The wealth management fintech firm Advyzon has a proven method for attracting and retaining high-quality employees — it turns them into owners.

CEO Hailin Li makes sure the company carves out approximately 15% of its equity for its workers — an incentive Li says has contributed to its 3% rate of voluntary turnover. (The national voluntary employee turnover rate is 27%, according to the latest research by the Work Institute.)

“We want everybody to be an owner — not just working for the company, but working for themselves,” he says.

This might explain why Advyzon, a Chicago-based maker of CRM software for financial planners, made Financial Planning’s 2020 list of the Best Fintechs to Work For. Companies that won a spot on this year’s ranking have something in common — they enable workers to have literal and/or figurative ownership by promoting inclusion, accountability or investment in the firm’s mission. It’s a strategy advisors would do well to emulate.

“The advisor force is aging, and the next generation coming in to take their place isn’t really drawn to traditional advisory firms,” says Kashif Ahmed, president of the LPL Financial advisory practice American Private Wealth. “I’m not saying that all advisory firms should have bean bags, but you need to be able to attract them with things that resonate.”

With about 40% of the advisor workforce expected to retire in the next decade, according to Cerulli Associates, attracting and keeping young planners has become a priority. Fortunately, planning firms seeking strategies may not have to look far for ideas: Some of their own vendors are already quite successful at it already. Wealth management fintech companies on this year’s list had an average voluntary turnover rate of under 12%. As planners adopt technology and new fintech vendors, can they benefit from adopting aspects of their cultures?

While the style and substance of fast-paced fintech firms and more steady RIA firms may differ, employee satisfaction and engagement are often triggered by certain company behaviors.

Over 90% of employees at the companies that made the fintech ranking said they had confidence in their leadership and believed the companies cared about their well-being, according to data analyzed by Best Companies Group, an employer assessment firm.

Furthermore, about 95% of the fintech employees said they understood the importance of their role in their company’s overall success.

For Ahmed, who is also a financial planning professor at Suffolk University in Boston, communicating a greater purpose is also significant.

“Advisory firms and wealth management firms do make a profound impact on people’s lives, but i don’t think they sell that part of it,” Ahmed says.

Then, of course, there are perks: scuba diving trips, happy hours or weekend passes to music festivals. Fintech companies on Financial Planning’s list offer pingpong tables; high-end toys and excursions; extended-to-unlimited leave time; and bread and butter benefits like health care and child care.

The Chicago-based wealth management software company Oranj shortens its workweek when the locally based Lollapalooza music festival is happening and offers workers VIP tickets. CRM provider Redtail invites each employee — and a guest — on an annual all-expenses-paid team-building trip to an exclusive resort.

Time off? Some employees get lots of it. Facet Wealth and 280 CapMarkets give employees unlimited vacation, personal and sick days. Independent advisor firms may be loath to adopt some of these perks.

But some say it’s time to adapt to a changing world. “I think a lot of people, including myself if it was 20 years ago, want to work with people who are up-to-date on things,” Ahmed says.

And advisors may stand to benefit from contemplating how fintech companies articulate their vision.

“Tech is able to tap into the idea of making people’s daily lives significantly better,” Jesse Coffee, an advisor at the Salem, Oregan-based RIA True Private Wealth Advisors, wrote in an email. “The message of making people’s lives better in a measurable way resonates with young talent, and seems to help attract and retain them.”

The firms that made the list also create a culture in which employees feel seen and heard, and in which they have room to make their own rules.

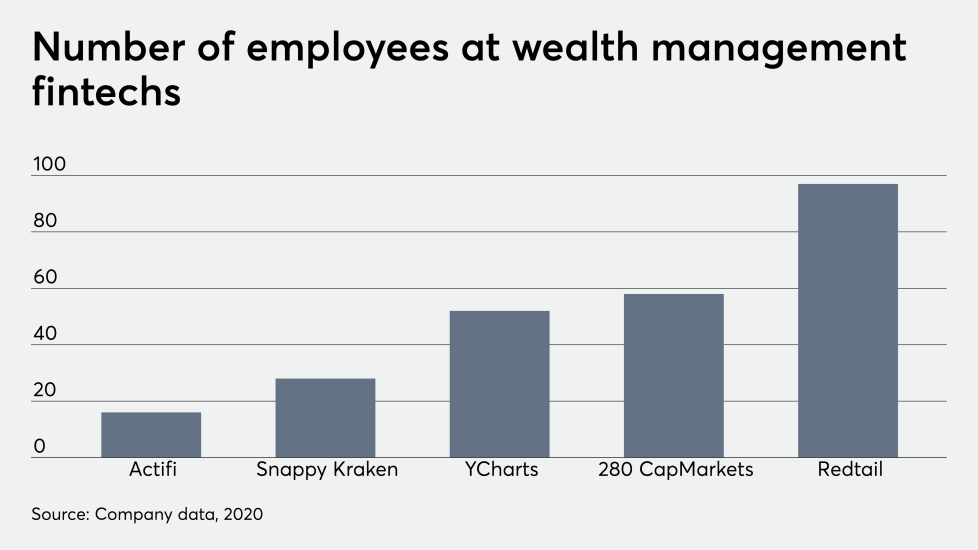

Because fintechs are often small — several of those surveyed have 50 or fewer employees — it’s critical that employee capabilities aren’t constrained by rigid job descriptions. ActiFi, which creates practice management tools for banks and investment advisory firms, puts a high priority on tailoring jobs to suit individuals.

“Instead of fitting employees into boxes, we draw the job around the individual to emphasize what they’re best at and most enjoy doing,” said Spenser Segal, CEO of the St. Louis Park, Minnesota-based firm.

ActiFi employees have wide flexibility to set their own hours and the latitude to create their own workstyle, as long as they stay productive.

“The key is ... getting people into that sweet spot where they feel challenged by their tasks, but they have plenty of freedom and flexibility in how they get things done,” Segal says.

But beyond creative outlets, in this tight market, employers must stand ready to provide rock-solid benefits as well, the Best Fintechs roster demonstrates; it takes more than sweeteners.

That’s because young talent has higher expectations than previous generations, according to Laura Hamill, who conducts research on employee engagement and inclusion at employee software company Limeade that promotes employee well-being. Millennials, especially, “are more likely to leave if they don’t feel [their firm is] supporting them,” she says.

The benefits you offer this cohort can be key, says Advyzon’s Li.

“Health care is the biggest one,” he says. “If somebody is coming out of school, [make sure] their insurance is fully paid for.”

ActiFi pays 100% of its employees’ health insurance premiums and deductibles and also pays about 97% of spouses’ and dependents’ health insurance premiums, with 100% of dental insurance covered.

Some wealth management and fintech firms stand out because of their investments in diversity and inclusion efforts. The digital bank and robo advisor Ally Financial, for example, is conducting manager-specific training in geographical locations where LGBTQ employees have indicated they do not feel connected to the company. The firm is also building stronger relationships with organizations and colleges to identify diverse employee candidates.

Giving employees a sense of stake in the company and its vision is key, Advyzon’s Li says. And a flat leadership structure enables employees to share their ideas.

“That’s what has gotten us so far,” he says. “Because everyone has thoughts and insights into how this business should be run. You collect all these ideas and figure out a better way.”

Methodology: The analysis is conducted by the Best Companies Group and is based on two surveys that gather detailed data on workplace benefits, policies and practices.