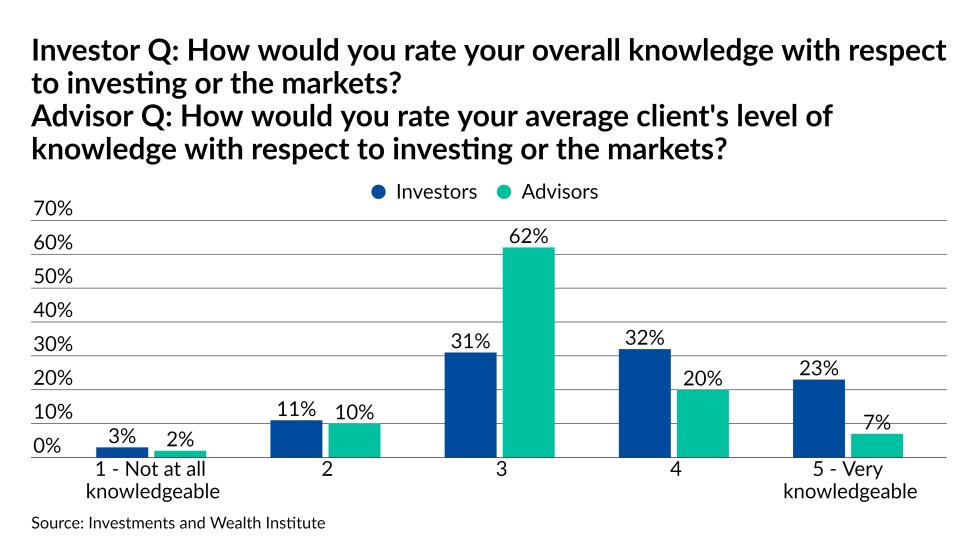

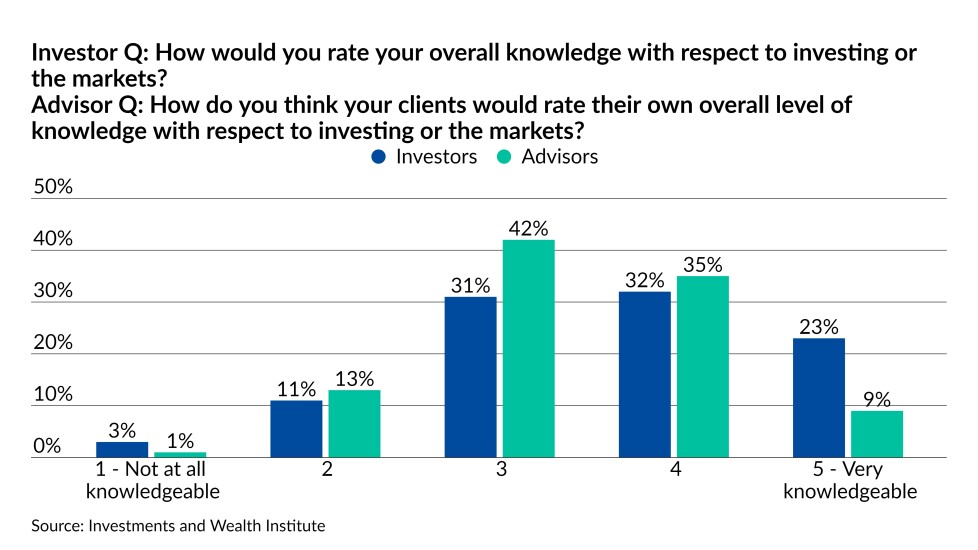

Clients think they understand how to invest — but their advisors don’t agree, a new study found.

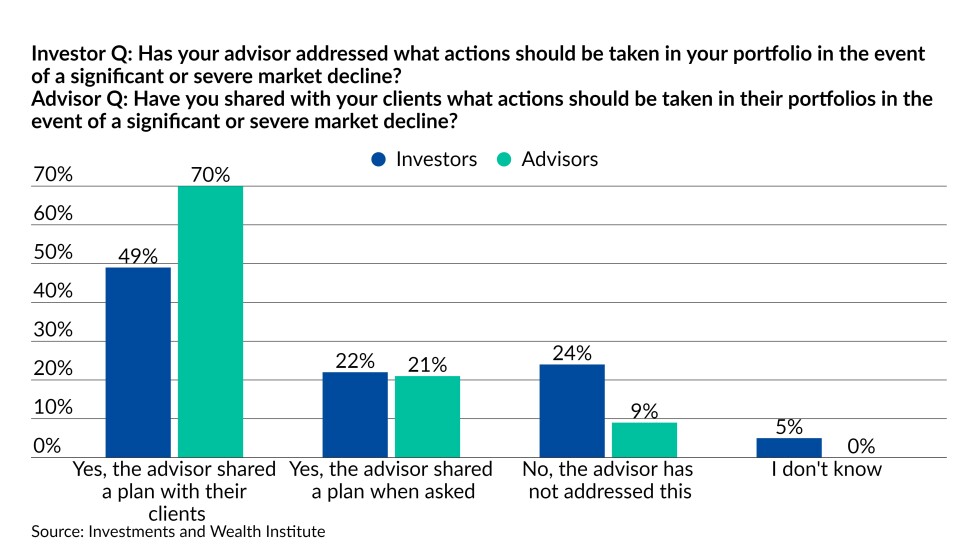

Investors were three times more likely to say they were knowledgeable about the markets as their advisors, according to the second annual Investments and Wealth Institute’s 2021 Investor Behavior in a Market Crisis report, which found that there are often disconnects between investor and advisor perceptions about the market.

“Most of the investors have between $1 million and $5 million of investable assets. … These are people that had some success in their lives, so it’s not unreasonable to think that they came to that through some sort of savvy,” says behavioral finance expert Eben Burr, president of the New York City-based Toews Corporation.

-

The study, conducted between January and March 2021, contains self-reported data from firms that custody their assets with Schwab Advisor Services or TD Ameritrade.

July 27 -

While US investors lag Asia and Europe, their perception of cryptocurrencies as an investment class, not a currency, is rising.

July 21 -

For every dollar, the median white family saves about seven cents, while the median Black family saves a penny or less. But when compared to families with the same income, the racial gap disappears.

June 22

“Investors really don't have a good sense of market history, and advisors thought that their clients knew much more than they did when it came to the financial crisis,” Burr says of the findings. “Last year, the advisors had a pretty high confidence that their clients would know what the max drawdown was of those periods. And they definitely did not.”

The key takeaway for advisors, he says, is thorough communication between advisors and clients.

“Communicating, specifically about the challenges that a client is going to face we think is absolutely imperative,” he says. “We've seen many studies where they show that education does a little bit, but not a ton. To me, it’s the training that matters. The difference between education and training is the application of knowledge and skills, rather than just the didactic ‘I'm going to tell you this thing.’”

The study found that clients may make bad decisions if they are not fully informed, and investor knowledge is both “imperfect” and “overstated.” Advisors also failed to provide support clients need when they do not understand their clients’ perception, IWI found.

“This is really important because without understanding these differences advisors may not be able to provide the support that clients need to implement their financial plans and stay focused on their long term financial goals, and clients may not make decisions that are in their best interests,” says advisor Marguerita Cheng, founder and CEO of Maryland-based Blue Ocean Global Wealth.

One interesting finding: women, older clients, and clients with less wealth are consistently more likely to respond “I don’t know” on questions related to maximum losses. This reflects their self-perception that their knowledge is lower, according to the study, she says.

“Is it a situation where women are more comfortable acknowledging lack of investment knowledge or is their knowledge lower?” asks Cheng. “There is certainly an opportunity to provide more engaging and relevant investor education to women. More knowledge about investments can help improve financial confidence.”

The report gathered data from 750 high-net-worth investors and 200 financial advisors and the research was conducted by a partnership between the Behavioral Investing Institute, the Investments and Wealth Institute and Absolute Engagement. The data was collected via online surveys during April and May 2021.

The questions this year were tailored to test assumptions about advisors and clients, as opposed to last year, when only advisors were surveyed.

“We have an opportunity to close these gaps through deeper conversations with clients, by checking our own perceptions, by ensuring that there is a clear and proactive plan in place to respond to market uncertainty and by communicating those plans — and communicating them again,” IWI’s researchers wrote in the report.

The findings include:

- Investors have an imperfect understanding of market history and a relatively low level of investment knowledge, which may impact their decision-making.

- Investors are less likely than advisors to believe that they will respond badly to specific market conditions. Advisors are more likely to believe that investors will exhibit negative behaviors and overstate how clients perceive their own reactions.

- Advisors make incorrect assumptions about their clients; understanding of history, their perceived investment knowledge, their views of the future, and their understanding of their plans.

- The biggest gaps between how investors view their behavior and how advisors view investor behavior relate to the temptation to sell stock when markets are going down; feeling impatient with strategies with lower returns and having a desire to change strategies to ones with higher returns; feeling impatient and a desire to make portfolio changes during periods of low or no growth.

