The changes to the ranks of the largest independent brokerages in wealth management in the past year represent only slight, yet notable, shifts at the top of the channel.

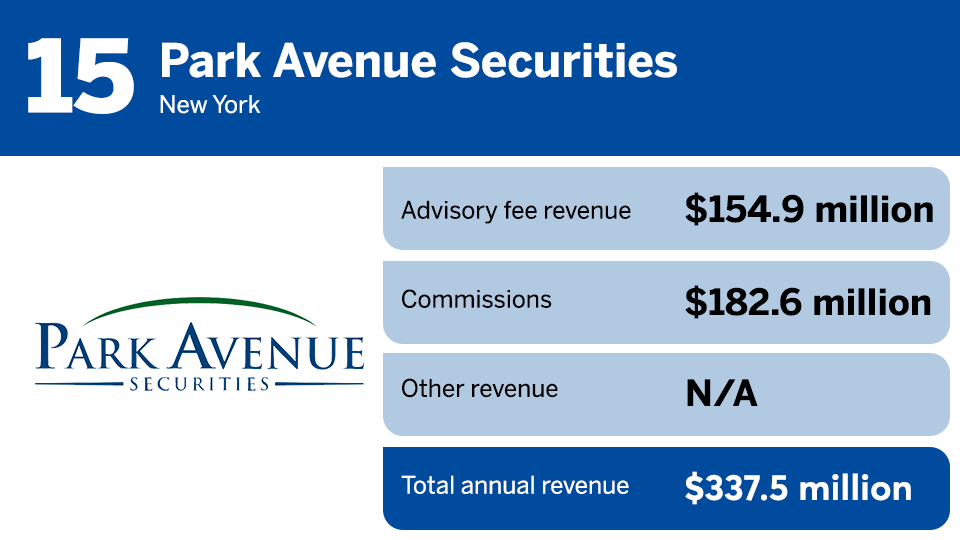

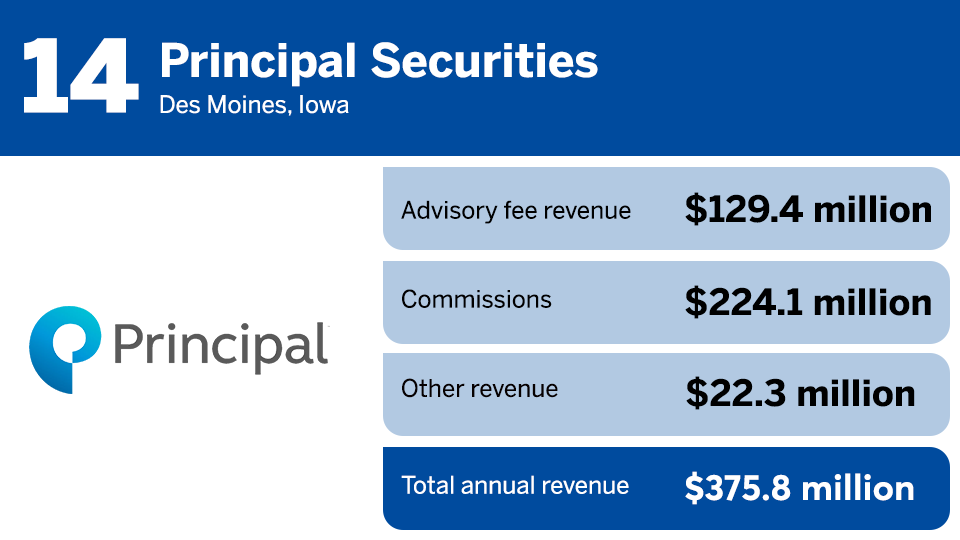

