Tax-efficient funds with the best returns of the decade managed to outpace the broader industry. But does that mean it’s a good long-term strategy?

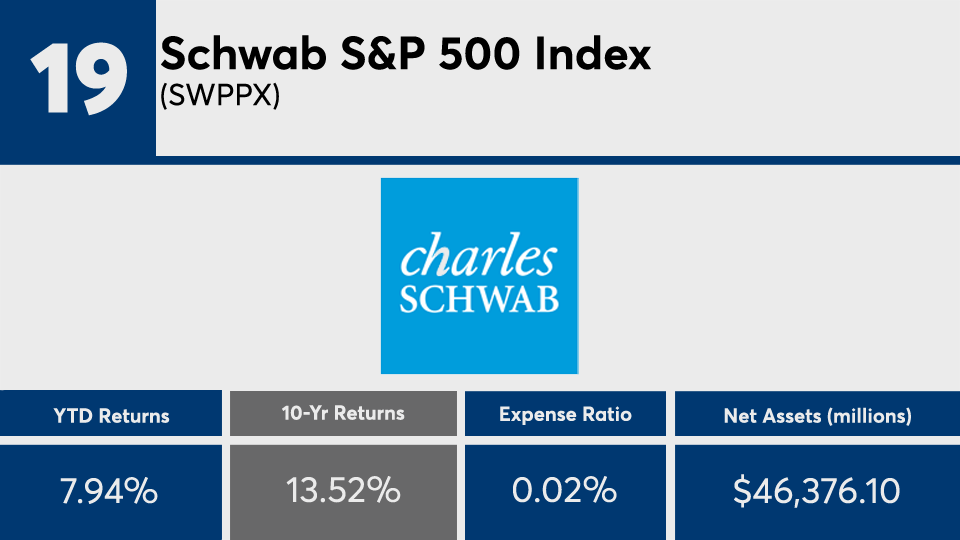

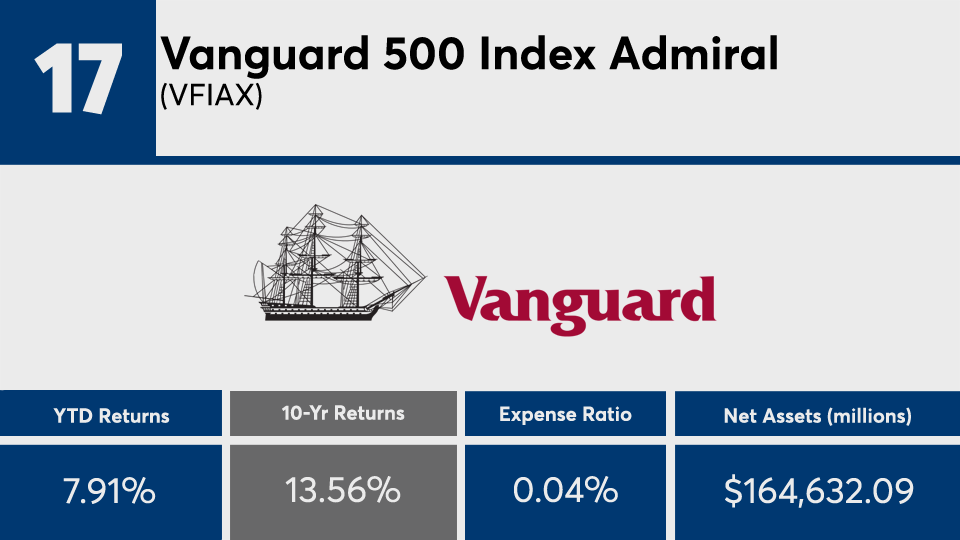

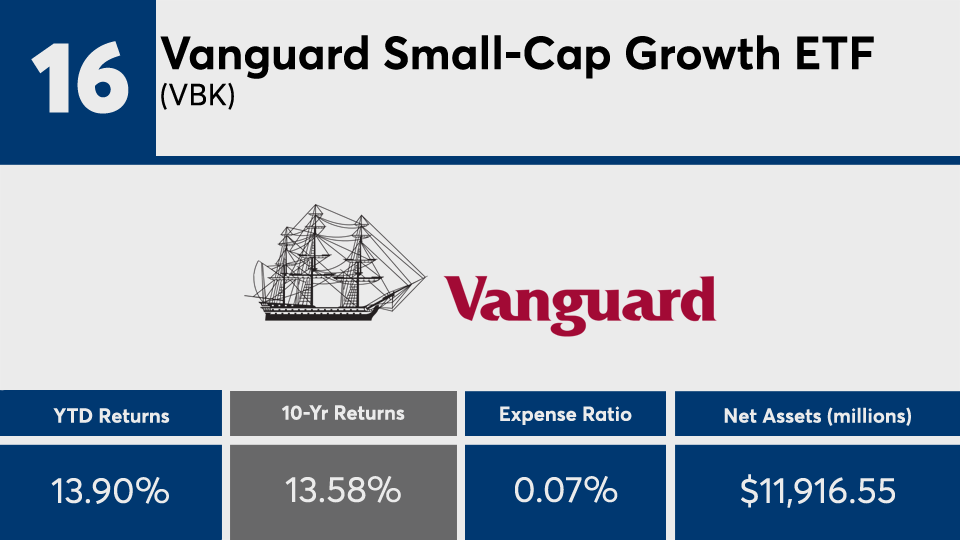

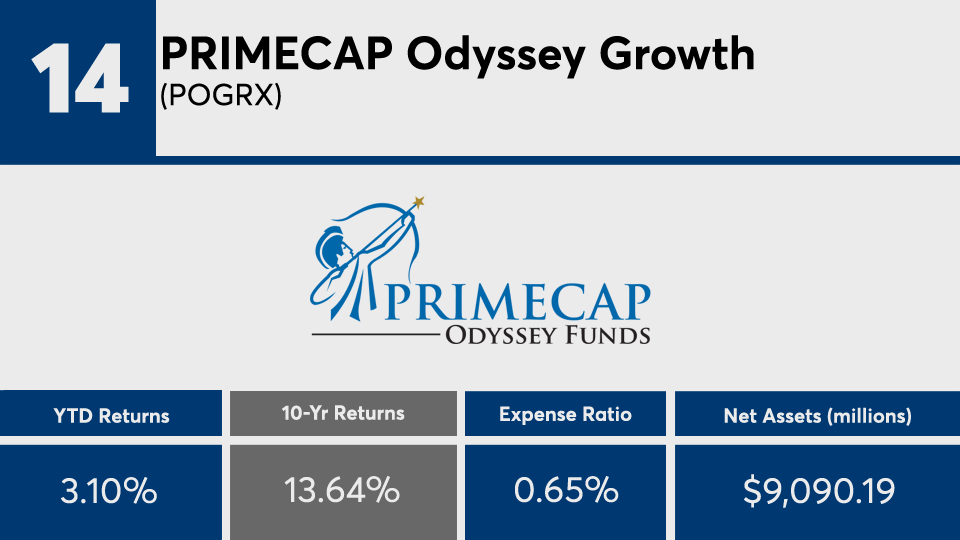

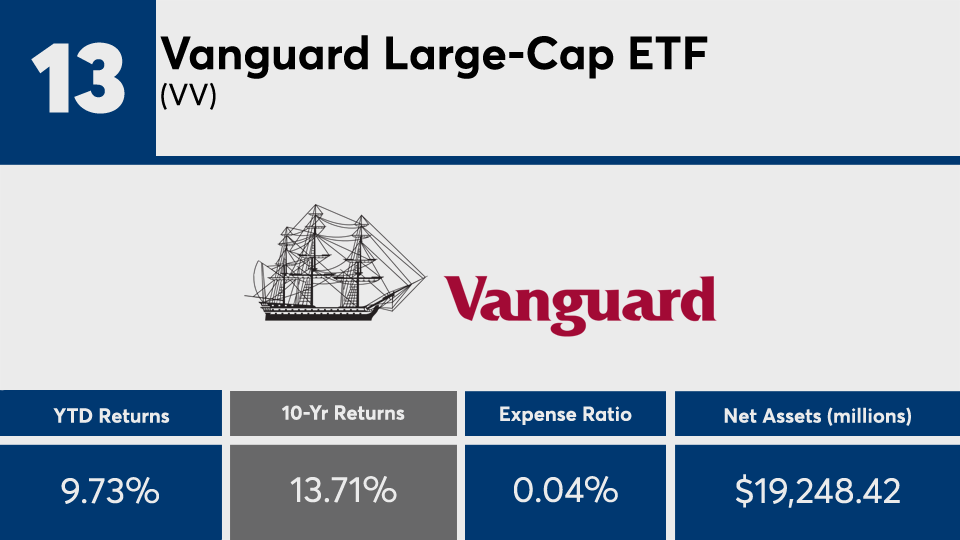

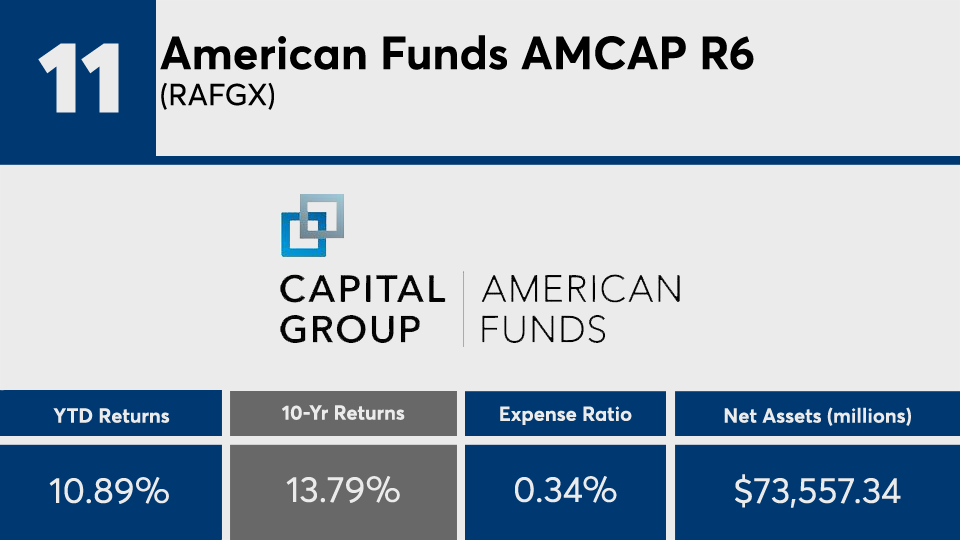

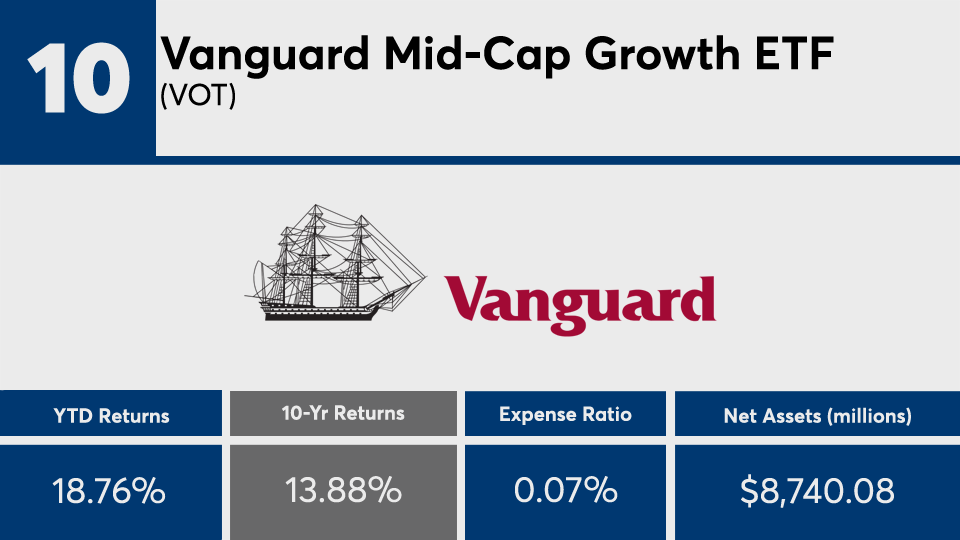

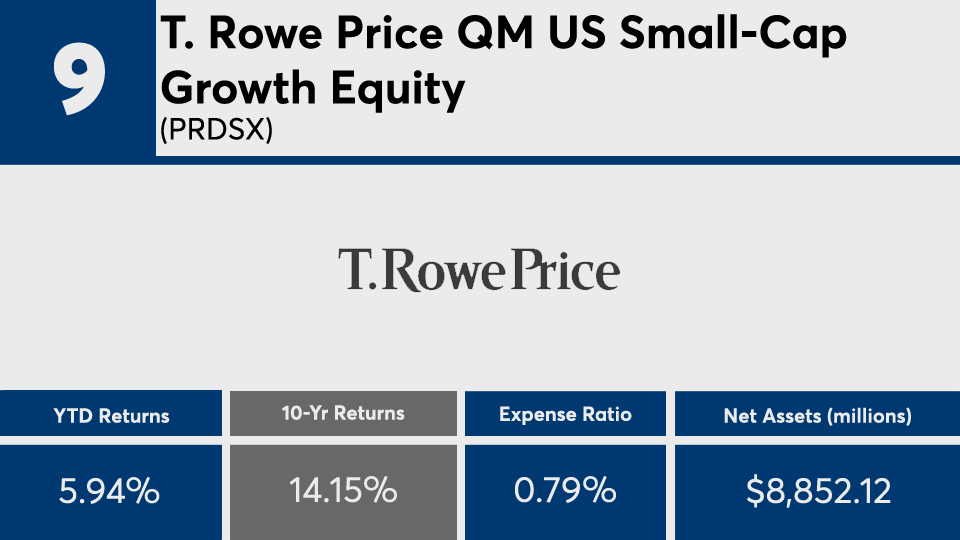

