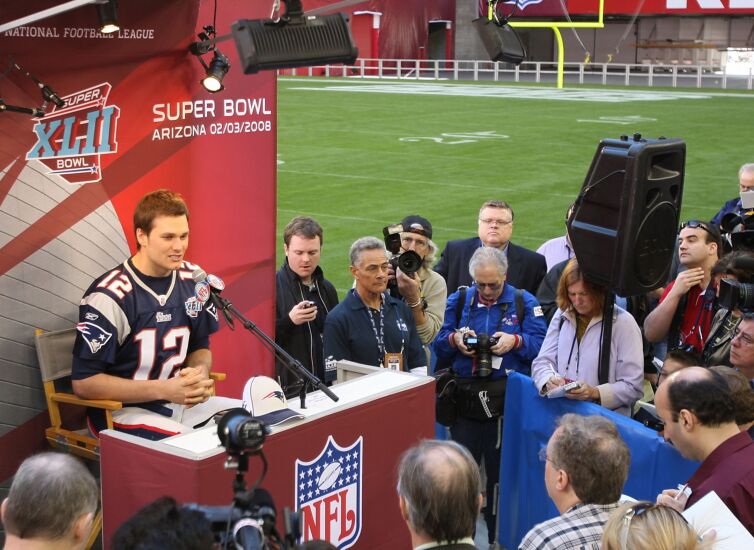

This month, Tampa Bay Buccaneers quarterback Tom Brady started his improbable 22nd season. Improbable not only because of the wear and tear that can break NFL players down long before they reach a handful of seasons — the average career is just over three years — but also because Brady famously announced his retirement at the end of last season, only to change his mind a few weeks later.

The problem with Brady, from a financial planning perspective, is that while he is what advisors hope their famous clients will become, wealth managers also know that the odds of that happening are slim. And it's incredibly difficult, they say, to convince people who have succeeded at every stage of their lives that they may come to the end of the road much sooner than they hope.

"I ask (famous clients), 'how many Paul McCartneys or Mick Jaggers are there?' Then I give the example of Vanilla Ice. He was a one-hit wonder and he disappeared," said Lee Rawiszer, chief financial officer and managing principal at Paradigm Financial Partners in Westport, Connecticut. "We don't know if you're going to be the next Paul McCartney or the next Vanilla Ice. That's not an insult. But you have to plan for retirement like you're going to be Vanilla Ice."

Rawiszer and Anthony DiValerio, a director in Morgan Stanley's Global Sports and Entertainment Division, said that while it can be deeply rewarding to help famous clients live out their dreams financially, they pose distinct challenges. The two wealth managers talked with Financial Planning on how they guide famous clients toward understanding the uncertainty surrounding their careers and how to build up what they can in the time they have in the spotlight.