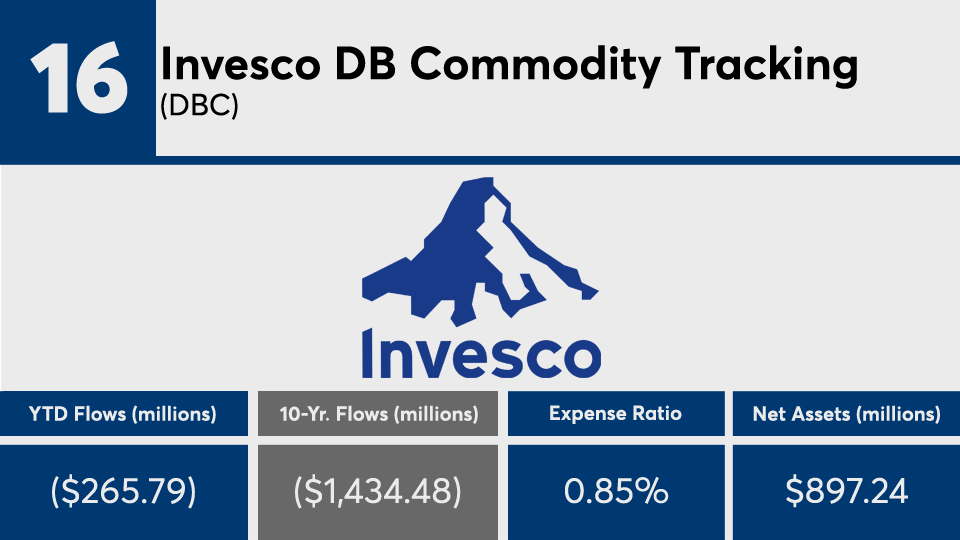

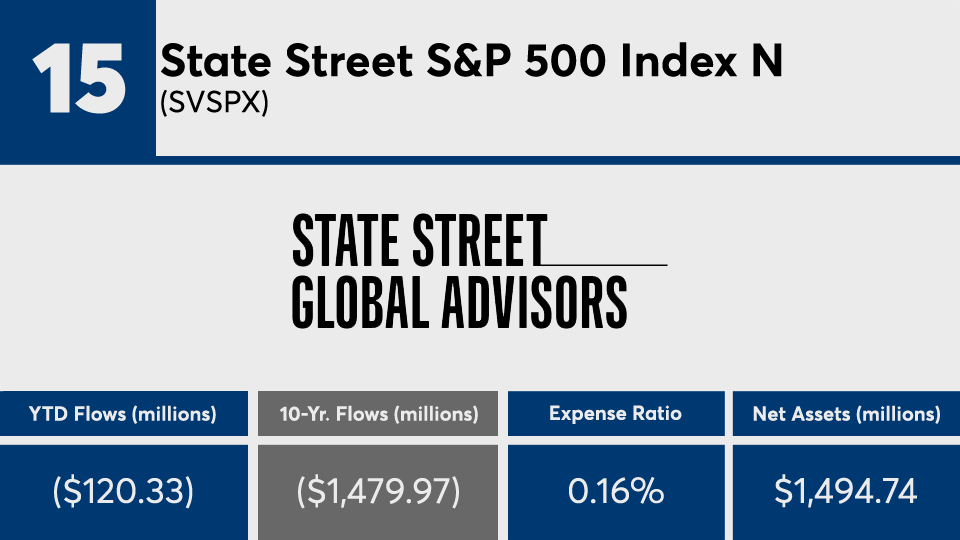

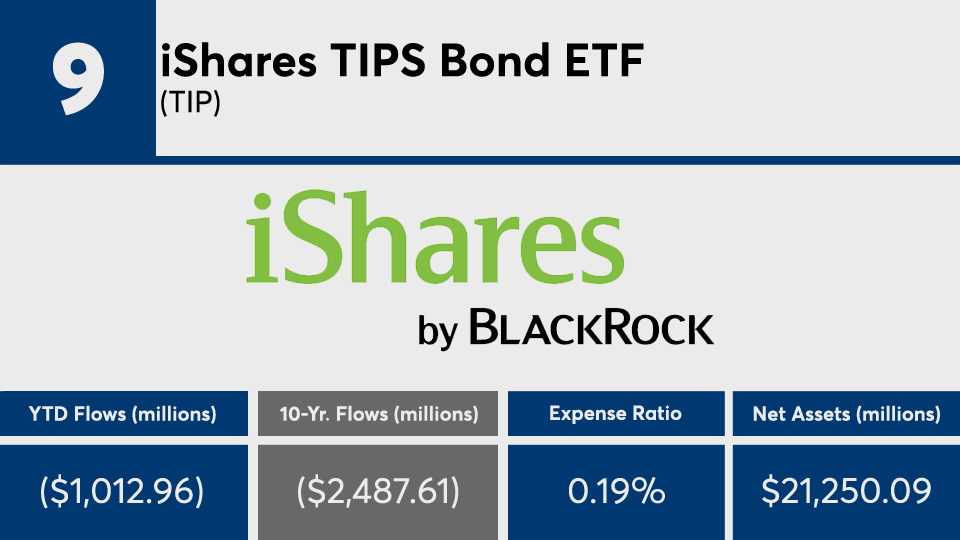

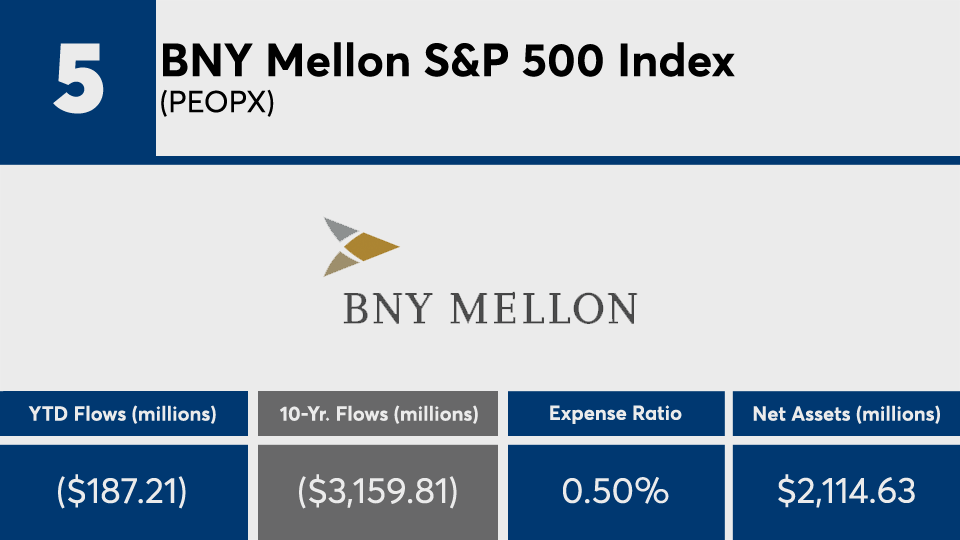

The 20 index funds with the largest net outflows over the past 10 years lost a combined $59.21 billion in assets under management, according to data from Morningstar Direct.

Their losses represented nearly half of their weight in cash, according to the data. The funds — tracking sectors from emerging markets to bonds commodities — had an average net expense ratio more than three-times the typical passively managed product. CLS Investments CIO Marc Pfeffer suspects many long-term investors are simply looking for lower-cost alternatives that accomplish the same goals.

“This is a combination of things,” Pfeffer says of the reasons for the exodus from many of the funds on the list. “Yes, emerging markets have been out-of-favor on a relative basis in comparison to domestic stocks, but there have also been many other emerging markets ETFs that have provided outperformance over the last several years that are more granular with different exposures, and they're cheaper.”

