For decades, many of the richest Americans tended to be associated with the classic wealth strongholds of New York and California's Silicon Valley. Then came the emergence of new hubs in Florida, Texas and the Pacific Northwest.

Today, the regions with the highest-earning people and, depending on the state, the steepest combined federal and state tax bills per taxpayer, are all over the map.

Part of that shift may stem from the retirement of aging investors to other locales. Or to significant time spent in sometimes-obscure areas for tax purposes. Or to recent growth in the number of millionaires. Around

As wealth advisors increasingly chase the most affluent clients, knowing where that coveted quarry lies can confer a competitive advantage. Large and mid-sized wealth management firms are increasingly merging their high-end private banking services with "lower-end" mass affluent offerings into

Wealth management is still a highly fragmented market. Goldman Sachs, for example, manages more than $1 trillion for roughly 16,000 ultrahigh net worth clients, each with an average $60 million in assets. That's

Meanwhile, registered investment advisory firms are the

Where the clients are

Of course, the average taxable income of a given ZIP code or city can skew wildly if just one multibillionaire is in the mix. Facebook CEO Mark Zuckerberg, for example, the

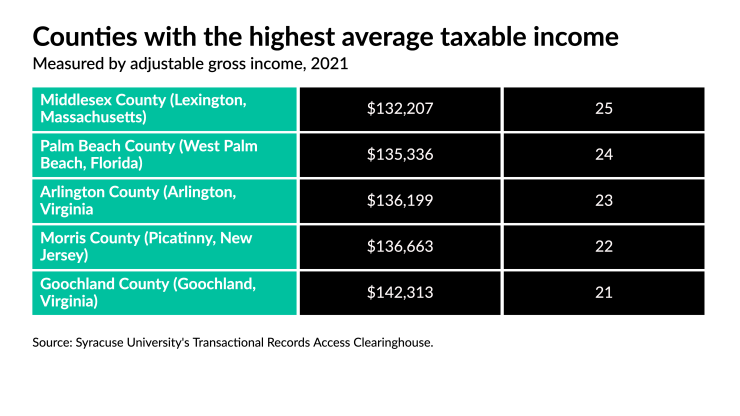

Scroll through the slideshow of the

All data is from Syracuse University's Transactional Records Access Clearinghouse and is based on federal income tax returns filed in 2021. All dollar figures refer to