Mutual funds and ETFs with the largest outflows this year lost a combined $86.6 billion. Those products collectively hold $1.2 trillion in client assets.

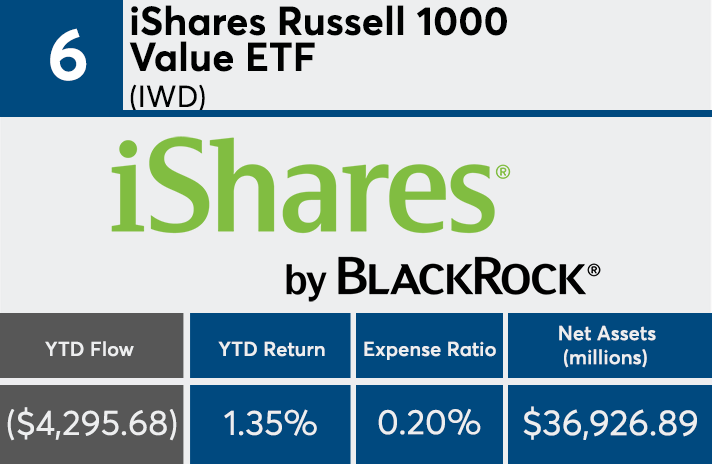

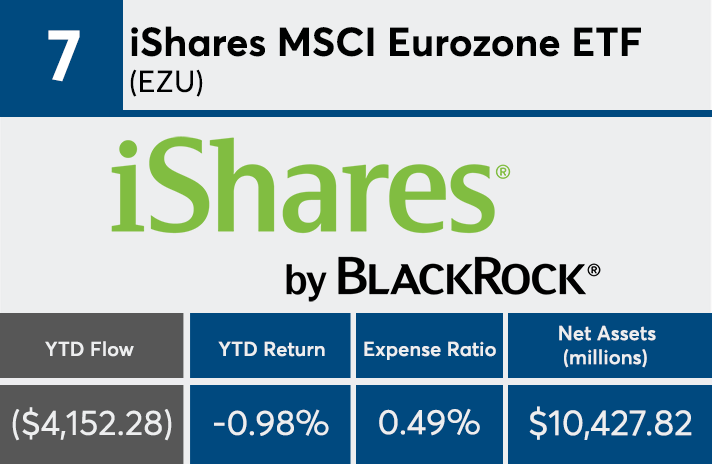

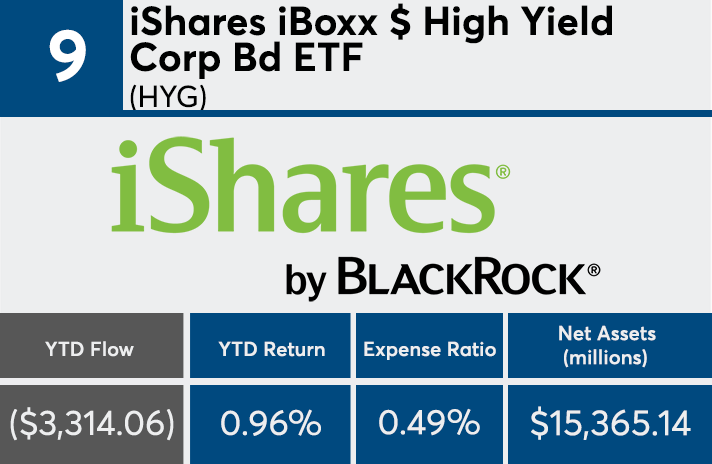

Despite redemptions from emerging markets and international equity, high-yield bond and large-value funds reported the largest combined year-to-date outflows at $23.1 billion and $21.4 billion, respectively, according to Morningstar.

The biggest takeaway, Morningstar Senior Fund Analyst Kevin McDevitt says, is the relative resilience of international equity flows versus U.S. stocks.

“U.S. equity funds have had about $21 billion in year-to-date outflows, despite the S&P 500 being up 6.5% or so,” McDevitt says. "International equity funds have collected about $86 billion in inflows, despite foreign markets being flat to slightly down year-to-date."

