Want unlimited access to top ideas and insights?

In terms of mutual funds, it's been a bad decade for doubting Thomases.

Morningstar Direct, the research portal of Chicago-based financial services firm Morningstar, has revealed the worst-performing mutual funds of the past 10 years, and they show a clear pattern: All of them bet against markets instead of on them.

"The commonality behind all of these funds is that they are trying to short or inverse the market," said Jay Zigmont, founder of

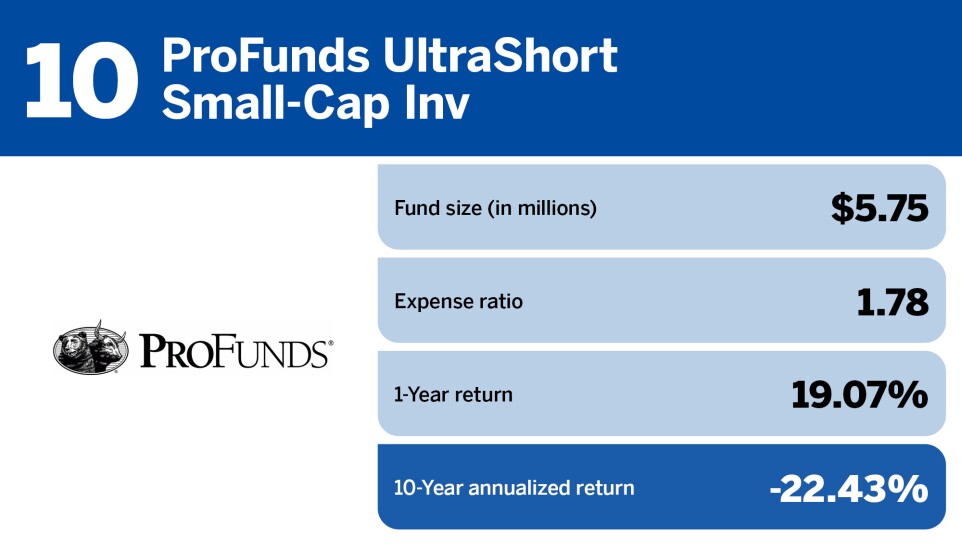

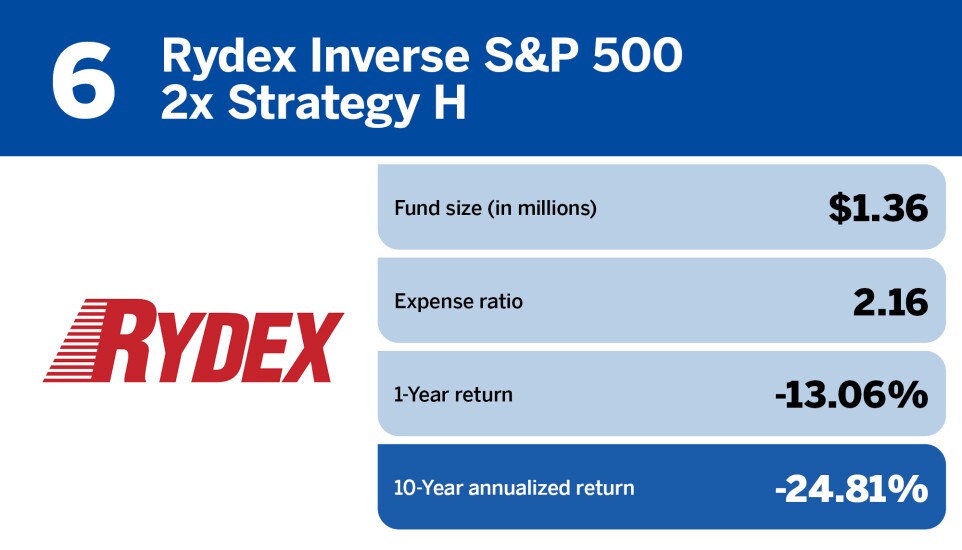

The list is dominated by inverse funds and shorts, which are designed to profit from the negative performance of an underlying index. Judging by their 10-year annualized returns, it's clear that these strategies didn't work — at least over such a long time frame.

"You want to be careful with leveraged funds looking at long-term results, because these funds originally weren't created to be long-term holdings," said Matt Slaton, founder and CEO of

At the top of the list — or perhaps we should call it the bottom — is the

But did it work? Not in the long run. On a 10-year annualized basis, the UltraShort NASDAQ-100 yielded negative-35.52%.

In the No. 2 spot is essentially the same product under a different brand: the

In some ways, these results are not surprising. The

No wonder, since the past decade overall has seen tremendous gains for tech stocks. Over the past 10 years, the Nasdaq-100 has

READ MORE:

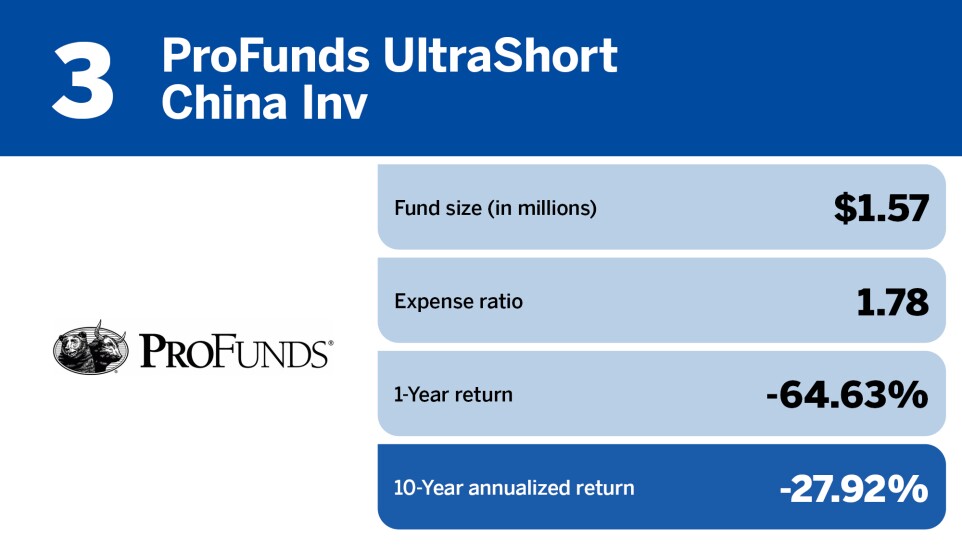

It was also a mistake, judging by Morningstar's data, to bet against certain countries. No. 3 on the list of low performers is the

It didn't pay off. The UltraShort China fund's 10-year annualized returns were negative-27.92%.

The same goes for the

And in what's perhaps a reassuring sign for the U.S. economy, those who bet against American stocks got burned as well. The

Over and over again, the lesson seemed to be that — at least over a 10-year timeframe — it pays to have faith.

"It is far more beneficial to be optimistic, rather than pessimistic," said Kashif Ahmed, president of

To see the full list of the top 10 worst-performing mutual funds of the decade, scroll through the cardshow below. And to see the other end of the spectrum,