Clients have sent the wealth management industry an important annual report card — and it wasn’t pretty for many of the most prominent firms in the space.

The companies building trust from clients, supporting their relationships with advisors, enabling digital communication, committing to social causes and hiring more women are ahead of their peers, according to the survey of investors who have worked with financial advisors. The results arrived with the coronavirus pandemic rippling across

“We know our clients in the industry have been increasingly interested in understanding the drivers of brand trust,” says Mike Foy, senior director of J.D. Power's wealth management practice. “It's particularly critical in an environment like we're in today, where people are obviously very concerned, they’re probably uncertain about what to do.”

He adds the data supports the notion “that if people do trust the brand and they trust the advisor, they're going to be more likely to follow the advice that's provided.” While J.D. Power isn’t publicly releasing the index of client trust that it compiled for the first time in the survey's 18-year history, Foy says the metric has a pretty strong correlation with overall satisfaction.

The key drivers of the client trust metric and overall satisfaction also displayed themes in common: acknowledging and resolving mistakes; giving out useful information; living up to service expectations and putting clients’ interest first. The strong and rising equity values at the time of the survey between November and January also boosted the industry’s average satisfaction index to a record 850 out of 1,000.

Top performers in client satisfaction excelled in areas unaffected by the turmoil sending

Lower ratings among other firms stemmed from bad grades for experiences with advisors, which represents about one-third of the satisfaction index. Still, less than 100 points separated the top firm and last firm on the list. Equitable — formerly known as AXA Advisors — reeled in the most improved mark of any firm year-over-year even though it was near the bottom.

