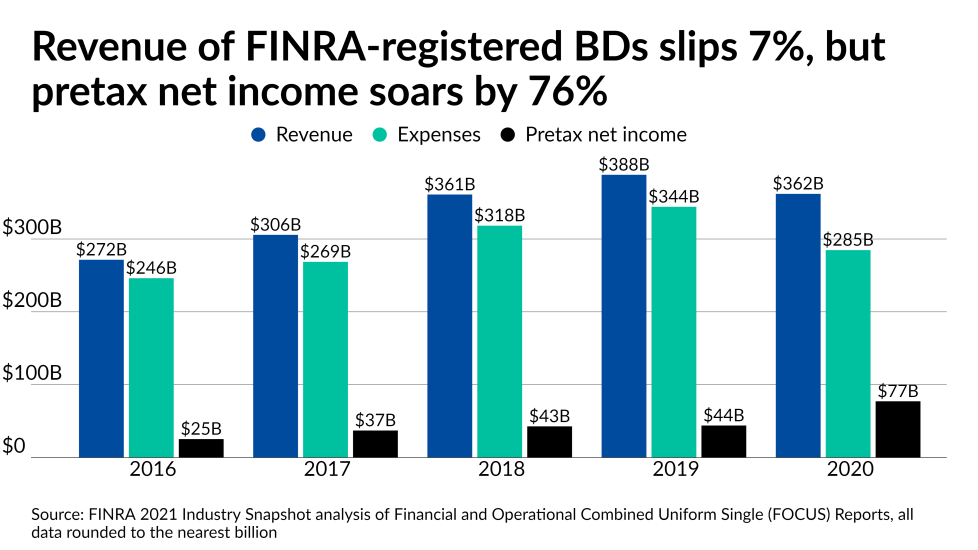

The trend in opposite directions on the two sides of wealth management’s most significant dividing line may be concealing what was, in some ways, a very good year for broker-dealers.

FINRA-registered firms — their numbers and ranks of registered representatives trimmed in each of the past five years as the count of RIAs rises steadily — earned a combined $77.21 billion in pretax net income in 2020, up more than three quarters from the previous year,

Higher volumes of transactions and a

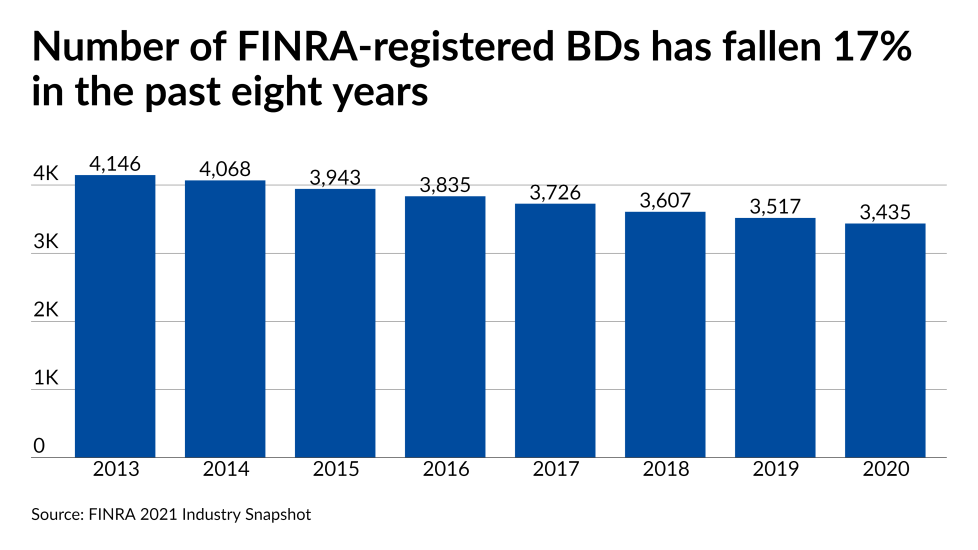

“It's been a very long and steady decline for broker-dealer firms, as compared to a long and steady rise in RIA firms,” Gebaur says. But that doesn’t mean brokerages are doomed: “I wouldn't be terribly alarmed if I was a broker-dealer...Broker-dealers aren't going anywhere.”

