Clients nearing retirement typically don’t expect to see an annual loss from their target-date funds. However, volatility spared no prominent fund last year, data show.

Funds targeting a 2025 retirement, which hold a combined $112.9 billion in client assets, are a prime example of how even well-balanced portfolios felt the pain in a year when the Dow posted a 5.97% retreat (a 6.91% year-over-year loss), says Greg McBride, chief financial analyst at Bankrate.

“Stocks and bonds, both domestic and international, posted negative returns in 2018, meaning that even diversified portfolios registered losses,” McBride says. “Target-date funds were no exception.”

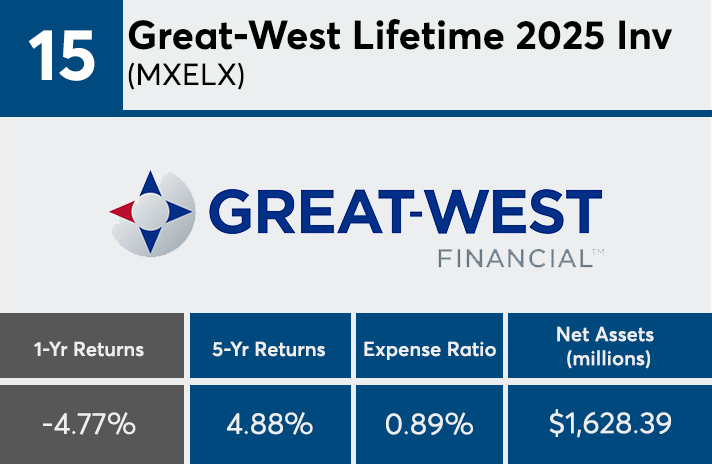

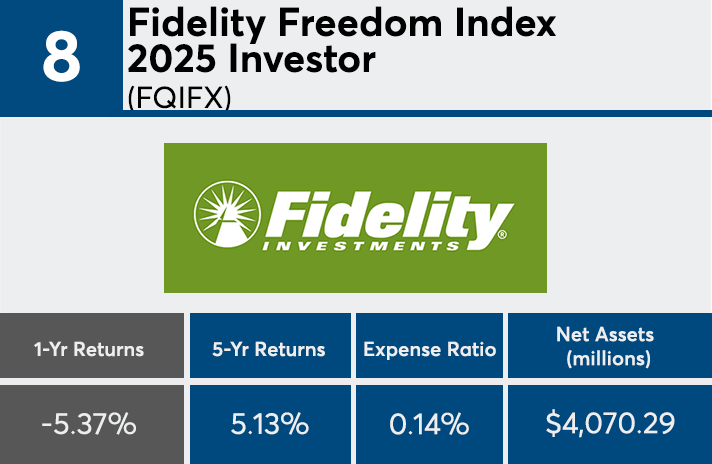

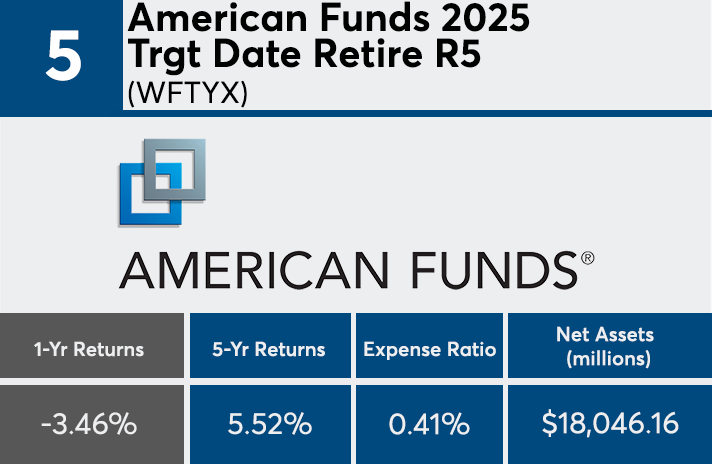

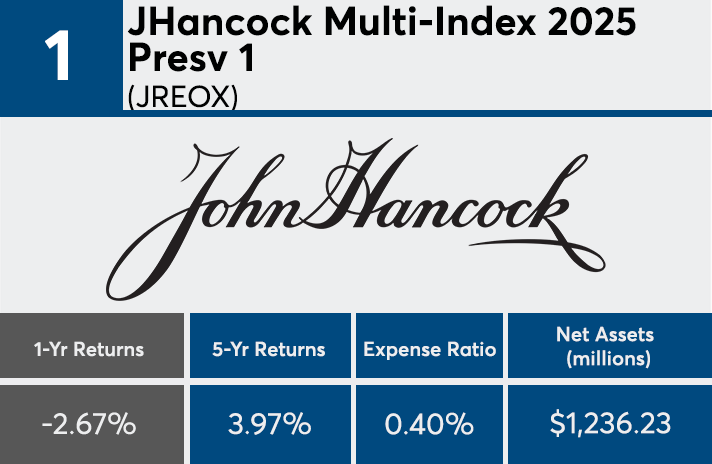

The 20 target-date funds that were the best performers last year — those with the slimmest losses — had significantly better returns over five years, according to Morningstar Direct. Despite posting losses in the year ending on Jan. 17, the 20 funds had an average annualized return of 4.62% over the past five years.

Management fees rounded out to roughly the industry average. Ranging from as low as 8 basis points to as high as 87, these funds had an average expense ratio of 0.54%, just 2 basis points higher than the 52 basis points investors paid in 2017, according to a Morningstar study that reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs.

“Not all 2025 target-date funds are created equal,” McBride says. “Different expense ratios and different investment allocations will deliver different returns. Target-date funds with a more aggressive posture had bigger losses in 2018, but that more aggressive posture has delivered higher returns over the preceding five years.”

For advisors with clients in any of these 20 funds, McBride stresses the importance of long-term strategies.

“Target date funds are not immune from losses in any given year, but over time the diversified all-in-one solution that is gradually reallocated can generate growth early on and offer some buffer from market volatility along the way,” he explains.

Scroll through to see the top-performing 2025 target-date funds with at least $100 million in AUM. Five-year returns, total assets and expense ratios for each fund are also listed.