Surprises, rebounds and momentum characterized RIA M&A activity in the first quarter.

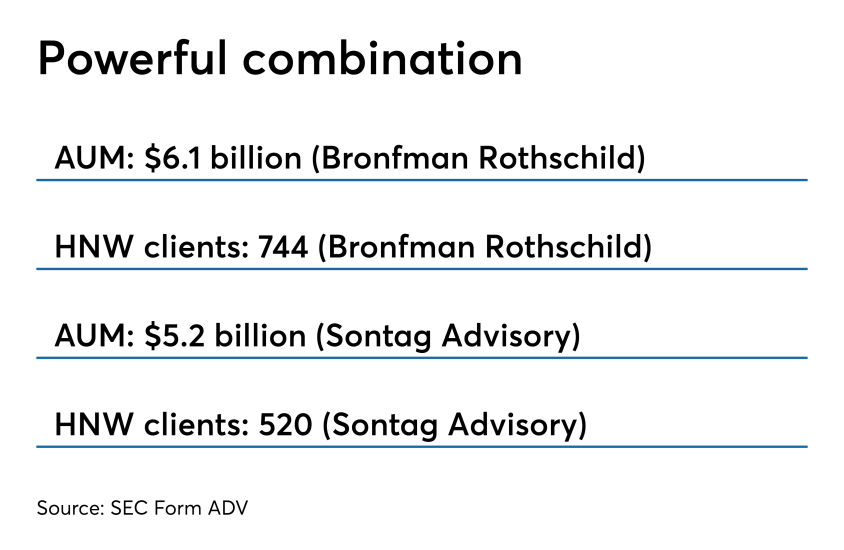

Perhaps the biggest surprise was NFP’s acquisition of Bronfman Rothschild, followed by the entry of Creative Planning, the $39 billion RIA behemoth that heretofore focused on organic growth, into the M&A market.

Another surprise: the purchase of M&A investment banking firm Silver Lane Partners by none other than IBD giant Raymond James.

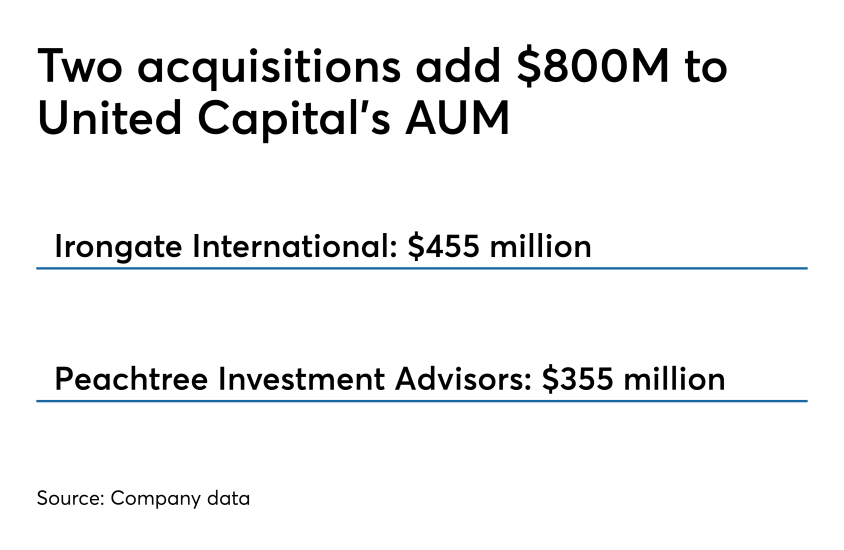

As for rebounds, United Capital led the way with acquisitions of two RIAs with a total of $800 million in AUM after completing only three deals in 2018.

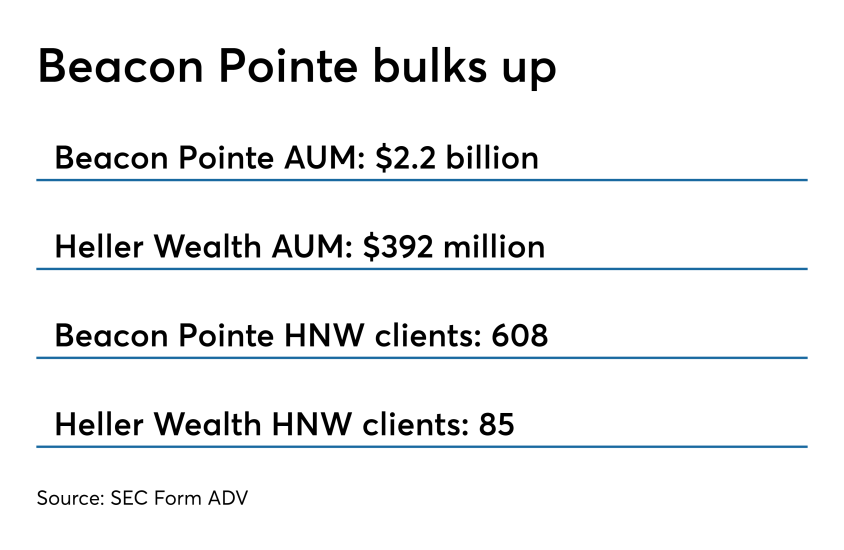

Beacon Pointe Wealth Advisors also rebounded with a $392 million deal after making no acquisitions last year.

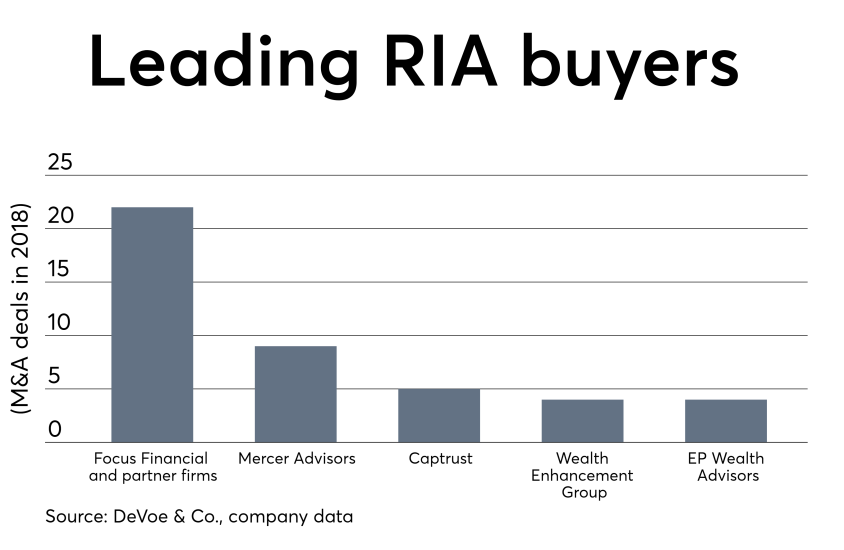

Momentum from a record-breaking 2018 was also evident in the first quarter’s volume and quality of deals. There were 33 wealth management transactions totaling $130 billion from January through March, according to Fidelity’s most recent Wealth Management M&A Transaction Report.

What's more, the appetites of private equity firms and strategic buyers for advisory firms appears to be unabated despite intense competition and rising valuations.

Deals in the first quarter have been smaller than in 2018, averaging around $600 million, down from around $1 billion last year, according to DeVoe & Co.

But the volume of deals signaled what Dan Seivert, CEO of Echelon Partners, calls “the thawing of the iceberg,” that is, an increased willingness of older advisors to sell who previously had held out for yet another year of healthy cash flow.

Here are some highlights from Q1: