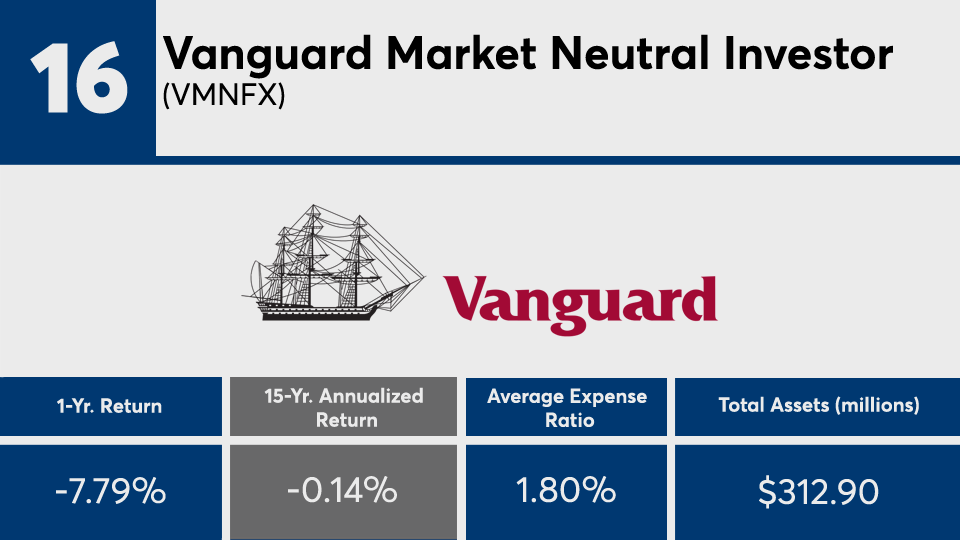

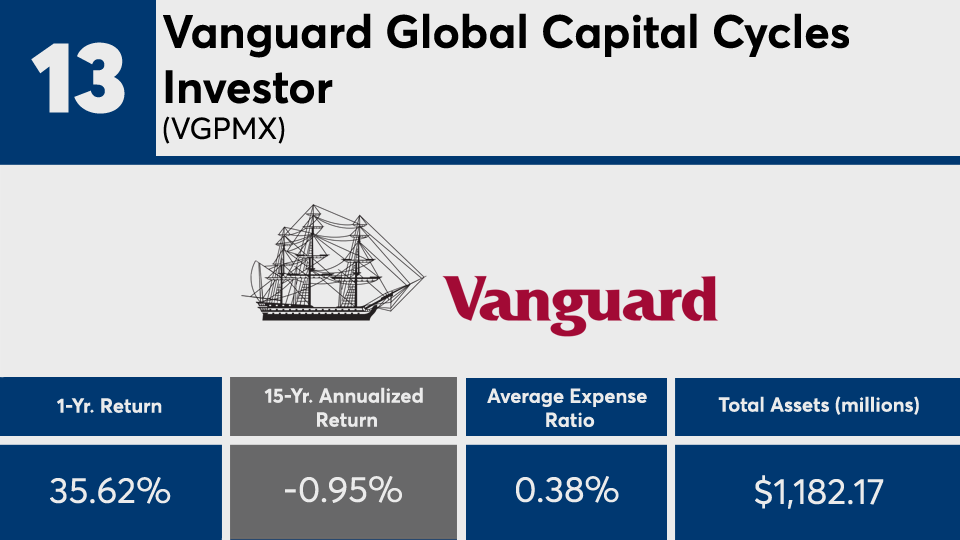

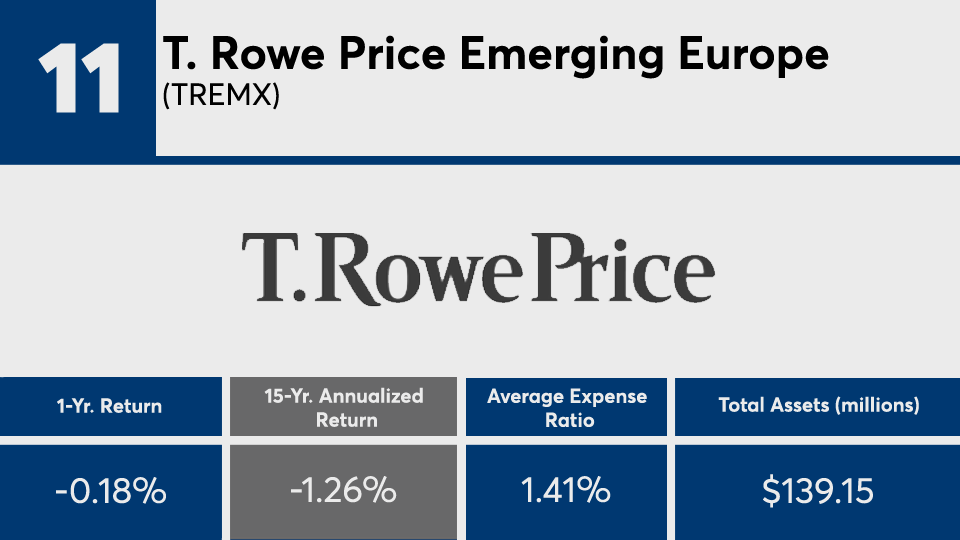

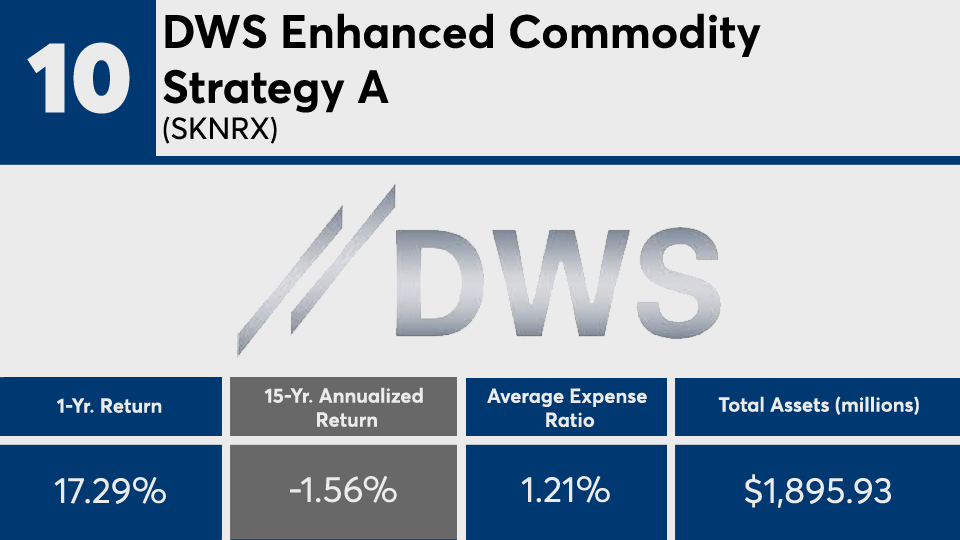

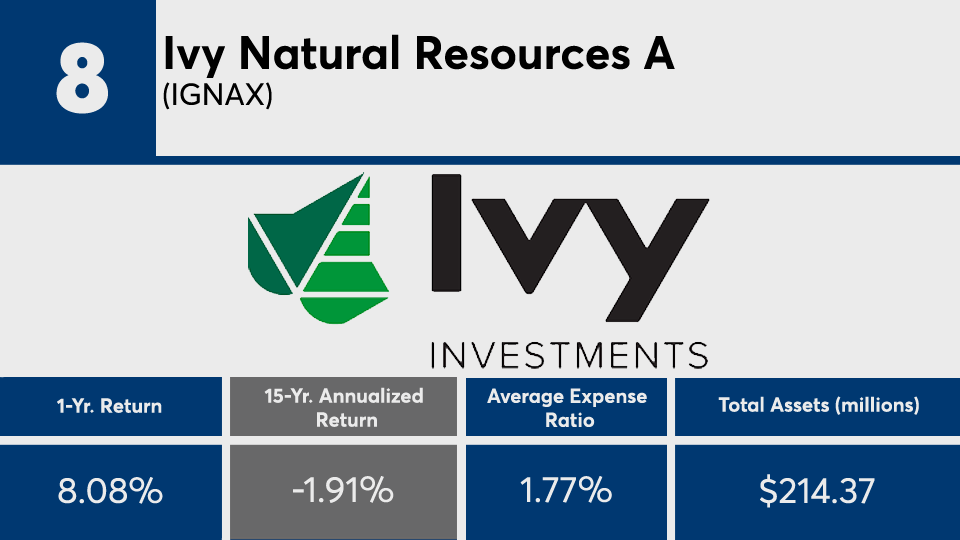

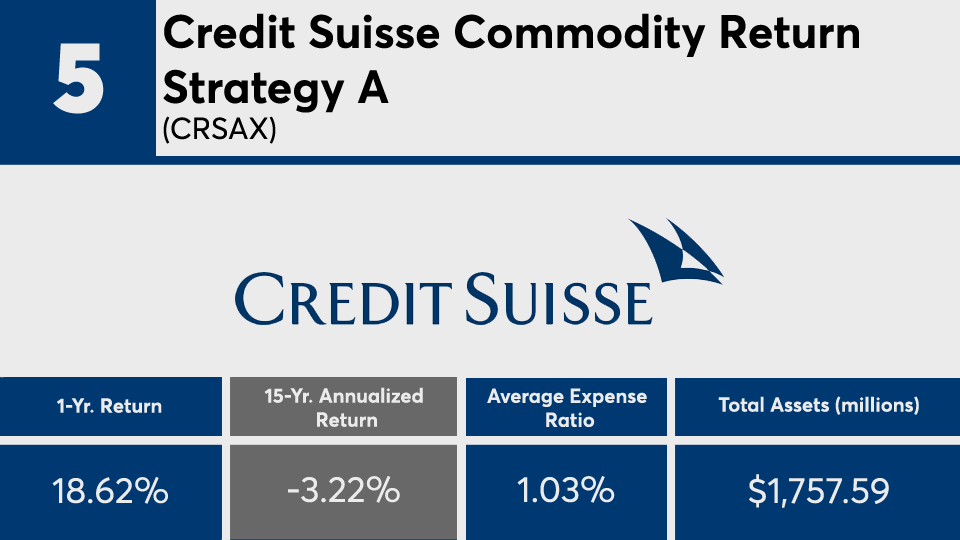

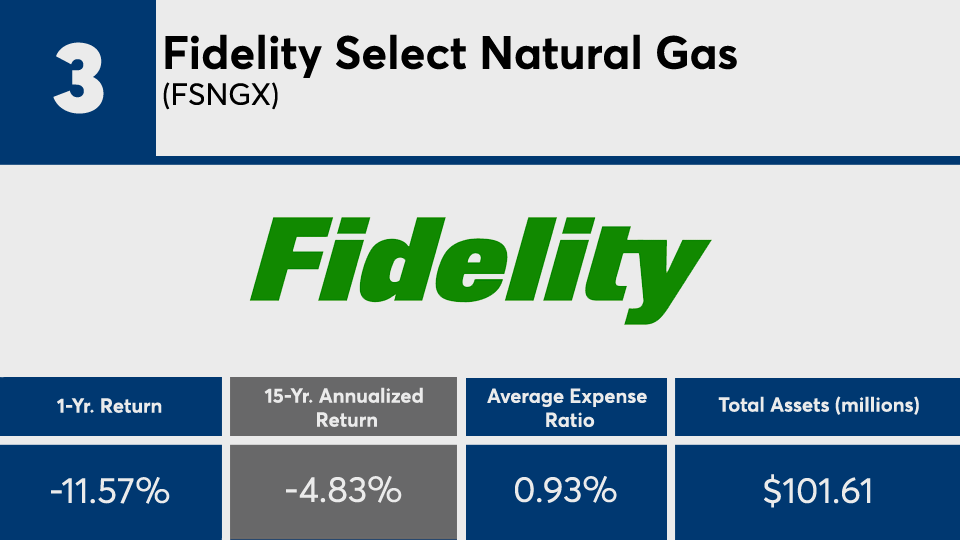

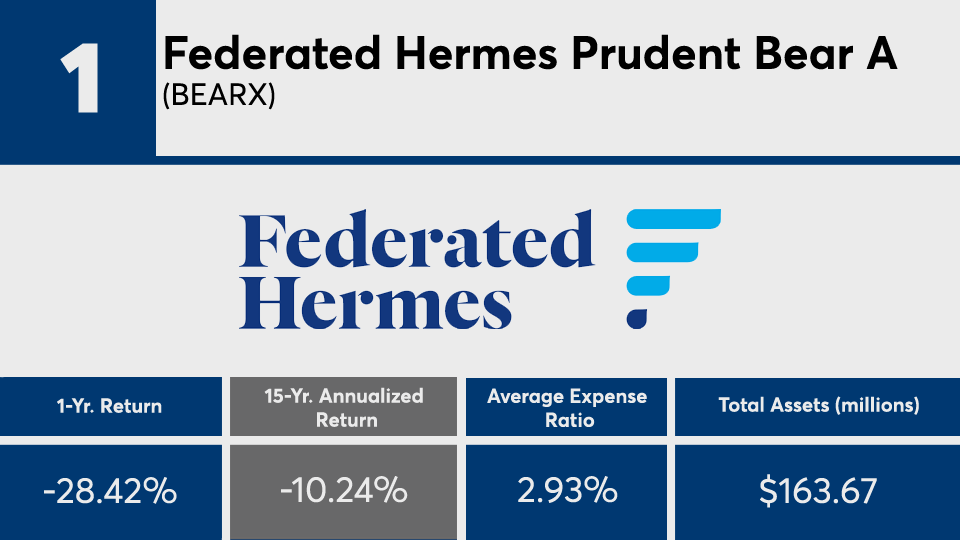

The 20 funds with the worst 15-year performance figures, and at least $100 million in assets under management, posted an overall loss of more than 2%, Morningstar Direct data show. Over the last year, many of the same funds have made up ground with the group posting an overall one-year gain of more than 16%.

Unlike funds with the

“It reminds me of the beginning of the novel ‘Anna Karenina,’ which reads, ‘each unhappy family is unhappy in its own way,’” Shea says. “While there are generally a few things in common among the best-performing funds, there are often a wide variety of ways to generate poor performance over any period of time.”

To be sure, funds in this ranking include a

Compared with the broader fund industry, index trackers such as SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

The top 20 funds here are also more costly than many of their peers. Ranging from as high as nearly 300 basis points, the funds carried an overall net expense ratio of 1.32%, nearly three times the 0.45% investors paid for fund investing in 2019, according to

Despite their high cost, it was their focus on unfavorable sectors that landed them on this list, notes Orion Advisor Solutions CIO Rusty Vanneman. That said, analysis of the worst-performing funds is one way for advisors to discuss with clients their long term plans, he adds.

“To build wealth, one needs to invest and stay invested,” Vanneman says. “Global diversification builds resilience into portfolios, especially given the cyclical nature of the markets. All sectors have their days in the sun, and all have their share of rainy days. It’s best to stay diversified.”

Scroll through to see the 20 funds, with more than $100 million in AUM, and the biggest 15-year annualized losses. Assets and average expense ratios, as well as year-to-date, one-, three-, five and 10-year returns through Feb. 25 are also listed for each. The data show each fund's primary share class and current portfolio manager or managers. All data is from Morningstar Direct.