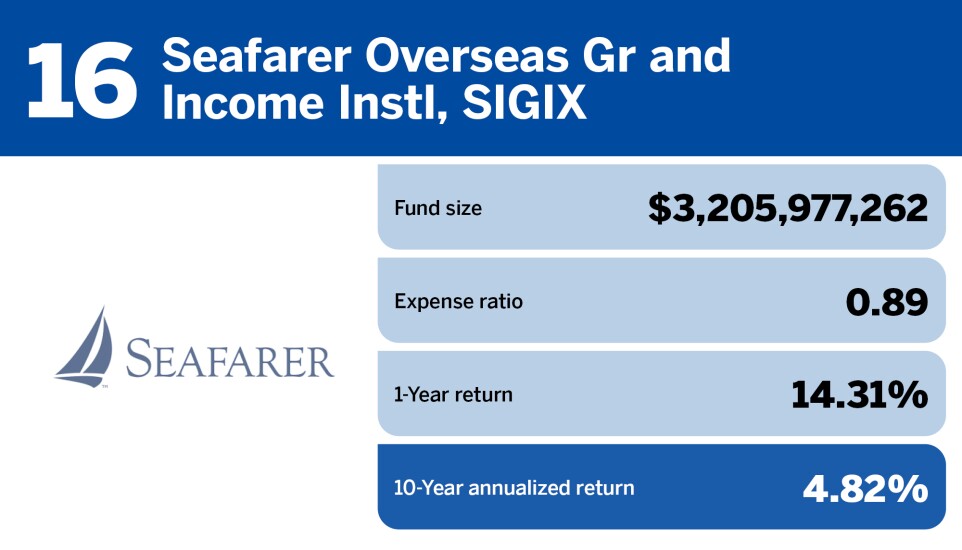

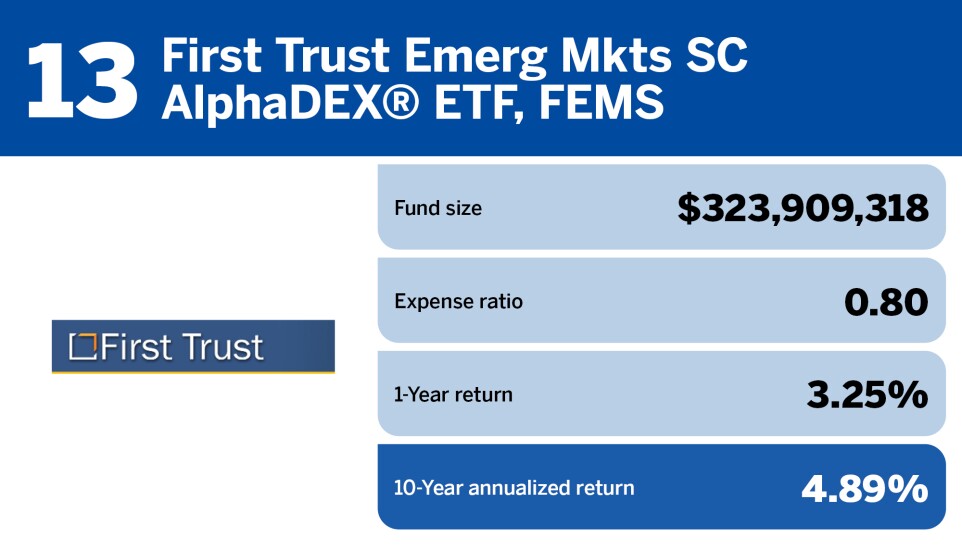

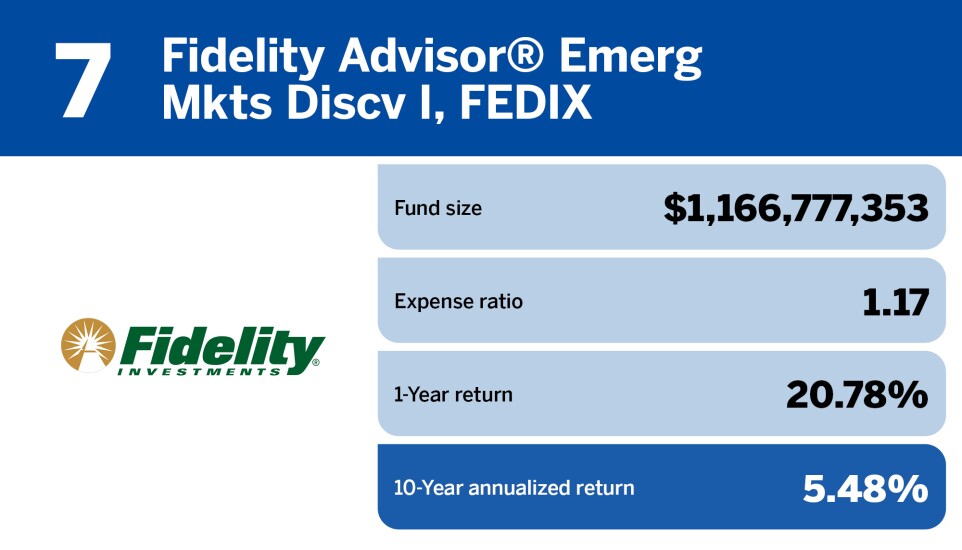

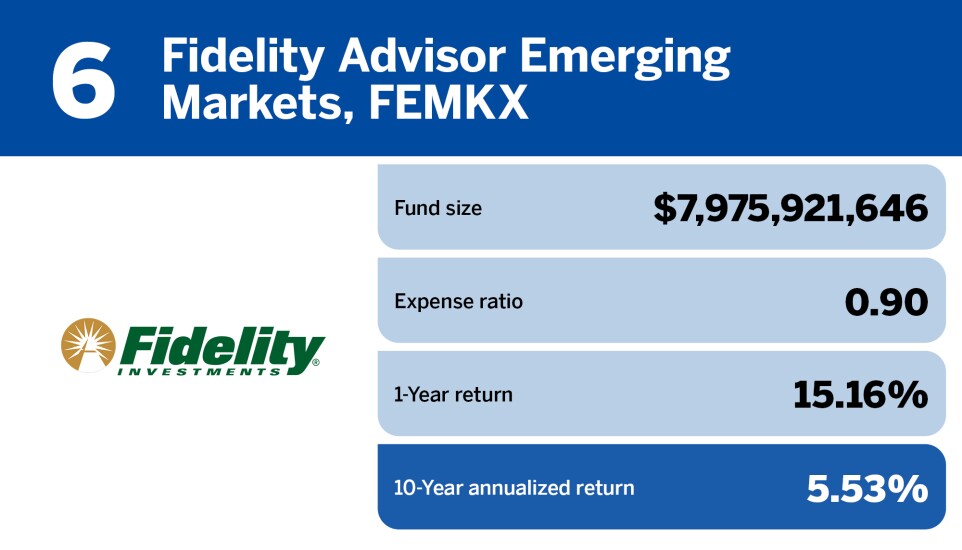

Many funds exist to harness the growth of these economies and their businesses. But to see their progress, you have to take the long view. Below are the top 20 emerging market funds of the past decade, as measured by their 10-year annualized returns. All data is from Morningstar Direct and is current as of Jan. 3, 2024.

READ MORE: