Solid management and an attractive sector are some of the key characteristics of the funds with over a decade of continued outperformance. Another feature? High fees.

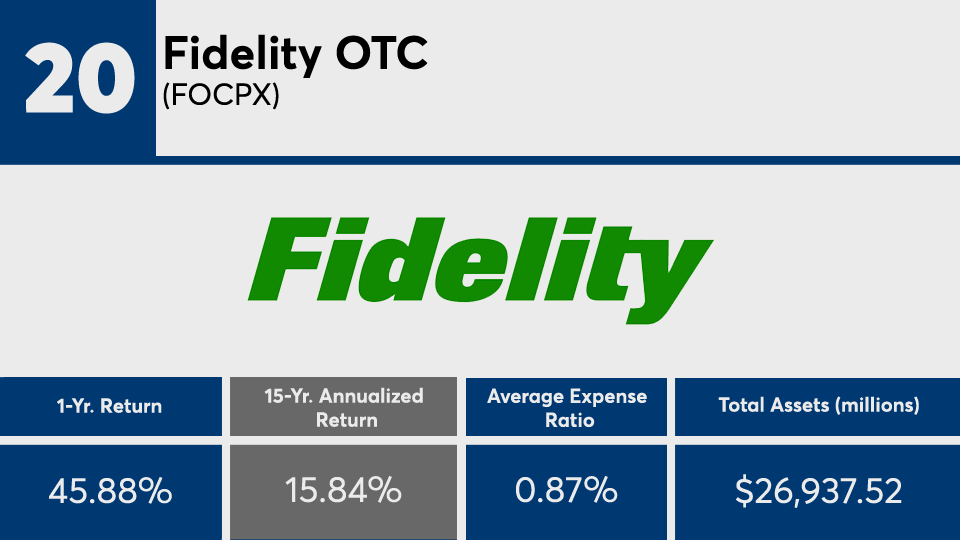

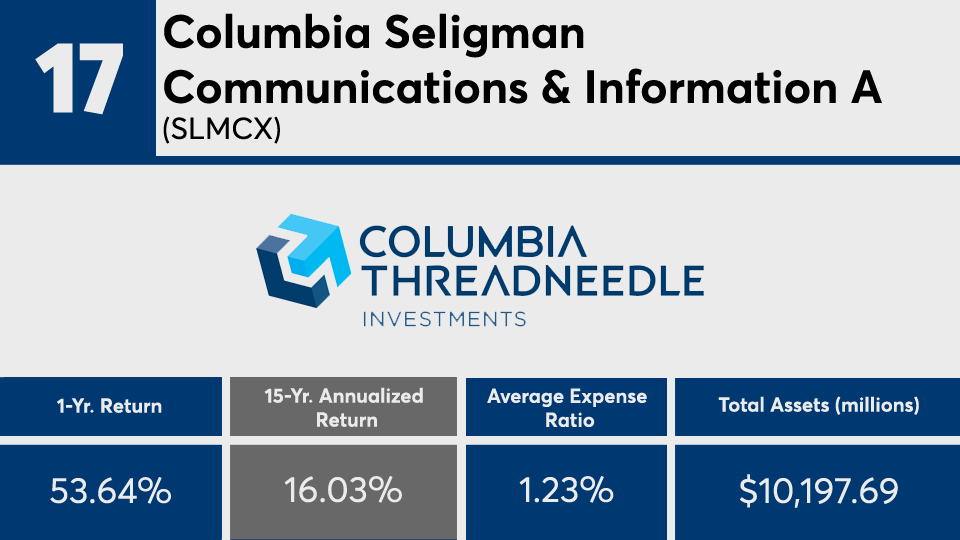

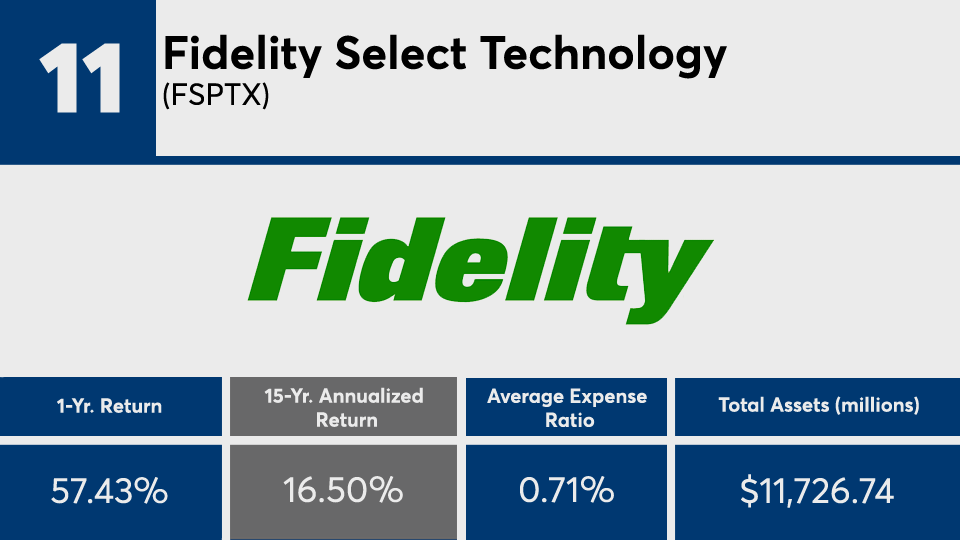

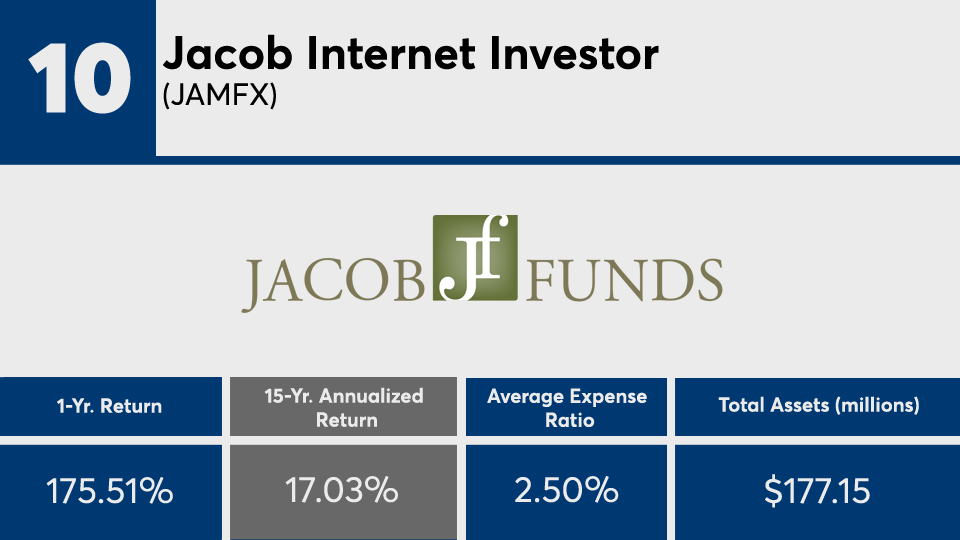

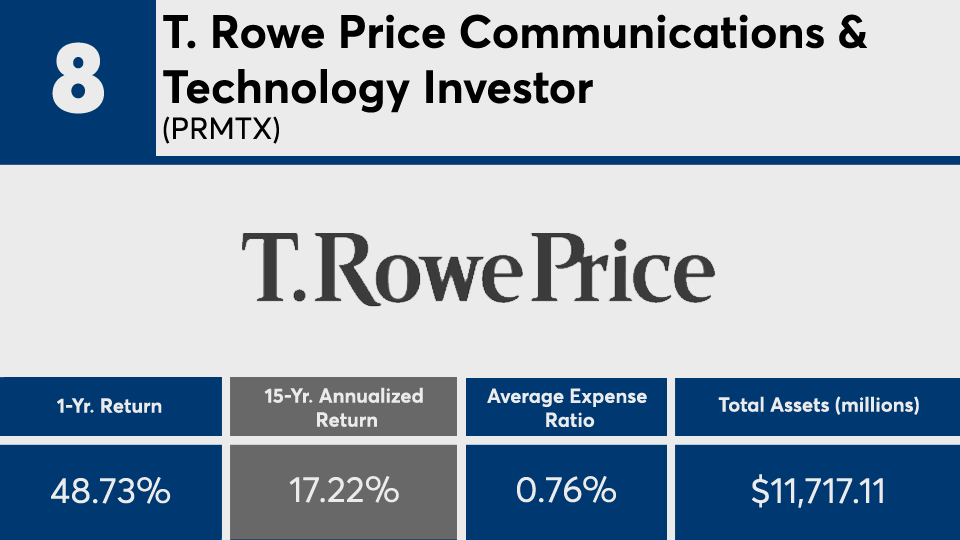

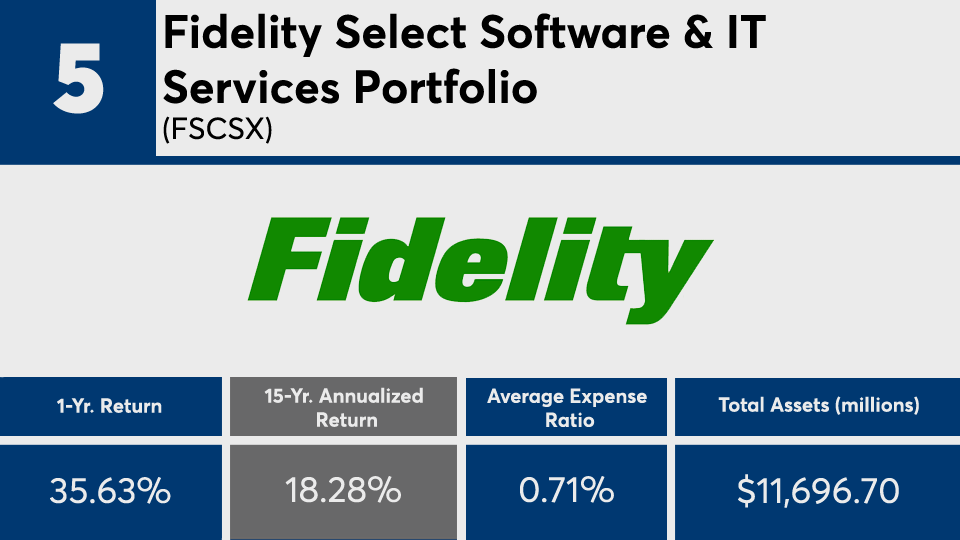

The 20 funds with the largest gains of the last 15 years notched an average return of more than 17%, Morningstar Direct data show. In the last year, the same funds returned over 76%.

Deeper analysis of the top 20 funds in this ranking depicts a time when large-cap technology has dominated investor attention, says Bryan Shipley, co-CEO and chief investment officer at Arnerich Massena.

“While these funds have managed to add alpha via stock selection, the primary reason for their strong absolute performance is most likely due to the benefit from the massive tailwind of investors’ strong demand for large cap technology companies,” Shipley says. “Large-cap companies have significantly outperformed small cap companies and growth has significantly outperformed value during this time period.”

