Long-term gains of the fund industry’s top-performing sectors show why portfolio diversity is mission critical.

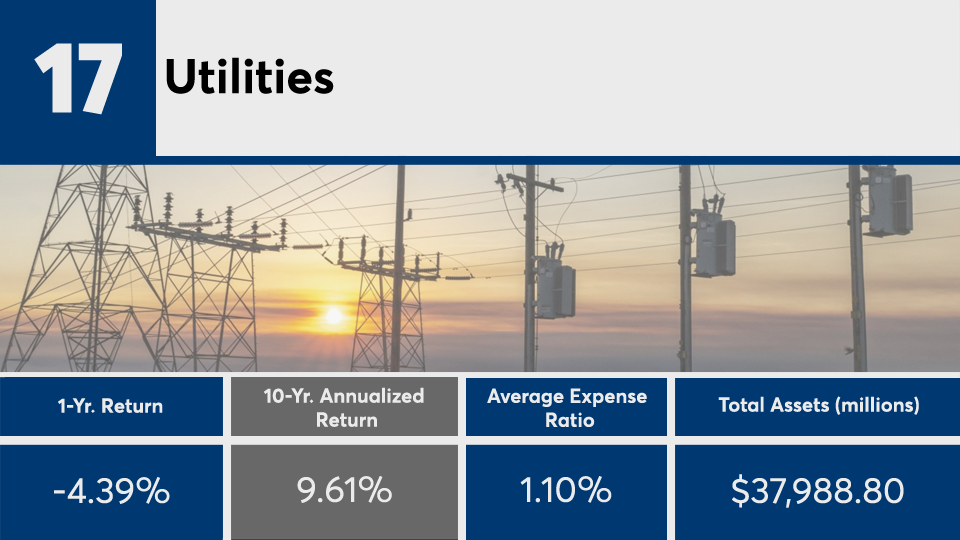

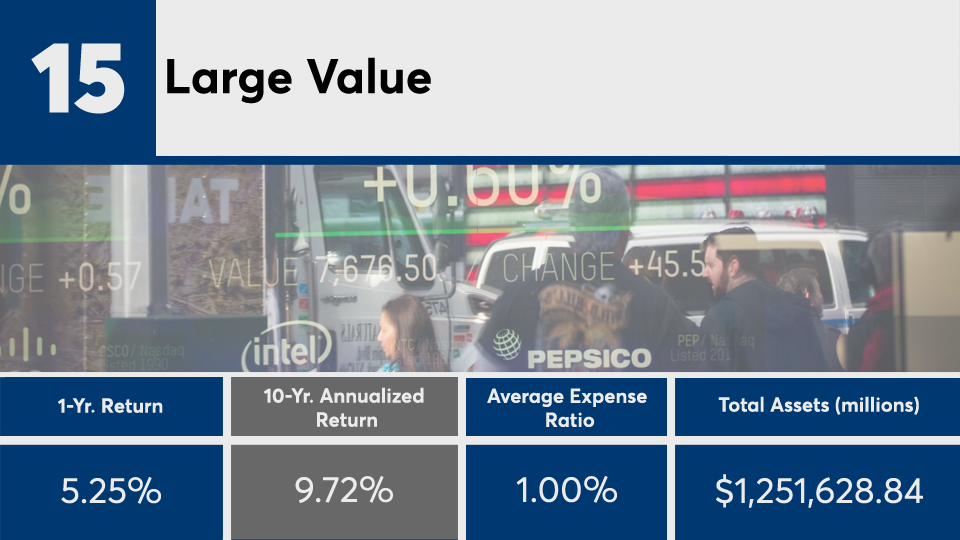

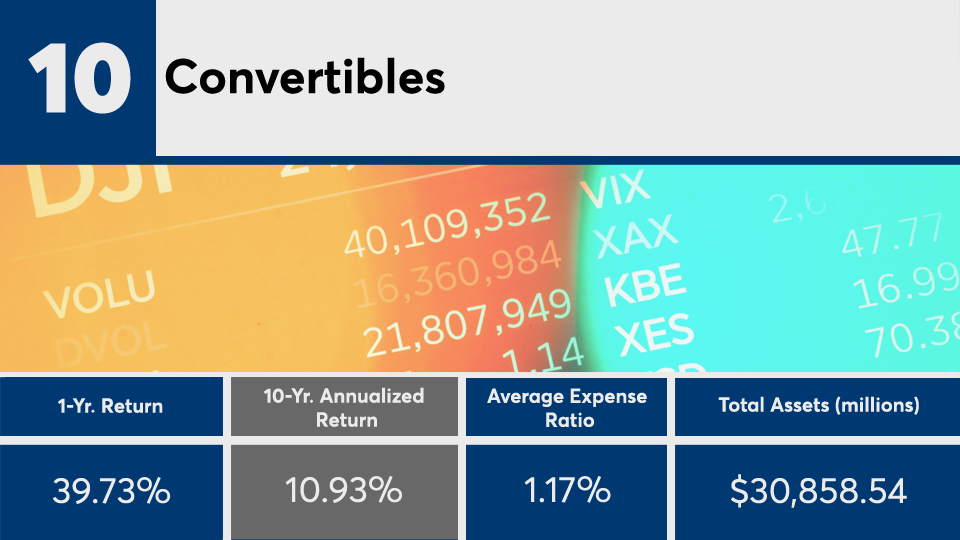

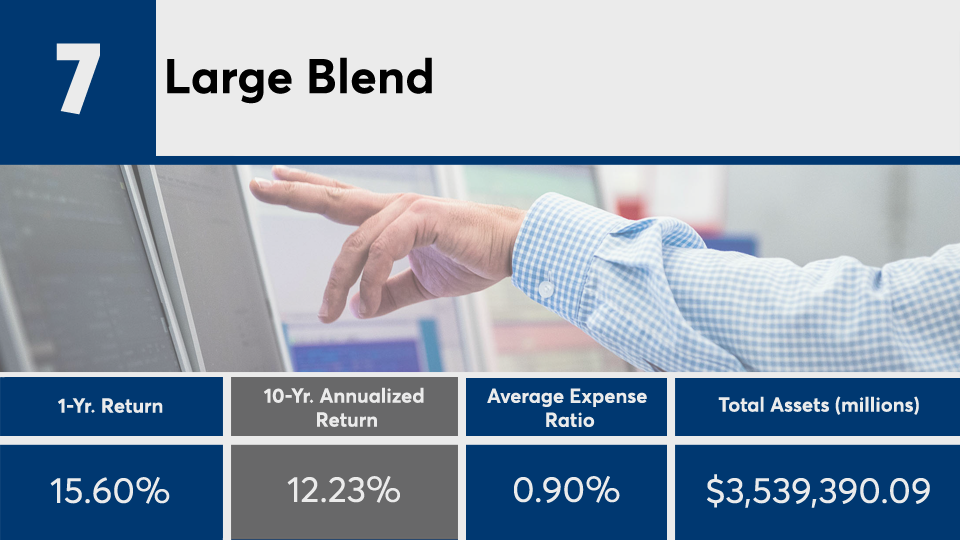

Home to a combined $9.99 trillion in combined assets, the 20 fund categories with the biggest returns of the past 10 years generated an average gain of less than 12%, undershooting some of the industry’s largest index trackers, Morningstar Direct data show.

This year, the same sectors — as defined by Morningstar — had an average gain of nearly 25%.

“When I look as these numbers, like technology for instance, I think ‘It's great, but can it continue to produce,’” says Pacer ETFs President Sean O'Hara, adding that “the hardest conversation to have with a client is how to make their expectations and goals align with how their portfolio is invested.”

Pitting these sectors against the broader fund universe, trackers such as the SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

