April is the cruelest month, the poet T.S. Eliot once wrote. And though he may not have been thinking of ETFs, last month's net flows for the funds were a bit of a wasteland.

In April 2024, U.S. exchange-traded funds took in 63% less capital from investors than they had in March. In total, consumers invested $37.98 billion in the products, down from a massive haul of

April's stock downturn partly explains the dip in investments. Last month, after almost half a year of gains, the S&P 500 dropped by 4.2% and the Dow fell 5%. According to an

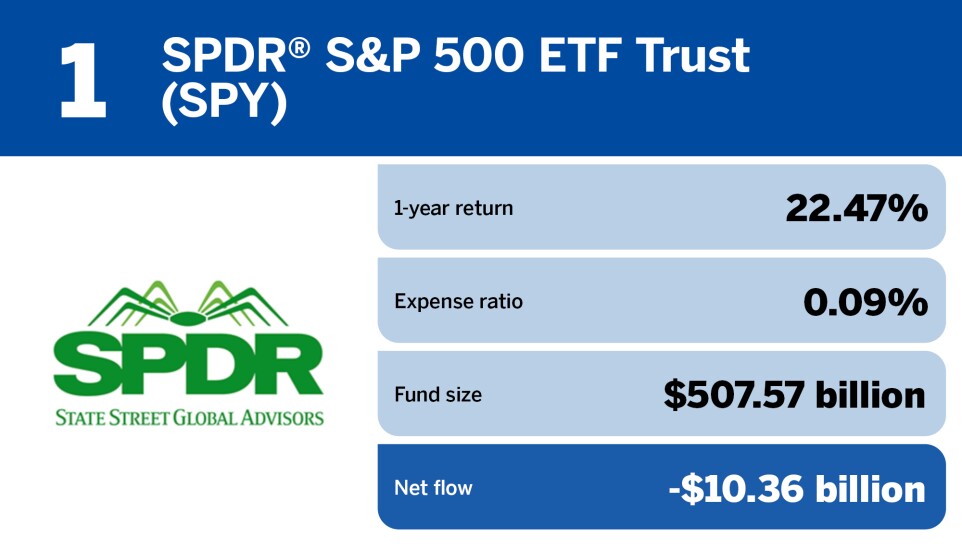

All this appeared to take a toll on stock-based ETFs. In April, U.S. equity ETFs took in $13.54 billion, down 75% from March. And sector equity ETFs went from inflows to outflows, suffering a net loss of $3.19 billion in investor cash.

