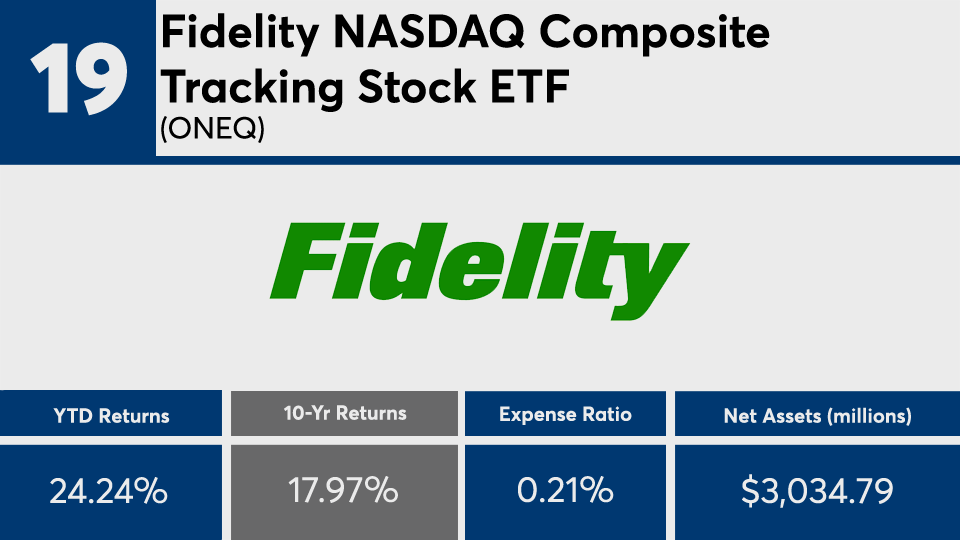

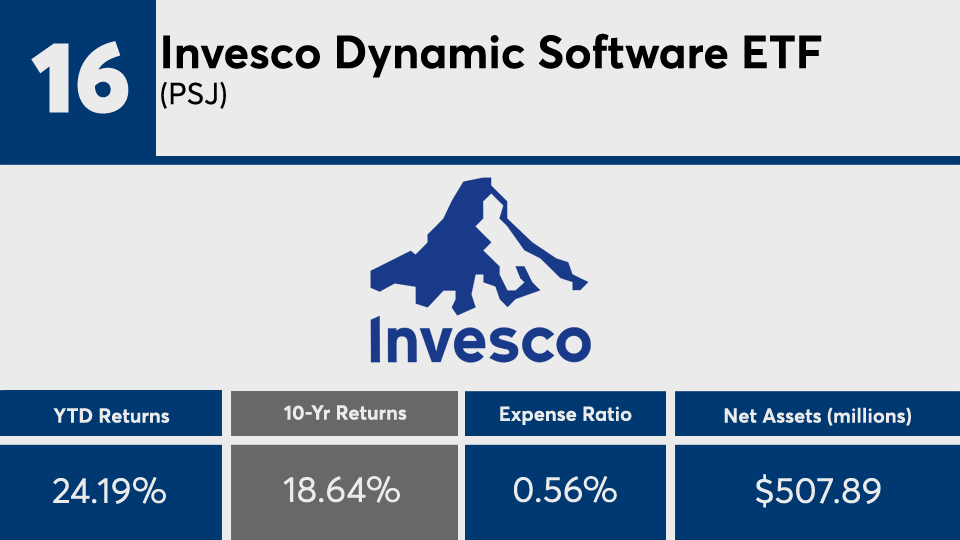

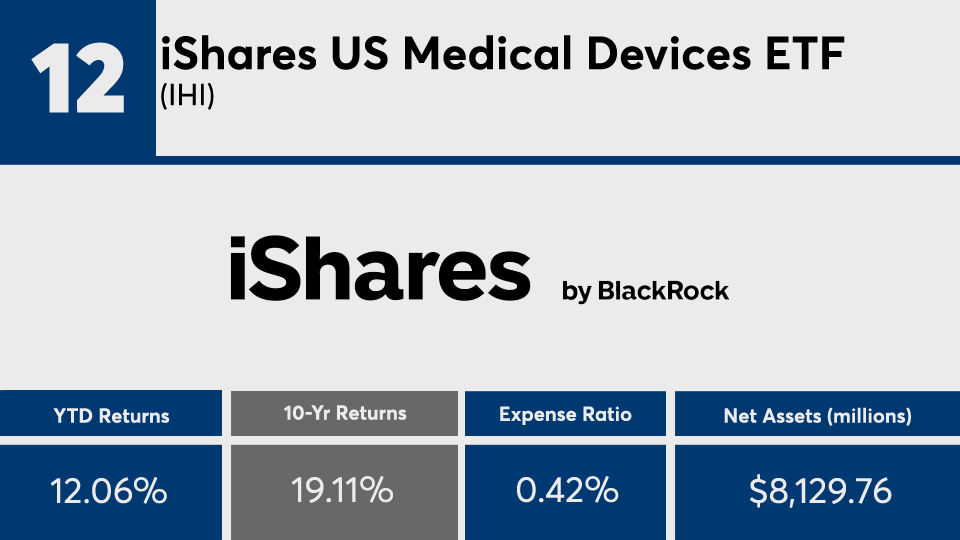

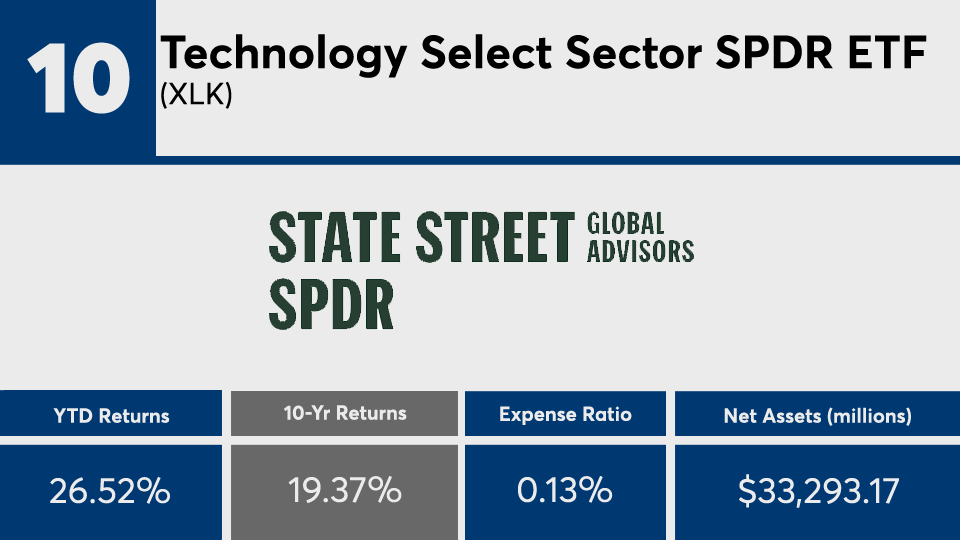

Home to nearly $260 billion in assets, the 20 ETFs with the biggest gains of the decade had an average return of nearly 20%, according to Morningstar Direct data. In a year defined by coronavirus-driven market volatility, the same funds have continued to outperform with gains more than four-times their peers.

For comparison, the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA) posted 10-year returns of 13.53% and 12.43%, respectively. When compared with the top-performers’ average year-to-date gain of more than 25%, SPY and DIA significantly underperformed. The funds had an average gain of 5.17% and a loss of 1.29% over the same period, respectively.

In bonds, the AGG has generated gains of 6.67% and 3.55% over the YTD and 10-year periods.

“This list is dominated by industries that have experienced colossal growth in the past decade, including [Internet of Things], semiconductor and software services,” notes Loreen Gilbert, CEO and founder of WealthWise Financial Services.