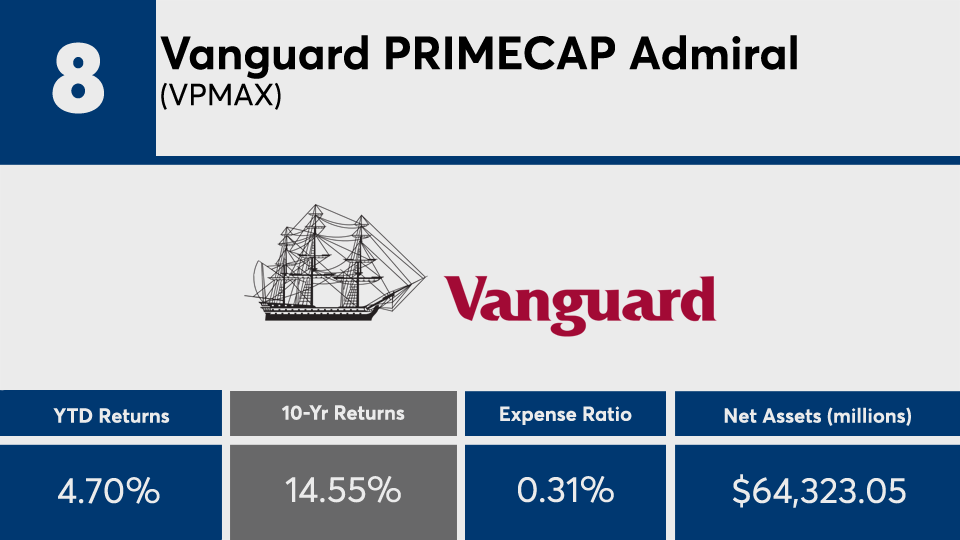

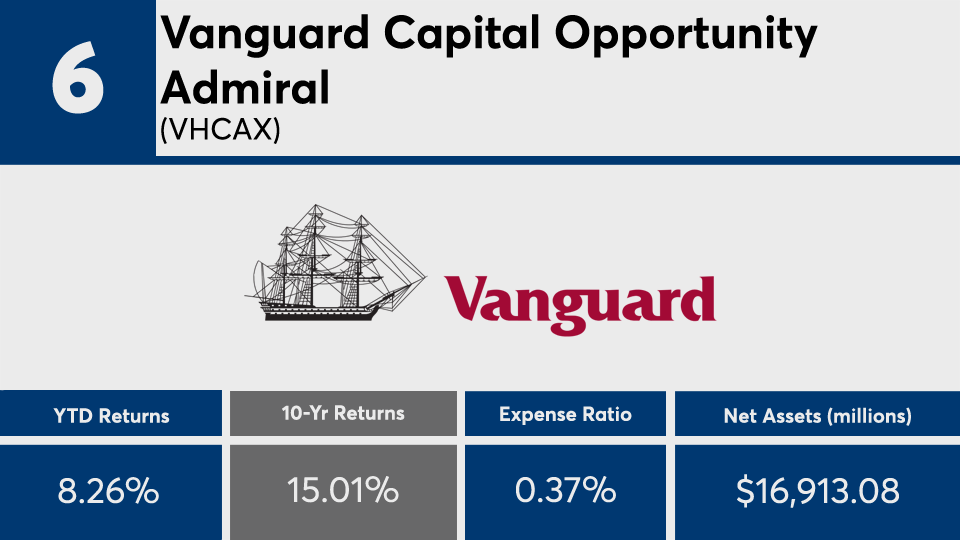

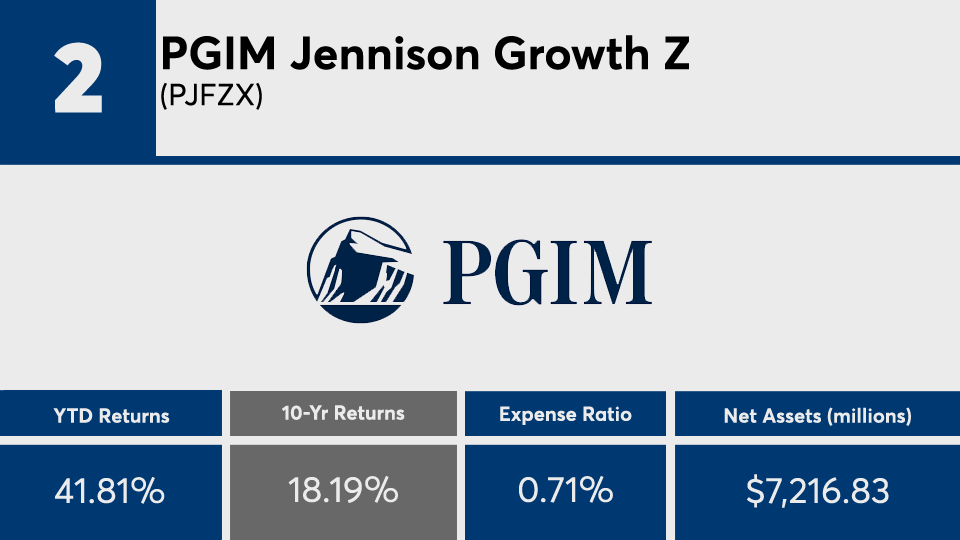

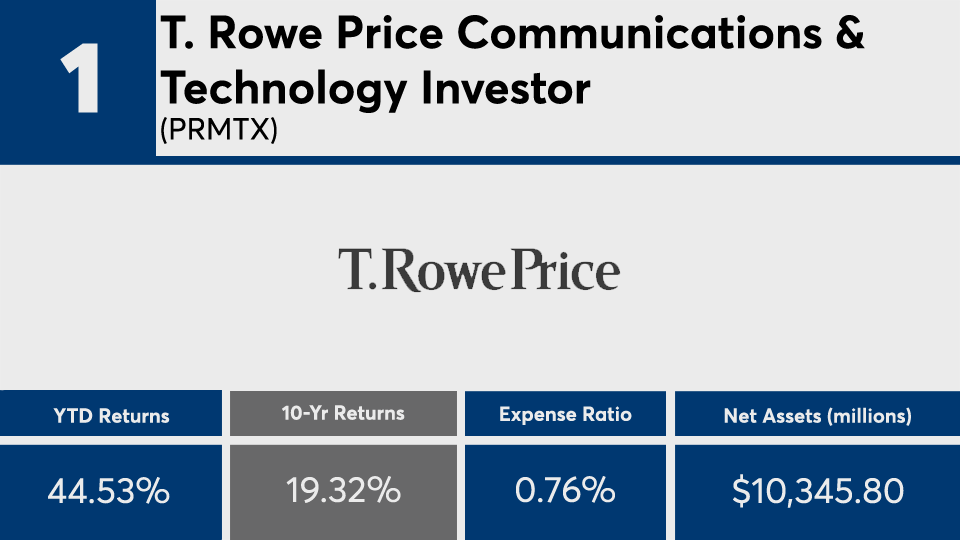

The 20 mutual funds and ETFs with tax-cost ratios lower than their peers generated an average 10-year gain of 14.89%, according to Morningstar Direct data. So far this year, the same funds delivered returns as high as 44%, and an average gain of more than twice the industry average.

For comparison, index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) posted 10-year returns of 13.49% and 12.31%, respectively, over the same period. Year-to-date, SPY and DIA reported gains of just 0.63% and 7.97%, respectively.

In bonds, the AGG has generated gains of 6.37% and 3.48% over the YTD and 10-year periods.

Though their returns are enough to account for overall outperformance, James Bruderman, president of Bruderman Asset Management and vice chairman of 1879 Advisors, says advisors and clients must consider the cost as well as the risks that come with chasing tax efficiency.

“Clients have got to invest for the long term,” Bruderman says, stressing that while it’s “not a bad idea to defer taxes, they shouldn't be afraid of taxes for the sake of performance.”

Fees among the top-performers, a mix of mutual funds and ETFs with an average tax-cost ratio of 0.70%, ranged from as little two basis points to as high as 1.25%, data show. With an average fee of 0.38%, however, they were generally less than the 0.45% investors paid for fund investing last year, according to

“Some of these funds are charging high fees to do the tax investment strategy and also pick the stocks,” Bruderman says, adding that the funds are also limited “by picking stocks because of the constraints of the tax strategy.”

Scroll through to see the 20 tax-efficient mutual funds and ETFs with the best 10-year returns through Oct. 22. Funds on this list adhere to