After soaring in March, ETFs came back to earth in April.

U.S. exchange-traded funds saw a net inflow of $37.98 billion last month. That's 63% less than in March, when the funds

Equity-based funds were hit particularly hard. U.S. equity ETFs took in $13.54 billion, a steep drop from the $54 billion they garnered in March. And sector equity plunged from a net inflow of $7.89 billion in March to a net outflow of $3.19 billion in April.

Given

But not all ETFs did poorly last month. The commodities category jumped from $127.81 million to more than seven times that amount in April, with a net inflow of $930.89 million. And taxable

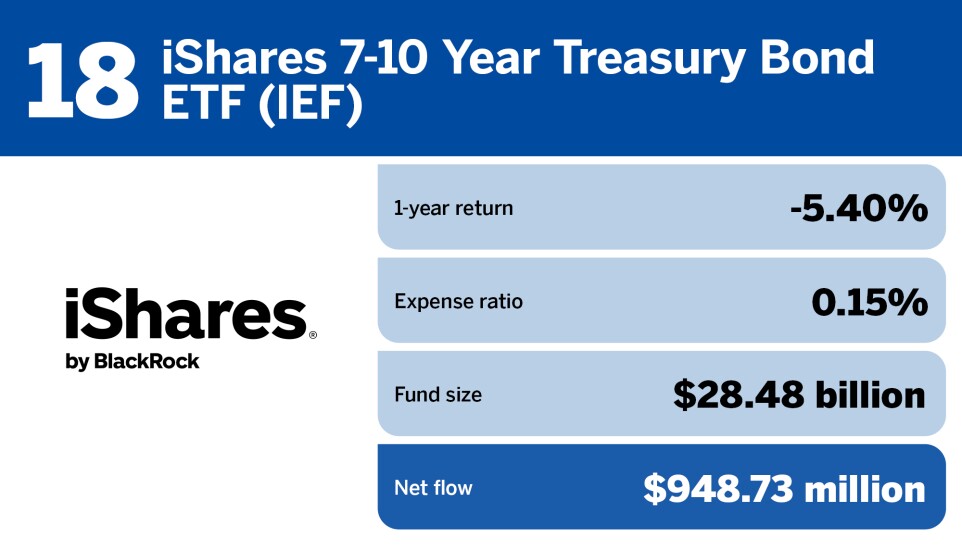

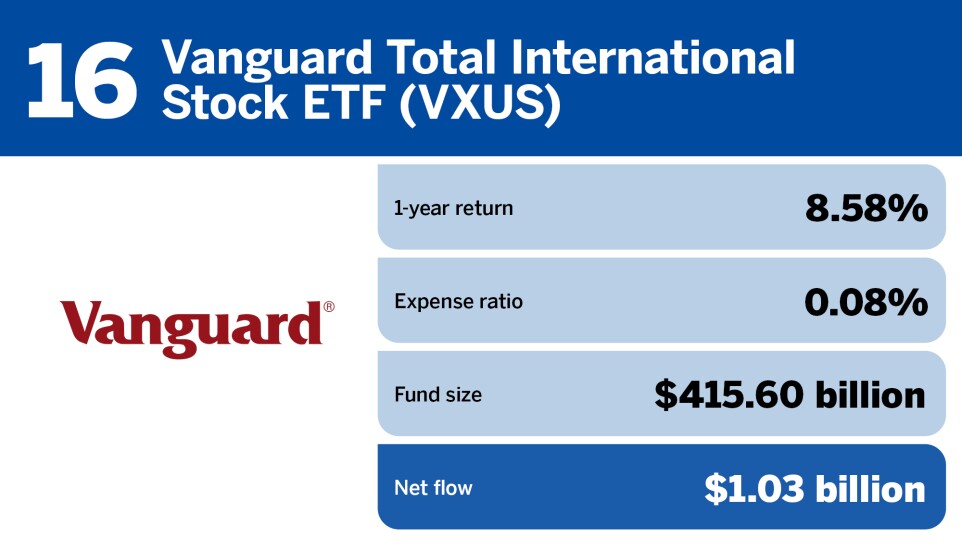

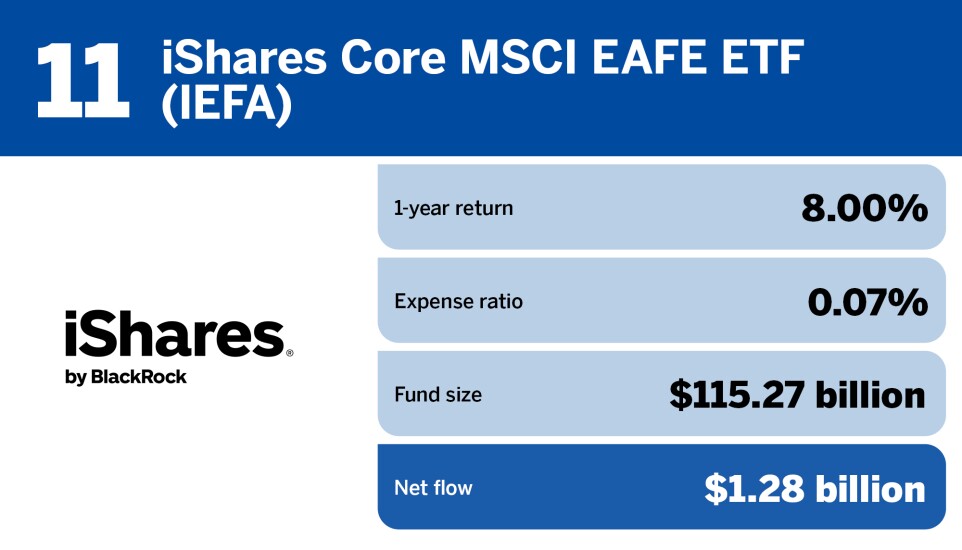

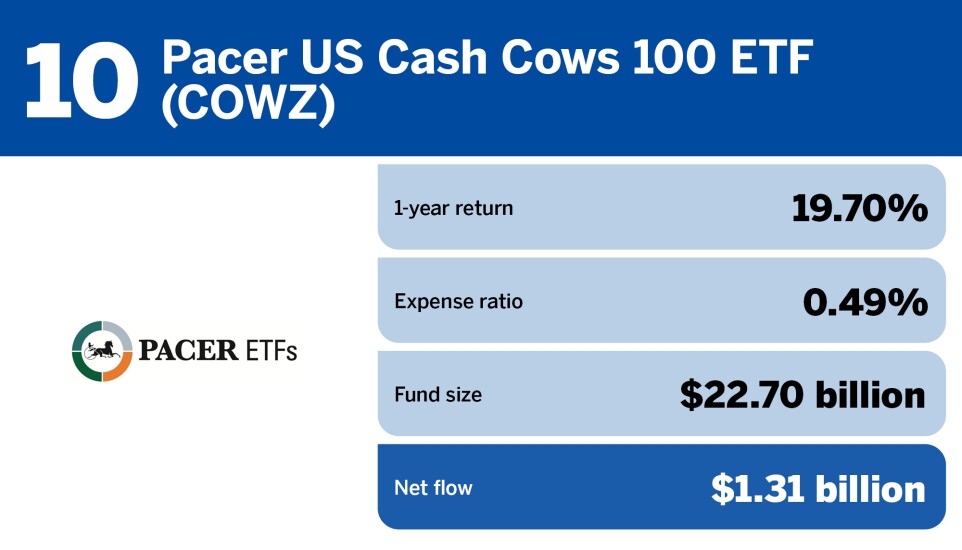

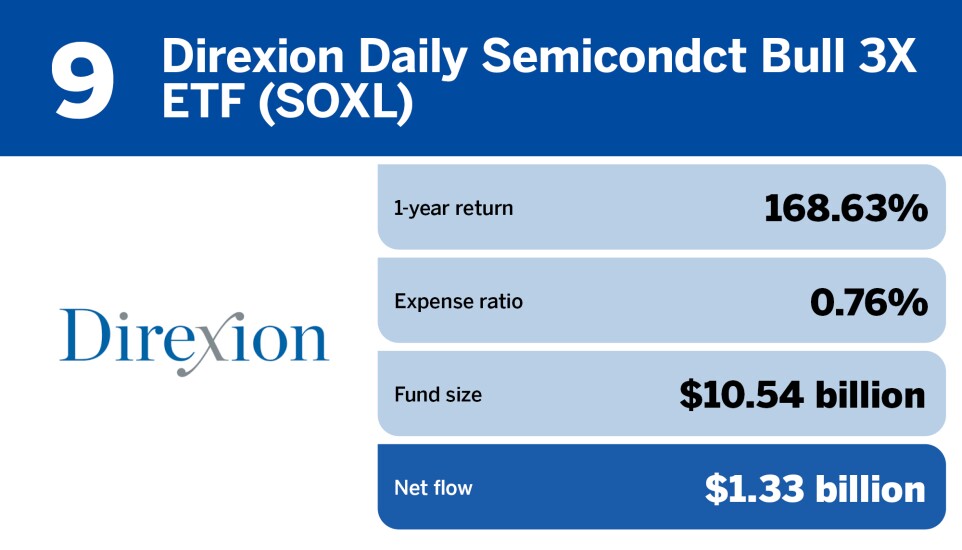

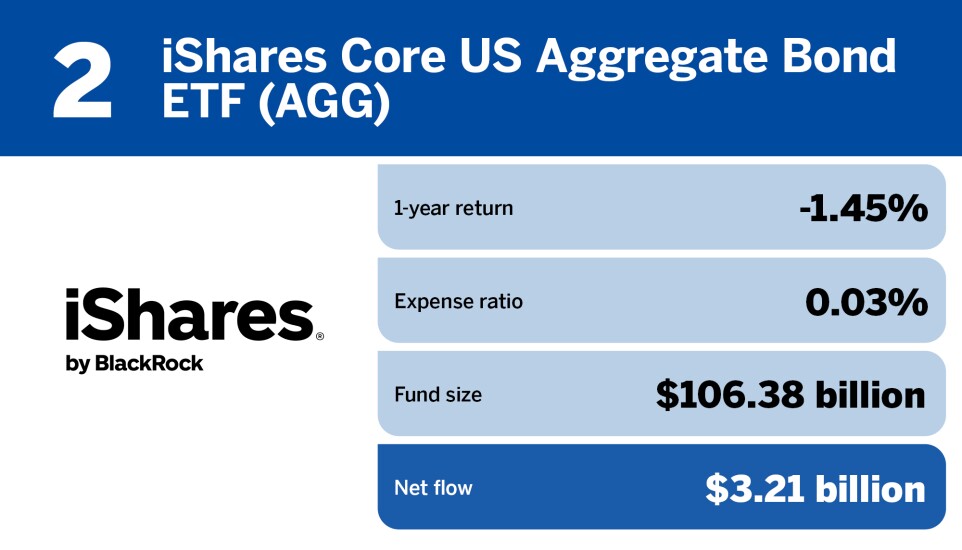

In terms of individual funds, which ETFs made the best of this lackluster month? Scroll through the cardshow below to see the 20 funds that took in the most investor cash. All data is from Morningstar Direct and is current as of April 30, 2024.

READ MORE: