Fueled by the rise of artificial technology and its associated infrastructure, many technology ETFs have experienced phenomenal growth over the past few years.

Chris Ward, founder and senior wealth manager at

He said until recently, he had kept the Roundhill Magnificent Seven ETF (MAGS), Technology Select Sector SPDR Fund (XLK) and Invesco NASDAQ 100 ETF (QQQM) as an overweight in client portfolios.

"Each of them targets the biggest names in tech with exposure to

"These firms are now reaching the peak of market saturation and may not deliver the same massive ROIs, but they are still profitable, and technology in itself remains a key part of the economic landscape," he said. "Sectors like AI and cloud hosting have significant growth potential, which means that tech ETFs are still very much a reasonable long-term addition to your portfolio. But it would also be a good idea to diversify without focusing solely on them."

READ MORE:

Fei Chen is founder and CEO of

"They offer a pure way to gain exposure to leading-performing subsectors like AI, semiconductors, cloud infrastructure and cybersecurity without the risk of one stock," he said. "On a risk-adjusted return basis, they've outperformed wider indices in the past over several-year horizons."

READ MORE:

Tsepaev said the current

"Since most major tech firms operate globally, tariffs may create supply chain challenges and leave them at a disadvantage compared to the local players," Chen said. "I'd say it makes sense for investors to watch how these policies impact companies reliant on imported components. That said, I don't believe the developments with tariffs do anything to change the fundamental role of technology in a portfolio."

Chen said recent retaliatory and tariff actions against China have introduced supply chain risk into the equation.

"That does not discredit the long-term tech thesis but does support the need for regional diversification within tech ETFs," he said. "Those ETFs with more exposure to foreign hardware manufacturers are likely to be subject to margin pressure, while U.S.-based software and AI stocks are less likely to be affected. We've been suggesting looking at country exposure and supply chain sensitivity within tech ETFs since late 2024."

Chen said when examining tech ETFs, he uses a three-layer approach, which includes thematic and sector composition, valuation versus growth metrics and macro sensitivity.

"Is the ETF diversified across semis, software, cloud, AI and cybersecurity?" he said. "How concentrated is it on mega-caps compared to mid-cap disruptors? We cross-compare forward earnings growth versus price-to-earnings multiples. There could be AI-heavy ETFs priced for perfection, so we closely monitor earnings revisions with the aid of AI modeling. We factor in our analysis such as interest rate exposure, tariff sensitivity and regulatory risk. For instance, high-exposure ETFs on Chinese tech American depositary receipts have geopolitical risks that need to be priced in."

Overall, Chen said the best-performing ETFs of the past three years aren't the best bets for the next three.

"Tech's pace of change demands active risk assessment even in passive funds," he said.

Tsepaev said that at this point tech ETFs are unlikely to deliver massive returns, but they should still be part of a portfolio because the sector as a whole remains vital.

"There are risks, of course — companies like Nvidia, for example, are facing semiconductor supply issues, and many tech businesses rely on raw materials from tariff-affected regions like China and Taiwan," he said. "It's too early to predict the full possible impact of these policies, but if the U.S. successfully boosts local manufacturing, industrial sectors could grow while global tech companies may face additional challenges without any particular benefits. So a diversified portfolio would make the most sense. Also, investors should closely examine financial metrics like profitability and valuation ratios when selecting ETFs."