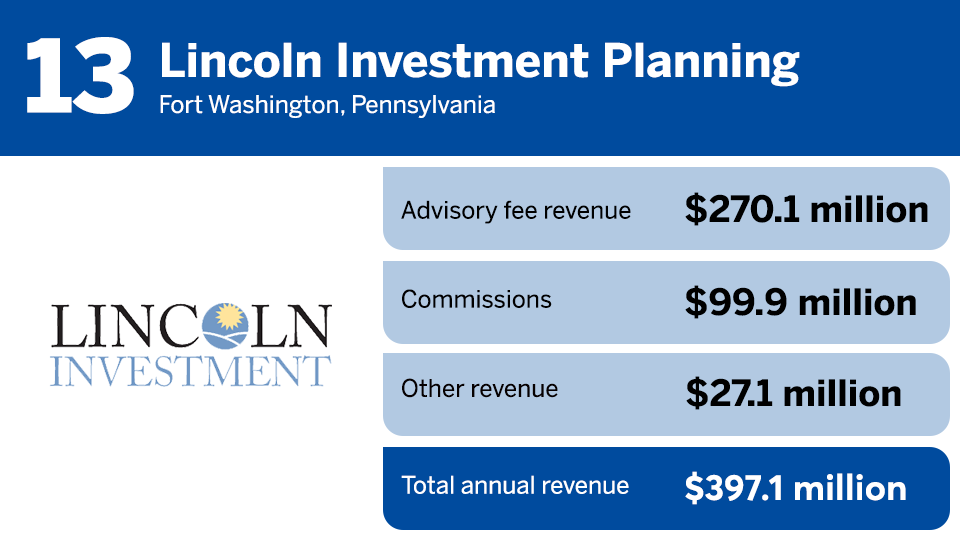

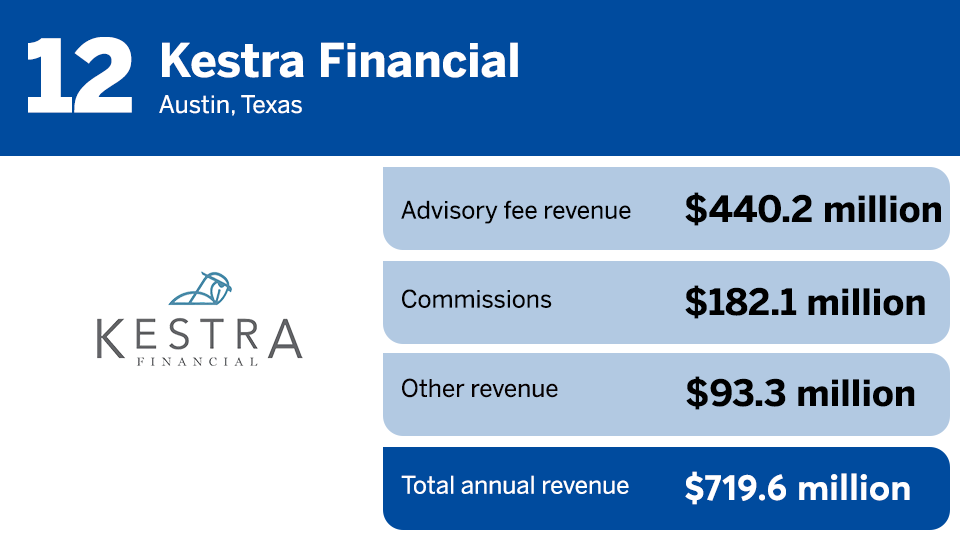

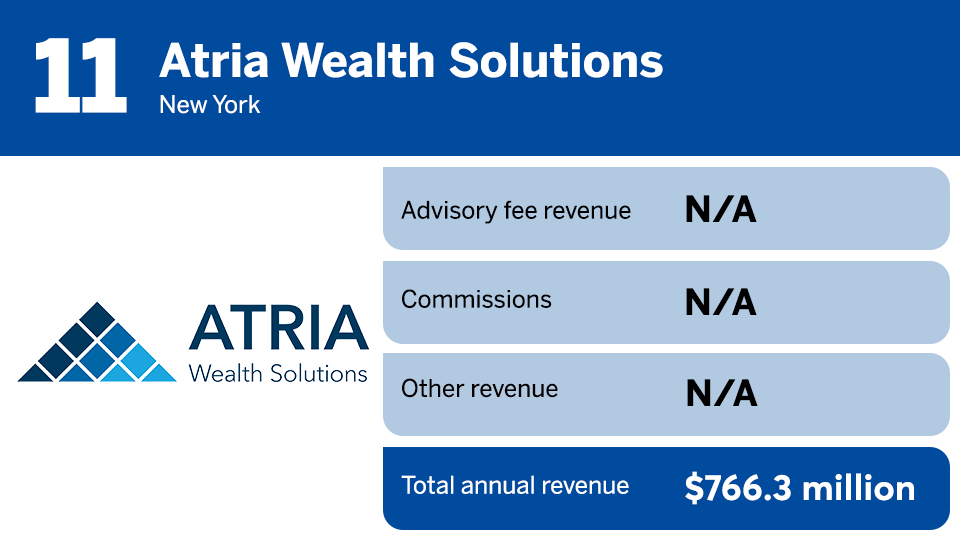

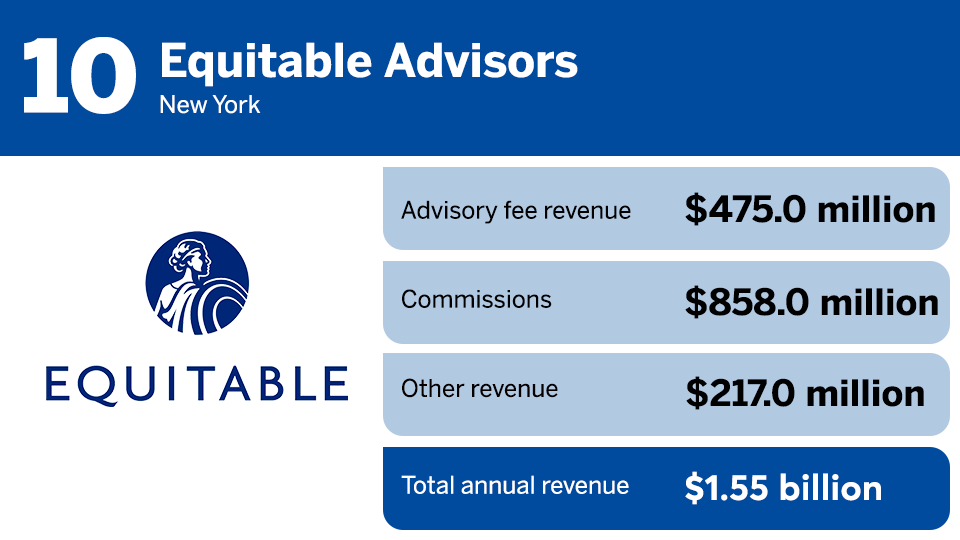

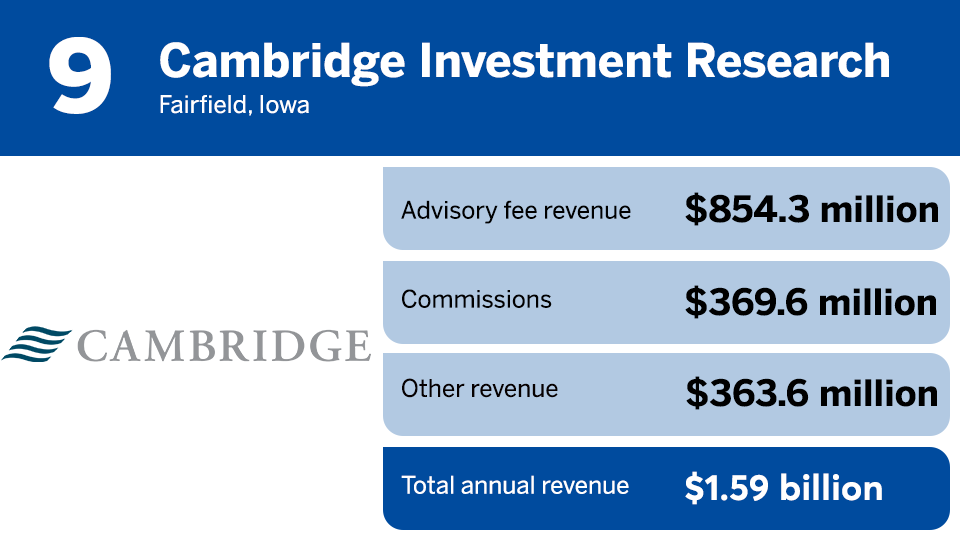

