Taxpayers who

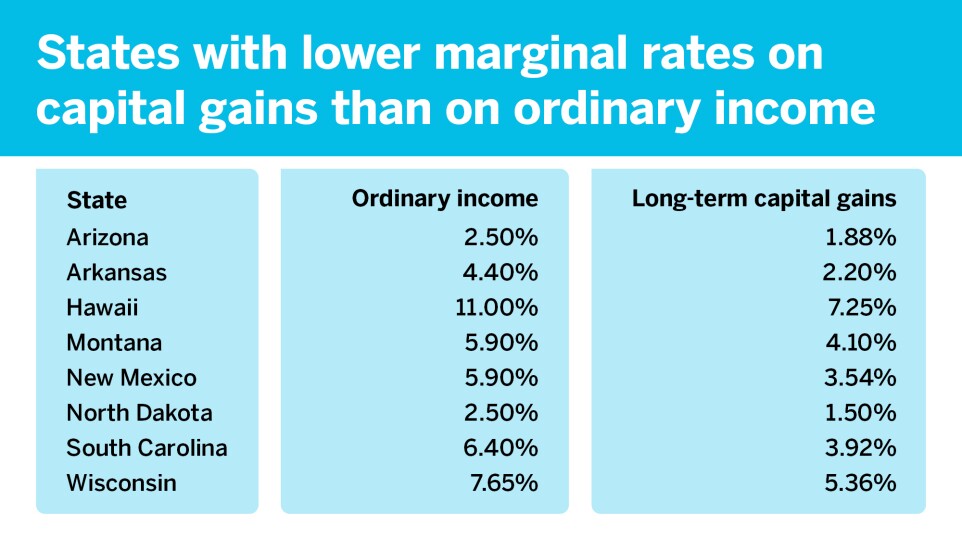

Eight states tax

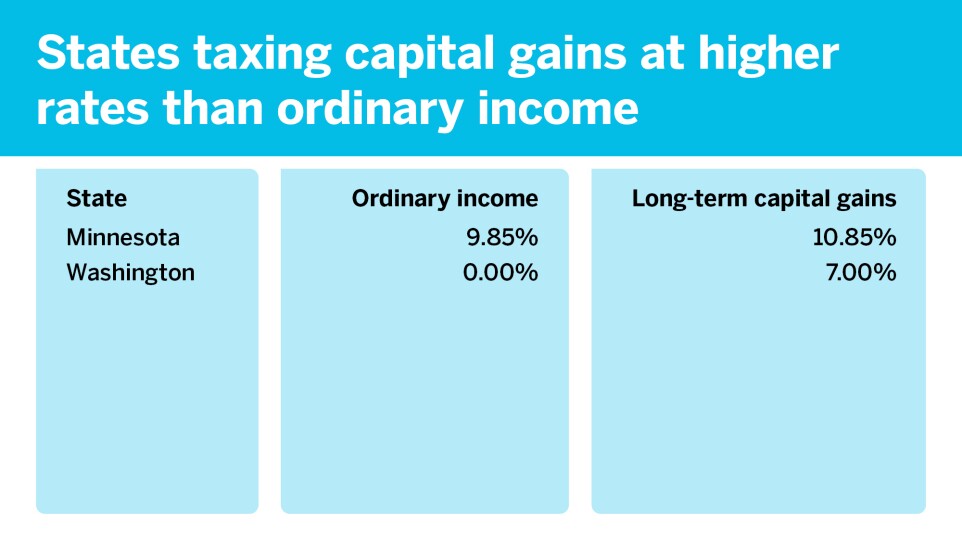

Scroll through below to learn more about the states and their tax rates on capital gains.

Source:

Taxpayers who

Eight states tax

Scroll through below to learn more about the states and their tax rates on capital gains.

Source:

The increased sophistication that cyber attackers are getting from technology requires more frequent updates to cybersecurity defenses, according to cyber insurance experts.

Larry Sprung wasn't looking for love (authors), but he wound up finding a great set of clients.

Public-sector pensions are shifting more risk onto employees through hybrid designs, variable contributions and COLA changes, transforming retirement planning for millions.

The choice of buyer and the price get the most attention, but a possible merger of equals and the technology side of the transition could loom large in the strategy.

The Swiss wealth management giant says many of its U.S. clients now "largely rely on other banks for their everyday banking needs."

Nearly half of advisors are considering adding this service, according to the Financial Planning's October Financial Advisor Confidence Outlook.