When measuring a stock's value, investors often focus on

Dividends are important for two reasons: First, and most obviously, they provide income for the investor, who can either hold on to the cash, invest it elsewhere or reinvest it in the same company — an important way to fuel compounding growth.

Second, a dividend simply shows that a company is making money.

"Dividends demonstrate the ability of a company to generate cash, which is a fundamental element of company value," said Jeremy Ouchley, founder of

On the other hand, a lack of dividends is not always a bad sign. Sometimes, rather than sharing profits directly with investors, a company chooses to spend those earnings on growing its business. Many

"Standing alone, dividends do not tell the whole story," Ouchley said. "If a company has the opportunity to reinvest its earnings at an attractive rate of return, that may be better for shareholders in the long run."

At the other end of the spectrum, there are the

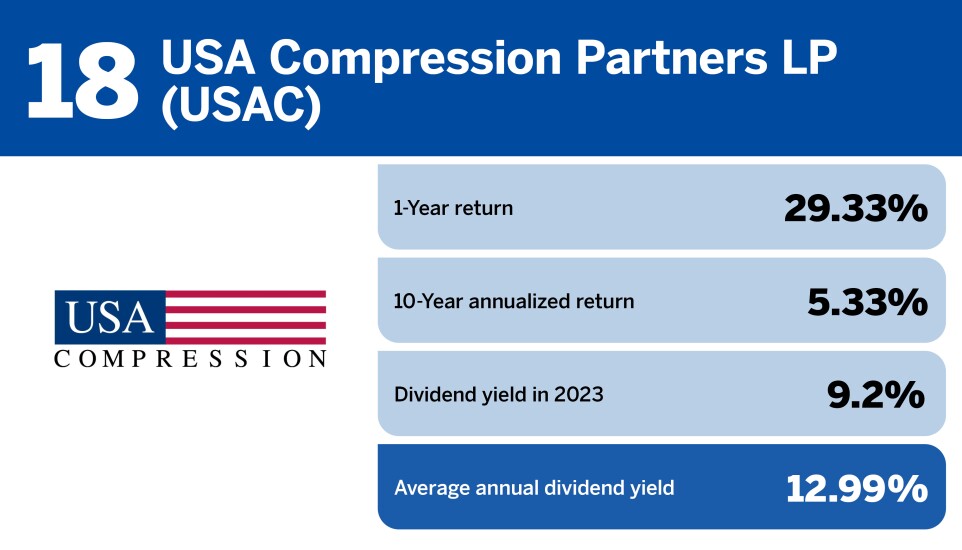

But that's not the only list. Morningstar Direct has ranked the 20 stocks with the highest dividends of the past decade, as measured by their average yearly dividend yield — the ratio of dividend per share divided by share price. At the high end, this yield was almost 19%.

READ MORE:

Who made the top 20? Many of the companies are involved in fossil fuels and real estate — two fields that are particularly well-suited to offering high dividends.

"These industries often involve operations with substantial cash flow, enabling higher dividend payouts," said Marcel Miu, founder of

Whatever the business, robust dividends can be useful for a number of reasons. For investors who need passive income, such as retirees, they can be a lifeline. For others, dividends simply give stockholders more freedom to invest their share of the profits however they see fit.

"They serve as a channel through which companies share their success with investors," Miu said.

To see the 20 highest-dividend stocks of 2014 to 2024, scroll through the cardshow below. All stocks are domiciled in the United States. All data is from Morningstar Direct, and is current as of March 8, 2024.

READ MORE: