In an unpredictable economy, cash is king.

Over the past year and a half, money market funds have exploded in popularity. In 2023, almost $970 billion flowed into the funds, according to Morningstar Direct. And just in the first three months of 2024, investors have already poured in another $17 billion.

What's behind this surge in demand? One answer is interest rates. As the Fed holds the federal funds rate at its pinnacle of 5.25% to 5.5%, the daily yields on prime money market funds have exceeded 5%, according to

Compare that to other cash assets, and you can see why these funds have such appeal. The average one-year certificate of deposit (CD), for example, offers an annual yield of 1.74%, according to

"Money market funds offer a way to earn interest safely on your savings, often achieving a higher yield than a bank savings account," said Nicole Sullivan, director of financial planning at

But there's also another, more fundamental reason these products are so popular: Money market funds are considered very, very safe. They invest in cash, cash equivalents and high-quality, short-term debt securities — all of which are extremely low risk.

In times of economic uncertainty, that safety can be very alluring to investors. And while the U.S. economy has improved in recent years, it is still uncertain in many ways — inflation has remained stubborn, stocks have lurched from historic lows to historic highs, and the Fed's next move on interest rates is still a big question mark.

Against that backdrop, money market funds look better than ever.

"These funds prioritize safety of capital by investing in low-risk, short-term securities like Treasury bills," said Seth Thompson, founder of

READ MORE:

On the other hand, the funds also have their drawbacks.

"They do have higher risk than some other cash options, such as high-yield savings accounts," said Louis Guajardo, founder of

Not only that, but the high yields that make the funds so attractive can be ephemeral.

"The biggest disadvantage that I see comes from the change in yield," Guajardo said. "Money market funds offer no guaranteed yield and can change in an instant."

But in the context of a well balanced, diverse portfolio, most wealth managers agree money market funds can serve a useful purpose, especially in today's unpredictable environment.

"With upcoming elections and high stock valuations, many investors are nervous and have cash sitting on the sidelines," said Joe Petry, founder of

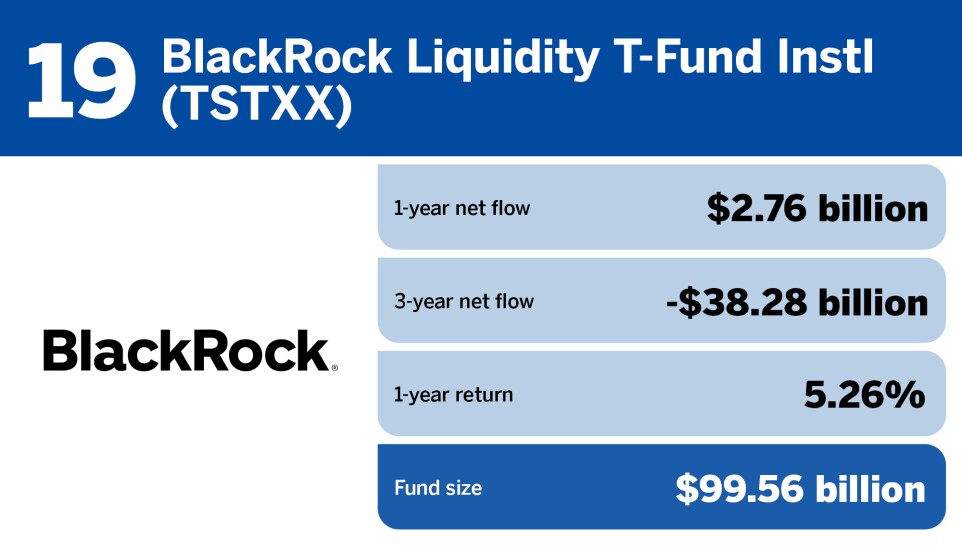

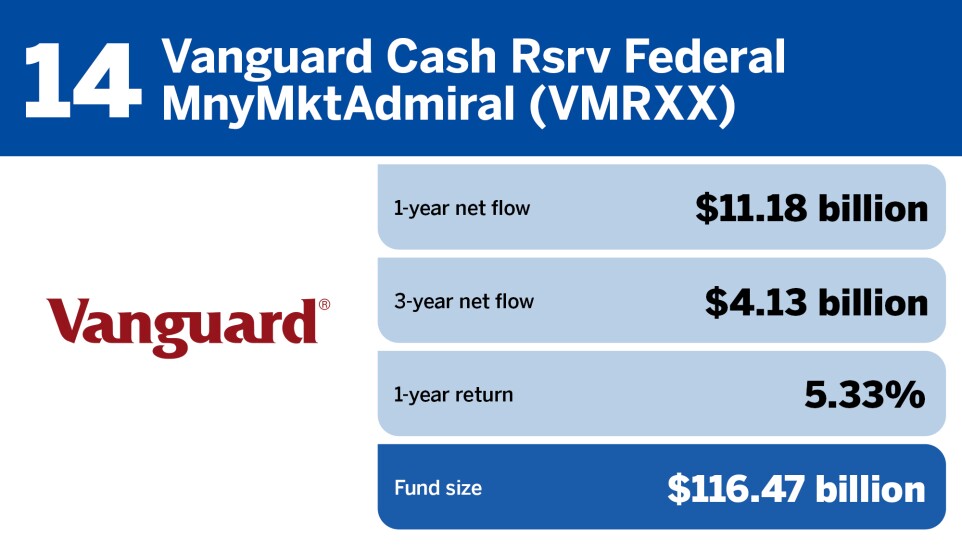

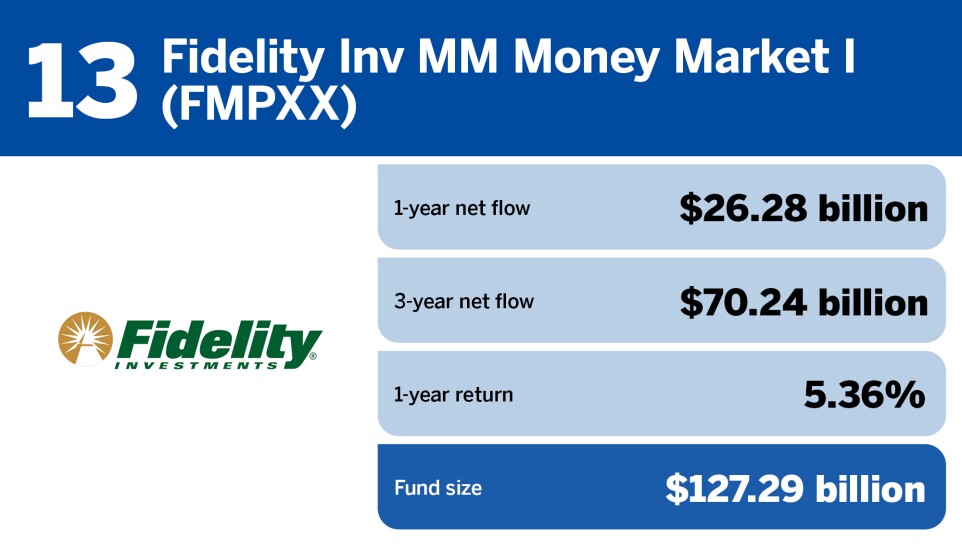

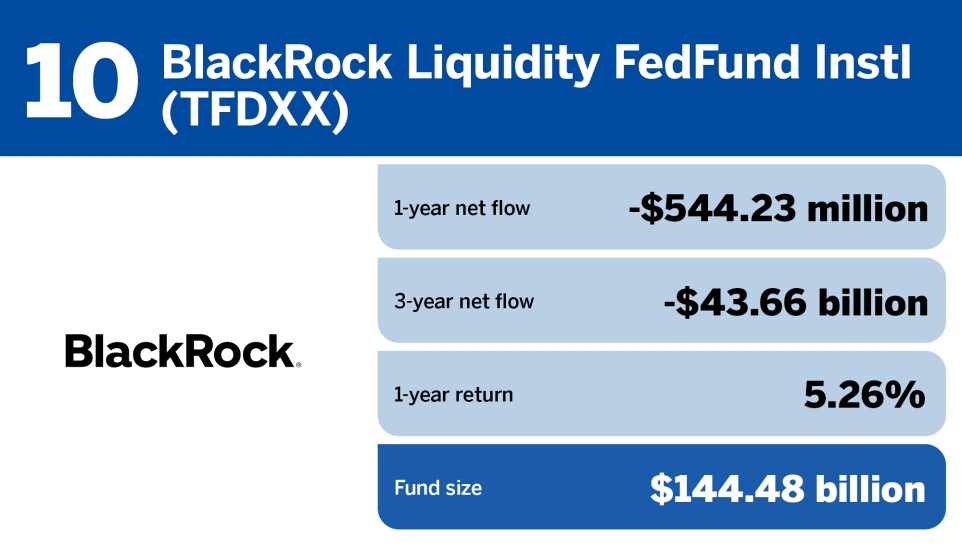

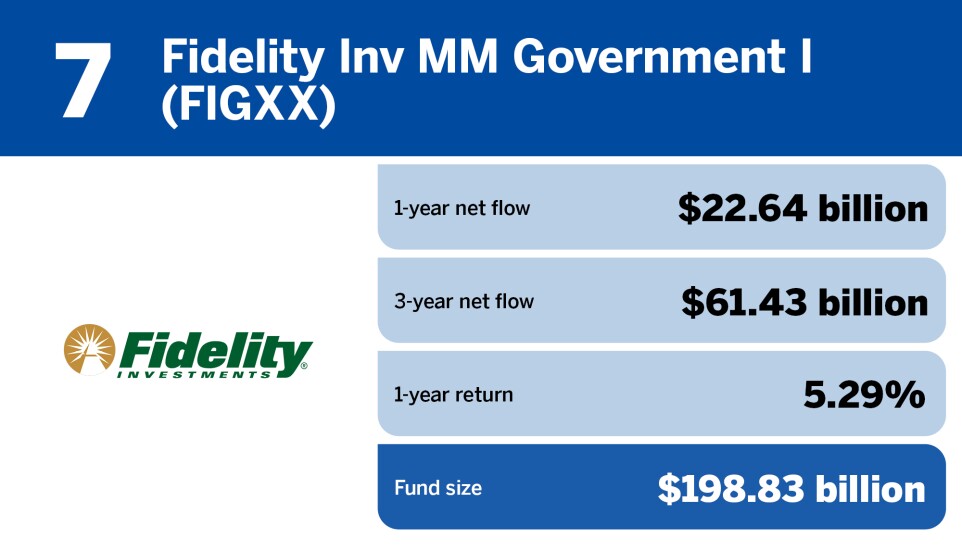

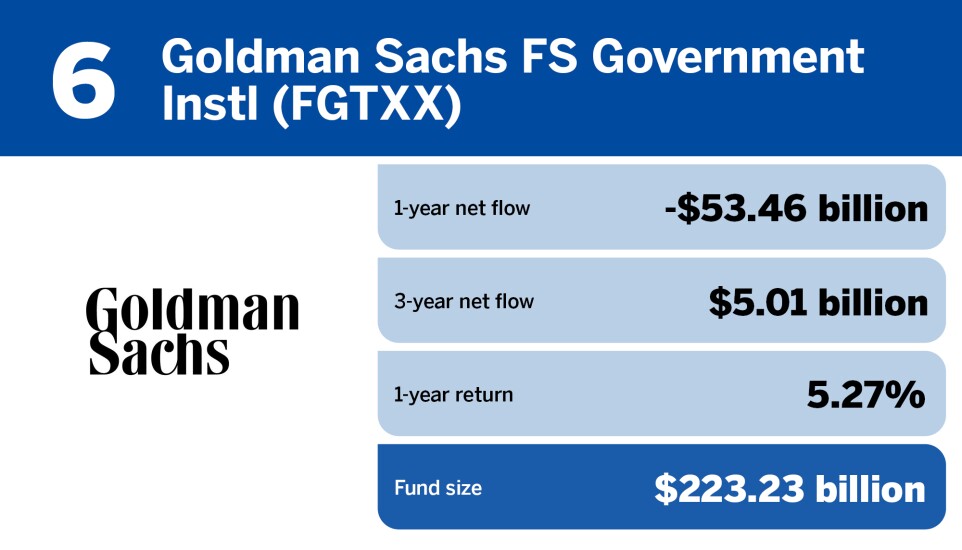

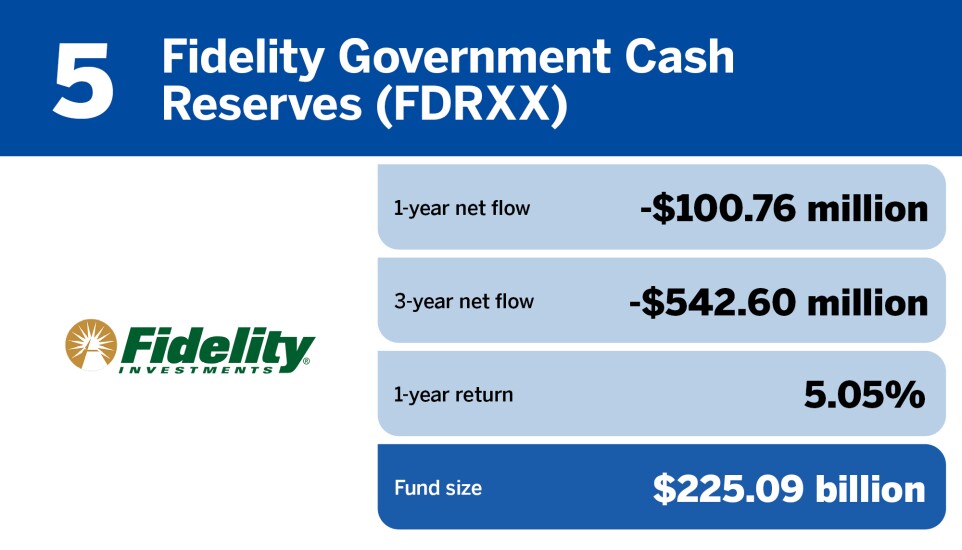

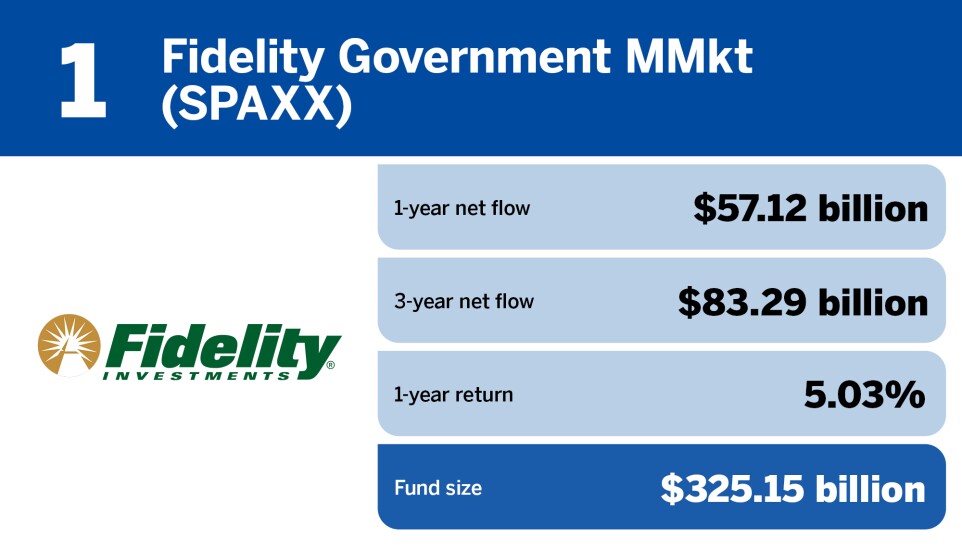

How does one measure the success of a money market fund? Since the yields change so frequently, we've focused on fund size. Below are today's largest money market funds in the U.S. market. All data is from Morningstar Direct, and is current as of April 18, 2024.

READ MORE: