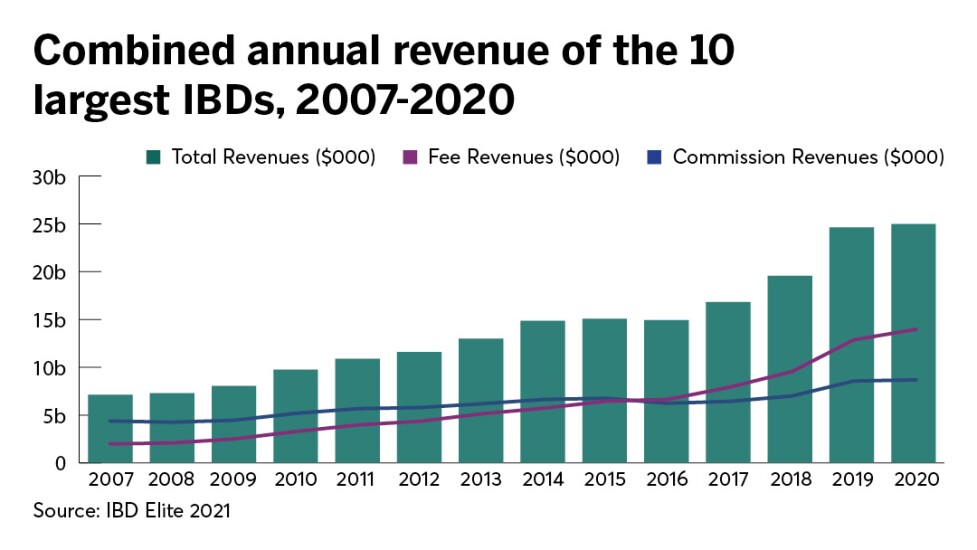

The independent broker-dealer industry’s massive growth slowed considerably in 2020 amid the impact of the coronavirus on the U.S. economy.

While the 10 largest firms didn’t sustain the steep declines among industries structured around live events or in-person services, their combined annual revenues ticked up by only 1.5% from the prior year to $25.01 billion, according to Financial Planning’s 36th annual IBD Elite survey. They maintained roughly the same level of business in 2020, compared to the double-digit hikes of the past three years and the huge 25.9% expansion the 10 firms raked in for 2019.

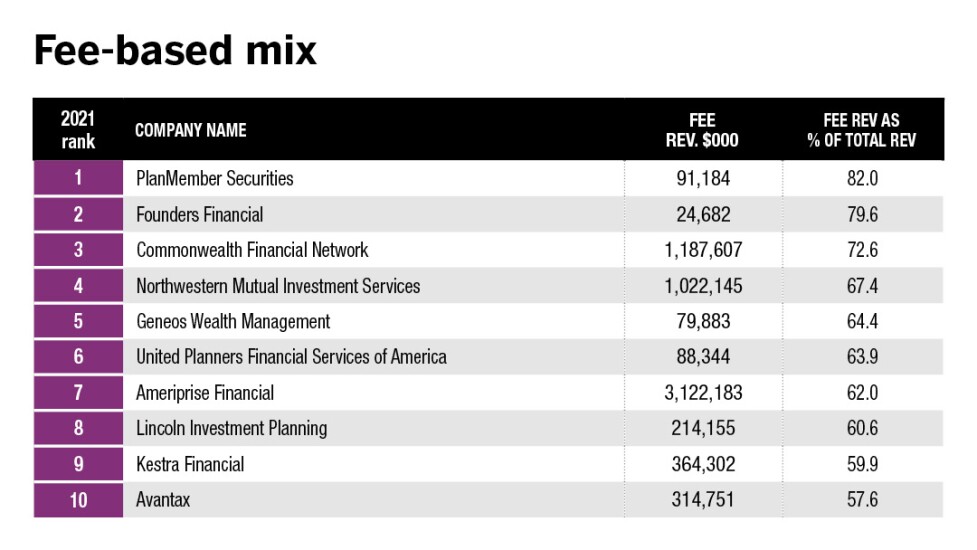

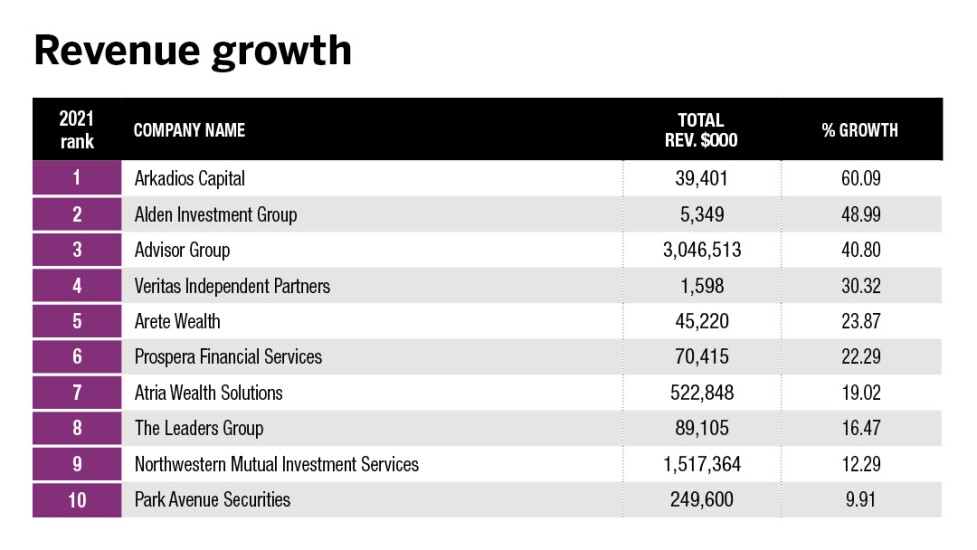

The topline findings are among the interesting data takeaways from the annual study, which also reflected the industry’s major shift over the past two decades when

To see a collection of the data from this year’s survey, including six lists of the top 10 firms for various indicators, scroll down our slideshow.

Plus, find two feature stories from the 2021 IBD Elite: “

Note: All figures refer to year-end results for 2020, and FP relies on companies to voluntarily disclose the data about their businesses without means of verifying it in most cases. After providing the required data about annual revenue for the survey, some firms didn’t disclose other metrics requested by FP.