With a digital tool for every aspect of an advisor’s daily life, wealth management is increasingly becoming a technology business.

The latest Financial Planning Tech Survey, finds that digital transformation is happening across the financial services industry at breakneck speed, and advisors are embracing it like never before.

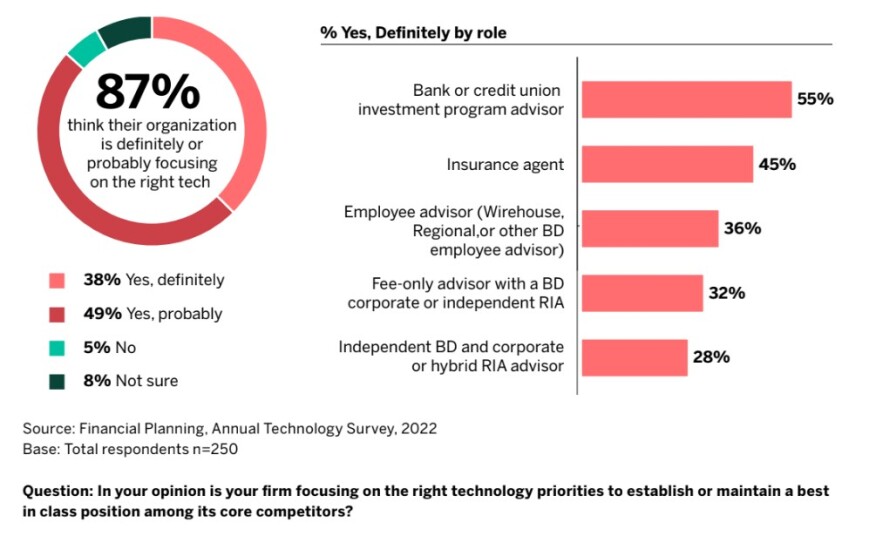

But the annual analysis reveals that even with that higher priority and a willingness to spend, wealth managers continue to have a difficult time navigating the crowded marketplace and lack confidence in their technology decisions.

“There are numerous choices out there, and they can cause a bit of paralysis. We used to talk about analysis paralysis in the investment world, and I certainly think that that applies to the volume of tech solutions that are available out there,” said Charles Reiling, CEO of the Delaware-based independent broker-dealer and RIA platform CoastalOne. “I think firms big and small have been slow in addressing the ever-changing tech landscape out there. Firms that have older legacy systems are never integrating fast enough for their advisors.

“It's a constant complaint as there are new, nimble solutions out there that advisors want to use. And for many reasons — and they're good reasons — firms aren’t providing.”

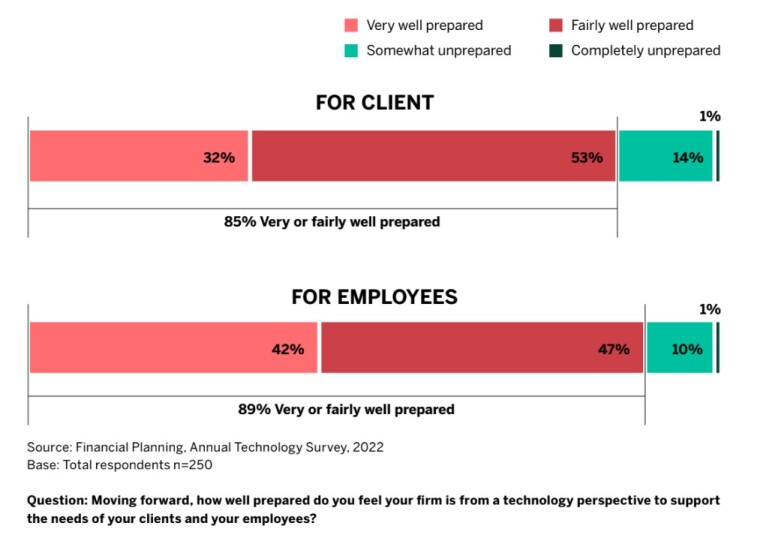

But if technology is focused on and implemented correctly, the payoff is well worth the stakes. For Don Patrick, chief strategy officer of Integrated Financial Group, digital tools can keep the human element of advisory front and center as a business grows.

“Technology creates capacity for the advisor so they can focus on their clients and the human aspect of it while taking away a lot of the mundane routine aspects,” said Patrick who founded the Atlanta-based consortium of independent financial planners in 2003. “It provides scale, and in a service business, it's a big deal as labor is one of the bigger expenses, but it also provides and can provide a very frictionless experience for clients.”

“That’s what’s most important. It allows for more families in America to have a financial planner and financial goals,” added Land Bridgers, CEO of Integrated Financial Group. “That really should be the heartbeat behind this. Whether you’re a millennial or 90 years old, when it comes to your finances … you want to have a real conversation with somebody, and there's no way AI or technology can provide that like a true financial planner who's got the time, resources and experience to provide that to that individual. But technology can help us connect with more individuals.”

The 2022 Financial Planning Tech Survey — conducted by parent company Arizent via an online survey completed by 250 advisors — explores the tech trends shaping the wealth management industry.

For advisors looking to keep pace or pull away from the pack, the report provides key insights into the perceived role of technology in future practices and a look at how advisors are investing for the future.

Scroll down to see some takeaways from this year’s survey. The entire analysis