Robo advisors rebounded from a tough first quarter to finish 2020 with strong investment performances.

The average automatically managed portfolio returned 14.90% on equity holdings and 6.3% on fixed income, according to Backend Benchmarking, a research firm that analyzes the performance of the industry’s leading digital advisors. Over the five years that Backend Benchmarking has published quarterly reports on robo advisor performance, the average robo returned 11.90% annually on equity holdings and 4.38% annually on fixed income.

Robos matched the trends of the broader market, though still lagged behind the S&P 500’s 16% gain in 2020,

“For those who were skeptical about the ability of an algorithm to manage money, the data suggests that robo advisors can produce strong returns at a much lower cost than traditional advisors,” wrote David Goldstone, Backend Benchmarking’s research and analytics manager, in his latest Robo Report. “The past five years have also shown us that robo advisors are not a monolith; there are real differences in portfolio construction that lead to disparate outcomes in returns.”

Those differences can have significant long-term impact for the millions of new customers who signed up for a robo advisor in 2020. National lockdown orders spurred many people to begin stock trading, but ongoing market volatility also

Given robos’ reliance on index funds, the fact they followed the broader market’s bounceback is not surprising, but

So which ones are doing the best?

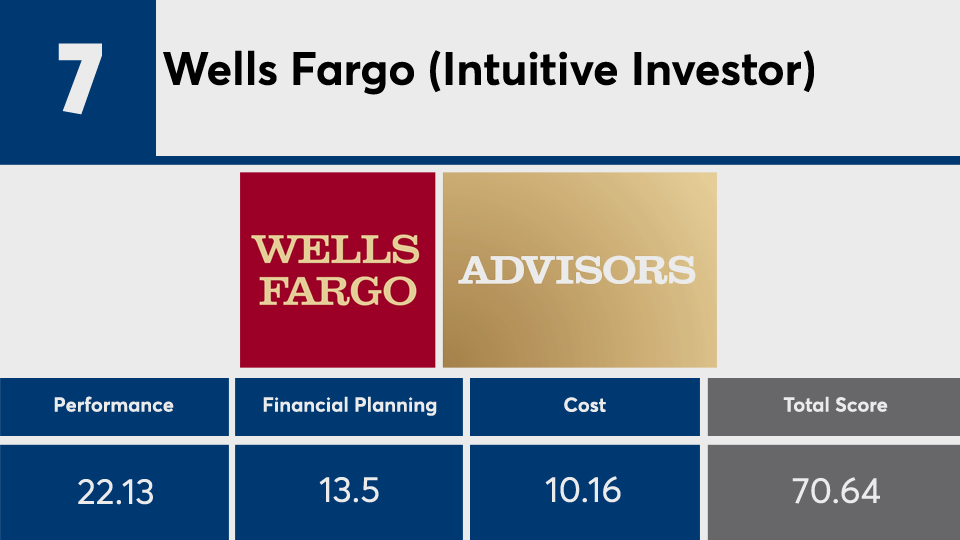

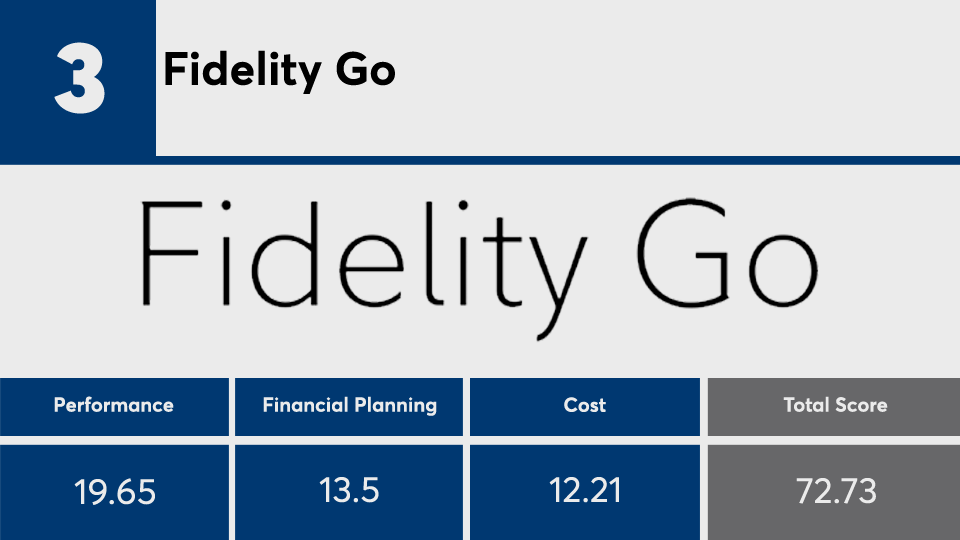

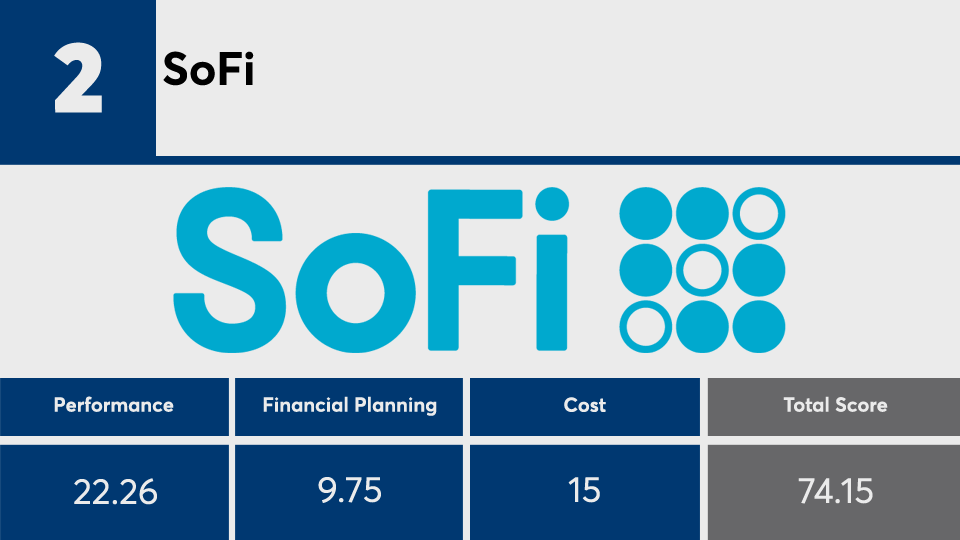

Using real accounts opened at the services, Backend Benchmarking scores the robos on quantitative measures like performance and cost, as well as qualitative evaluations of features and services. The total score represents the robo’s sum across nine categories out of 100 possible points.

“Although we rank and give each robo an overall score, we also acknowledge the differences in individual investors and their situations,” Goldstone wrote in the report.

For example, some robos are best for clients with more advanced needs, while others are better for first-time investors. Some might offer superior financial planning tools, despite not being named a “top overall robo.”

“Once investors have identified their needs, the category rankings can help them select a provider that stands out in the areas that are most important to them,” Goldstone said.

Scroll to see the top 15 robo advisors according to Backend’s overall scores. How the services performanced across the nine individual categories is also included. Numbers are scores, not dollars or percentages, and carry different weight. For example, performance is worth a possible 25 points while size and tenure is worth two. All data is from Backend Benchmarking.