Want unlimited access to top ideas and insights?

The potential use of AI in financial planning is rapidly evolving. Researchers from Case Western Reserve University and accounting automation solutions provider

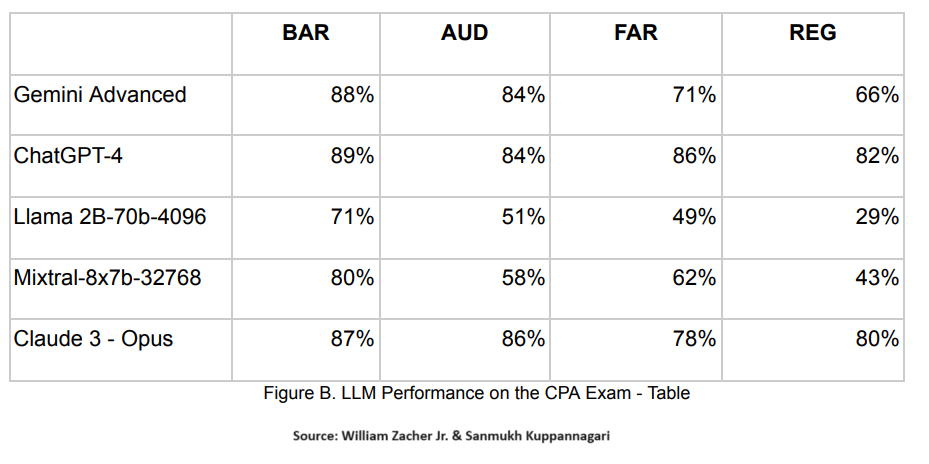

Results were mixed. The paper concluded that ChatGPT is "the only real option for zero-shot BAR automation," meaning that ChatGPT-4 could be used to help with automated financial statement preparation or additional forecasting. On the other hand, the researchers said Claude was probably better on auditing-related tasks, which the paper said "is a solid indication that it can be used for fraud detection and internal control validation."

READ MORE:

The idea of a large language model passing the CPA exam raises concerns for professionals: Am I eventually going to be replaced by a bot?

A recent MIT study co-authored by Andrew Lo, a professor of finance at MIT Sloan and director of the MIT Laboratory for Financial Engineering, suggested that while these models have the potential to simulate certain behaviors of human advisors, there's still a long way to go.

In fact, there may be more potential for job growth on the back end, after AI has created enough efficiencies to generate more assets, or clients, to manage. This means more human advisors will be needed, industry experts have suggested.

"It's going to help the advisor, and it's going to create efficiencies and process changes that will benefit the advisor," Christopher Marsico, chief financial officer and a partner at Rossby Financial, recently told Financial Planning's

READ MORE:

Catch up on Financial Planning's coverage of how wealth managers are responding to the growing relevance of AI in the industry.