In an up market, it’s easy for clients to view investments through an absolute lens. Annual returns of 20%? Sounds great; 3%, not so much. But as advisors need to remind them, investment returns aren’t absolute. They’re relative.

Investment returns are most meaningful when compared to the broader markets or industry indexes. That 3% suddenly looks better if the corresponding industry lost 10%.

To be sure, clients may use a relative gauge, but it’s often the wrong one. Investor psychology suggests that we tend to make comparisons using arbitrary statistics we conjure up, in this case probably to historical market averages of 8% to 10%.

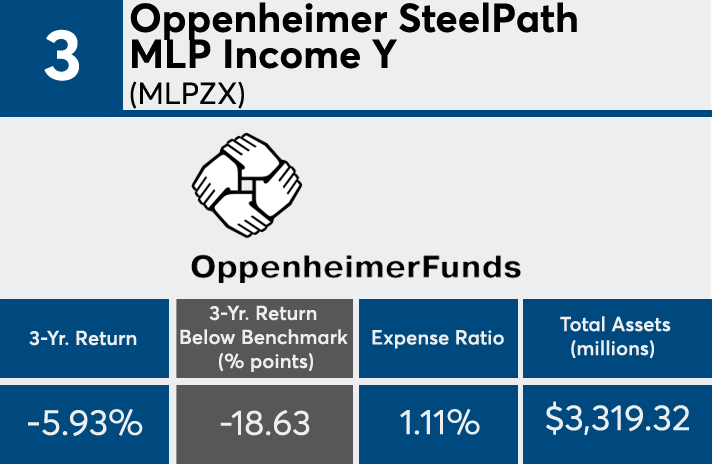

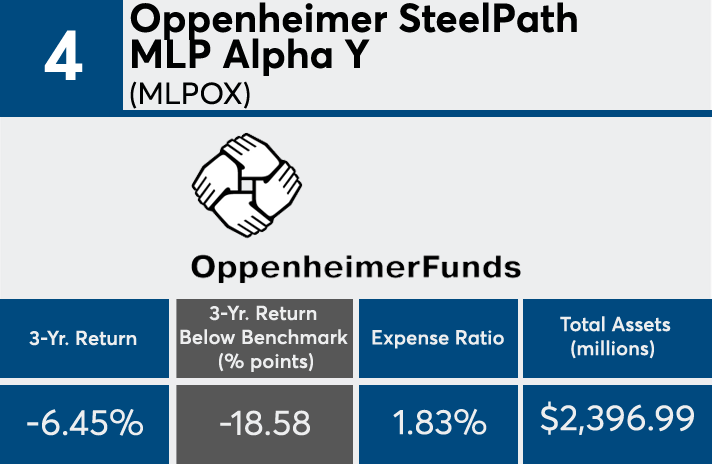

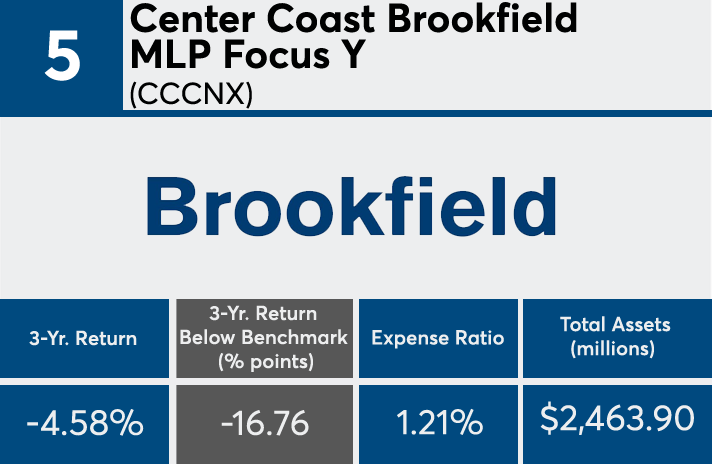