The funds, 14 of which track Morningstar’s technology category, had an average expense ratio of 40 basis points. Investors paid an average of 0.45% for fund investing last year, according to

For advisors with clients seeking a piece of the outperformance action, Gilbert warns of the risks that come with relying on past performance for future gains.

“They should make sure the same methodology of the past is still the same methodology,” she says. “Some ETFs change their strategy and that can impact future performance.”

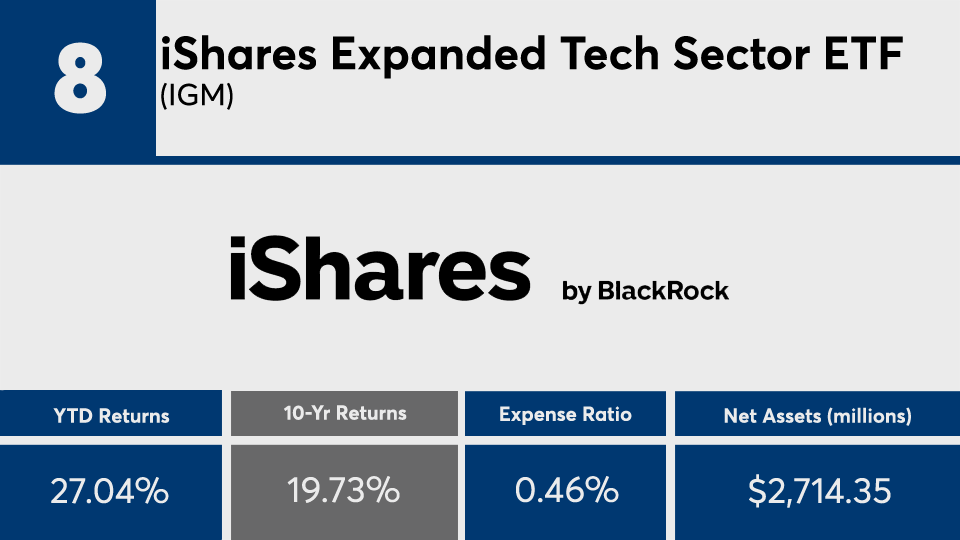

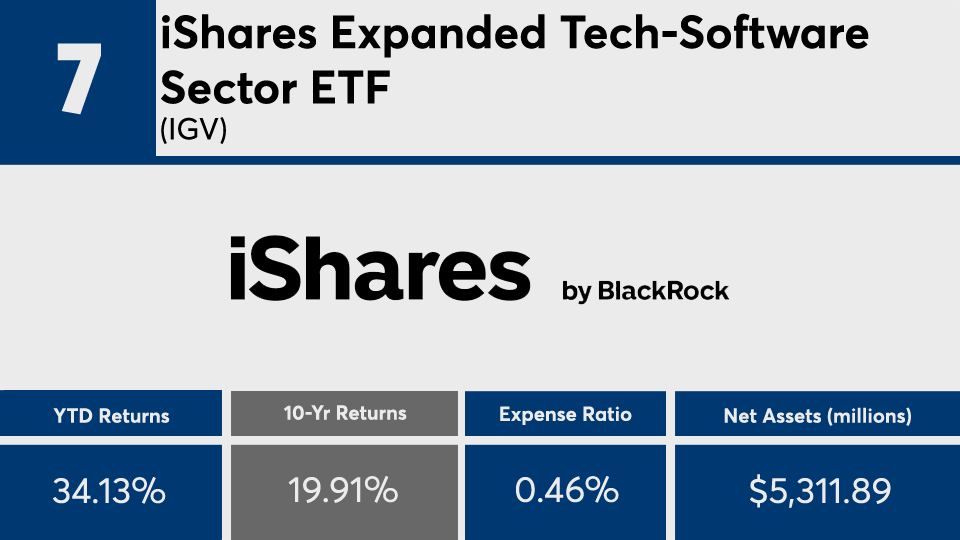

Scroll through to see the 20 ETFs with the biggest 10-year gains through Oct. 5. Funds with less than $100 million in AUM were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three- and five- returns are also listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.