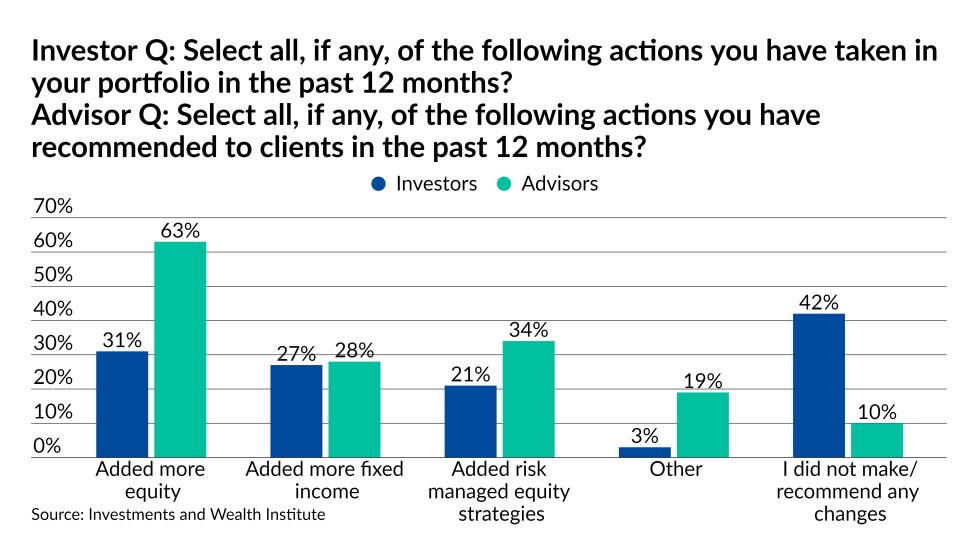

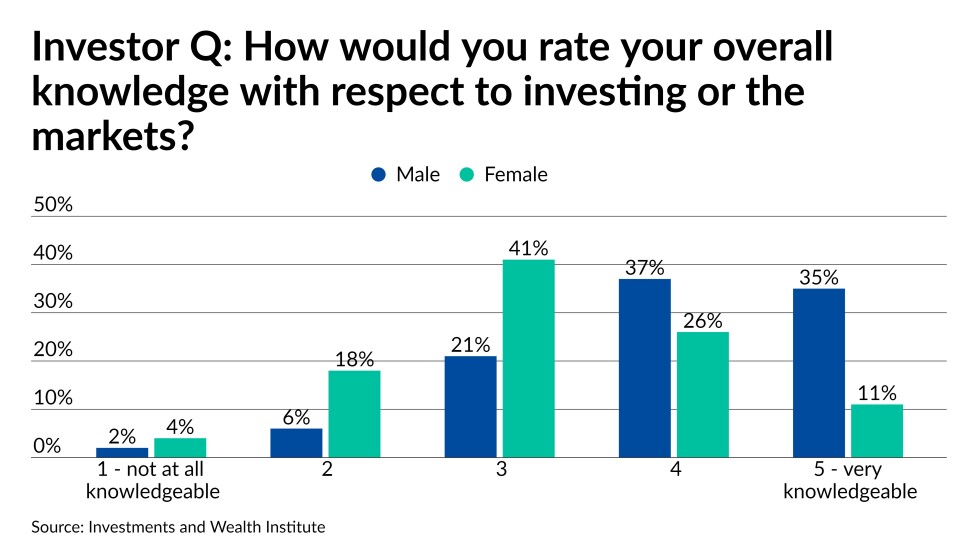

- A majority of advisors in the past year indicated they recommended an increase in equity positions in client portfolios, with about one-third of them recommending more fixed income or risk-managed equity strategies. Yet investors were four times more likely to say they did not make any changes.

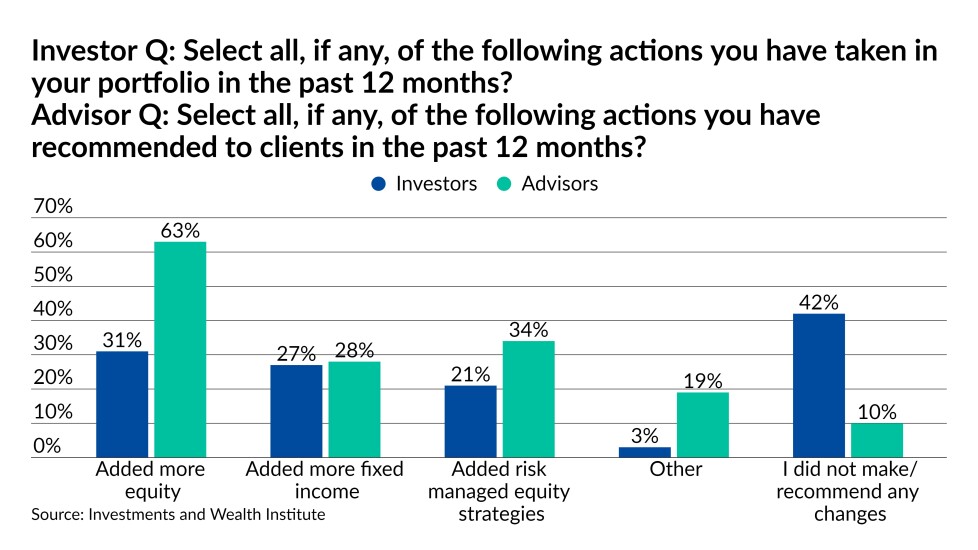

- Though a majority of advisors indicated that they have shared a plan with clients, only 49% of clients said that was the case.

Scroll through for insights from the survey.