Compared to the broader industry’s performance, the 20 index funds with the biggest outflows missed their relative marks. With an average 10-year return of 8.54%, these funds notched gains well below stock trackers like the SPDR S&P 500 ETF (SPY) and SPDR Dow Jones Industrial Average ETF (DIA), which managed returns of 13.54% and 12.25%, respectively, data show. On the bonds side, the iShares Core US Aggregate Bond ETF (AGG), meanwhile, eked out a 3.88% gain.

With a combined $116.99 billion in assets, the 20 funds on this list carried fees significantly higher than their peers. At 0.40%, the average net expense ratio here was well above the 13 basis points investors paid on average for passive investing in 2019, according to

“If you're looking at a standard S&P 500 fund right now, many of those have expense ratios of five to 10 basis points, tops,” Pfeffers says, adding that while “there's no question fees are playing a major role, … there's no reason to give up any return to an expense ratio.”

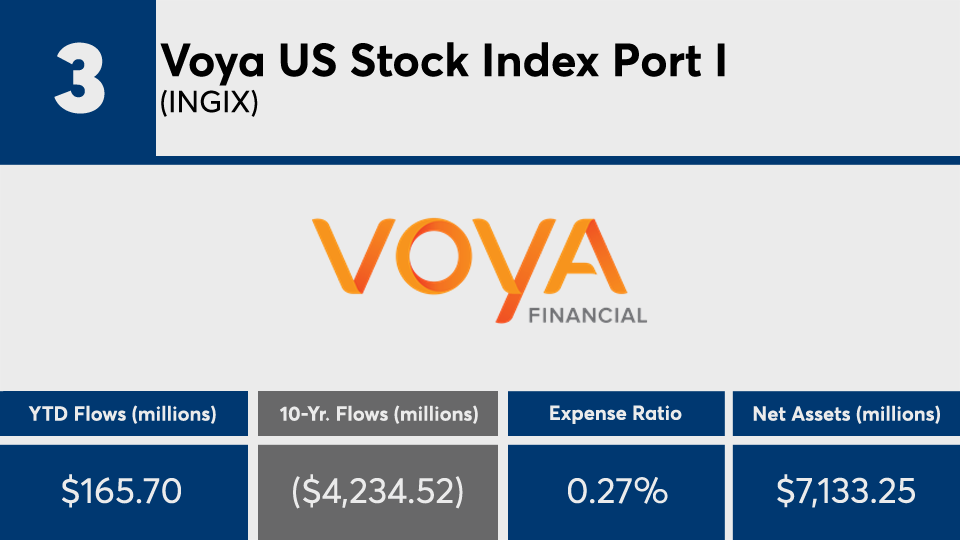

Scroll through to see the 20 index funds with the largest 10-year net outflows through July 1. Funds with less than $500 million in AUM and with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as year-to-date and one-, three-, five- and 10-year returns and net flows are listed for each. Returns are through July 10. The data show each fund's primary share class. All data is from Morningstar Direct.