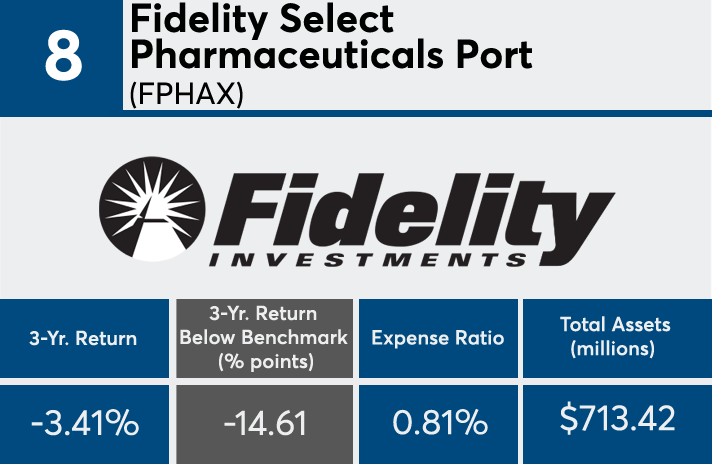

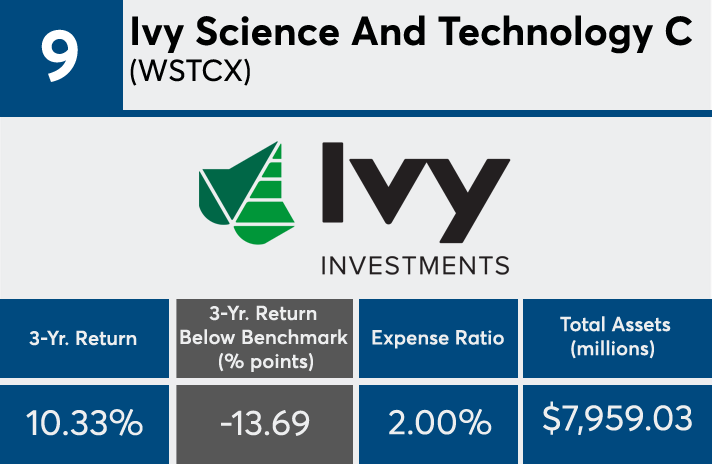

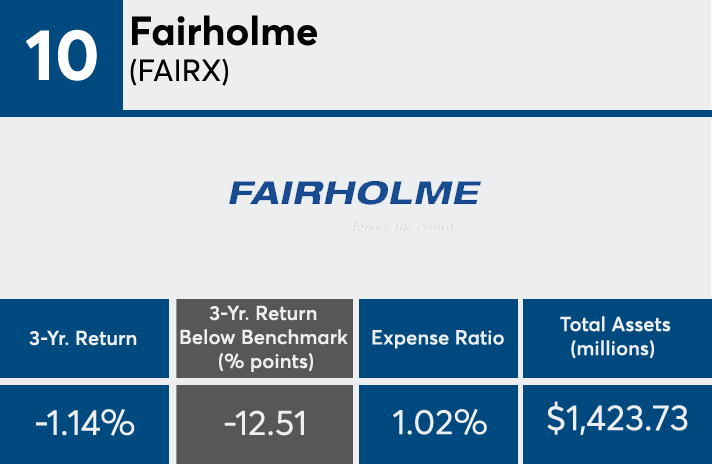

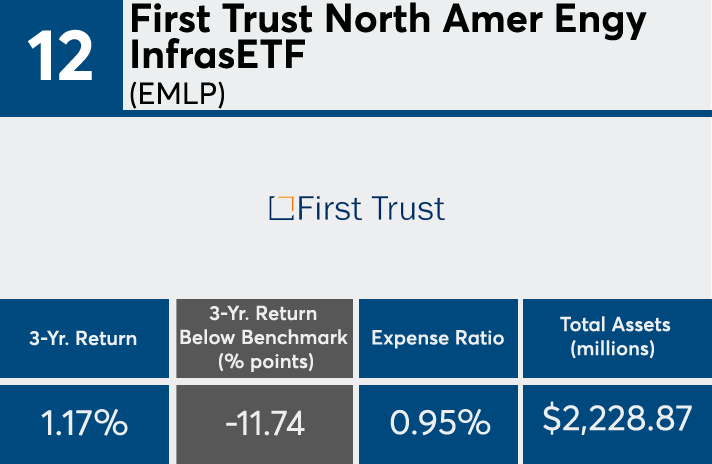

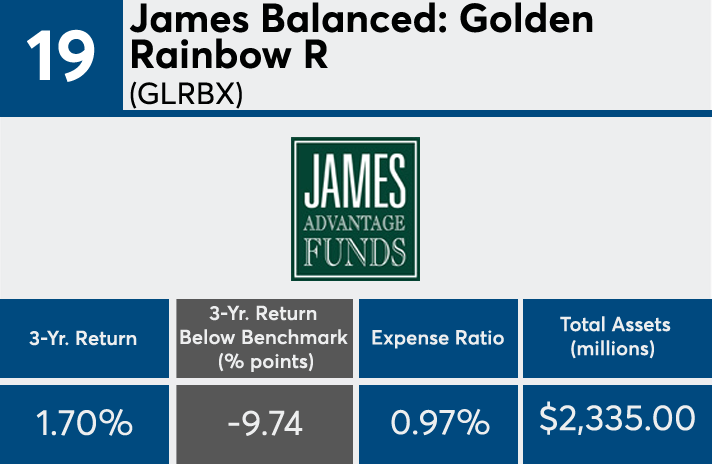

This uncertainty is why clients are best-served by diversifying and using broad-based index funds. But in the name of hindsight, we’ve collected the 20 funds that have underperformed their respective benchmarks by the widest margins over the past three years – the average here is 13.9 percentage points.

Scroll through to see the 20 funds with the worst underperformances. Funds with investment minimums higher than $100,000 were excluded, as were leveraged and institutional funds. We also show three-year returns, assets and, as usual, expense ratios for each fund. All data from Morningstar Direct.