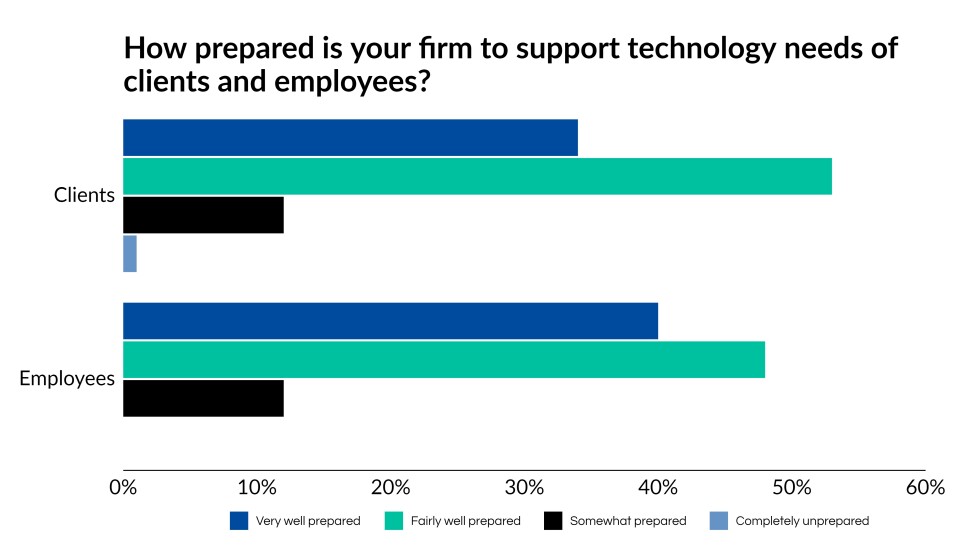

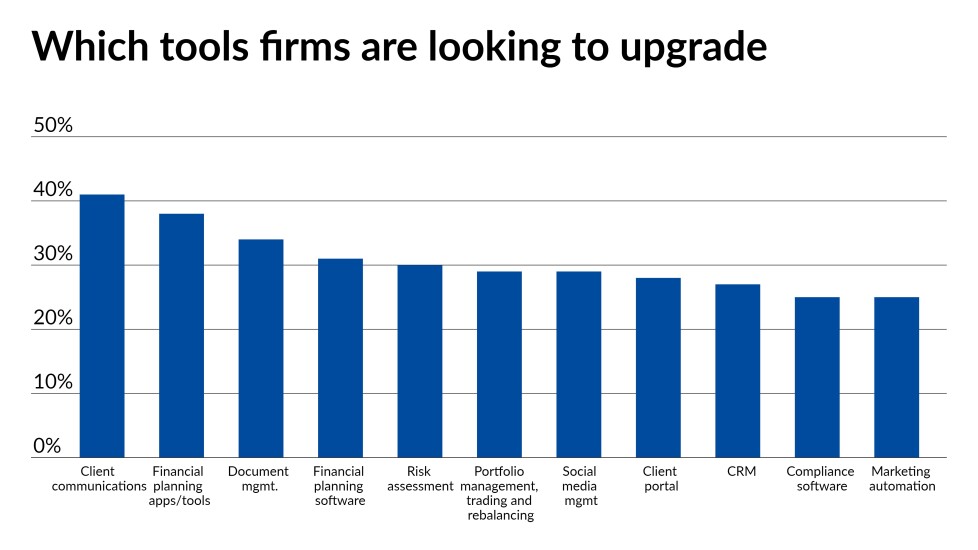

While there may be a divide between how large and small firms are using their technology budgets, advisors across the board recognize how important technology is for the future of their firms and the wealth management industry.

Ninety-three percent of financial advisors say technology plays either a critical or very important role in their practice, according to Financial Planning’s 2021 Technology Survey. Another 6% agree that it is somewhat important, leaving just 1% who feel technology isn’t important at all.

Rather than a ranking of individual technology vendors, Financial Planning’s 2021 Technology Survey instead takes a broader look at the trends shaping the wealth management industry. More specifically, the survey explores the impact and role of technology on the future of practice management, how firms are currently using technology and where they are planning to invest.

Two-thirds of advisors agree that technology is key to serving more clients and driving growth, and will significantly change advisory practices in the future. These attitudes remain fairly consistent across small, mid-sized and large practices.

However, there are tech gaps that some firms are looking to close, especially in the wake of the pandemic, and advisors offer differing opinions on which next-generation technologies will be most impactful going forward.

Below are more highlights from Financial Planning’s 2021 Technology Survey.

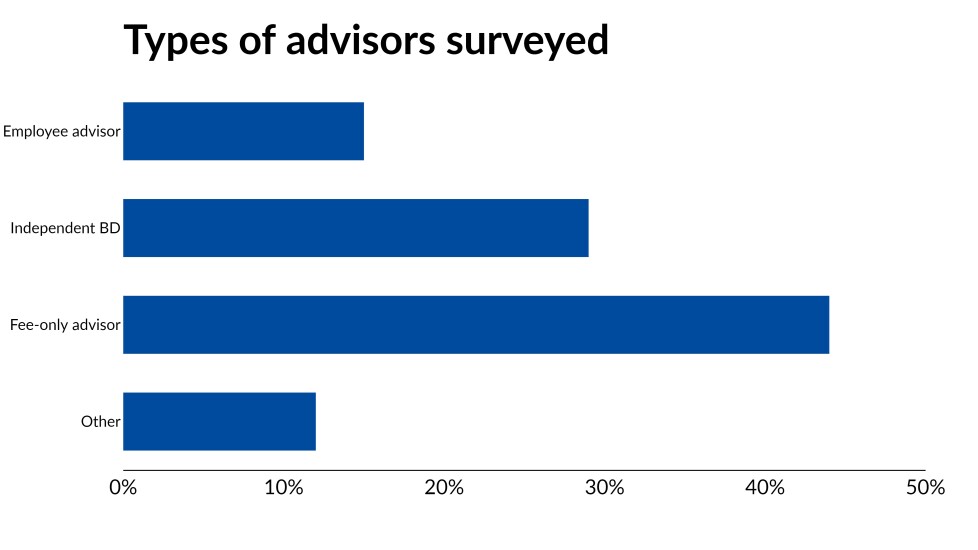

Methodology: This research was conducted online during May 2021 among 351 financial advisors. Qualified respondents included a mix of employee advisors, independent broker-dealers and fee-only firms of various sizes.