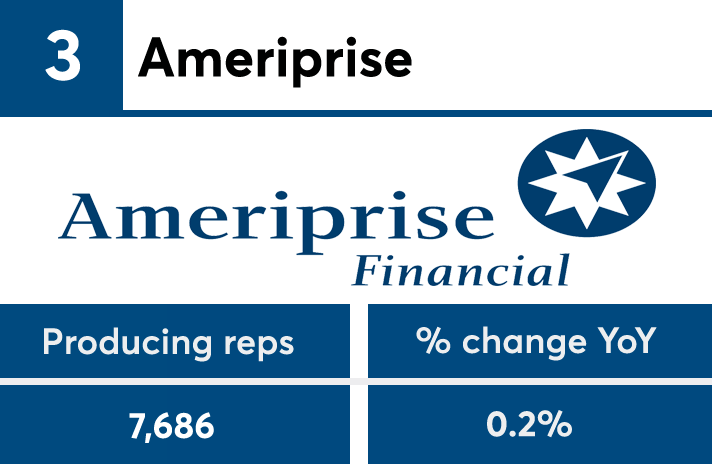

Wealth management executives from firms with limited advisor head counts like to point out that a large representative force doesn’t necessarily translate into massive revenue.

While this is true for many firms, the independent broker-dealer with nearly double the number of producing representatives of any other firm, LPL Financial, has also generated more revenue than any other IBD

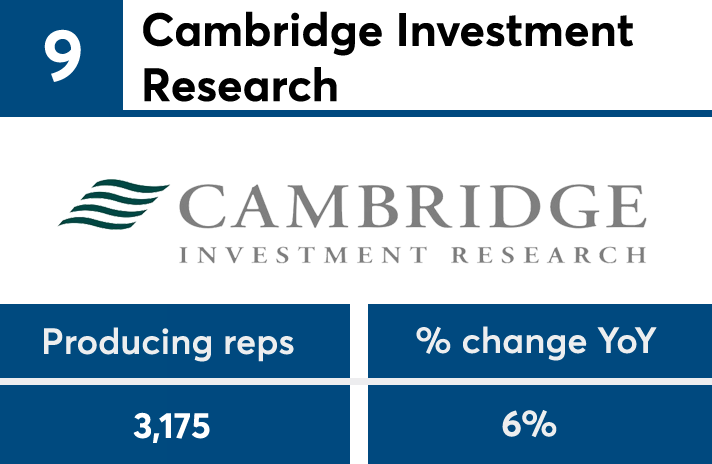

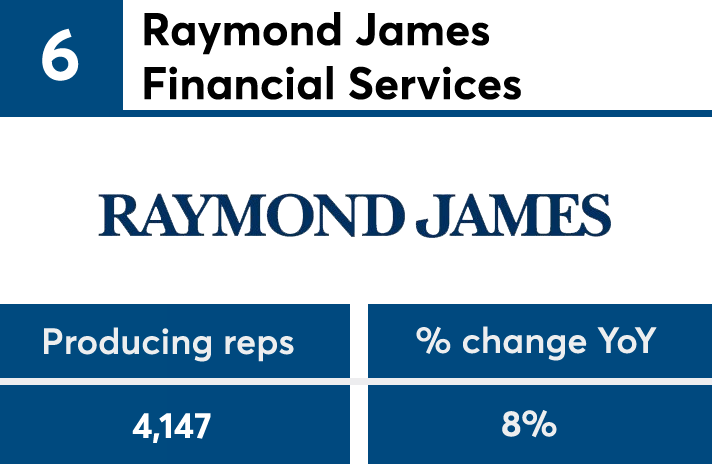

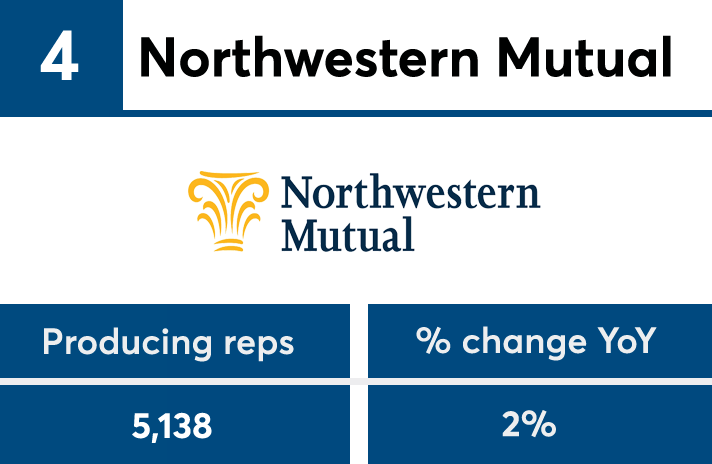

However, the list of the top 10 IBDs ranked by the number of producing reps includes three firms from outside the group of the 10 firms with the highest revenues in the IBD space, according to figures disclosed for Financial Planning’s

One firm’s absence from the top 10 largest head counts also stands out. Commonwealth Financial Network, which reported far and away the highest average payout of $512,000 per advisor and the fourth-highest revenue at $1.2 billion, reported only the 14th highest number of producing reps at 1,778.

Other firms have a long way to go to match Commonwealth in productivity, but many are trying to narrow the gap by

Five of the top 10 firms by producing reps were also among the 10 IBDs

Firms’ head counts, then, show how they’re responding to a challenging time in which experts predict the overall number of advisors

In fact, the number of producing reps disclosed by firms has increased 9% over the past five years to 92,834, roughly 7,500 additional producing reps. In the same span, though, the number of registered reps, a more inclusive figure including back-office reps, has fallen 8% to 112,141.

The data on firms’ head counts come from the end of 2017. To see how firms stack up based on their number of producing reps, scroll through the slideshow. For a list of the top 25 firms based on revenue,