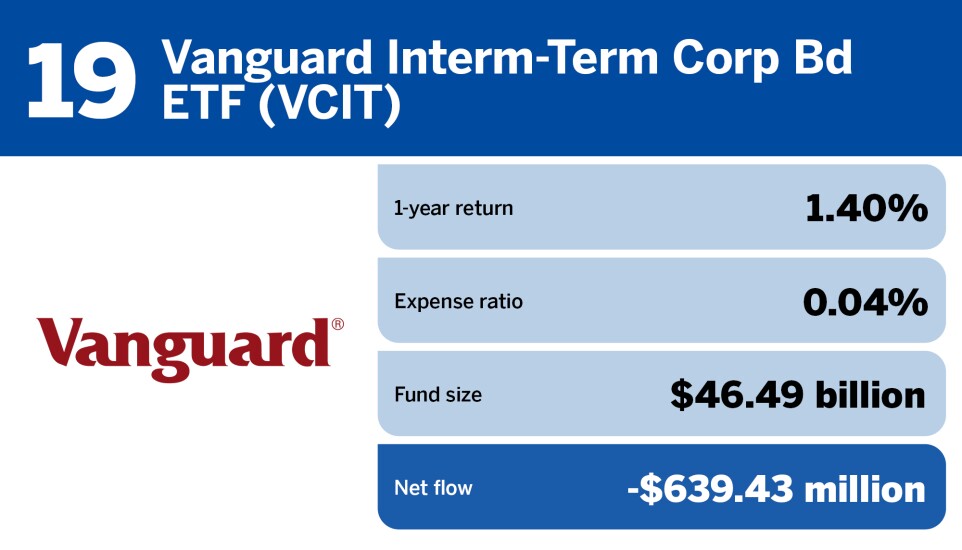

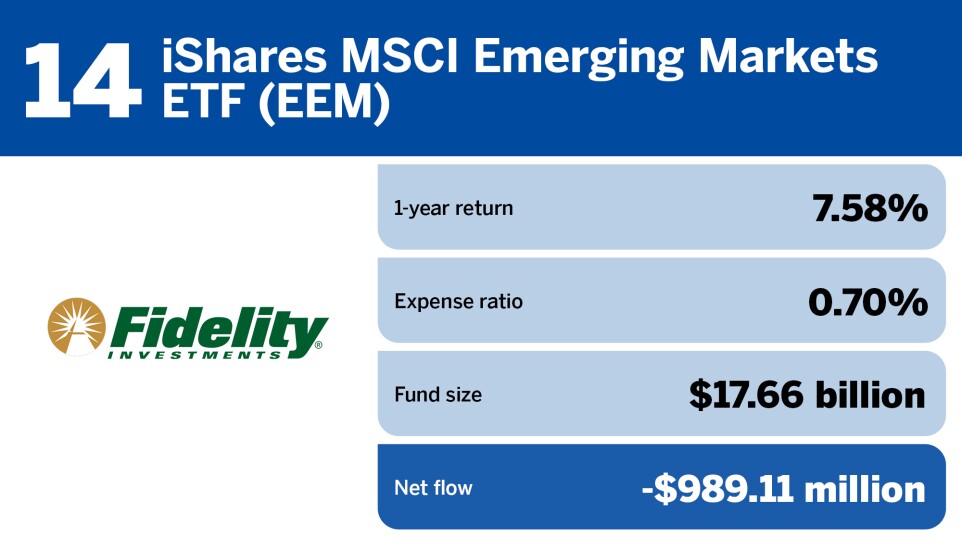

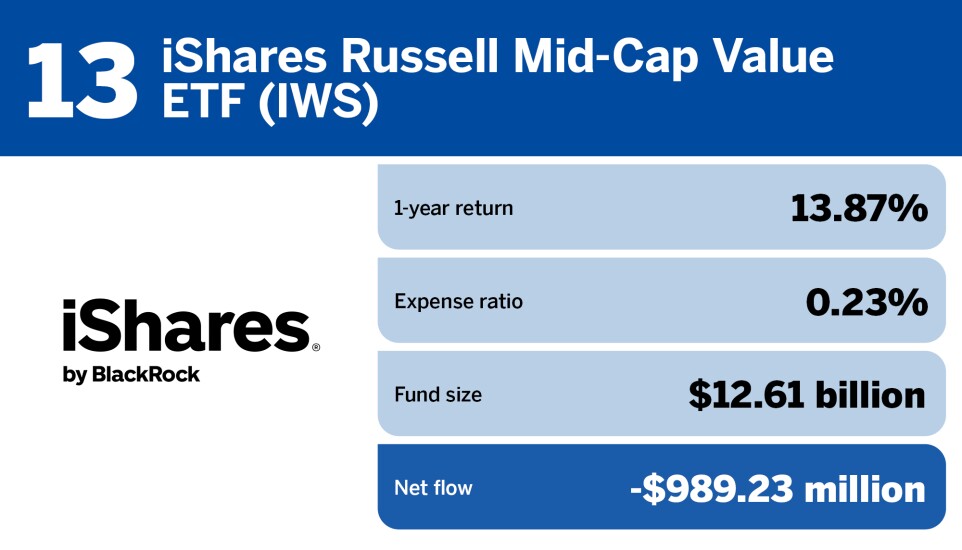

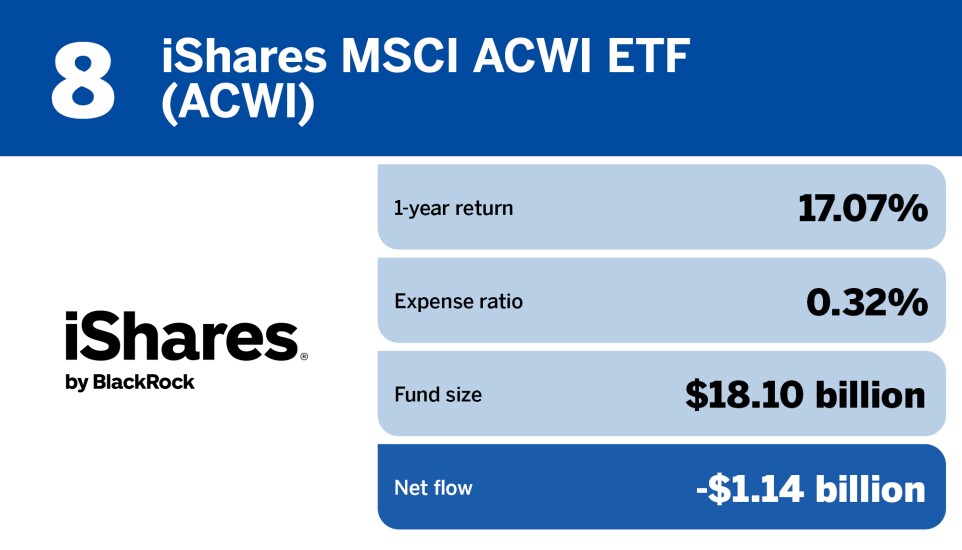

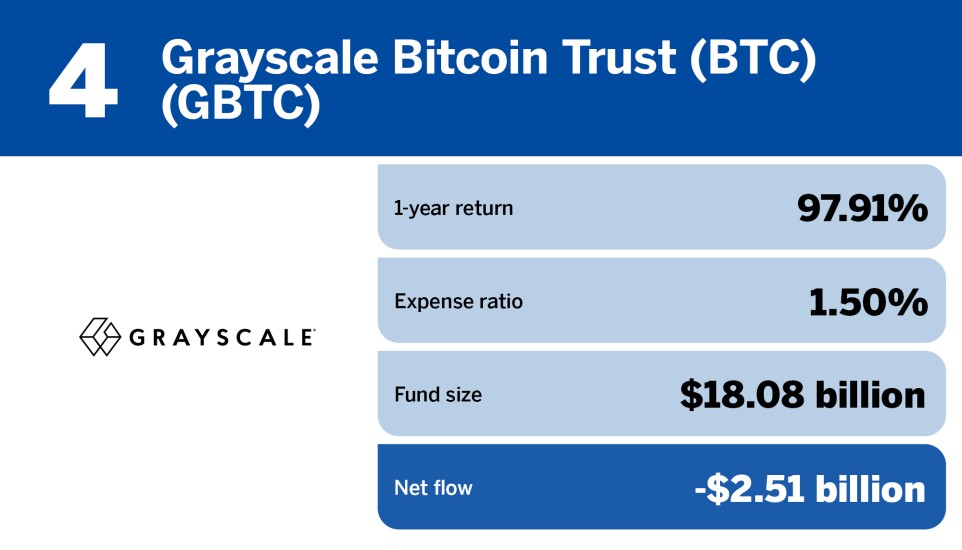