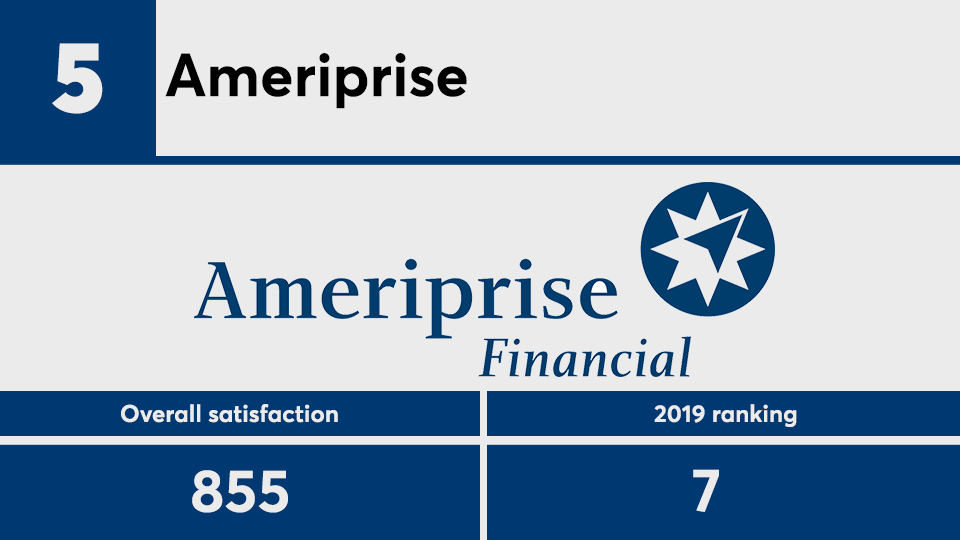

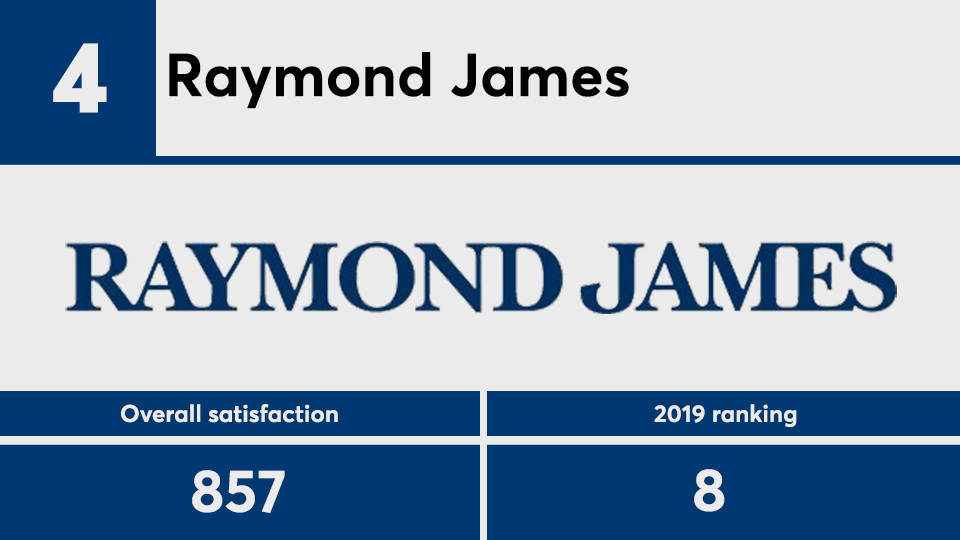

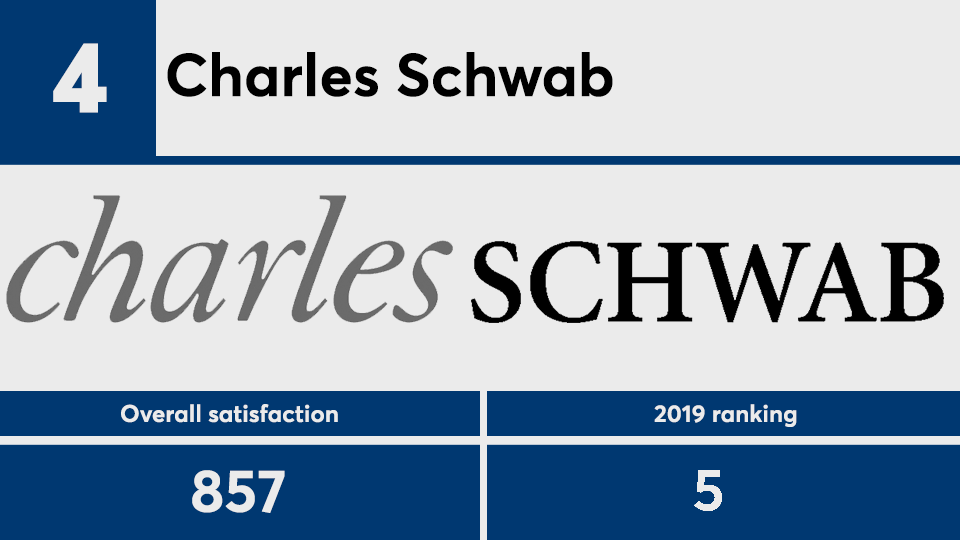

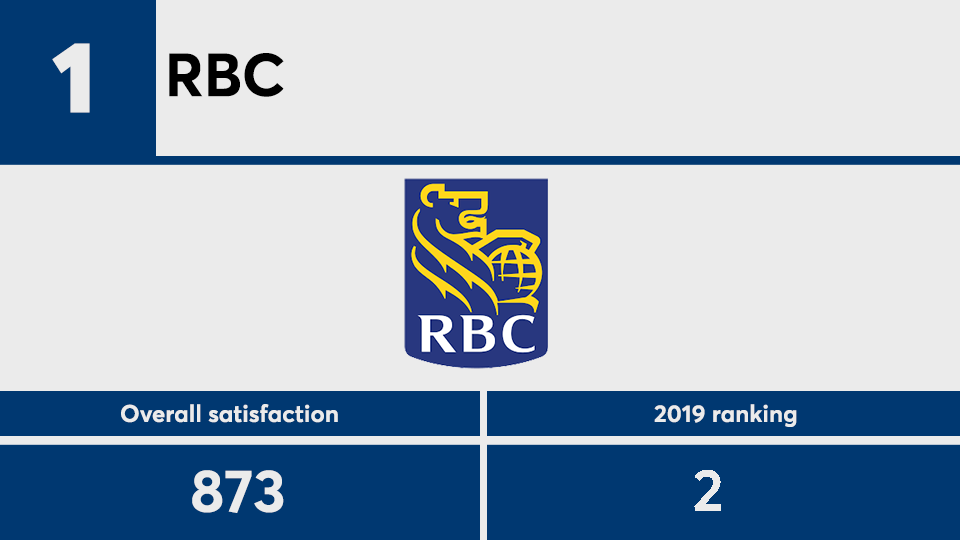

After Advisor Group snagged the

The survey also yielded notable figures across all firms in the space. For starters, millennial women are almost 2.5 times more likely than older female clients to work with an advisor of the same sex. Male advisors still far outnumber women in the profession.

“As this generation grows and inherits wealth, it's important for the firms to close the gap between female-owned wealth and representation in the industry,” Foy says. “Having diversity that’s reflective of the market is an important aspirational goal.”

Another result has become even more pertinent for a time of remote work. Advisors who spoke to clients four or more times in the past year through digital means like texting, emailing or video were 50% more likely than those who didn’t use any online contact to garner increased investments. At the same time, 94% of clients said they never spoke to their advisor on video.

Lastly, more than three quarters of clients who rated their firm a 9 or a 10 for its commitment to social causes said they “definitely will” recommend it to friends and family. At a score of 6 or lower, only 32% said they would definitely refer others to the firm.

J.D. Power spoke with 4,532 clients who make at least some of their investments with the help of a financial advisor. The firm compiled overall satisfaction on seven weighted factors, with financial advisors as the most important. At least 100 clients of any firm must participate in the survey for the company to show up on J.D. Power’s list.

To view last year’s results,