Compared with the broader fund industry, index trackers such as SPDR S&P 500 ETF Trust (

In bonds, the iShares Core U.S. Aggregate Bond ETF (

"The big focus in technology during the past 12 years, and even the three years prior during the financial crisis should be considered the principal driver, and so thinking about the outlook for technology companies will be a key consideration in how these funds perform going forward," adds Steven Skancke, chief economic advisor at Keel Point.

Steady 15-year gains, however, came at significantly higher price than the industry average. Carrying an average expense ratio of 123 basis points, the 20 leaders since 2006 were well above the 0.45% investors paid for fund investing in 2019, according to

With many in this ranking actively managed by a fund manager or management team, it may be no surprise to see some with expense ratios well over 200 basis points, notes Jennifer DeSisto, chief investment officer at Anchor Capital. “The fees of these funds' relative 15% annualized returns does not look absurd,” DeSisto says. “The question, in my opinion, is whether you could get the same exposure in a technology sector ETF or even the S&P 500 for lower fees.”

For advisors with clients focused on their own long-term horizons, Shipley says it’s important to ask, “Do I expect the next 10 to 15 years to play out exactly as they did in the past cycle which led to these strong results?

“Looking at past performance as the sole deciding factor is a poor recipe for identifying potential future outperformance,” Shipley says, noting that it’s also important discuss “qualitative factors like the stability of the firm and underlying investment team, structure of the portfolio, investment manager style, and what your expectations are for what the future might look like.”

Scroll through to see the 20 funds, with more than $100 million in AUM, and the biggest 15-year annualized gains. Assets and average expense ratios, as well as year-to-date, one-, three-, five and 10-year returns through Feb. 18 are also listed for each. The data show each fund's primary share class and current portfolio manager or managers. All data is from Morningstar Direct.