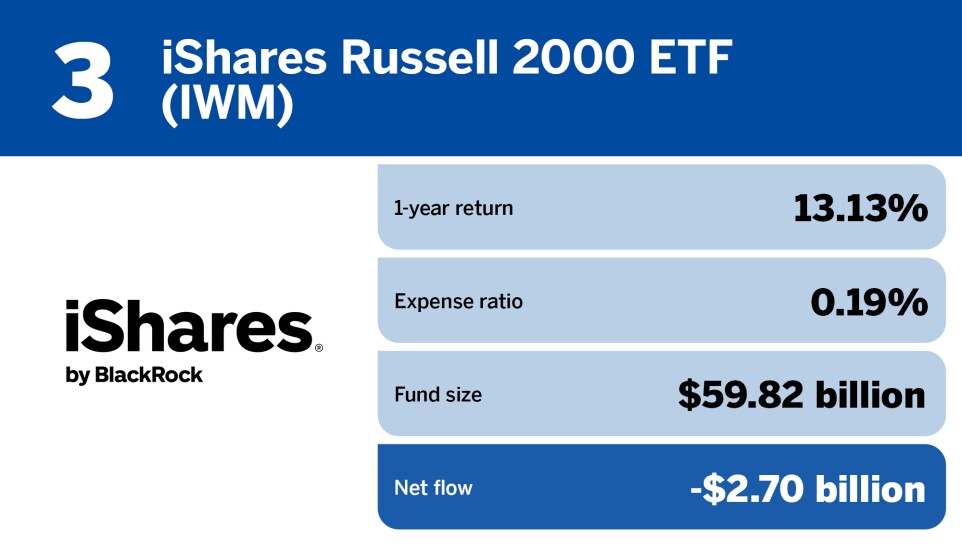

Which funds suffered the biggest outflows? Scroll through the cardshow below to find out. All data is from Morningstar Direct and is current as of April 30, 2024.

READ MORE: