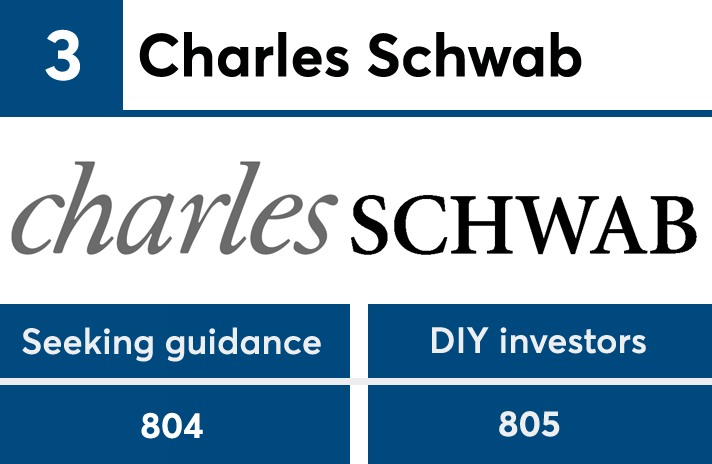

Fidelity and Charles Schwab snapped Vanguard’s two-year winning streak in J.D. Power’s annual study of self-directed investors — a signal that incumbent firms have moved into a new phase of fintech.

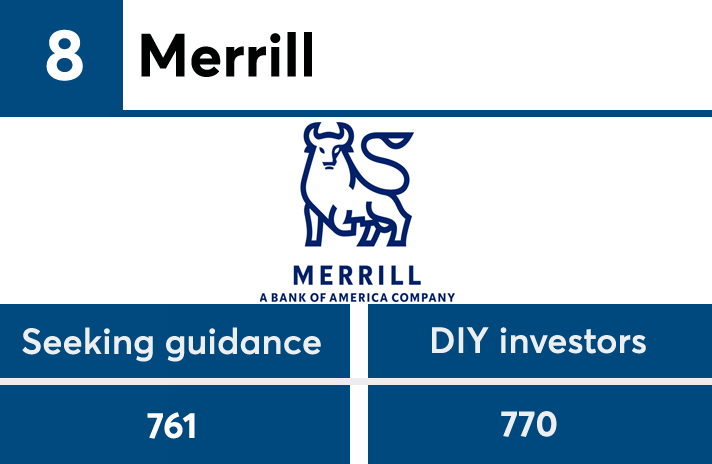

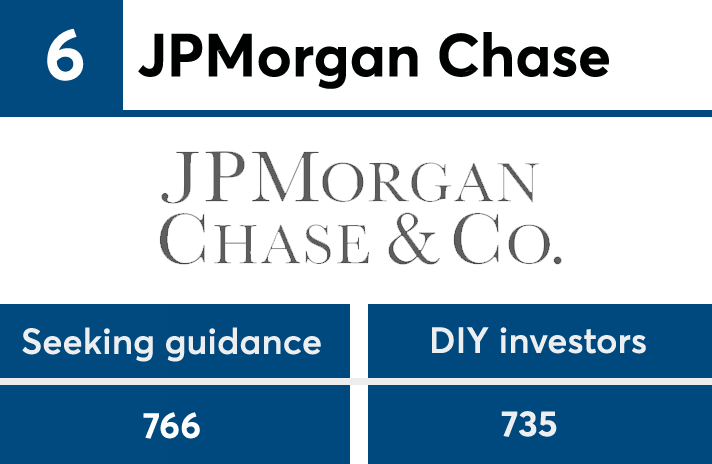

Schwab's retail brokerage unit supplanted Vanguard among pure do-it-yourself clients, while Fidelity's edged ahead for those who don’t have a financial advisor yet seek some guidance, the market research and consulting firm reports in its 2019 survey. The full results are below.

J.D. Power spoke with 5,418 investors between November and January, a time marked by U.S. equity volatility. That figured in the lower industry-wide satisfaction scores in both categories, driven by significantly lower scores for investment performance. The survey also showed differences between millennial and boomer investors.

The younger generation is less satisfied, loyal and trusting than their elders. Millennials are also more goal-oriented and more interested in passive investing. The survey also displayed how incumbents are less focused on responding to robo advisors and instead embracing “ongoing development and competition,” says AdvisorEngine co-founder Lex Sokolin.

“Brokers have made meaningful progress both in their product shelves, providing low-cost and transaction-free ETFs that diminish Vanguard’s core value proposition, and in technology offerings to the consumer,” Sokolin said in an email. “We are shifting from a world where products matter most (Vanguard has best model) to where platform and tech win it all (think Amazon).”

Indeed, millennials said they had particular investment goals at a rate nine points higher than boomers and said they were interested in digital advice at a clip two times as high as boomers. Among DIY investors, only about a third of millennials said they try to beat the market with individual stock picks, compared to half of DIY boomers.

Millennials also reported lower rates of satisfaction, trust and loyalty toward firms, notes Michael Foy, J.D. Power’s senior director of wealth and lending intelligence.

“What separates millennial investors from previous generations is not just greater mobile usage; they’re actually approaching investing in a fundamentally different way,” Foy said in a prepared statement. “The customer experience that firms deliver needs to reflect this evolution in priorities to build loyalty with this critical segment.”

While J.D. Power didn’t break out the firms’ performance in the eight factors tracked in the survey in its public summary of the findings, it appears some firms are cracking the code better than others.

Fidelity’s satisfaction index jumped higher over the previous year than any other firms among investors seeking guidance. It was one of only three firms to see positive movement from 2018. The firm achieved the most improvements in its scores on client interaction, fees and products and services, according to Foy.

Only Schwab achieved a higher score from the previous year with DIY investors.

On the other end of the spectrum, Vanguard, TD Ameritrade and E-Trade each lost 20 or more points from 2018 among self-directed clients seeking guidance. Wells Fargo, JPMorgan Chase and TD fell by 25 points or more in the group of DIY investors.

In addition to the decline in scores on investment performance, Vanguard also sustained lower marks for the advisor experience in the "seeking guidance" group, Foy says. Significant recent acquisitions by TD and E-Trade may have been related to their lower scores in 2019, he says.

The research firm didn't include robo disruptors in the survey because they have a "very small share" of the market and are different from the incumbents because their clients' investments are automated rather than managed by humans, according to Foy. He says such firms would require a separate study to assess them.

J.D. Power requires a sample of at least 100 to report a satisfaction index score. Self-directed clients measured their firms on eight factors, with company interaction and account information the most important ones in the weighted 1,000-point satisfaction index.

To see how firms stacked up against one another in 2018,