Small and midsize firms read on at your own risk: The giants of the independent broker-dealer sector are growing rapidly.

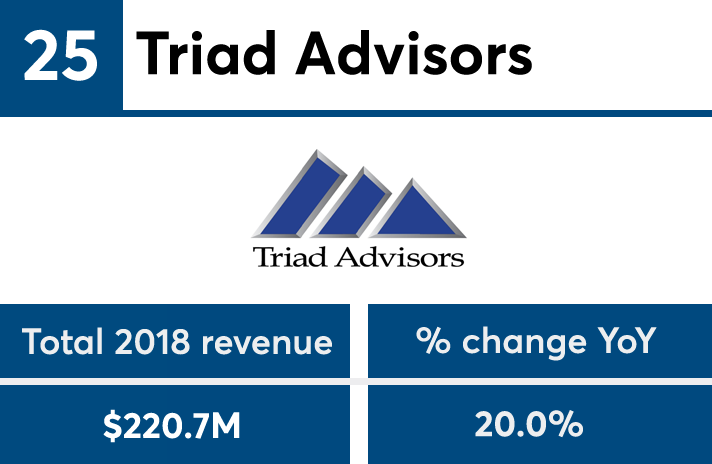

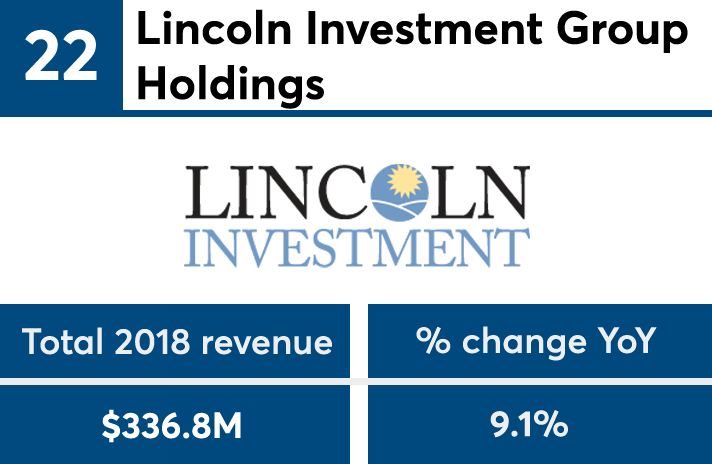

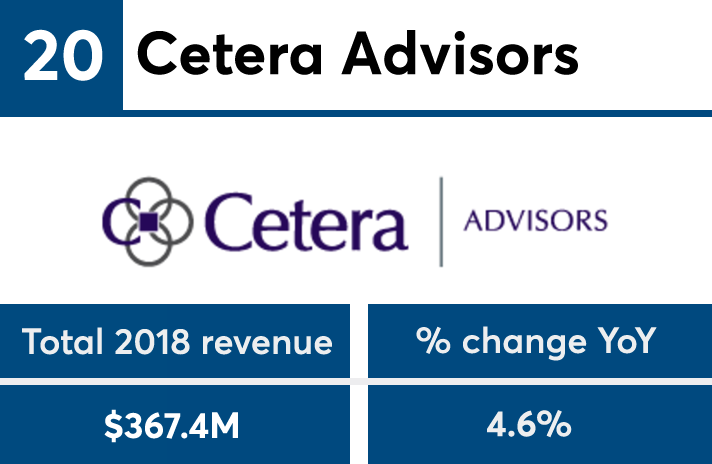

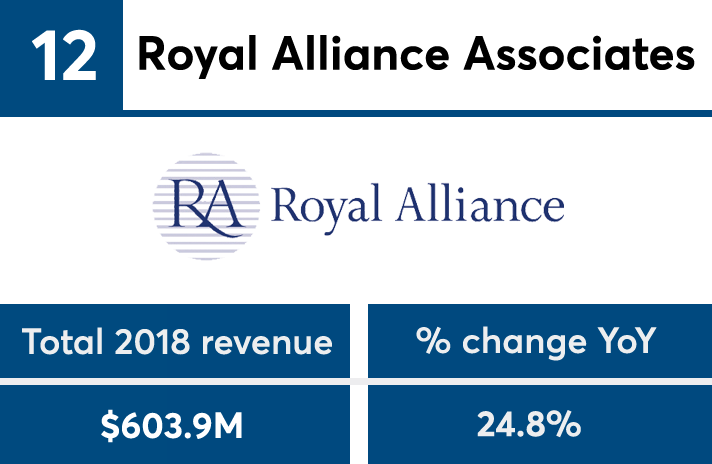

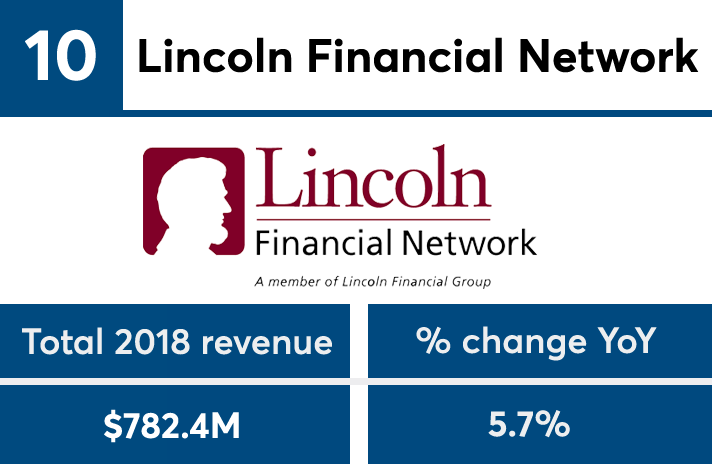

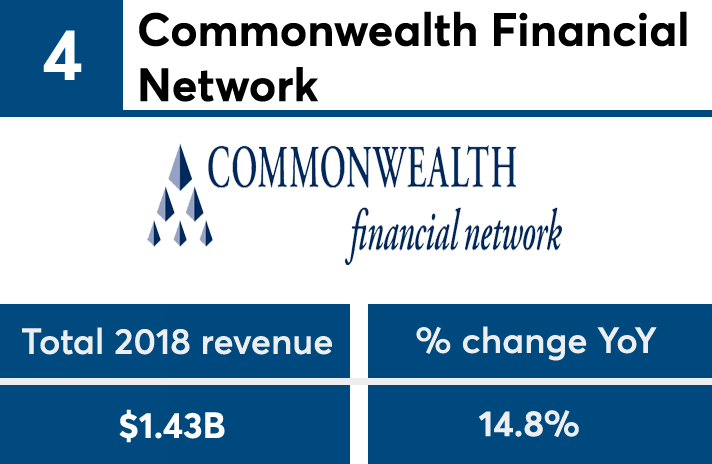

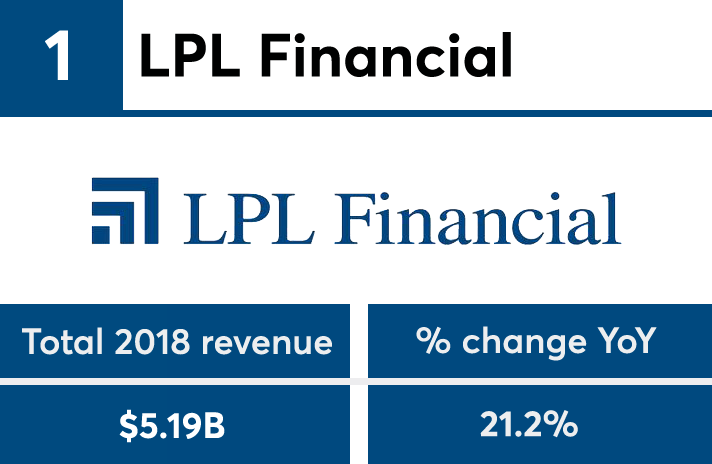

Not one of the top 25 firms in annual revenue took a step back in 2018, according to Financial Planning’s annual IBD Elite survey of the largest IBDs. On the contrary, 15 of them generated double-digit increases in business — and five firms’ revenue jumped by 20% or more for the year.

The ranks of IBDs and networks reeling in more than $1 billion in sales added a new member to expand to nine companies, as Northwestern Mutual’s revenue brought it into the top echelon of the sector. Only LPL Financial, the perennial No. 1 firm, topped $5 billion in revenue.

Other firms made notable moves in the rankings during the past year, the 34th edition of FP’s survey. Advisor Group’s Woodbury Financial Services saw the most growth for the year, after its parent made two acquisitions

In fact, the firm’s ranks surged by more than 600 representatives over an 18-month span following the two deals and substantial recruiting in the wake of

Experts expect the

The environment means that the might of scale and capital often makes right in the increasingly competitive IBD sector. Small and midmarket players are therefore looking to find a niche, an acquisition to give them scale, a bigger partner to serve as parent or an exit ramp to get out.

To view the top 25 firms by annual revenue in the IBD sector, scroll down the slideshow. For last year’s list,

Principal Securities' data arrived after the initial publication of the story due to a technical error. The firm is the No. 23 IBD in annual revenue with $316.2 million following its addition, though no firms have been removed from the permanent version of the slideshow. Principal's position in the rankings is noted with an asterisk below.