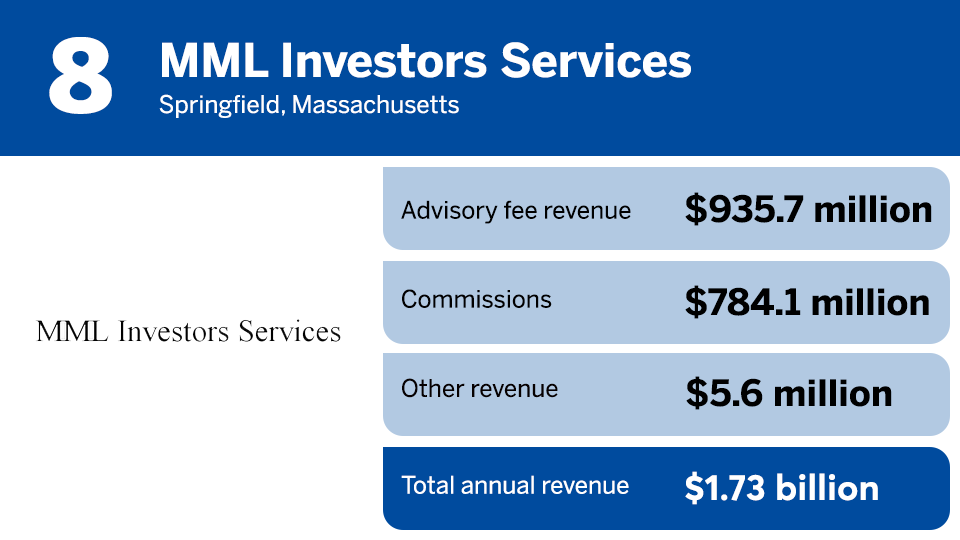

The slideshow below displays the 15 biggest independent brokerages based on their annual revenue, which the companies provided to Financial Planning as part of

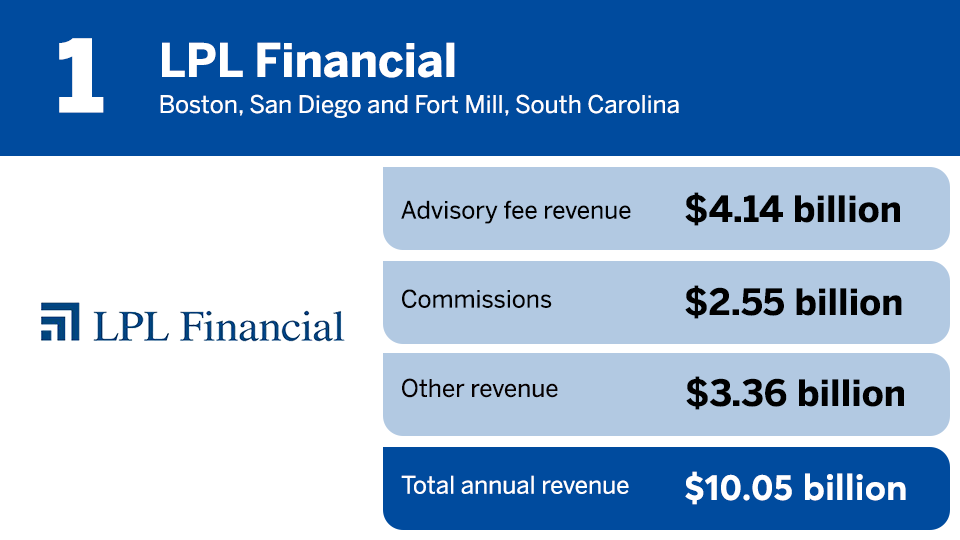

The perennial No. 1 firm, LPL Financial, is currently

Major independent brokerages are certainly pressing their advantages in the channel, as reflected in the makeup of this list and the fact that the number of FINRA-registered firms

