With the investing world eagerly anticipating cuts in interest rates by the Fed this year, bond funds bounced back toward the end of 2023 from steep declines over the previous 21 months.

The Central Bank's

Bond funds had been "on pace for a third-consecutive year of losses" in 2023 before "a fourth-quarter comeback" in the asset class "rewarded those who stayed the course,"

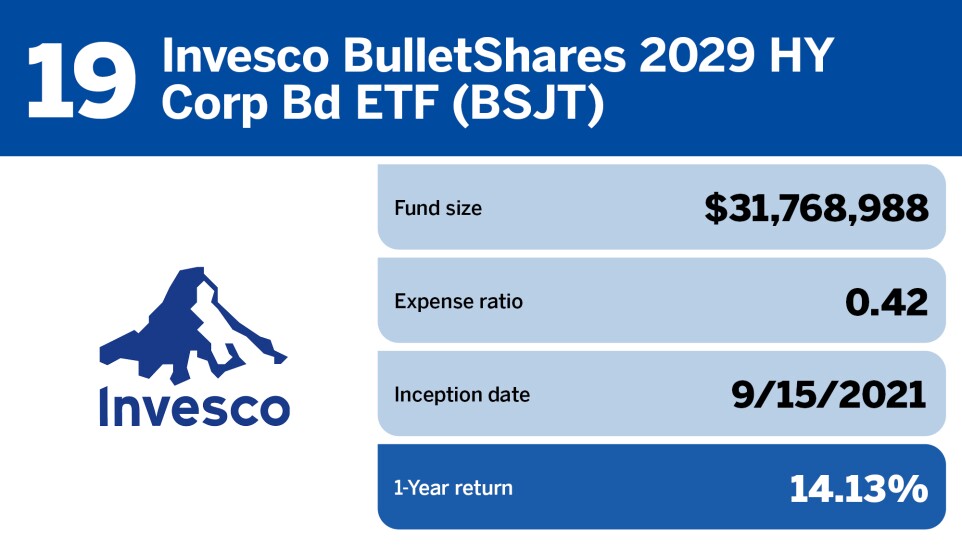

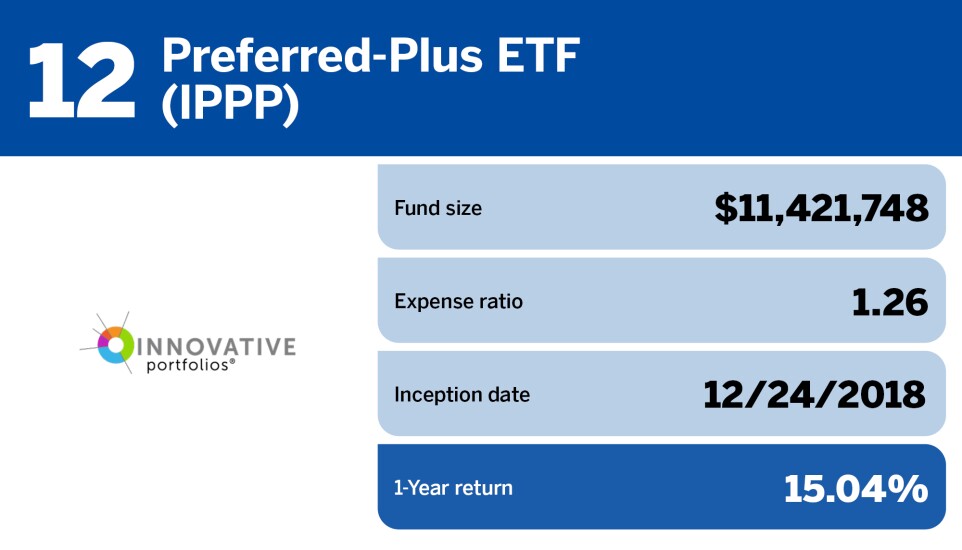

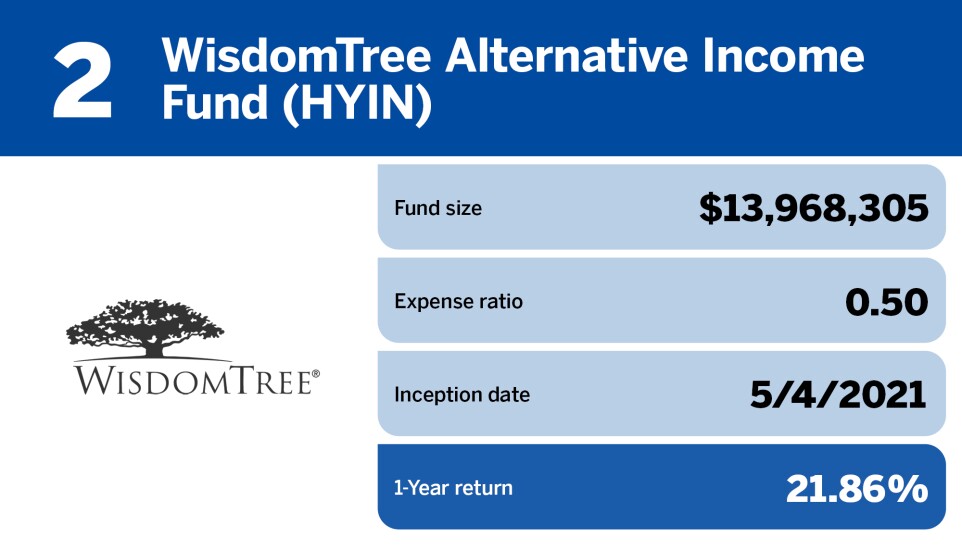

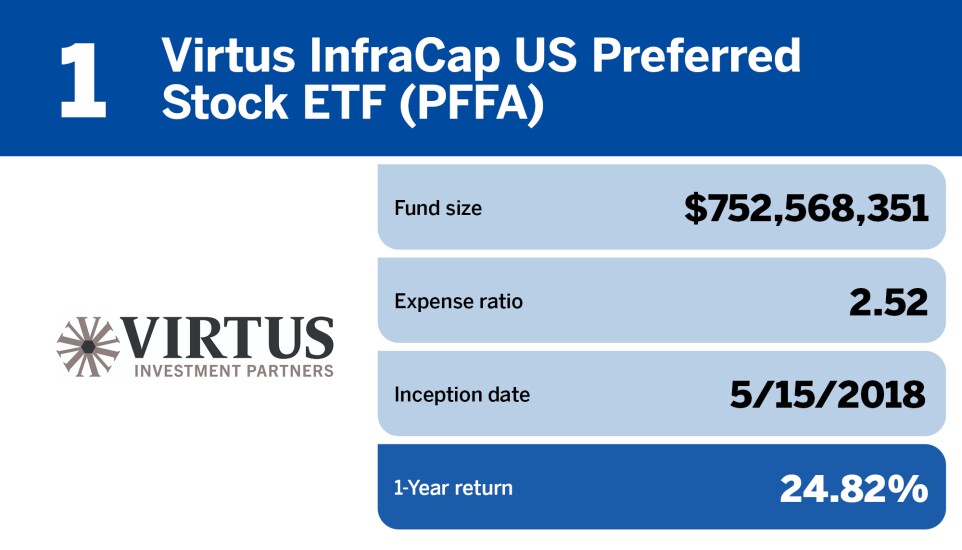

The top 20 bond ETFs of 2023 — ranked below using data from Morningstar Direct — include those types of products, as well as a preferred stock fund linked to equity that's often grouped with bonds due to the fixed dividends paid to the shareholders.

Financial advisors know that the Fed's stated goal of 2% inflation "may not happen this year," so they're asking themselves "what did you do for clients" before the cuts, according to certified financial planner Raman Singh, the founder of Phoenix-based

"I know I can lock in that rate. I own the individual bond, and I don't have to worry about the interest rate changing," Singh said, noting the contrasts with the hundreds of individual bonds collected together in an ETF. "You cannot really get a sustainable rate of return. It changes with the outlook of what the interest rates are going to do."

As the

"The probability of a recession has eased considerably as economic growth remains more resilient than expected," Larry Adam, the chief investment officer for the Raymond James Private Client Group, wrote in

"This should drive the economy's growth rate from a 2.3% pace in 2023 to a below-trend rate of [about] 1% in 2024. It should also drive inflation lower, building a case for less restrictive Fed policy in the coming months," he added. "A continuation of this favorable macro backdrop of moderating growth (slowing, but still at a level to avoid a deep recession) and cooling inflation should provide support for the bond market and lead to lower yields in the months ahead."

And those lower yields for newer fixed-income products will boost the value of the longer-duration bonds.

In addition to the fact that interest payments on municipal bonds may be "

To see Morningstar Direct's rankings of the top-performing bond ETFs of last year, scroll down the slideshow. And follow the links below to see more investment analysis from Financial Planning: