Want unlimited access to top ideas and insights?

Back in January 2024, the SEC finally, reluctantly approved 11 spot bitcoin exchange-traded funds. It was not a full-throated endorsement.

"While we approved the listing and trading of certain spot bitcoin ETP [exchange-traded product] shares today, we did not approve or endorse bitcoin," SEC Chair Gary Gensler

The half-hearted tone was not a surprise. For years, the SEC had resisted giving these funds the green light — in fact, it had rejected more than 20 applications for exactly this kind of product. The regulator only relented after the U.S. Court of Appeals in Washington, D.C., ruled against one of those decisions.

Nevertheless, a new asset was born: the

"Futures made more sense when that was the only option available in traditional investment accounts," said Andrew Herzog, a CFP at

But spot bitcoin ETFs aren't for everyone. Marcel Miu, founder of

"I approach making bitcoin recommendations to clients with caution," Miu said. "Bitcoin is known for its significant volatility."

READ MORE:

Other advisors don't recommend the products at all.

"Investing in these is nothing more than gambling," said Kashif Ahmed, president of

Today, that calculation may still be impossible, but there's far more data available. When the SEC made its announcement, many questions hung over the new ETFs: Would they be popular? Would they gain value or lose it? And, over time, how would these 11 new funds compare to each other?

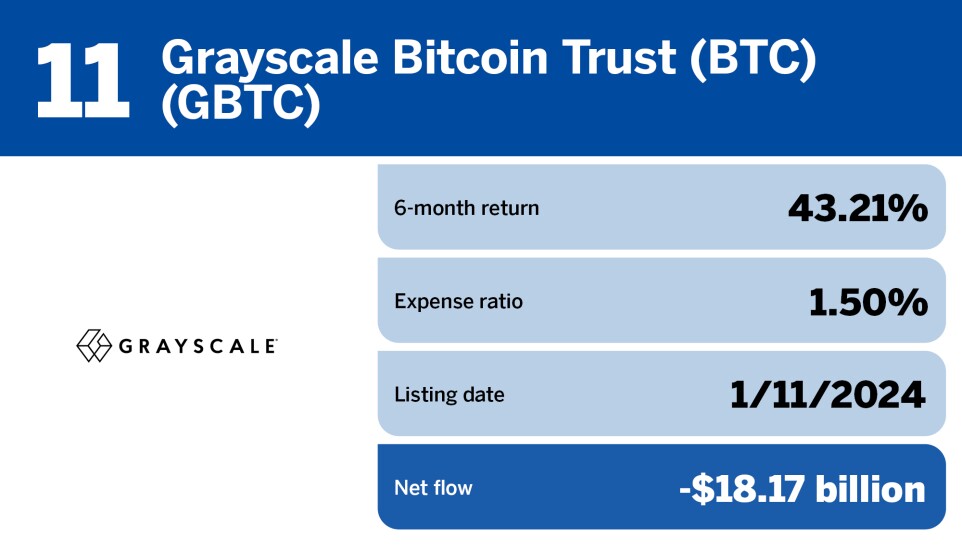

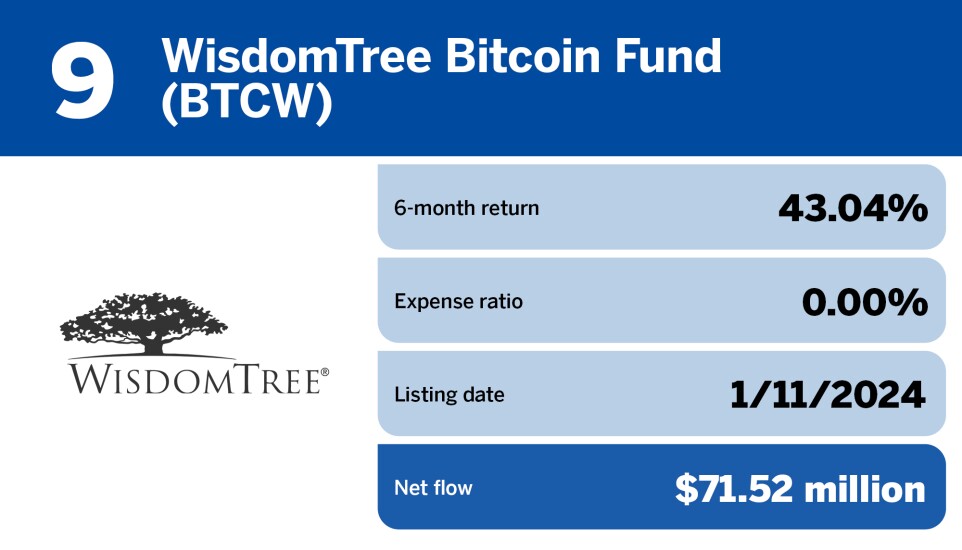

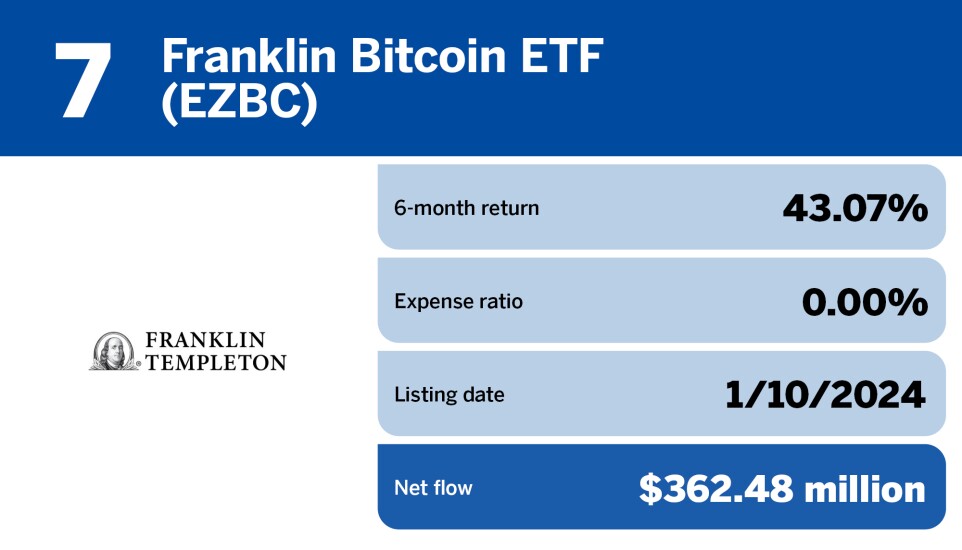

Now, six months later, we have some of the answers. Below are the 11 spot bitcoin ETFs, ranked by their net flows so far. Also included are their returns, listing dates and expense ratios. All data is from Morningstar Direct and is current as of June 17, 2024.