Investors weren’t happy as retail brokerages struggled to handle skyrocketing interest in markets and

More than 10 million new brokerage accounts were opened in 2020, according to J.D. Power’s latest study of self-directed investor satisfaction. Robinhood alone claimed 27% of those new accounts.

But even that growth doesn’t account for the sharp rise in customer complaints, which have doubled since last year’s report, says Michael Foy, J.D. Power’s head of wealth intelligence. With website issues, trade processing and execution failures, and account statement errors leading the way, problems have impacted 11% of all do-it-yourself investors and 12% of those who seek additional guidance.

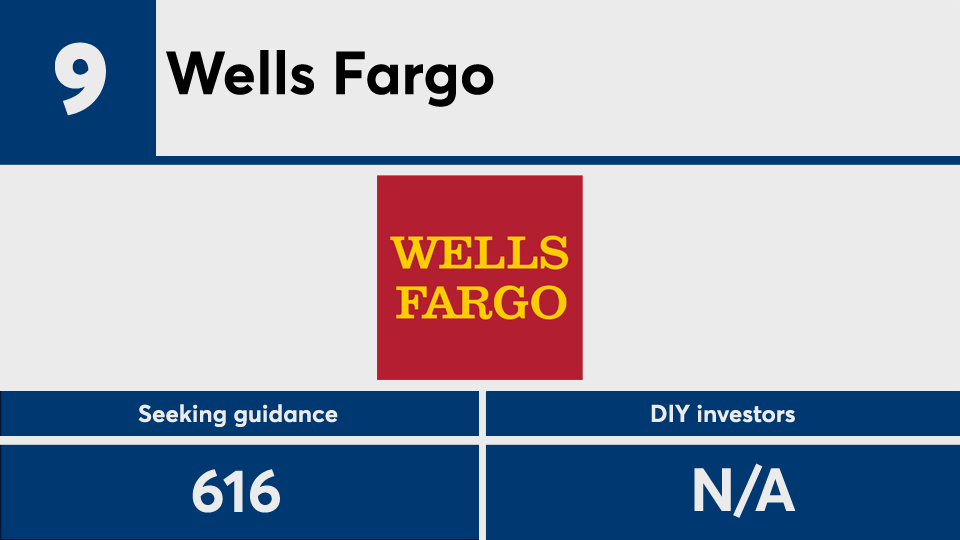

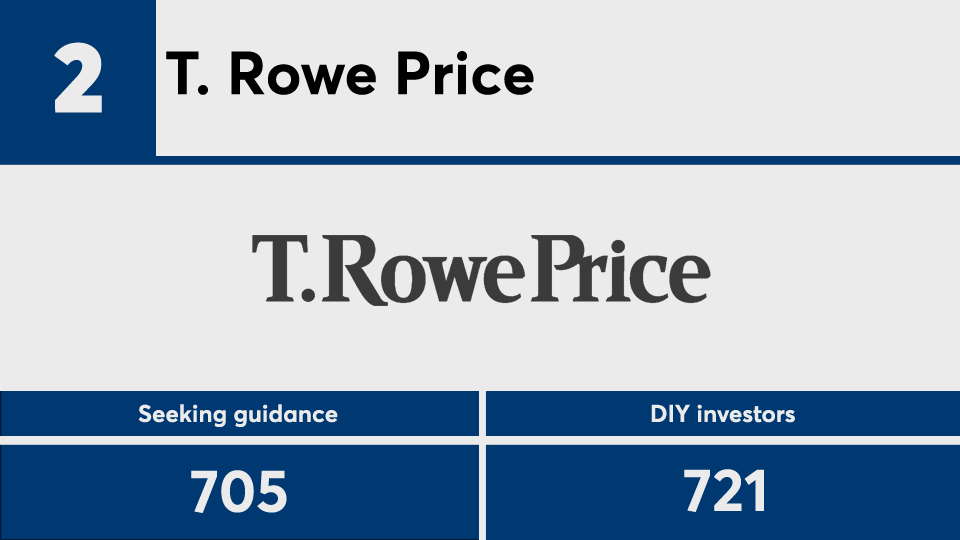

As a result, customer satisfaction scores fell across the board for every company ranked.

“There is a big risk that these firms may lose some of these clients that they have just recently gained if they are not able to provide a seamless, reliable experience. Or, at a minimum, if they aren’t able to quickly resolve the problems that happen,” Foy says.

The J.D. Power study, now in its 19th year, is based on responses from 4,895 investors who make financial decisions without the counsel of a full-service, dedicated financial advisor. This year, the firm added new criteria involvingbrand trust and convenience — allowing an investor to manage money how and when they want — to its overall score.

With firms unable to compete on price thanks to nearly ubiquitous free trading, providing financial advice and education is more valuable than ever for creating a competitive advantage, Foy says. Firms that provide useful investing guidance, an automated investing tool or access to a human professional receive a 155-point boost (out of 1,000) to customer satisfaction scores among investors who seek guidance, and 148 points among DIYers.

However, fewer than half of self-directed investors say they get this level of service from their brokerage.

“Many new investors who maybe have gotten burned in the market [are recognizing] the value of advice and guidance,” Foy says.

Overall customer satisfaction is highest when investors use four or more products from a single

financial institution — such as an investment account alongside banking and a mortgage. The ability to cross-sell and create stickier client relationships is going to be key for wealth management firms moving forward, Foy says.

“That’s where the battlefront is going, as fees are no longer a key competitive differentiator,” he says. “Which brands are better at providing a breadth of holistic financial services that a client can manage through one single, seamless digital experience?”

Here is how J.D. Power ranked the brokerages according to satisfaction of investors who seek additional guidance. To see last year’s results,