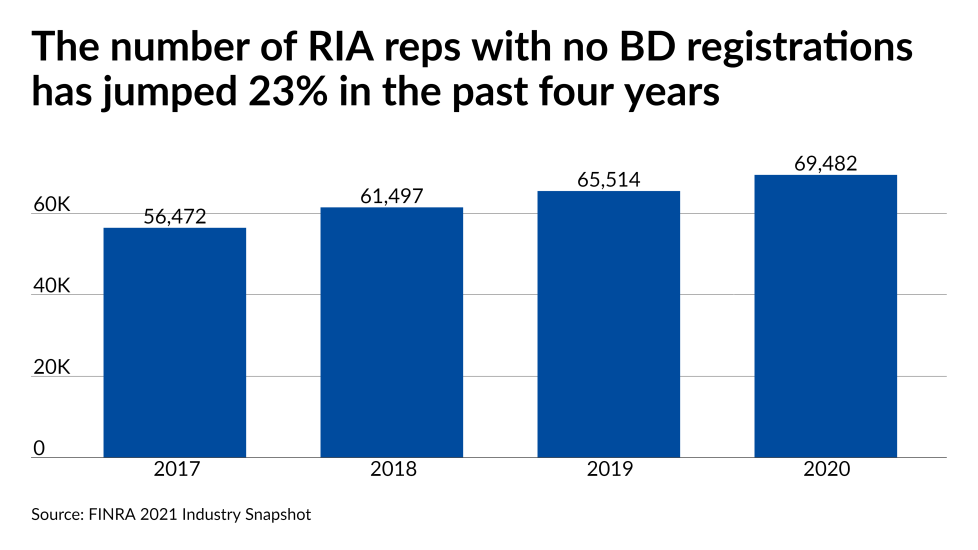

Gebaur acknowledges that wealth management and the larger investment industry have moved away from commissions and towards advisory services. In fact, he says, financial advisors should be bullish about the future when considering the expanding reach of advisory accounts and the eventual transition to RIAs of younger investors crowding into digital trading services. Growing numbers of RIA-only reps and dually registered ones reflect new career paths into the profession, he says, noting the traditional path called for trainees to start only as brokers.

The data also display the ongoing movement of experienced advisors leaving brokerages to pursue opportunities on the RIA side, according to Scott Gill, founder of Synergy RIA Compliance Solutions.

“This is indicative of not only an industry migration away from commission-based compensation arrangements but also an increased appetite among the general public for asset-based fees and flexible financial planning service offerings,” Gill said in an email.

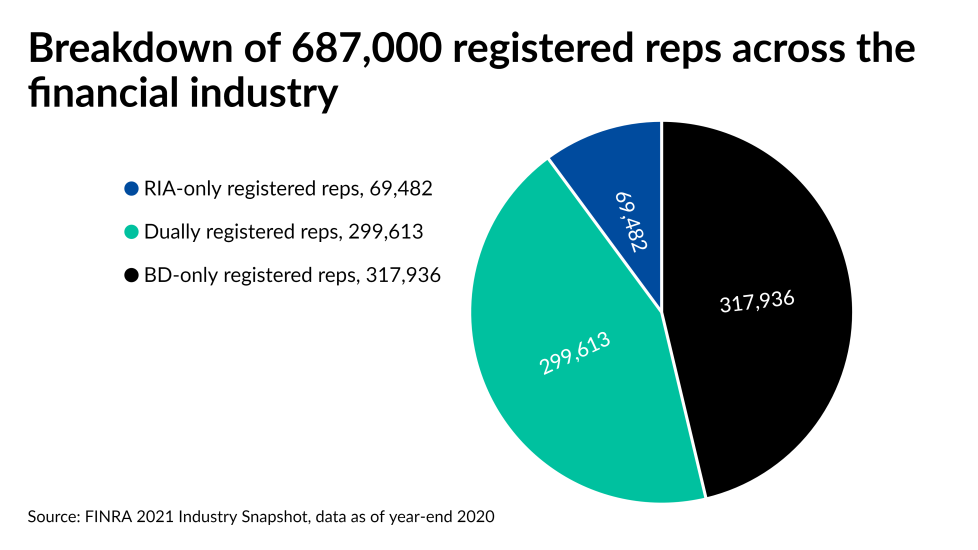

FINRA’s reports offer context about the population of professionals with securities registrations, which is much larger than the generally accepted industry figure of about 300,000 financial advisors. Many of the other roughly 400,000 reps work in adjacent sectors such as insurance and asset management. And even though the SEC and state regulators oversee RIAs, the brokerage regulator’s snapshot offers notable figures about advisory firms nationwide.

Please scroll down our slideshow for the most significant statistics from FINRA’s