Overall, the best-performing categories carried fees well above the industry average. Sectors such as Foreign Small/Mid Growth and World Small/Mid Stock were among the priciest with overall expense ratios above 130 basis points, while two target-date fund sectors in the ranking were less than 0.75%, data show. As a whole, fees averaged around 1.11%, more than twice the 0.45% investors paid for fund investing in 2019, according to

A conversation with clients about the performance and characteristics of individual sectors can help provide necessary context when considering short-term market fluctuations and trendy stocks, O’Hara explains.

“We have to manage a client’s goals and expectations,” he says. “When you have inevitable declines, fear takes over; and when you have an up market, greed takes over. That’s the biggest challenge for an advisor.”

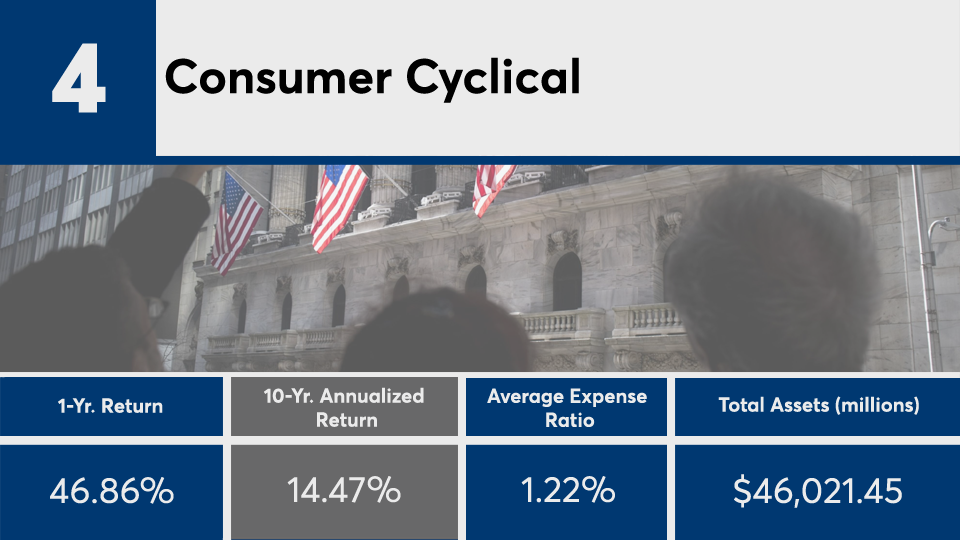

Scroll through to see the 20 Morningstar categories with the biggest 10-year annualized gains. Assets and average expense ratios, as well as one-, three- and five-year returns through Jan. 28 are also listed for each. Data is derived from the primary share classes of mutual funds and ETFs in each category. All data is from Morningstar Direct.