The third hardest hit among Morningstar's categories, U.S. Fund Mid-Cap Value, reported $9.3 billion in outflows year-to-date, the research company's data show.

Meanwhile, long-term mutual funds and ETFs reported $22.1 billion in redemptions in June, the biggest one-month outflow since August 2015, McDevitt wrote in a monthly report on asset flows. U.S. equity funds lost a combined $20.8 billion to redemptions, according Morningstar. Sector-equity, international-equity, allocation, alternative and commodity funds all had net outflows. Only taxable-bond and municipal-bond funds reported inflows.

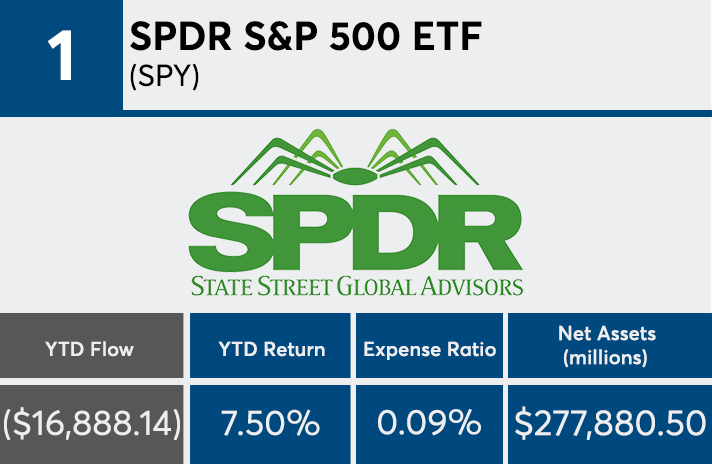

Most of the outflows this year have come from index offerings. At $16.9 billion, the S&P 500 tracker SPY reported the largest redemptions this year. SPY, iShares Core S&P 500 ETF (IVV), Vanguard Institutional Index (VINIX), Invesco QQQ Trust (QQQ), and Vanguard Total Stock Market Index (VTSMX) reported combined year-to-date outflows of $14.7 billion, according to Morningstar data.

The industry’s top 50 fund families, however, recorded a combined $170.5 million in inflows over the same period, McDevitt says.

“Don’t assume that flows blindly follow market performance,” McDevitt warns advisors. “Also, don’t get too wrapped up in monthly flows; focus on broader trends over quarters and years.”

