Want unlimited access to top ideas and insights?

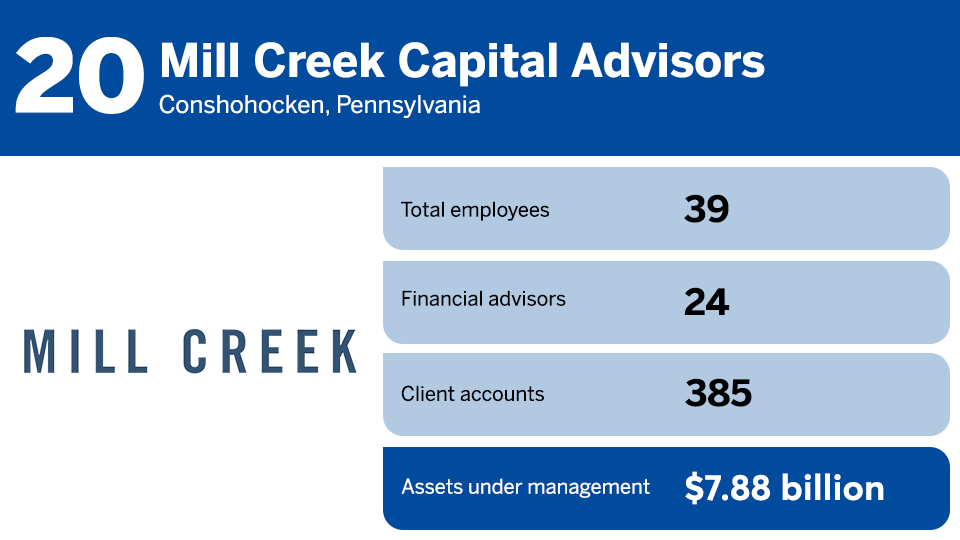

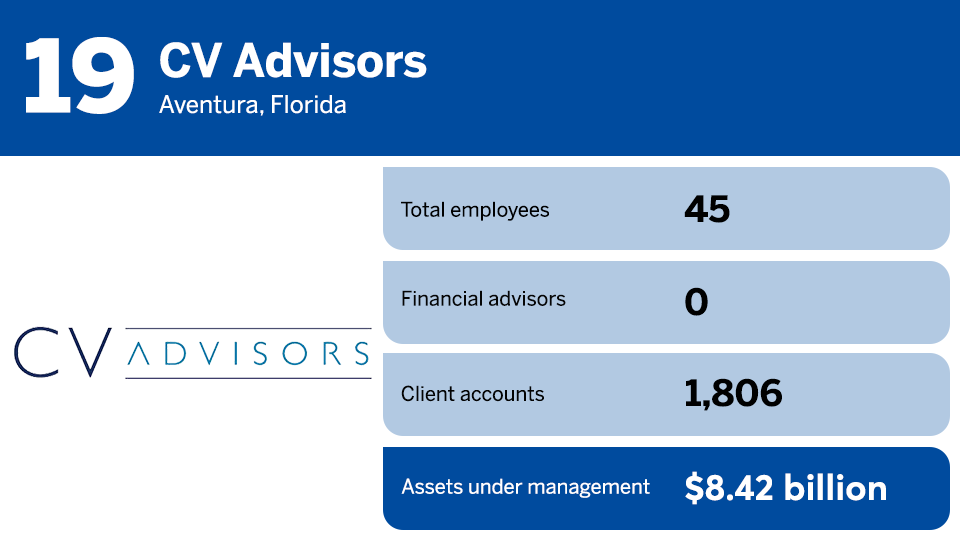

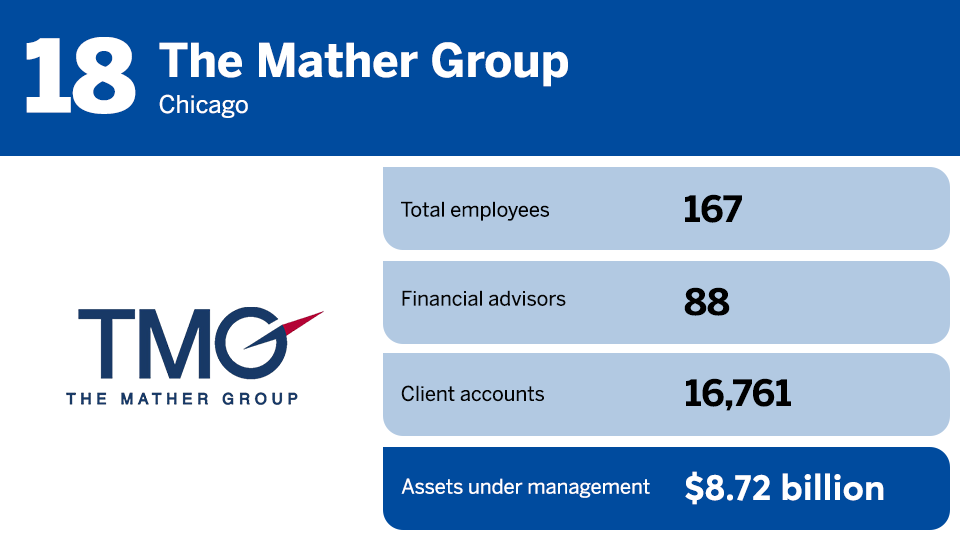

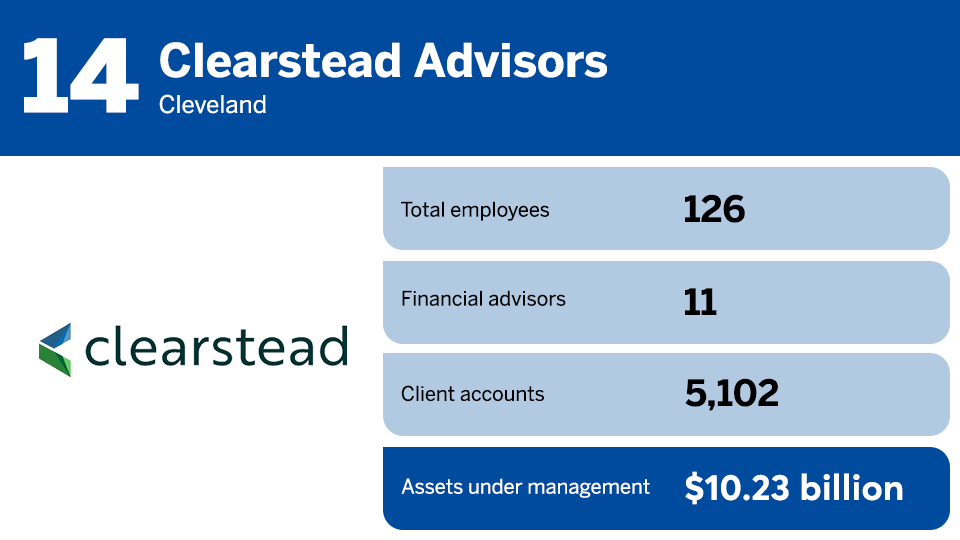

The assets managed by the 20 largest fee-only registered investment advisory firms in the financial planning profession took a hit in last year's stock and bond slump.

That accounts for the main differences between the 2023 rankings, which data partner

While stock and bond performance took a toll on most firms' assets under management last year, the group of 20 RIAs stands out among the roughly 2,800 RIAs that met FP's criteria for their sheer size as fee-only planning firms. Their girth displays "the importance of being able to offer planning that crosses more than just investments," as well as the continual movement of financial advisors out of wirehouses and of capital from private equity firms and other backers of

"There's a whole lot of money still floating around out there funding these roll-ups," Besheer said. "From that perspective, it's about getting to scale and/or super-scale."

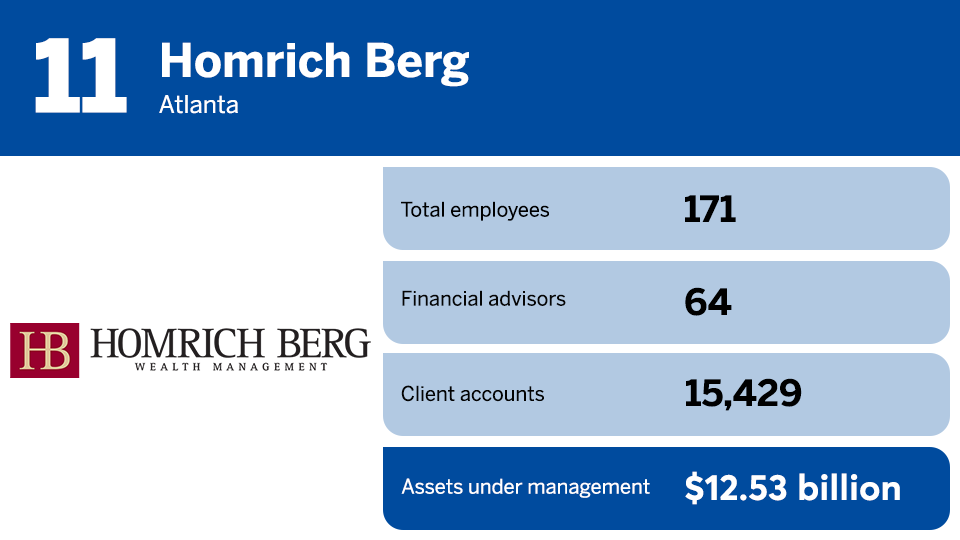

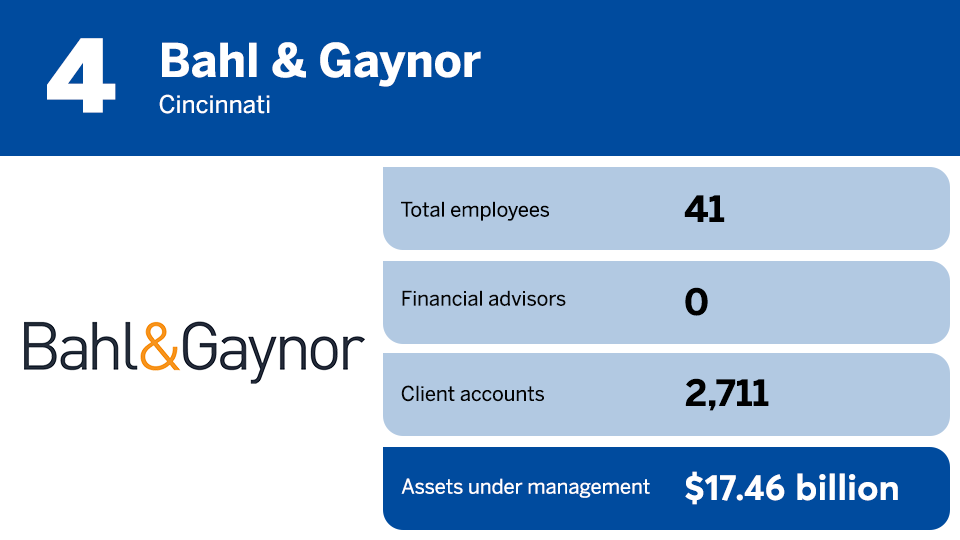

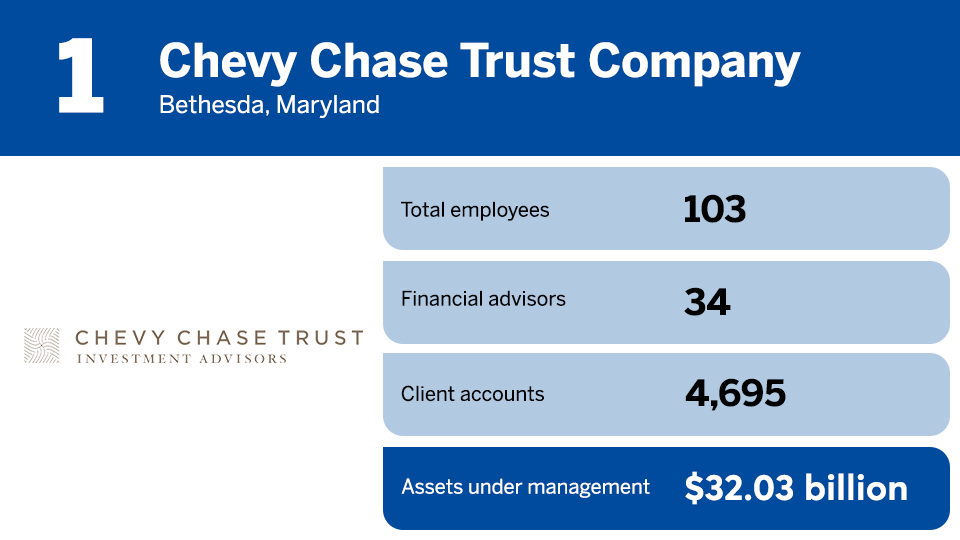

Scroll down the slideshow below to see the rankings of the largest fee-only RIAs in the U.S. that provide financial planning services to clients. To read the RIA Leaders cover story, "Schwab and Fidelity referrals give certain RIAs business, deal others out,"

Notes: FP's data partner for the RIA Leaders feature, COMPLY, produced the below rankings by applying the following six criteria to firms' required SEC Form ADV filings in July 2023:

- Firms must have zero registered representatives of a broker-dealer.

- At least 50% of the firm's clients must be individuals or high net worth individuals.

- Firms must not list commissions as a compensation arrangement.

- Firms must have more than zero financial planning clients.

- Firms must not list commission-taking businesses in "other business activities."

- Firms cannot be affiliated under common ownership with commission-taking businesses.