"We're kind of like 'Cheers' where everybody knows your name, and that is part of the fabric of our firm," Kestra President Stephen Langlois said in an interview, referring to the concierge support teams that work with the firm's 1,700 advisors. "When they call in, the first question is not, 'What's your rep ID?'"

Conversely, the largest players' branches can curate this more personalized experience through their ability to act as the

"It's really challenging when you're at a big firm to be able to take advantages of the resources that they offer," Robbins said. "We try to provide not only the resources that are available at Osaic, but our own resources."

Scroll down the slideshow to see the rankings of the 15 largest independent brokerages in wealth management by their annual revenue. Or read the 2024 IBD Elite cover story, "

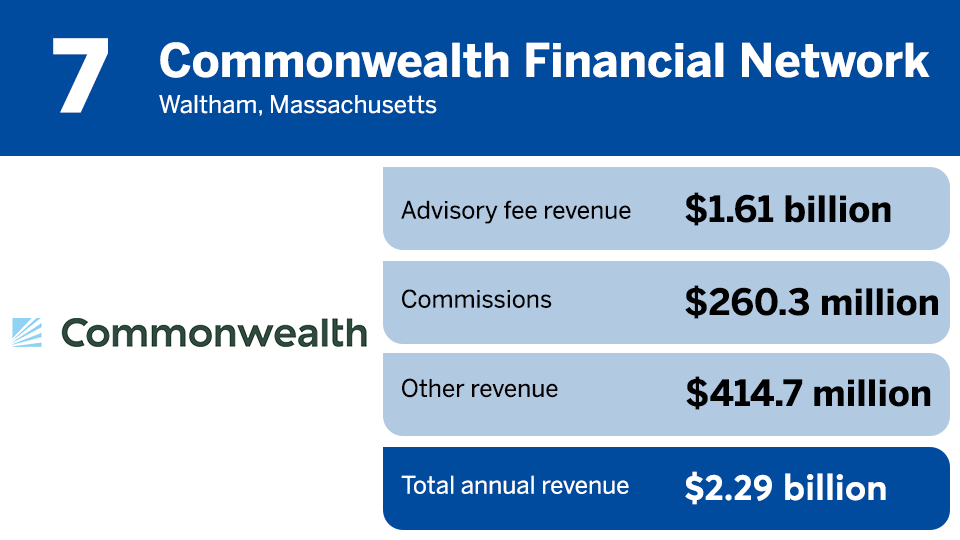

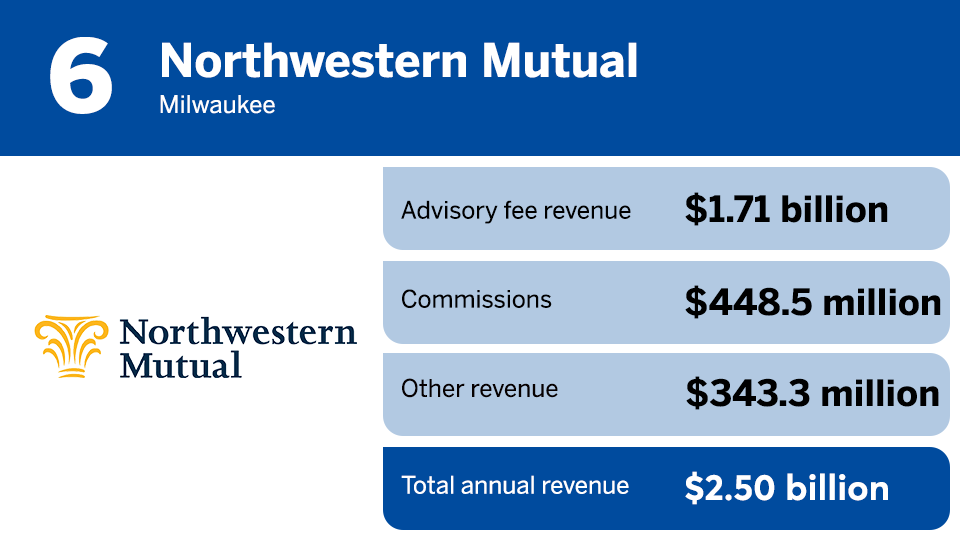

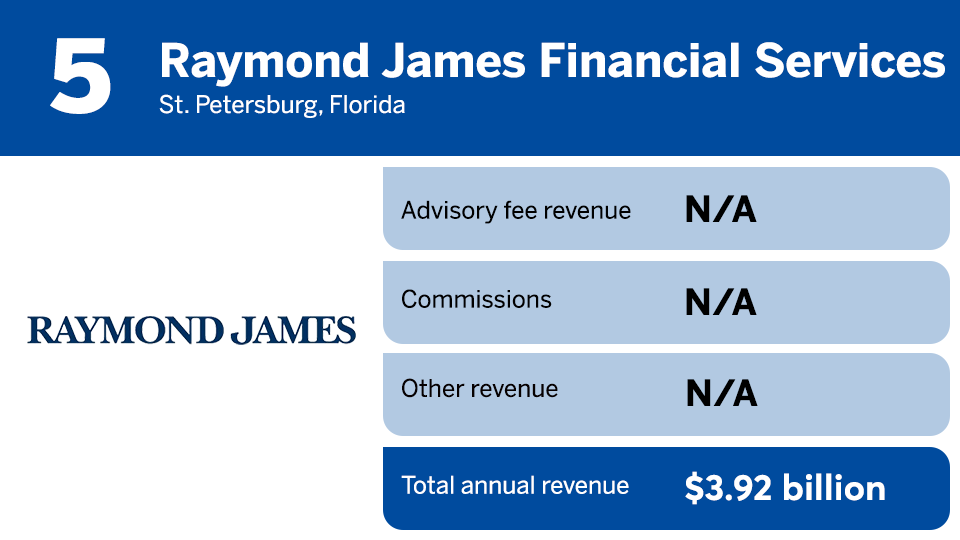

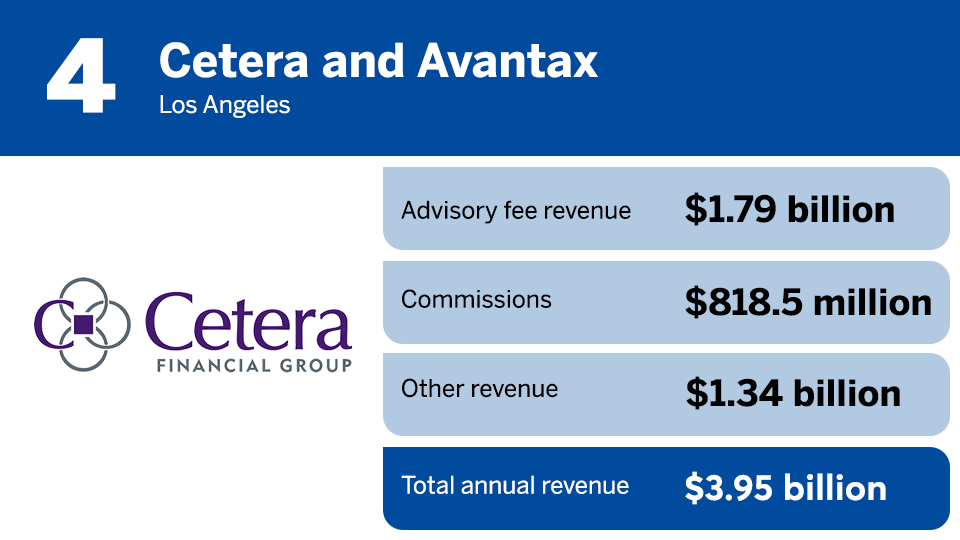

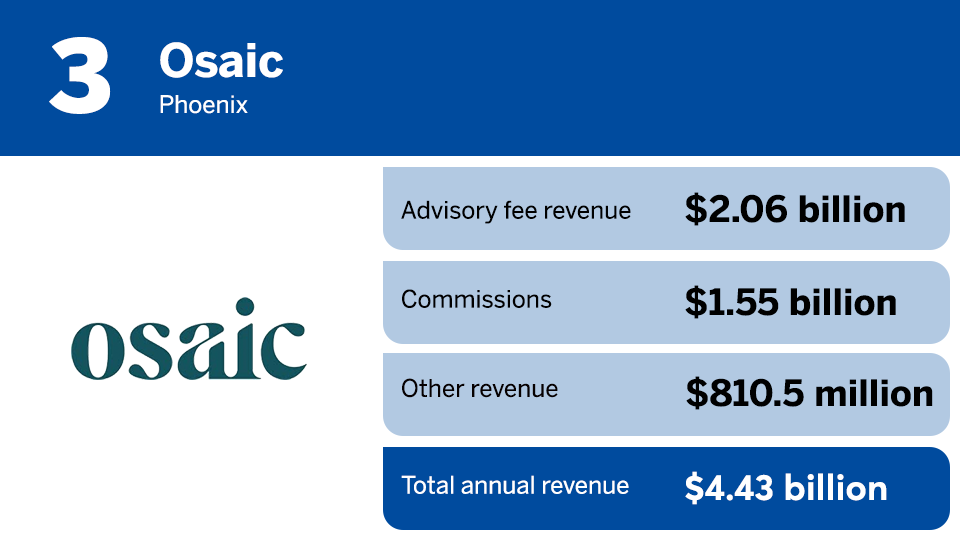

