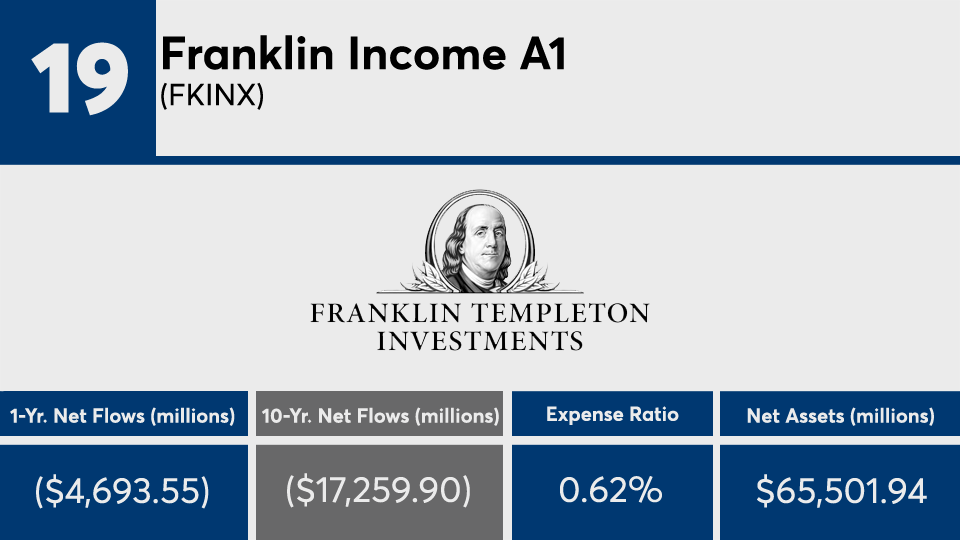

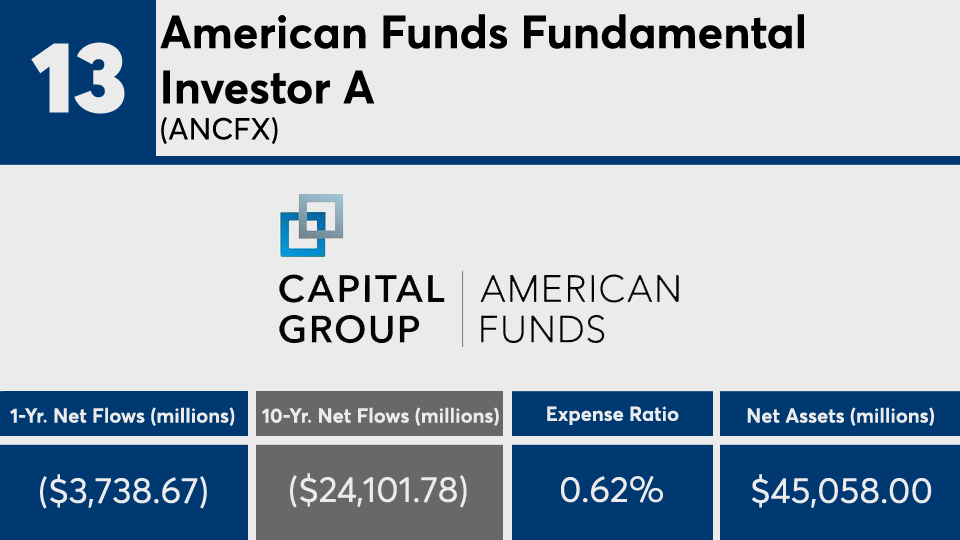

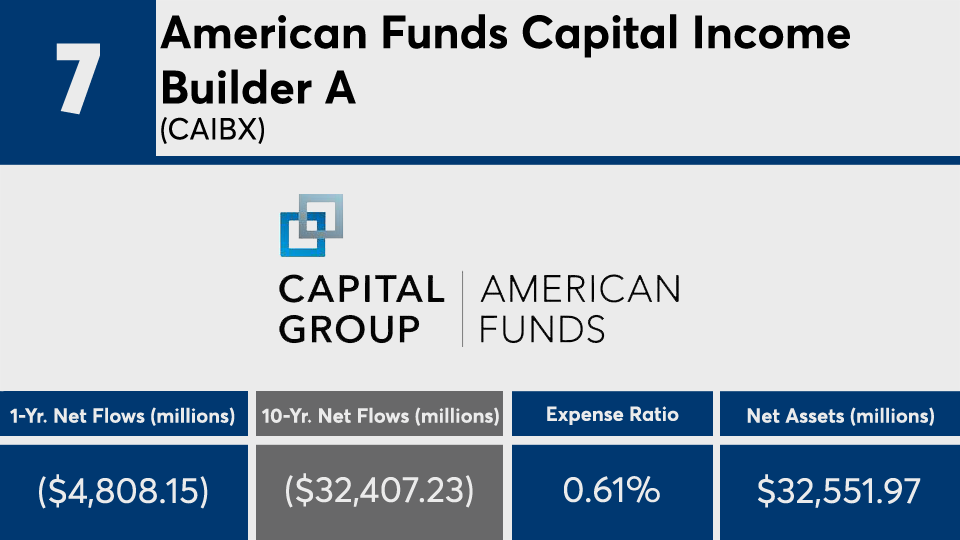

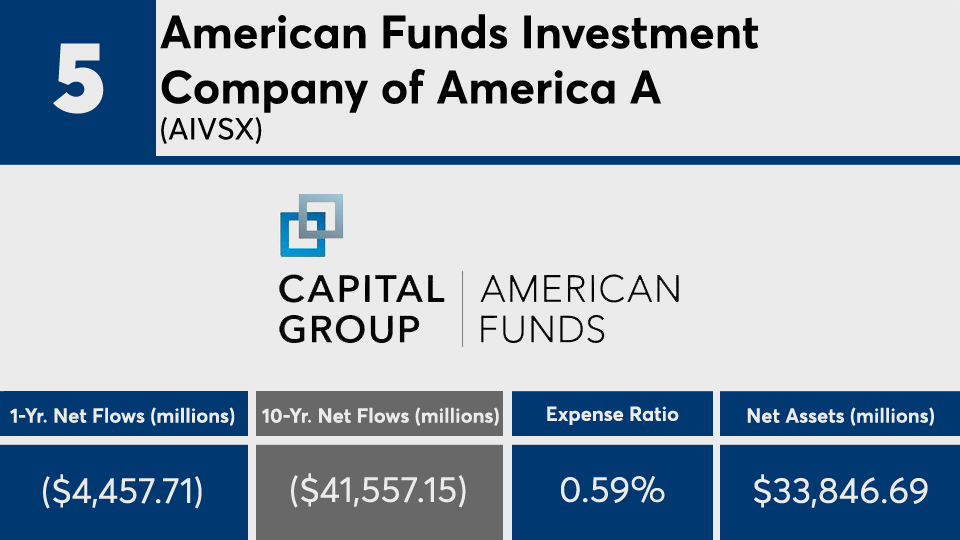

The 20 mutual funds with the decade’s largest net outflows lost a combined $620 billion.

With an average 10-year return of 11.4%, these funds were just shy of the broader fund industry’s performance over the period, according to Morningstar Direct data. The SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) posted 10-year gains of 13.87% and 12.84%, respectively. However, the same funds recorded an average 1-year return of nearly 14%, more than double SPY and DIA over the same period, which had a 6.28% gain and 0.05% loss.

In bonds, the AGG has generated gains of 6.90% and 3.64% over the last 1- and 10-year periods.

“Investors are going into lower, more passive mutual funds because they don't want to pay the fees,” says Marc Pfeffer, CIO at CLS Investments. “That's fine to a certain extent, but there are several funds on this list that have done really well, so people need to look further than the expense ratio.”

Funds with the biggest outflows have an average fee of 67 basis points, well above the 0.45% investors paid on average for fund investing overall last year, according to

The largest mutual fund, the Fidelity 500 Index (FXAIX), which has $259.2 billion in assets under management and 0.015% expense ratio, has generated a 12.56% gain since it’s inception on May 4, 2011, data show. In the 12 months, FXAIX has returned 6.23%.

“Just because something has a high expense ratio does not mean you should just leave it,” Pfeffer says, adding that both advisors and clients “have to look at the track record of the manager before making that decision.”

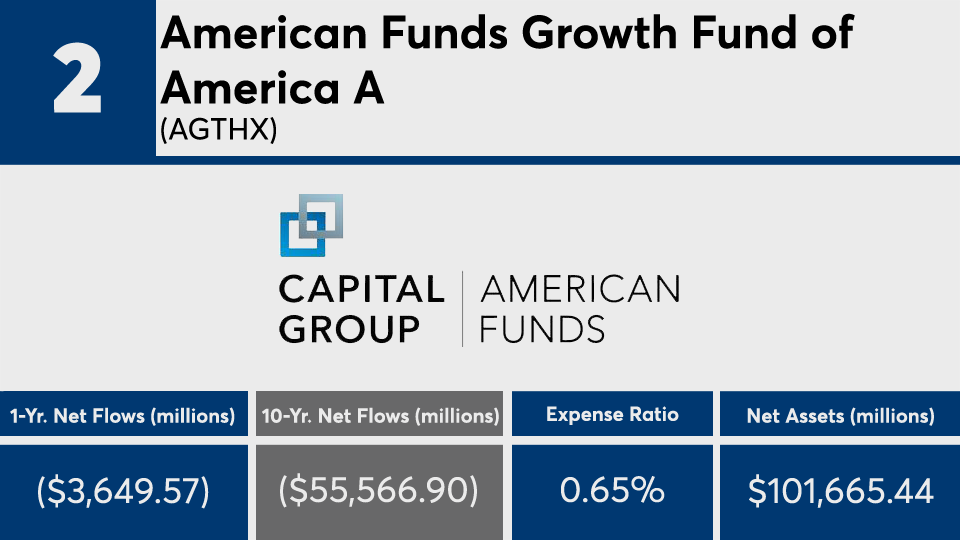

Scroll through to see the 20 mutual funds with the biggest 10-year outflows through Aug 31. Funds with less than $500 million in AUM and with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three-, five- and 10-year flows and returns are listed for each. Daily returns figures are as of Sept. 17. The data show each fund's primary share class. All data is from Morningstar Direct.