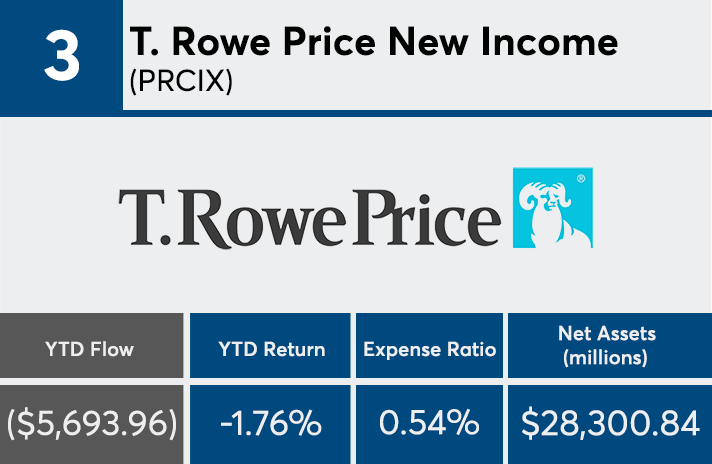

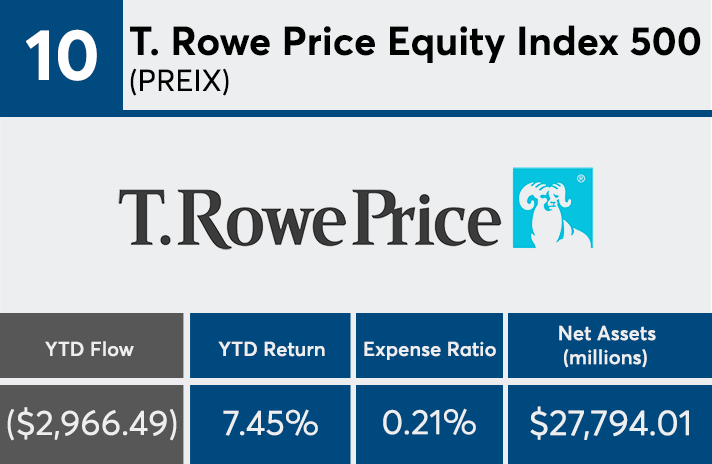

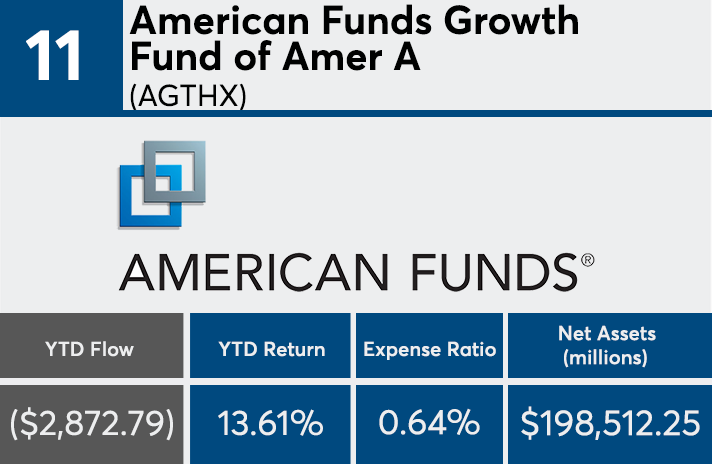

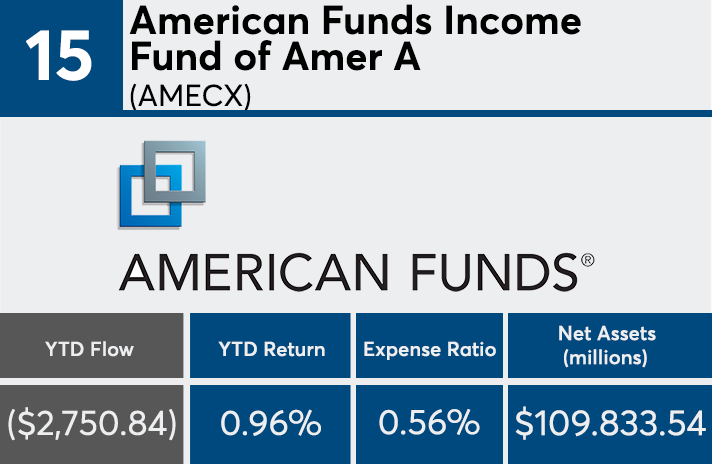

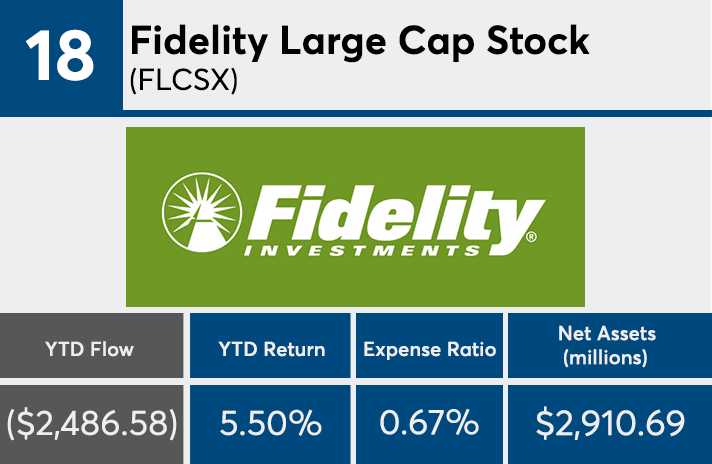

Scroll through to see the 20 funds with the largest outflows. Funds with investment minimums higher than $100,000 were excluded, as were leveraged and institutional funds. We also show year-to-date returns, assets and, as usual, expense ratios for each fund. All data from Morningstar Direct.