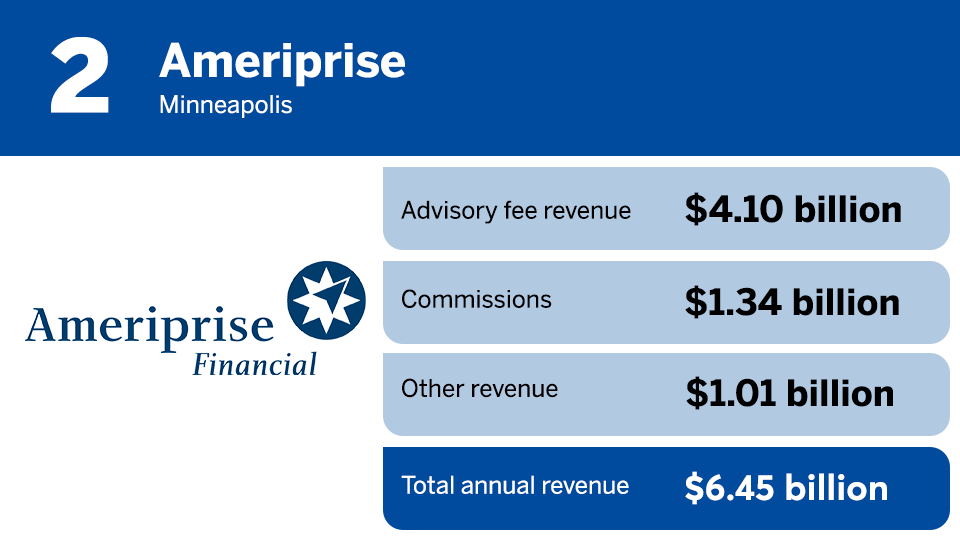

Notes: The companies are ranked below by their 2023 revenue, as reported by the firms themselves. FP relies on each firm to state their annual metrics accurately and rounds each figure. The industry term "producing registered representative" refers to each firm's most accurate count of financial advisors using the firm as their brokerage or RIA. "Other revenue" means any other business besides sales commissions and advisory fees. Each metric is as of year-end 2023. "N/A" stands for "not available."