What should financial advisors keep their eyes focused on in coming years?

There’s a lot to consider: Aging Boomers are retiring and kicking off The Great Wealth Transfer to heirs. Advisors are increasingly embracing a “wear two hats” model of fee-only services and commissions. Independent advisory firms are merging left and right. Computer-driven robo advisors, such as those at Vanguard, Fidelity and Schwab, are competing ferociously for investors’ wallets.

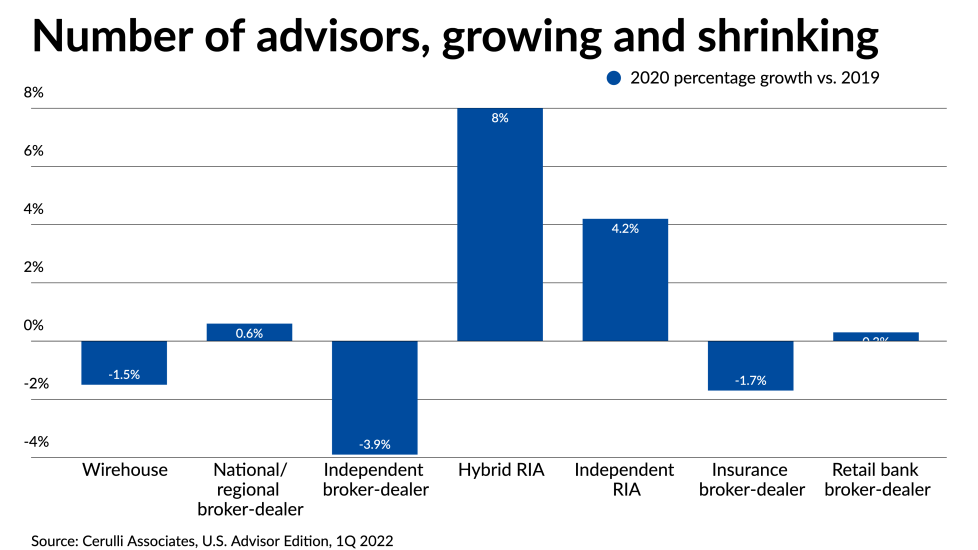

Affluent earners want a full buffet of services, from estate planning to tax strategies. And more than one-third of advisors will retire by 2029, a changing of the guard that will prompt the transition of nearly 40% of the industry's assets, according to research firm Cerulli Associates in Boston.

“The last five years is probably going to look a lot like the next 10,” said Matthew Crow, the president of Mercer Capital, a business valuation and financial advisory firm in Memphis, Tennessee. “Advisors continue to have a growing, profitable model to implement, especially firms that have modeled themselves on sustainable practices, which are grounded in the development of the next generation of leaders.”

In a new, data-driven