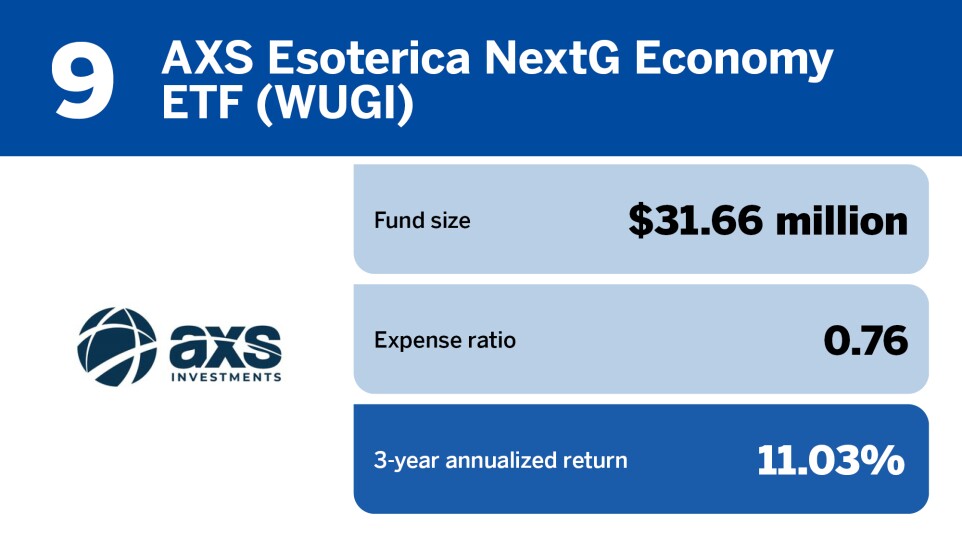

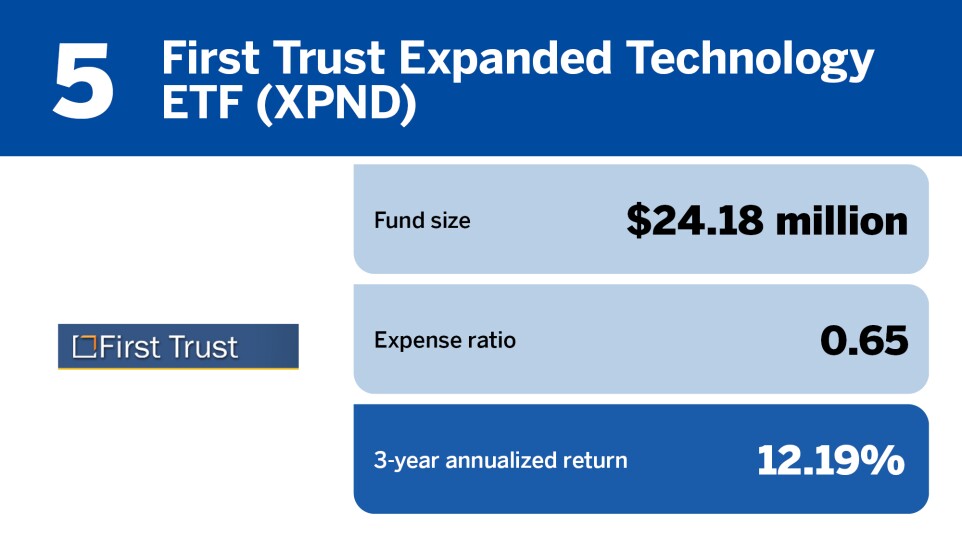

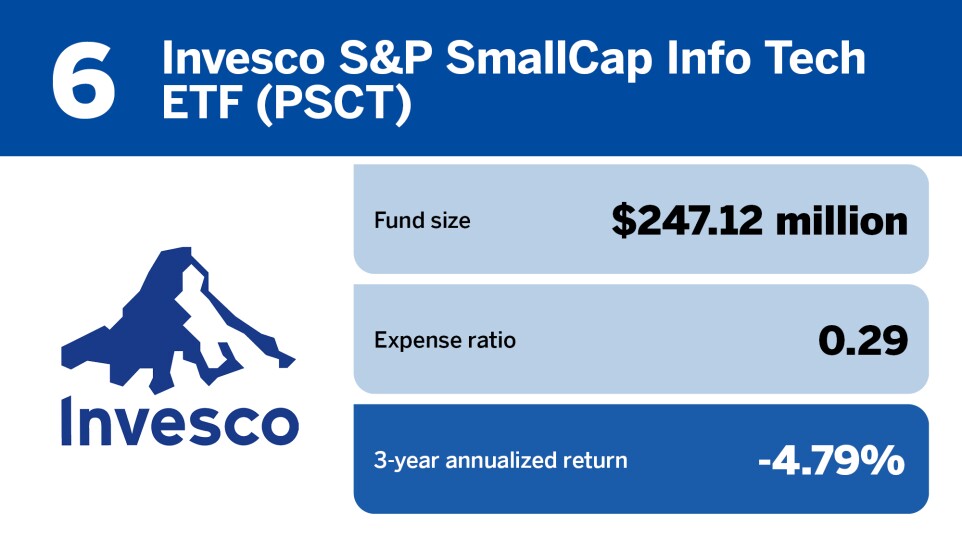

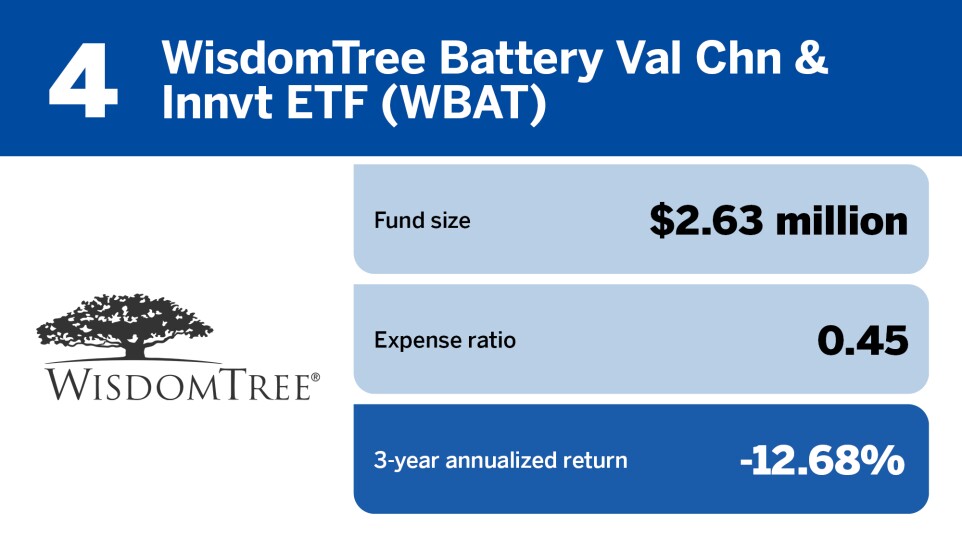

Scroll down the slideshow below for the 10 best-performing and 10 worst-performing technology ETFs in the U.S., based on their three-year annualized return through the end of March 2025. All data is from Morningstar Direct.