A so-called reverse breakaway team coming back to the broker-dealer world on different terms has launched a channel for advisors leaving the wirehouses.

As advisors eye multiple kinds of affiliation, an expanding LPL Financial hybrid RIA — Integrated Partners — has attracted more than $2 billion in recruited client assets this year. Its incoming family office practice is providing another option for ex-wirehouse teams.

The enterprise has recruited 51 advisors to grow to a total of 148 with $6 billion since it affiliated with LPL in 2016, the firm

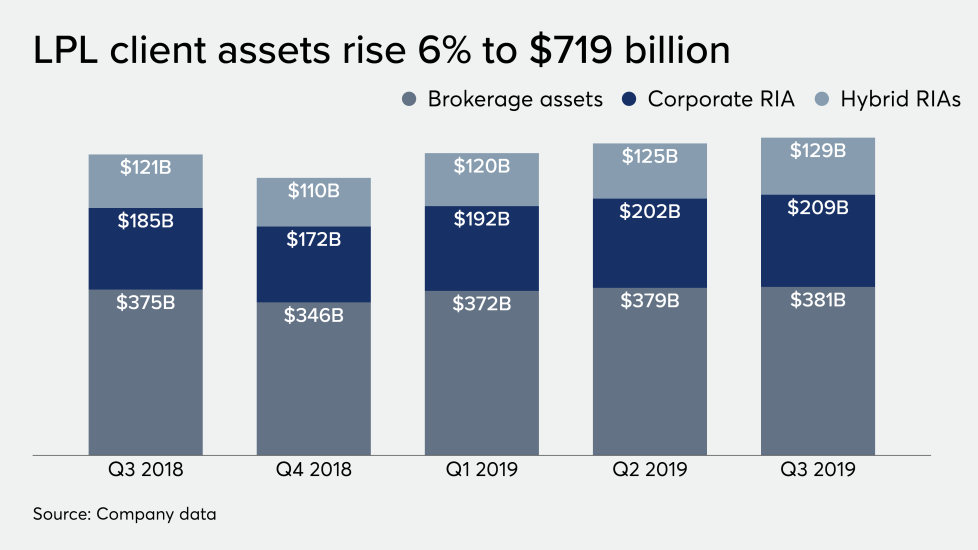

Another $200 million in brokerage and advisory assets came to Integrated as LPL also made large gains. The No. 1 IBD has added

The ten other recruiting moves fueled LPL’s corporate RIA, but Integrated uses Charles Schwab, TD Ameritrade and Fidelity as its RIA custodians in addition to LPL. Rhonemus — who dropped his BD registration in 2017 — and his team are moving Juncture to Integrated’s RIA.

Prasad, the practice’s vice president for business development, is also joining the group at Integrated led by Head of Advisor Recruiting Rob Sandrew in order to pitch wirehouse prospects. He notes the Scottsdale, Arizona-based Juncture has a CPA and two CFAs.

“We know advisors would want to be part of this,” says Prasad. “And then as we started our 30 or 60 days in, we said, ‘You know what? The faster way to do it, though, is to find an organization that might be five years or 10 years ahead of us.’”

Rhonemus and Prasad first met during the Juncture founder’s tenure with Wells Fargo Advisors, where Rhonemus spent a dozen years before going independent in 2010, according to FINRA BrokerCheck. Juncture is retaining Schwab and TD Ameritrade as its custodians.

The practice serves high-net-worth and ultrahigh-net-worth clients ranging between $2 million to $25 million in assets. CPA referrals, family office resources, advanced portfolio management and other Integrated services made it stand out from 20 other suitors, Rhonemus says.

Juncture aims to help support wirehouse and private bank advisors accustomed to robust in-house resources, he added. "They can pick up a phone, they can walk down the hall and be able to tap into some of these resources — How do you take them with confidence to independence?” he says. “And we really felt there was a gap there.”

In addition to Juncture, Homer Smith and Dave Stuehling of Seattle-based Konvergent Wealth Partners

The approach of Integrated founder Paul Saganey and his team represents an example of “what you see resonating in the marketplace,” Rich Steinmeier, LPL’s head of business development, said in an interview last month.

“Advisors who are looking for a choice of affiliation are going to challenge into what's the value that we're going to exchange?” Steinmeier says. “Integrated steps forward and says, 'You have complex cases, we'll help you win them. You won't be on your own.’”

The ten other recruiting moves brought nearly 30 more advisors to LPL’s corporate RIA platform and other offices of supervisory jurisdiction that use it. LPL unveiled the move in a barrage of recruiting announcements over the past month and a half, adding two teams from newly rebranded Avantax Wealth Management and four from the Advisor Group IBD network.