At first glance, the Small Business Administration’s PPP loan data reveals which firms received government help to fund operations amid the coronavirus pandemic. But a closer analysis paints a broader and more nuanced picture of how — and where — the investment advisory industry has snapped up these government loans.

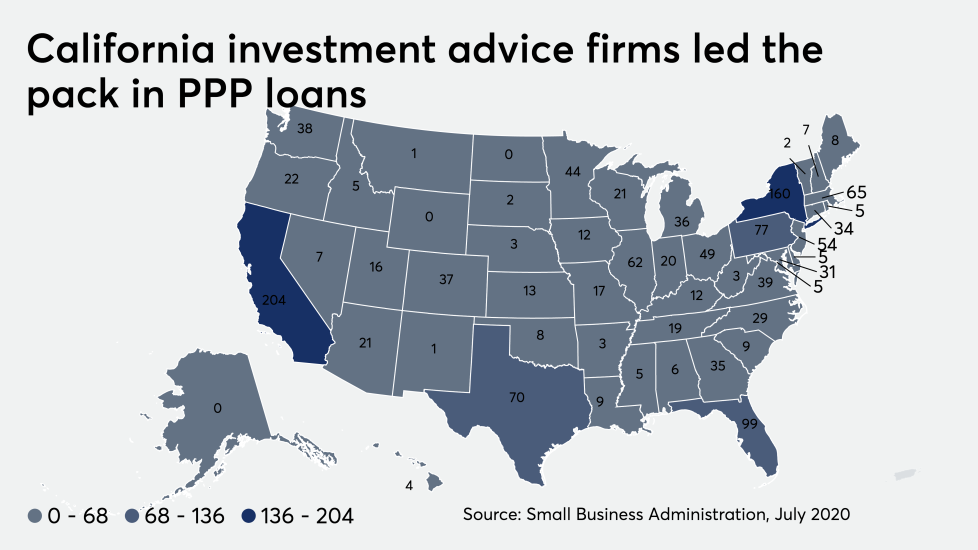

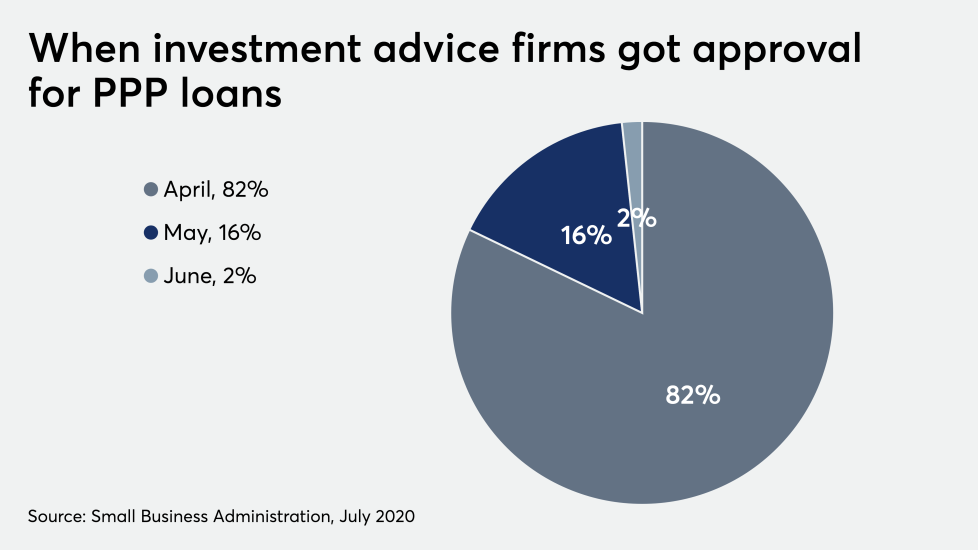

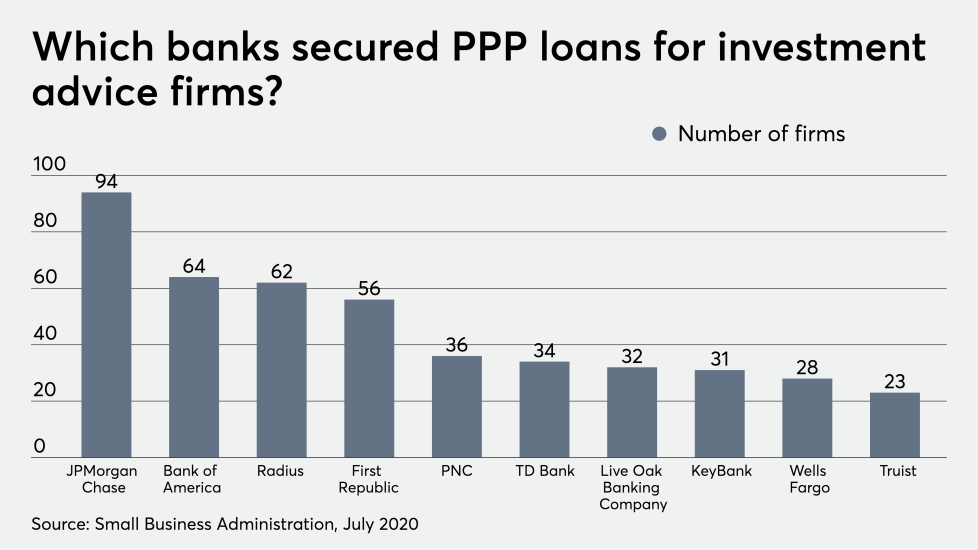

An examination of the data, released this week, shows which lenders advisors turned to, which states had the most applicants for the Paycheck Protection Program loans and other revealing information.

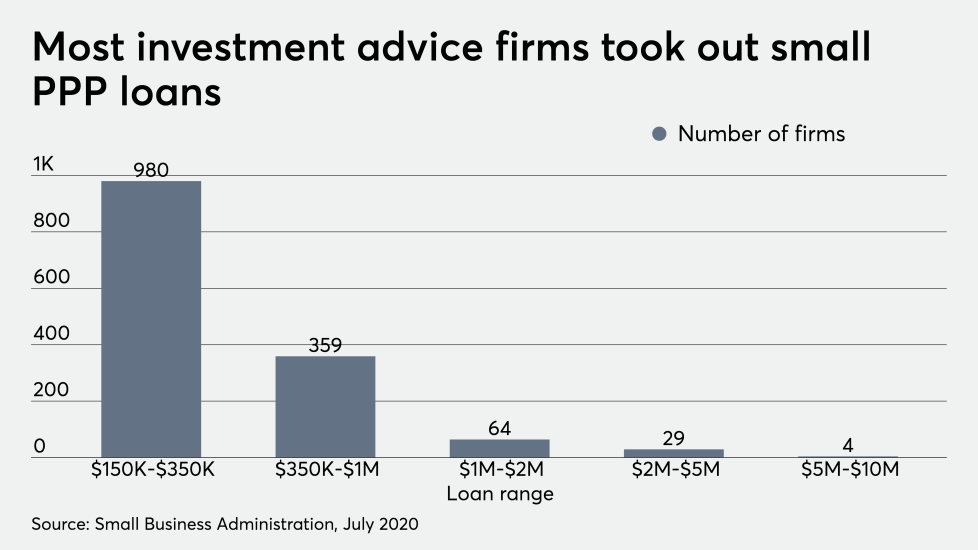

Overall, firms characterizing themselves as “investment advice” providers received between $414.7 million and $1 billion, according to the SBA data, which disclosed a loan range, rather than the specific dollar amount.

The loans were intended to provide “direct incentive for small businesses to keep their workers on the payroll and to maintain their operations,” according to the SBA, which authorized PPP loans and limited applications to firms with fewer than 500 employees, with a

Comparatively speaking, investment advice firms utilized a mere fraction of overall funding. Under the CARES Act, signed into law on March 27, $350 billion was earmarked for loans for small companies, and an additional $320 billion was set aside in May. About $130 billion has still not been claimed.

Though applicants were

A spokeswoman for the SBA did not respond to a request for comment on the scope to which companies may be misidentified in the data.

Scroll through to learn more about loans received by investment advice firms throughout the country, plus which states didn’t have any secure funding: