ETFs had a banner year in 2024, breaking records with global assets surpassing $15 trillion, according to a recent Bank of America report.

And U.S.-listed ETFs attracted an all-time high of $1.15 trillion in assets last year, the latest ETF Flash Flows report from State Street Global Advisors indicated.

"ETFs once again helped investors build portfolios to seek their financial outcomes," said Matthew Bartolini, head of Americas ETF research at

ETFs in areas including bitcoin, technology and

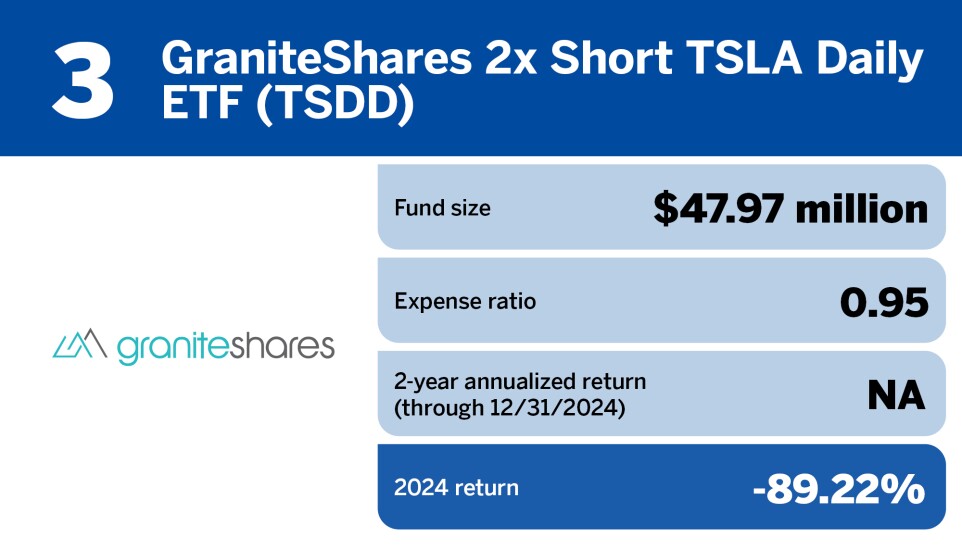

Indeed, the three U.S. ETFs with the best performance in 2024, as measured by total return data provided by Morningstar Direct, reflect the ongoing AI boom: GraniteShares 2x Long NVDA Daily ETF (NVDL), T-Rex 2X Long NVIDIA Daily Target ETF (NVDX) and Direxion Daily Nvda Bull 2X Shares (NVDU).

The ETF landscape

As 2024 began it represented the first year in which the SEC approved spot bitcoin exchange-traded funds. Since then, BlackRock's iShares Bitcoin Trust (IBIT) has grown to a

Steve Dean, chief investment officer at

"ETFs offer several benefits of tax-efficiency, liquidity and potentially lower cost, as well the liquidity and flexibility to allow shifting portfolio allocations to respond to market changes and client needs," he said. "Broad equity ETF performance in 2024 reflected the continued dominance of growth and tech-oriented U.S. large-cap stocks. More value- and dividend-oriented stocks, small-cap and international stocks trailed those leaders by a large margin in 2024, despite a surge in those categories in July and for a few weeks post-election. This dispersion has created some challenges to the narrative of the benefits of diversification, as the way many investors diversify their equity portfolio is by holding some small-cap and international stocks."

ETFs' performance in 2024 proved their resilience and flexibility in navigating a volatile market, said Christopher Berry, a financial planner with

"As we move into 2025, I'm optimistic about their continued strength, particularly in sectors like infrastructure and dividend-focused strategies, which align with broader economic trends," he said. "For portfolio allocations, I'm planning to increase exposure to inflation-protected and income-generating ETFs while staying nimble to adjust for any market shifts."

Why advisors turn to ETFs

Antwyne DeLonde, founder and CEO of AI collaboration platform

"As we step into 2025, I'm keeping a close eye on ETFs tied to alternative investments like private equity, credit and digital assets," he said. "These areas are growing rapidly and offer exciting opportunities for diversification, especially as traditional markets face uncertainty. It's all about staying ahead of the curve and aligning portfolios with the evolving landscape."

DeLonde said he plans to rebalance his portfolio by increasing exposure to these alternative-focused ETFs.

"The goal isn't just growth," he said. "It's building resilience and ensuring investors are prepared for whatever the market throws our way. I'm optimistic that 2025 will be another transformative year for ETFs, driven by innovation and investor demand."

Romy A. Pickron, founder and CEO of

"The general expectation is that growth will keep going strong in 2025, because the new administration in Washington is seen as more business-friendly," she said. "For my clients, I plan to balance growth-focused ETFs with more stable options like dividend stocks to stay prepared for any shifts."

Even with ETFs' solid performance in 2024, diversification is still key, said Tara Shulman, principal wealth advisor at

"In addition, the concentration has also meant the leading stocks and categories have gotten relatively expensive and are priced for perfection," Shulman said. "Any hiccup in the pace of growth for those companies would usher in a rotation to the segments that have lagged. On the flip side, some of the laggards in 2024 may not represent great bargains to chase, so it is wise to not be naively contrarian. For 2025, we think that a broadening out of market leadership will remind investors of the benefits of the kinds of diversified portfolios, especially if any rotation comes with a drawdown in the market."

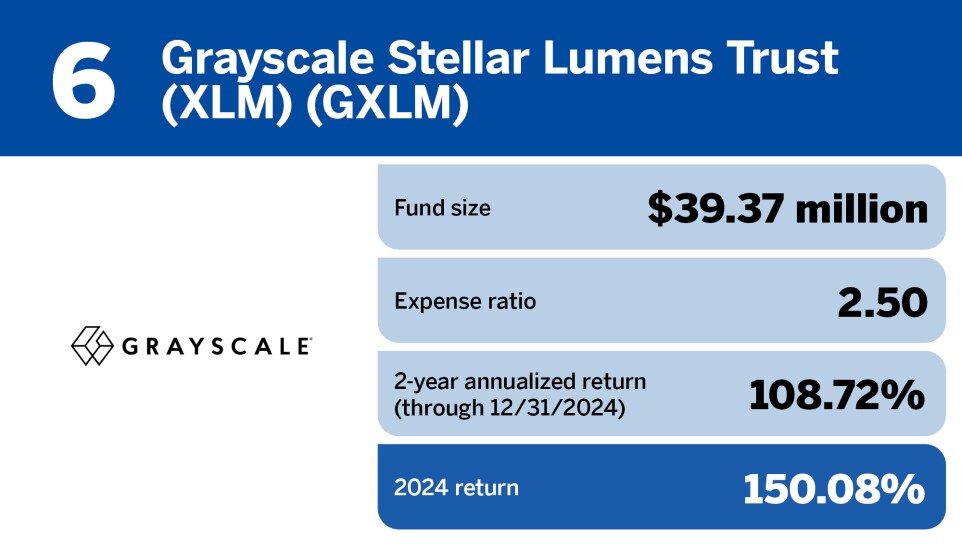

Scroll down the slideshow below for the 10 best-performing and 10 worst-performing ETFs domiciled in the U.S. in 2024; all data is from Morningstar Direct.

READ MORE: